Table of Contents

Germany is turning into one of the maximum popular locations for students desiring to build a profession in finance. Known for its robust economy, worldwide economic hubs, and wonderful training, Germany gives awesome opportunities for each undergraduate and postgraduate finance programs. Choosing the right university is important, as it can shape your educational growth, practical talents, and the profession potentialities in areas like investment banking, company finance, risk management, and the economic analytics. In this blog, we discover the top universities in Germany for finance, their rankings, applications, and what makes them stand out for aspiring finance experts.

Start learning German today to fast-track your career in Germany!

Introduction

Germany is extensively identified as one of the leading countries for higher education, especially in the fields like finance, business, and economics. The country is understood for its strong economy, thriving financial markets, and the worldwide commercial enterprise connections. German universities provide world-class finance programs that combine theoretical expertise with the practical abilties, getting ready students for careers in the banking, investment, economic evaluation, corporate finance, and more. Many packages additionally highlights research, internships, and collaboration with the industry specialists, making graduates extraordinarily competitive inside the global job market.

Choosing the right university for finance research is extraordinarily vital due to the fact it is able to form each your learning experience and your professional opportunities. Different universities offer precise specializations, coaching patterns, enterprise partnerships, and the global publicity. Selecting a degree that aligns with your future guarantees you gain the right talents, construct a strong expert network, and boom the probabilities of landing ideal roles in the finance field. A well-selected college additionally gives get admission to to internships, workshops, and the location opportunities, which might be essential for gaining the real-international reviews.

Top Universities for Finance in Germany

1: How do you say "Good Morning" in German?

Germany is a top destination for students pursuing finance education due to its strong economic system, financial markets, and the advanced universities. German institutions integrate theoretical expertise with sensible training, preparing the students for careers in investment banking, company finance, economic analysis, and the risk management. Below is a detailed overview of the main universities for finance in Germany.

1. University of Mannheim

The University of Mannheim is broadly identified for its excellence in finance and business studies. It is thought for strong research output and a rigorous curriculum that equips college students with the abilties needed to thrive in the worldwide monetary zone.

Programs and Curriculum

The finance programs at Mannheim cover regions including company finance, funding control, economic markets, and risk evaluation. Specialized electives in worldwide finance, FinTech, and quantitative finance allow college students to align their training with precise career goals.

Career Opportunities

Graduates from Mannheim revel in excessive employability, securing positions in main banks, consulting firms, and multinational businesses. The university also maintains a strong alumni network and profession offerings, providing students internship possibilities and sensible exposure that enhance their career possibilities.

2. Ludwig Maximilian University of Munich (LMU)

LMU Munich is one in all Germany’s oldest and most prestigious universities. Its finance packages provide college students with a global attitude on financial markets, funding techniques, and company finance.

Industry Connections

The university has robust partnerships with economic establishments, multinational corporations, and consulting firms. These connections create possibilities for internships, industry initiatives, and networking, which are important for profession development in finance.

Specializations and Research

LMU highlights studies-led coaching, permitting college students to have interaction in areas inclusive of investment banking, risk control, and global monetary markets. Exchange programs with international universities additionally provide students with publicity to worldwide monetary practices.

|

German A2 Exercises – Download Free PDF |

||

3. Technical University of Munich (TUM)

TUM is globally diagnosed for its analytical technique to finance education. While it is widely recognized for engineering and technology, TUM additionally offers finance applications that target quantitative techniques, monetary modeling, and data-driven decision-making.

Collaboration with Financial Institutions

TUM collaborates with leading banks, investment corporations, and economic consultancies. These partnerships allow college students to works on real-world projects, take part in internships, and benefit hands-on experiences in monetary analytics and portfolio control.

Curriculum Highlights

Courses at TUM include financial engineering, risk analytics, corporate finance, and investment techniques. The software highlishts problem-solving and analytical skills, which are crucial for careers in ivestment banking, asset control, and corporate finance.

4. Goethe University Frankfurt

Located inside the heart of Germany’s economic capital, Goethe University Frankfurt provides students with direct access to important banks, financial institutions, and the European Central Bank. This region gives students unique possibilities to benefit realistic exposure even as reading.

Programs and Specializations

Goethe University offers specialized programs in investment banking, global finance, quantitative finance, and risk control. Students also can recognition on financial regulation and capital markets, preparing them for careers in banking and company finance.

