LEARN STOCK MARKET COURSE BY ENTRI FINACADEMY

Stock market courses designed for aspiring traders and investors. Learn intraday, options, and forex trading in your own language. Join now and start trading smart.

Get Started with Our Stock Market Course

Course Features

-

Mentor Support & Doubt Clearance

Get your questions answered and receive guidance from NISM-certified profitable traders.

-

Exclusive Live Classes

Participate in live, interactive classes with expert instructors for real-time learning and engagement.

-

Premium Community Membership

Join an exclusive community of 15,000+ traders for networking, support, and collaboration.

-

Get Detailed Information

Gain insights through detailed analyses and discussions on market trends and performance.

-

Recorded Video Lessons

Access high-quality video lessons that you can watch at your own pace, anytime, anywhere.

-

Become a responsible Trader

Analyze market trends, and refine approach without any financial risk.

Your Stock Market Academic Journey

- Attend Live Sessions

- Access Recorded Classes

- Practice with Real-Time Support

- Market Analysis

- Enhance Practical Skills with Premium Community Support

- Become a Responsible Trader

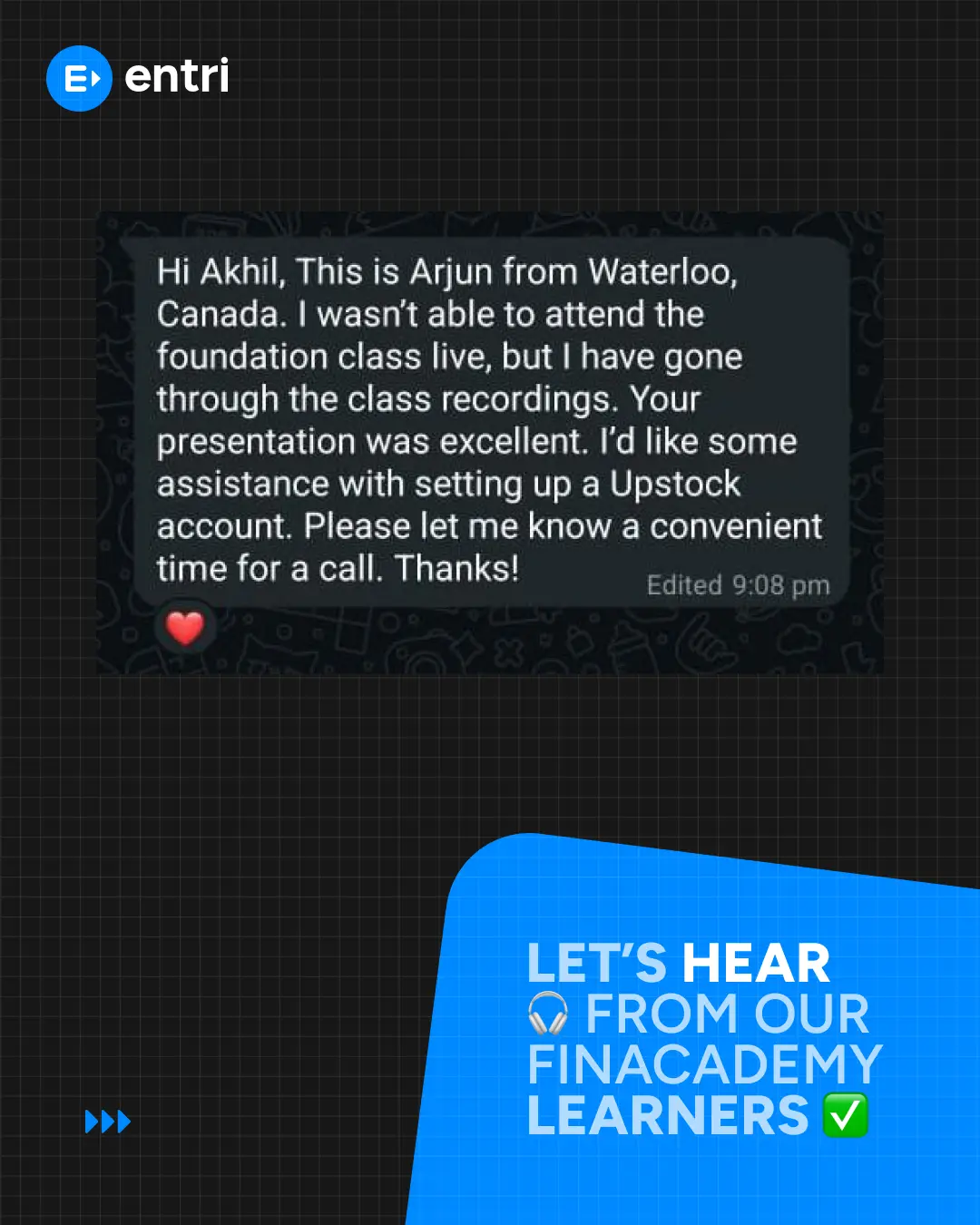

