Table of Contents

Imagine a busy clinic where claims get paid fast, denials drop low, and staff focus on patients instead of paperwork. That setup saves money and reduces stress. It comes from using the best revenue cycle management software. Healthcare faces rising costs and complex billing rules. Good RCM software automates tasks, catches errors early, and speeds cash flow. Providers see quicker reimbursements and fewer lost dollars. It fits small practices or large hospitals. The right tool boosts efficiency and supports better care. This post explains RCM software. It covers core features, reviews top options for healthcare, looks at future trends with AI and automation. Read on to see why the best systems make a real difference in daily operations.

Join Entri’s Hospital Administration Course

Introduction: What Is Revenue Cycle Management (RCM) Software?

The major goal of revenue cycle management software is to help in the process of billing and payments in healthcare institutions. They help in following up on the patient cycle from initial enrollment in a healthcare system to a final payment. This allows service providers to concentrate solely on providing their services, as they do not need to be concerned with issues such as claim submissions, fee collection, or denials. The software also has automated capabilities such as eligibility checks and coding. This helps in reducing or eliminating errors during the process. The software allows healthcare clinics to process all billing charges without any omissions. With revenue cycle management software, even large volume billing is easily handled by hospitals.

RCM software integrates with electronic health records for smooth data flow. It flags issues like incorrect codes before submission. Reports show performance trends to guide improvements. Security keeps patient info private under rules like HIPAA. Small practices save time on manual work. Large systems handle complex payer mixes. The tool reduces unpaid balances and boosts cash flow. It supports value-based care by tracking outcomes. Adoption grows as costs rise and rules change. Providers who use it report higher collections and less administrative burden. The software turns billing from a chore to a smooth process. It lets staff focus on care instead of chasing payments. RCM stands as a key part of modern healthcare finance.

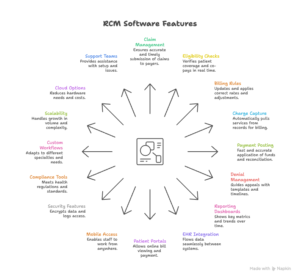

Core Features of Effective RCM Software

Top Revenue Cycle Management Software for Healthcare

Several RCM software options stand out for healthcare providers. Each fits different sizes and needs. Athenahealth tops many lists for its cloud-based system. It handles claims, denials, and payments end to end. Integration with EHR pulls data smooth. AI tools flag errors early. Reports show performance clear. Pros include high collection rates and easy use. Cons note higher costs for small practices. Pricing bases on revenue percentage. It suits large groups and hospitals. CareCloud offers affordable plans with strong billing features. Real-time dashboards track finances. Claims management scrubs for accuracy. Patient portals boost payments. Pros lie in custom fits and support. Cons involve learning curve for advanced tools. Monthly fees start low per provider. It works well for mid-size clinics. Epic leads for enterprise setups. It covers full revenue cycle with deep analytics. Denial tracking guides appeals. Integration ties to its EHR tight. Pros show in scale and data insights. Cons include complex setup and high price. Custom quotes fit big systems. Hospitals pick it for multi-site control.

Oracle Health, once Cerner, focuses on automation.

AI predicts denials and suggests fixes. Billing workflows run efficient. Reports pull trends fast. Pros come from smart tools and compliance. Cons point to transition time from old systems. Pricing uses quotes for each setup. It fits large health networks. MEDITECH Expanse provides integrated RCM. Claims process quick with built-in checks. Payment posting automates funds. Analytics monitor outcomes. Pros include user-friendly screens and reliability. Cons note limited custom options. Fees base on users. It suits community hospitals. AdvancedMD offers cloud ease for small to mid practices. Billing tools code visits right. Denial management tracks rejections. Patient portals collect fees online. Pros lie in mobile access and reports. Cons involve occasional updates. Monthly costs stay reasonable. Practices like its flexibility. Kareo targets independent clinics. It combines billing with practice management. Claims scrub automatic. Payments post fast. Pros show in simple interface and support. Cons mention add-on fees. Pricing starts low per provider. Small offices use it for daily tasks.