Practical Learning

Alaso the university highlights practical mastering through internships, industry projects, and collaboration with financial specialists. Students gain treasured hands-on experiences, that is important for expertise real-world monetary structures and strategies.

5. Frankfurt School of Finance & Management

The Frankfurt School of Finance & Management is a private institution with a strong global reputation in the finance education. It offers a wide range of degrees, including bachelor’s, master’s, and the executive programs, focusing on practical and the international finance.

Global Focus and Practical Training

Programs on the Frankfurt School highlights global finance, funding management, and financial leadership. Students engage in sensible workshops, simulations, case studies, and internships, presenting hands-on experiences that enhances their employability.

Career Support and Networking

Graduates from the Frankfurt School have get admission to the career offerings, mentoring, and networking events, supporting them stable positions in top banks, investment corporations, and consulting businesses worldwide. The institution’s strong enterprise hyperlinks make certain college students are properly-organized for professional roles in finance.

Free German A1 Mock Tests – Powered by AI!

Test your skills on our interactive platform. Get instant feedback from our AI to help you communicate better and track your progress. Start your free German mock test now.

Test Your German A1 for FreeKey Factors to Consider When Choosing a Finance Program

Selecting the right finance program is one of the most important steps in shaping a successful career in the financial sector. Germany offers a range of universities and programs, but not all programs are the same. To ensure you choose the best option for your goals, it is important to consider several key factors.

Selecting the right finance program is one of the maximum vital steps in shaping a a hit career inside the monetary area. Germany offers a number universities and programs, however no longer all packages are the same. To ensure you pick the excellent choice to your desires, it’s far crucial to consider numerous key elements.

1. Curriculum and Specializations

The curriculum of a finance program determines the knowledge, capabilities, and information you may get during your studies. Different universities provide varying specializations including investment banking, corporate finance, economic analytics, risk control, and financial technology (FinTech). Choosing a application that aligns with your profession goals ensures you expand applicable capabilities on your preferred discipline.

For example, in case your goal is to work in investment banking, it’s useful to select a program that consists of publications on corporate finance, capital markets, and economic modeling. Similarly, if you are interested in FinTech or financial analytics, look for packages with robust quantitative, data-driven, or technology-oriented modules. Programs that integrate principle with realistic initiatives, case studies, or simulations are specifically treasured because they prepare college students for real-world monetary challenges.

2. Accreditation and Rankings

Accreditation is an important marker of quality for any university program. Choosing an accepted program ensures that the training meets recognized instructional standards, making your degree extensively familiar by employers and other universities. Accreditation additionally shows that the curriculum, faculty, and mastering resources are of high quality.

University rankings can also offer guidance, mainly in terms of reputation, studies output, and international recognition. Highly ranked universities frequently have better infrastructure, skilled faculties, and more potent networks for profession growth. However, ranking must be considered along other factors which include curriculum relevance, school expertise, and possibilities for practical getting to know. A well-authorized and respectable finance software increases your chances of profession achievement and further training possibilities.

3. Industry Connections

Finance is a practical and highly network-driven discipline, so the connections a university has with enterprise can significantly impact your profession. Universities with strong partnerships with banks, funding firms, consulting companies, and multinational organizations provide college students possibilities for internships, live projects, and networking occasions.

Practical experience gain through internships or enterprise collaborations allows students to use theoretical understanding in real-world scenarios. Networking with specialists in the discipline can also assist students secure jobs after commencement or even gain mentorship for career guidance. When deciding on a finance software, it’s crucial to evaluate the university’s industry links and the guide it presents for profession placements.

4. Location

The location of the university can influence both your education and career opportunities. Studying in or near financial hubs like Frankfurt or Munich provides direct access to banks, investment firms, and corporate headquarters. This proximity increases your chances of internships, industry exposure, and networking with professionals.

Location also affects lifestyle, cost of living, and exposure to local industry practices. Universities in major financial centers allow students to attend workshops, seminars, and conferences more easily, giving them practical insights into the financial world. Choosing a location that balances academic quality with career opportunities is an important factor in making the most of your finance education.

|

Goethe 2025 Exam Dates: Multiple Test Centers |

|

| Trivandrum Goethe Exam Dates | Kochi Goethe Exam Dates |

| Chennai Goethe Exam Dates | Coimbatore Goethe Exam Dates |

Admission Requirements for Finance Programs

Germany is a popular destination for college students pursuing finance training due to the strong economic system, world-magnificence universities, and first-rate profession opportunities. However, universities have precise admission requirements to ensure students are academically organized and able to succeeding in rigorous finance applications.