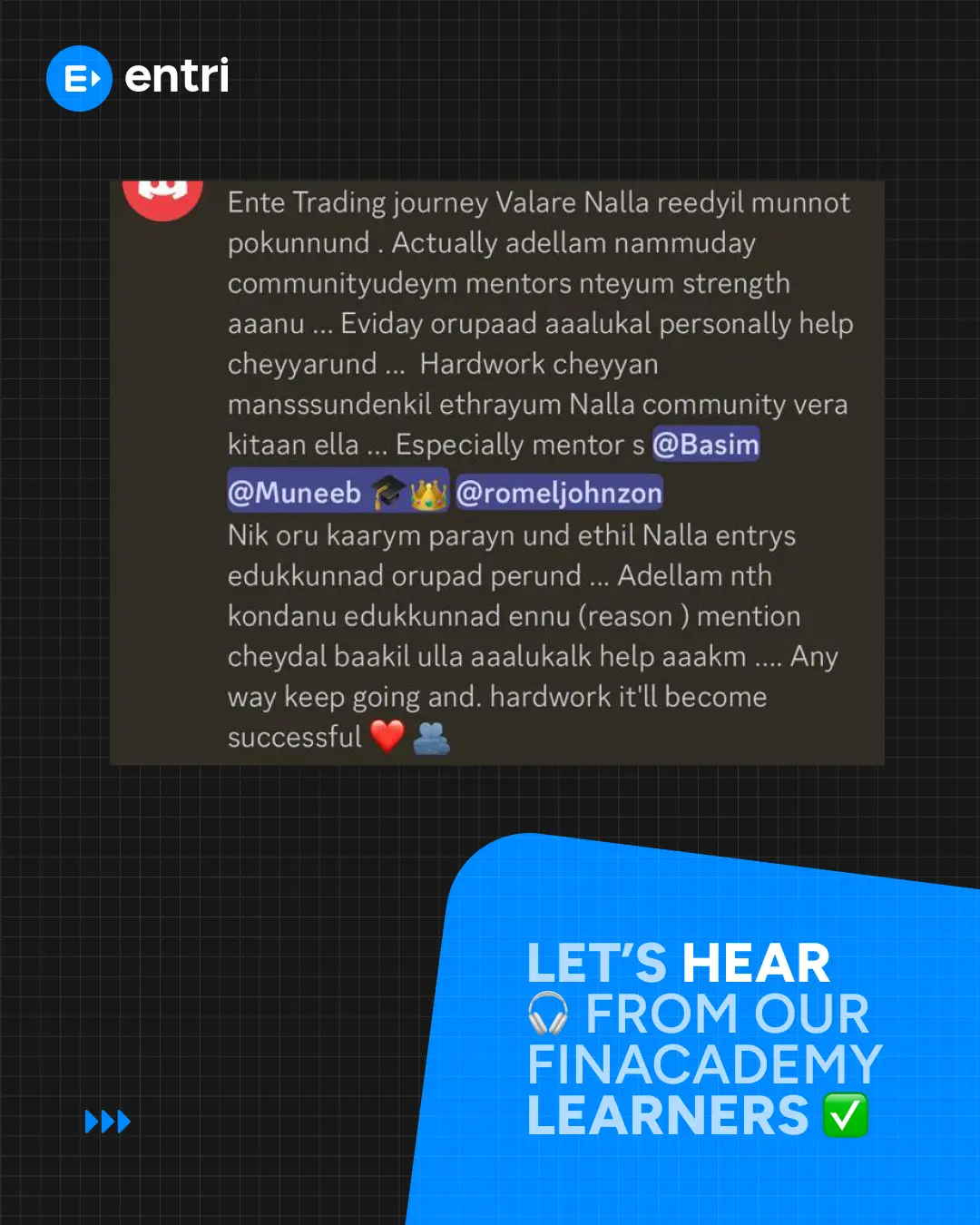

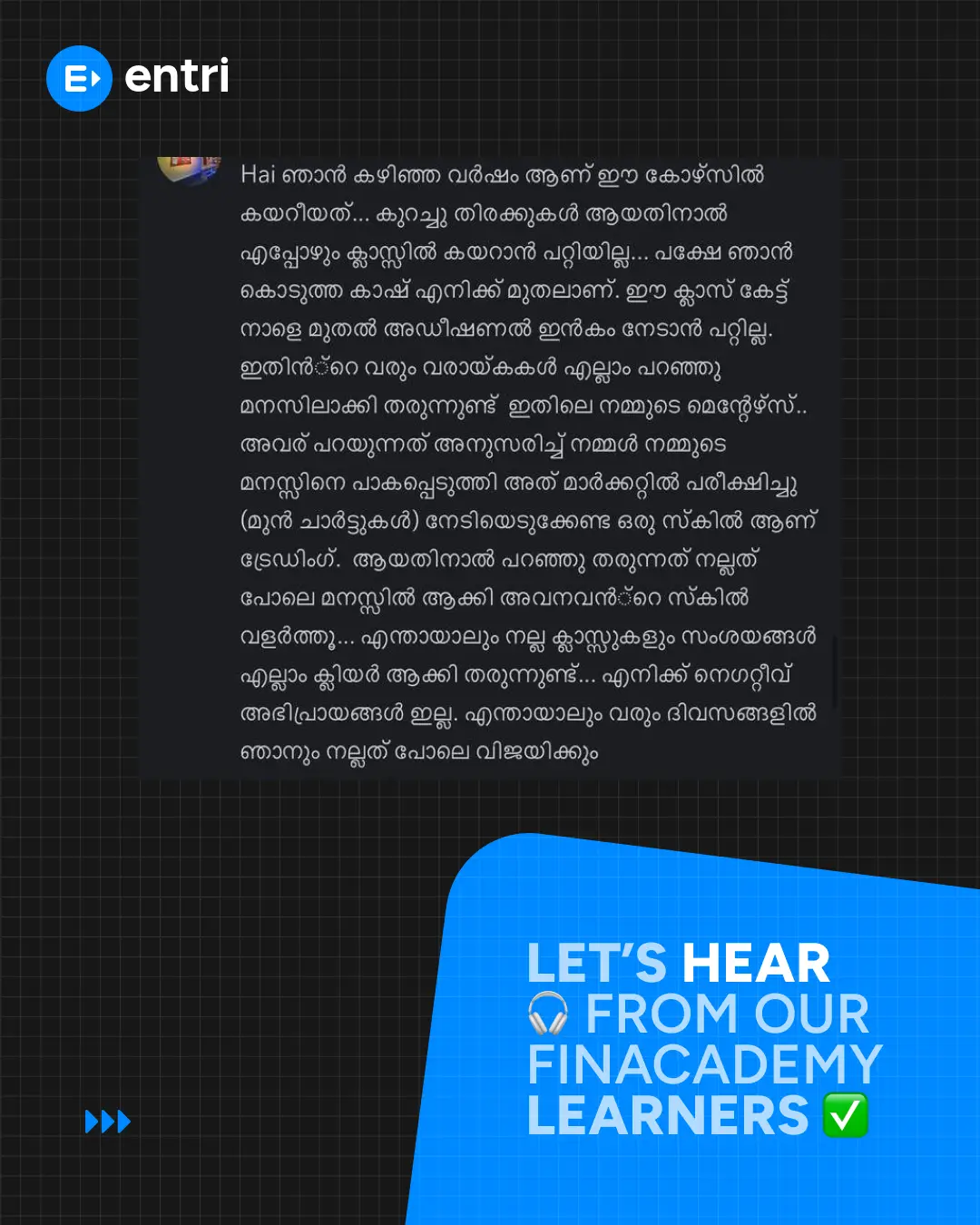

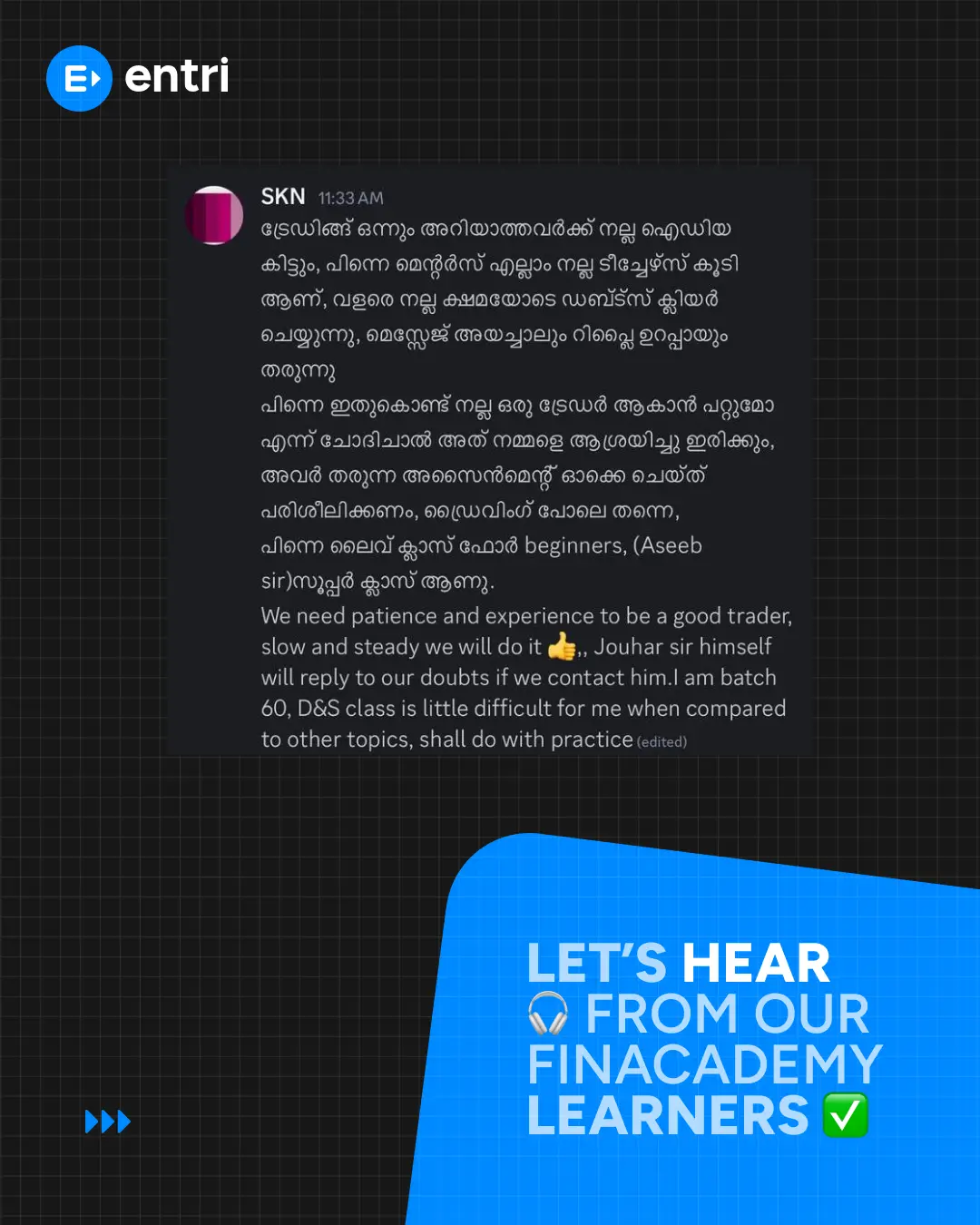

Learner's Feedback

Professional Traders to Guide You

Hear From Our Students

_8687.webp)

Stock Market Syllabus

-

Basics of Indian Stock Market

- Introduction to Indian Stock Market

- Stock Exchange and Market Timing

- Fundamental vs Technical

- Introduction to Trading Brokers

- What is Leverage or Margin?