Optum RCM uses AI for efficiency.

It handles complex payer mixes. Denial prevention spots risks. Analytics guide improvements. Pros include high returns and scale. Cons note enterprise focus. Custom pricing fits big providers. Health systems choose it for revenue gains. R1 provides full-service RCM. It automates claims and appeals. Performance dashboards show metrics. Pros come from expert support and results. Cons involve service fees. Pricing bases on collections. Hospitals use it for outsourced help. Waystar offers end-to-end tools. Claims management reduces denials. Payment intelligence speeds funds. Pros lie in payer connections and analytics. Cons point to setup time. Fees use percentage model. Providers pick it for broad coverage. These systems share strengths like automation and security. Each brings unique perks. Athenahealth excels in data-driven work. CareCloud fits budgets. Epic scales large. Oracle adds AI smarts. MEDITECH integrates easy. AdvancedMD stays mobile. Kareo keeps it simple. Optum boosts returns. R1 offers service. Waystar connects payers. Costs vary but return through better collections. Providers test demos to match needs. The best RCM software lifts revenue and eases work.

Future Trends in RCM Software (AI & Automation)

RCM software trends point to more AI and automation. AI will spot denial risks before claims go out. It reviews codes and docs for matches. This cuts rejections low. Predictive tools forecast cash flow from past patterns. Automation handles routine tasks like eligibility checks. It runs them at registration without staff input. Voice bots answer billing questions fast. Blockchain secures payment data across payers. It cuts fraud and speeds approvals. Machine learning learns from denials to fix workflows. Reports pull deeper insights on trends. Integration with telehealth captures virtual visit charges automatic. Mobile apps let patients pay bills on phones. Compliance updates roll out automatic with rule changes.

Cloud systems scale without hardware buys. Partnerships with payers streamline claims direct. Analytics flag high-risk accounts early. Automation reduces staff burnout on repetitive work. AI aids decision-making with suggestions. The focus stays on value-based care tracking. Software adapts to new models like bundled payments. These trends make RCM faster and smarter. Providers who adopt them see higher collections and less waste. Future systems prioritize ease and accuracy. They prepare for rising costs and complex rules. AI and automation drive the next wave in revenue management.

Join Entri’s Hospital Administration Course

Conclusion

Revenue cycle management software streamlines billing and boosts collections. It automates tasks and cuts errors. Core features like claim scrubbing and analytics make it effective. Top options include Athenahealth for data insights and CareCloud for affordability. Providers pick based on size and needs. Future trends with AI and automation promise even better results. The best revenue cycle management software improves cash flow and supports care focus. It fits modern healthcare demands. Start checking options now to strengthen finances.

Frequently Asked Questions

What is revenue cycle management software?

Revenue cycle management software manages the entire billing and payment process in healthcare. It starts when a patient registers and ends when the final payment arrives. The software tracks every step from scheduling to collecting fees. It submits claims to insurance companies, handles patient payments, and manages denials. Automation takes care of tasks like eligibility checks and coding. This reduces mistakes and speeds up reimbursements. Clinics use it to capture all charges accurately. Hospitals process large volumes without delays. Patients receive clear bills with easy payment options. Insurance payers get clean claims that pay faster. RCM software connects to electronic health records so data flows smoothly. It flags errors before claims go out. Reports show collection rates and denial patterns. Security protects patient information under rules like HIPAA. Small practices save hours on manual work. Large systems handle complex payer rules. The tool lowers unpaid balances and improves cash flow. It supports value-based care by tracking outcomes. Adoption grows because costs keep rising and rules keep changing. Providers who use it collect more revenue with less effort. The software makes billing reliable and efficient.

Why do healthcare providers need RCM software?