1. Typical Prerequisites

To apply for a finance program in Germany, students need a solid academic background in subjects related to mathematics, economics, and business.

- Bachelor’s programs: Students are generally required to have a recognized high school diploma or equivalent. Strong grades in mathematics, economics, and sometimes accounting or business studies are highly recommended. Some programs may also require prior knowledge in statistics or financial basics.

- Master’s programs: Applicants must have a relevant bachelor’s degree, typically in finance, economics, business administration, or accounting. Universities may also consider degrees in related fields if the applicant has completed sufficient quantitative courses.

- Additional requirements: Some programs ask for a CV, statement of purpose, or letters of recommendation, especially for competitive programs. Certain programs may also require students to demonstrate analytical or quantitative skills through entrance exams or assessments.

2. Language Proficiency Requirements

Finance programs in Germany are offered in both German and English. Depending on the language of instruction, applicants need to provide proof of proficiency:

- English-taught programs: Students must submit scores from recognized tests like TOEFL or IELTS.

- TOEFL: A minimum score of 80–100 (internet-based test) is usually required.

- IELTS: A band score of 6.5–7.0 is typically expected.

- German-taught programs: Students must demonstrate proficiency in German through exams such as TestDaF or DSH.

- TestDaF: Usually requires level TDN 4 or higher in all sections.

- DSH: Typically requires a DSH-2 level.

Some universities may accept alternative proofs, such as prior education in English or German, or completion of specific preparatory language courses offered by the university.

3. Application Deadlines and Procedures

Application deadlines and procedures vary by university and program. However, some general points apply to most institutions:

- Application portals: Many universities accept applications through the Uni-Assist platform (for international students) or directly via the university’s official online portal.

- Required documents: Applicants generally need to submit:

- Academic transcripts and certificates

- Proof of language proficiency (TOEFL, IELTS, TestDaF, or DSH)

- CV or resume

- Statement of purpose or motivation letter

- Letters of recommendation (if required)

- Passport copy

- Deadlines:

- Winter semester: Applications are typically due between May and July.

- Summer semester: Applications are generally due between November and January.

After submitting an application, universities evaluate candidates based on academic performance, language proficiency, and supporting documents. Some programs may also require interviews or additional assessments before offering admission.

Career Prospects After Completing a Finance Degree in Germany

Germany is one of the leading economic facilities in Europe and gives a extensive variety of opportunities for finance graduates. Completing a finance degree in Germany no longer best gives a strong educational foundation, but also allows the students advantage the practical abilties and exposure to real monetary markets. Graduates can pursue numerous roles in the area of banking, funding, corporate finance, monetary advisory and extra. The combination of a robust schooling, industry connections and the Germany’s sturdy financial system make finance a completely promising profession path for both the home and the international college students.