-

Basic Technical Analysis

- Introduction to Technical Analysis

- Getting Started with Candlestick

- Anatomy of Candlestick

- Different Types of Candlestick

How to Buy and Sell a Stock

Intraday Stock Selection Method

- Different Types of Market Structure

Support and Resistance

-

Advanced Technical Analysis

- RSI and Trendline

- Fibonacci Strategy

- Different Types of Chart Patterns

- Time Frame Top-Down Analysis

-

Supply and Demand

- Basics of Supply and Demand

- How Banks Use Supply and Demand Zone

- How to Find Quality Supply and Demand Zones

-

Swing Trading

- Introduction to Swing Trading

- Swing Trading Technical Strategies

- Stock Selection Method

Indicator Strategies

- Bollinger Band

- RSI

- Pivot Points

- Exponential Moving Averages (EMA)

-

Futures and Options Trading

- Basics of Futures and Options Trading

- Types of Options and Option Chain Analysis

- Open Interest and Option Greeks

Option Selling Strategies

- Straddle and Strangle

- Call and Put Spread

- Iron Condor

- Iron Fly

- Ratio Spread

Option Selling Strategies Adjustment

-

Smart Money Concept (SMC)

- Introduction to SMC

- Market Structure

- Break of Structure and Momentum Shift

- Trading Range

- Supply and Demand

- Fair Value Gaps (FVGs) and Types of FVGs

- Premium and Discount

- Liquidity

- Entry Models

-

Trading Psychology, Emotions and Risk Management

- Understanding Trading Psychology

- Emotions in Trading

- Risk Management Strategies

- Creating a Strong Trading Plan

- Journaling and Self-Assessment

- Position Sizing

Why Learn Share Trading?

-

Financial Independence

Gain control over your investments and financial future.

-

Wealth Building

Potential to generate significant returns over time.

-

Market Understanding

Develop a deeper knowledge of how financial markets operate.

-

Diversification

Diversify your investment portfolio beyond traditional savings.

-

Risk Management

Learn strategies to manage and mitigate investment risks.

-

Economic Awareness

Stay informed about global economic trends and their impacts.

-

Career Opportunities

Open doors to careers in finance, investment, and trading.

-

Passive Income

Potential to earn passive income through dividends and stock appreciation.

Explore Free Stock Market Course

Free Stock Market Basics Course in Malayalam

Free Health Insurance Masterclass by Sharique Samsudheen

Free Stock Market Course For Beginners in Malayalam

Free Stock Market Trading Course for Beginners in Tamil

Introduction To Stock Trading in Tamil

Free Forex Trading Course for Beginners in Malayalam

Free Personal Finance Course in Malayalam

Free Trading Psychology for Beginners by Nagaraj Sir

Free Beginner’s Guide to Investments by Nagaraj Sir

Free Mutual Funds Course by Nagaraj Sir

Entri Financial Tools: Empowering Your Financial Journey

Explore Entri’s suite of free, easy-to-use financial tools built to simplify your savings, budgeting, and investment decisions. Take control of your financial future with calculators and planners made for you.

Try Financial Tools NowStock Market Blogs

-

Why Should Women Be Financially Independent?

Financial Independence Isn’t Just About Earning - It’s About Making Your Money Work Harder than You Do.

Read Now -

How to Invest Smartly in Stock Market in 2026

This guide will give you the strategies to invest smartly in the stock market this year.

Read Now -

8 Steps to Become a Profitable Trader in 2026

This article discusses methods you can adopt to ensure your trades are consistently profitable.

Read Now -

Survey Insights: Why People Fear the Stock Market and How to Beat It

We asked our vibrant community on Instagram and YouTube: “What’s your biggest investing fear?” Their candid responses inspired us to explore these concerns and share practical solutions.