Healthcare providers need RCM software to stay financially healthy. It automates billing so staff can focus on patient care. Manual processes lead to errors and delayed payments. Good RCM catches mistakes early and speeds reimbursements. It reduces denials from wrong codes or missing information. Faster cash flow helps cover rising costs. The software manages patient payments through portals and reminders. This lowers unpaid balances. Integration with health records avoids double entry. Providers see accurate financial reports to spot issues. It handles complex payer rules without confusion. Small practices save time on paperwork. Large hospitals process high claim volumes smoothly. The tool supports compliance with privacy laws. It tracks performance so leaders make better decisions. Providers who use RCM collect more revenue and reduce stress. It fits modern healthcare where efficiency matters.

What are the core features of good RCM software?

Good RCM software includes claim scrubbing to catch errors before submission. This lowers denials significantly. Automated claim submission sends clean claims to payers fast. Real-time tracking shows claim status at every step. Eligibility verification confirms coverage during registration. This prevents surprise bills. Charge capture pulls billable services from records automatically. Payment posting applies funds and reconciles accounts quickly. Denial management organizes rejections by reason and provides appeal guidance. Reporting dashboards display collection rates and days in accounts receivable. Integration with EHR eliminates duplicate data entry. Patient portals allow online bill viewing and payments. Mobile access lets staff work remotely. Security uses encryption and access logs. Compliance tools meet current regulations. Custom workflows adapt to specialties. Scalability handles growing patient volumes. Cloud options reduce hardware needs. Support teams assist with setup and issues. These features make RCM reliable and practical. They improve revenue and reduce administrative work.

Which RCM software works best for small practices?

CareCloud works well for small practices. It offers affordable plans with strong billing tools. Real-time dashboards track finances clearly. Claims scrub for accuracy. Patient portals encourage online payments. Support helps with setup. Kareo targets independent clinics. It combines billing with practice management. Claims scrub automatically. Payments post fast. The interface stays simple. AdvancedMD provides cloud ease. Billing tools code visits correctly. Denial management tracks rejections. Monthly costs stay reasonable. These options keep things straightforward. Small practices avoid complex features they do not need. They save time and collect more revenue. Providers test demos to confirm fit. Benefits show in less paperwork and better cash flow.

Which RCM software suits large hospitals?

Epic suits large hospitals best. It manages full revenue cycle with deep analytics. Denial tracking guides appeals. Integration with its EHR stays tight. Scale handles multi-site operations. Oracle Health focuses on automation. AI predicts denials and suggests fixes. Billing workflows run efficient. Reports pull trends fast. Athenahealth offers cloud-based power. It handles claims and payments end to end. AI flags errors early. High collection rates stand out. These systems manage high volumes and complex payers. Security and compliance stay strong. Large hospitals benefit from integration and data insights. Custom pricing fits enterprise needs. They improve revenue and efficiency.

How much does RCM software cost?

RCM software costs vary by vendor and practice size. Athenahealth often bases pricing on a percentage of revenue collected. This aligns fees with results. CareCloud starts with low monthly fees per provider. Small practices find it affordable. Epic and Oracle Health use custom quotes for large systems. Costs run higher due to scale and features. AdvancedMD and Kareo offer reasonable monthly rates. Some vendors charge per user or per claim. Cloud options keep upfront costs low. Add-ons like advanced analytics increase the price. Trials help test before committing. Benefits like higher collections and fewer denials offset costs. Providers compare total value over years. Good RCM returns investment through better revenue and less staff time.

Can RCM software reduce claim denials?

RCM software reduces claim denials effectively. It scrubs claims for errors before submission. Wrong codes or missing information get caught early. Automated rules apply payer requirements correctly. Eligibility checks confirm coverage upfront. This avoids rejections from invalid insurance. Denial management organizes rejections by type. It provides templates and timelines for appeals. Reports show denial patterns so teams fix root causes. AI tools predict risks and suggest fixes. Integration with EHR ensures accurate data. Providers see denial rates drop significantly. Faster appeals recover more revenue. The software saves time and money lost to rejections. Good RCM keeps cash flow steady.