Read Now

Stock Market Trading Course Learning Outcomes

Understand the basics of stock markets and how they operate.

Analyze financial statements and ratios to evaluate company performance.

Develop skills to perform technical and fundamental analysis.

Learn how to execute trades and understand different order types.

Gain knowledge of market indices and their significance.

Understand risk management techniques and portfolio diversification.

Recognize the impact of economic indicators and news on stock prices.

Learn about regulatory bodies and compliance in financial markets.

Develop strategies for short-term and long-term investing.

Understand the role of brokers, dealers, and market makers.

Gain insights into behavioral finance and investor psychology.

_4153.webp)

Finacademy - Best Trading Community

Around 25000+ Students across Kerala, Tamil Nadu and Karnataka

Around 15000+ Students Onboarded from Kerala

Learning and Guidance in Your Native Language (Malayalam and Tamil)

Lifetime Access to Premium Community Membership

Course Completion Certificate recognized by NSDC

Opportunities Beyond Self-trading After Stock Market Course

-

Broker

Execute buy and sell orders for clients in the stock market.

-

Wealth Manager

Develop and manage investment portfolios for high-net-worth individuals and families.

-

Financial Planner

Helps create strategies to meet long-term financial goals, including retirement, education, and investment planning.

-

Equity Dealer

Buys and sells stocks on behalf of clients, executing trades in equity markets, often working for investment banks or brokerage firms.

-

Research Analyst

Evaluates financial data and trends to provide investment recommendations, focusing on specific sectors or companies.

-

Investment Banker

Advise companies on mergers, acquisitions, and other financial transactions.

-

Financial Advisor

Provide financial planning and investment advice to individuals and businesses.

-

Portfolio Manager

Oversee investment portfolios and make decisions on how to allocate assets to achieve specific financial goals.

-

Risk Manager

Assess and manage investment risks to protect client's portfolios.

-

Market Research Analyst

Gather and analyze market data to identify trends and investment opportunities.

-

Financial Journalist

Write articles and reports about financial markets, companies, and economic trends.

-

Financial Educator

Teach others about investing and financial planning.

Best Stock Market Course Online

Entri Finacademy Stock Market Course is the best stock market course online, offering comprehensive learning and equipping you with the skills to confidently navigate stock complexities. Expert instructors cover trading basics to advanced strategies, using real-world cases and simulations for practical insights in analysis, risk, and diversification. Tailored for all levels, from beginners to experts, this course enables informed decisions for financial triumph. Enroll now to start your journey as a confident investor.

Student Testimonials

I joined Entri App to learn trading. First of all, to be honest, I didn't prefer online classes but I wanted to learn trading, so I joined the Entri App. Seriously, it is good for learning. The mentors really make us learn and the coordinators follow us for classes. I liked the support they provided. Entri is best for learning trading. I suggest the Entri App.

Vivin

Hello everyone, Entri Academy classes have been very useful for me. They help me understand the market situation especially the pre-market analysis and review, which are particularly helpful. The classes are easy to understand, & the instructors explain clearly in both Tamil & English. They also continue to clear all doubts through the Discord app. Stock Market 360 Batch 45

R. Bhaskaran

I want to express my gratitude for having such an exceptional mentor. The classes have improved my understanding of trading, offering clarity that has been valuable for beginners like me. I hope that with this guidance, we will all become successful earners on the trading platform. Thank you once again.

Mohan Kumar

Thanks for your wonderful sessions. These three months of learning journey is really an eye opener, particularly option hedging.

Bala

Hello Sir, I did not know anything about the stock market trading. Your classes are really an eye opener for me. Even when I am not able to attend your live classes, the recorded videos help me to learn everything at my own convenience. I am really excited to listen to all your sessions. Thanks a lot for the wonderful classes.

Vinoth

Hai, I am Asha. I heard about the Entri App from Facebook...I joined the stock market course and I am very happy to say that it is an excellent course offered by the team. Classes are very simple to understand. I shall recommend this course to those who are interested in share trading.

Asha

Hi, I am Anand Padmanabhan, working in a private firm. I heard about Entri through an advertisement and I was sceptical initially, but after joining the course and attending the classes, now I am very much eager to learn more. Initial classes start with the basics and are really very easy to understand. The tutors are real-time traders and are very much helpful. Our batch and all other batches have their own groups and if you follow the group daily itself you will be able to learn a lot. A lot more to go and want to be a full-time trader.

Anand Padmanabhan

The Stock Market 360 course at Entri is designed to be very easy to follow for a beginner like me. The live classes, post-market section, live trading, and live interactions helped me a lot to improve my trading skills.

Anu Abi

Thank you so much sir for the wonderful classes! It has helped me to overcome my fear of trading in stock market. I have realized that trading is not gambling and now I approach the market with confidence, by using proper risk management. Earlier, I dealt with the market like a ludo game. Only after the course, I understood that share market is actually a business.

Ramaadevi

Entri's stock market class by Nagaraj sir guided me to focus on learning and earning. Before attending this course, I didn't know anything about the Stock market. I mainly relied on tips. Now I take all the decisions on my own. I started investing in SIP for the long term and did short-term MTF to buy a large quantity of stock by paying less margin and generating good profits consistently. I also invest in growth. value, dividend stocks and strictly avoid penny stocks. Now I trade-in option buying in Banknifty, Nifty. Stock options and commodity options in Crude oil, Gold, Natural gas.

Krishna Prabhu

I'm Vijay, from Chennai's Sholavaram area. Let me tell you about my share market journey. Back in 2018, I tried learning through YouTube, but it felt like wrestling with confusion. I backed out. Recently, I found Entri Finacademy tamil stock market 360 course and attended a seminar. It was an eye-opener, reigniting my interest. I took the plunge into the course, and it's been a gamechanger. Nagarajan Sir's teaching is clear, calm, and patient. He's like that friend who clears your doubts without hesitation. Now, I'm more confident in the market. Knowledge and confidence aside, I'd recommend this course to anyone entering the market. It's an investment that truly pays off.

Vijay

Stock Market Course - FAQs

What is share trading?

Can I start investing with a small capital of Rs.1000/-?

What are different Types of Stock Trading?

There are several sorts of stock trading that investors can participate in. Some of the most ordinary types of stock trading include:

- Day Trading: Day traders buy and sell stocks within the same trading day, hoping to profit from short-term price movements. Day traders typically use technical analysis and rely heavily on charts and indicators to make decisions.

- Swing Trading: Swing traders hold positions for a few days or weeks, attempting to profit from medium-term price movements. They often use a combination of technical and fundamental analysis to make trading decisions.

- Position Trading: Position traders hold positions for weeks, months, or even years, aiming to profit from long-term price movements. They typically rely on fundamental analysis to identify undervalued stocks and hold onto those positions until the stock reaches its target price.

- Scalping: Scalping is a type of day trading that involves buying and selling stocks quickly to profit from small price movements. Scalpers typically hold positions for just a few seconds or minutes.

- Options Trading: Options trading involves buying and selling options contracts, which give the holder the right to buy or sell a stock at a specific price within a certain time frame.

- Futures Trading: Futures trading involves buying and selling contracts for the delivery of a specific asset at a specific time in the future. This type of trading is often used by investors who want to hedge their positions or speculate on future price movements.

Can I join the course without any prior experience?

Can a beginner make a profit?

What are the benefits of this stock market course?

Can I start learning to trade along with my job?

Will I be able to manage trading with my profession

What types of resources are typically provided in online stock market courses?

Are online stock market courses a guaranteed way to make money in the stock market?

Do I need any prior knowledge to enroll in an online stock market course?

What is the stock market course fee?

What is the stock market course duration?

Who Can Join Our Stock Market Course?

Our comprehensive stock market course is designed for beginners and intermediates looking to excel in trading. We offer trading courses in Malayalam and Tamil languages.

- Intermediate traders

- Employed personnel for side Income

- Freelancers have multiple income streams

- Students who want to earn pocket money

- Retired personnel for better returns on investments

- Entrepreneurs/Business owners

_282.webp)

_2675.png)