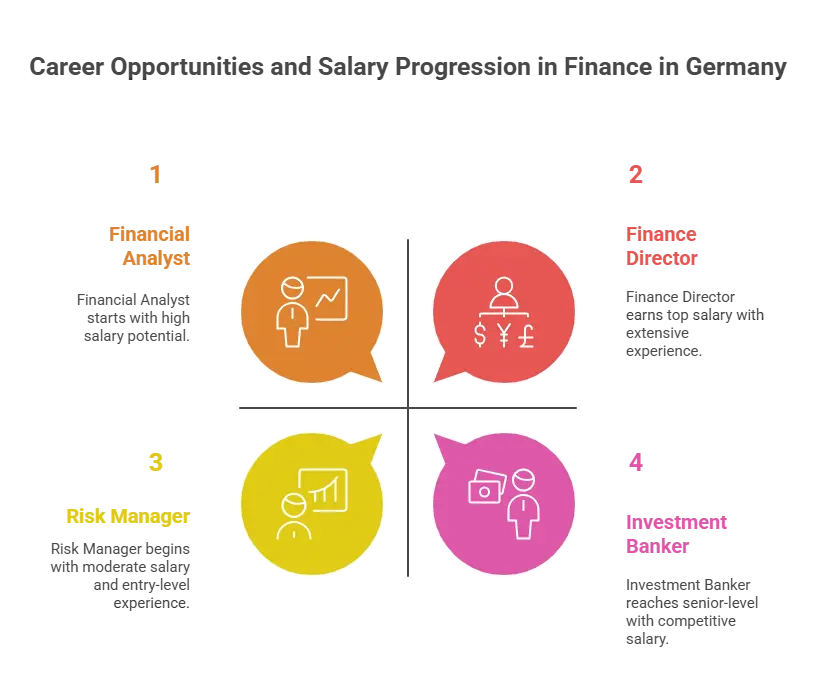

1. Overview of Career Opportunities

Finance graduates in Germany have get admission to to a large spectrum of career possibilities. Common roles consist of monetary analyst, investment banker, danger manager, corporate finance specialist, economic representative, portfolio manager, and economic guide. In addition, emerging fields like FinTech, sustainable finance, and facts-driven financial analytics are growing rapidly, developing new career avenues.

Many universities also combine internships, tasks, and realistic case studies into their programs, giving college students hands-on enjoy that substantially boosts employability. Graduates also can pursue careers in research, financial law, or management consulting, depending on their specialization and interest.

2. Potential Employers and Industries

Germany is domestic to a extensive range of industries that actively hire finance graduates. Some of the maximum prominent sectors consist of:

- Banking and Investment: Major banks including Deutsche Bank, Commerzbank, and HypoVereinsbank provide opportunities in funding banking, corporate finance, and asset management.

- Corporate Finance: Multinational corporations in automotive, manufacturing, and technology sectors hire finance experts to manage corporate finance, budgeting, and economic making plans. Companies like BMW, Siemens, and Volkswagen are examples.

- Financial Consulting: Consulting companies like PwC, Deloitte, KPMG, and EY hire finance graduates for advisory roles, monetary strategy, and risk assessment.

- FinTech and Startups: Germany’s growing FinTech sector, especially in cities like Berlin and Frankfurt, gives roles in financial technology price structures, and records analytics.

- Regulatory and Public Sector: Opportunities exist in monetary regulatory bodies, significant banks just like the European Central Bank, and government groups handling financial rules.

3. Average Salaries and Career Progression

- Entry-level positions: Fresh graduates commonly earn between €45,000 and €55,000 per year, relying on the corporation, town, and specialization.

- Mid-level positions: With 3–5 years of experience, finance specialists can expect salaries starting from €60,000 to €80,000 per year. Roles may consist of senior analyst, funding supervisor, or monetary consultant.

- Senior-level positions: Experienced experts in managerial or specialised roles, consisting of finance director, portfolio supervisor, or investment banker, can earn €90,000 to €120,000 or more annually.

Career development frequently depends on continuous talent improvement, sensible experiences, and professional certifications along with CFA (Chartered Financial Analyst), FRM (Financial Risk Manager), or ACCA (Association of Chartered Certified Accountants). Graduates who pursue advanced tiers, international publicity, or management roles have better incomes capability and profession growth.

Start learning German today to fast-track your career in Germany!

Free German A1 Mock Tests – Powered by AI!

Test your skills on our interactive platform. Get instant feedback from our AI to help you communicate better and track your progress. Start your free German mock test now.

Test Your German A1 for FreeConclusion

| Related Links | |

| Masters in Economics in Germany | Masters in Cyber Security in Germany |

| Best Universities in Germany for Computer Science | Best Universities in Germany for Finance |

Free German A1 Mock Tests – Powered by AI!

Test your skills on our interactive platform. Get instant feedback from our AI to help you communicate better and track your progress. Start your free German mock test now.

Test Your German A1 for FreeFrequently Asked Questions

Which universities are considered the best for finance in Germany?

Some of the top universities for finance in Germany include University of Mannheim, Ludwig Maximilian University of Munich (LMU), Technical University of Munich (TUM), Goethe University Frankfurt, and Frankfurt School of Finance & Management. These institutions are known for their strong finance programs, research output, industry collaborations, and international exposure.

What specializations are available in finance programs in Germany?

Finance programs in Germany offer various specializations such as investment banking, corporate finance, financial analytics, risk management, FinTech, portfolio management, and international finance. Students can choose electives and focus areas that match their career goals, helping them gain relevant skills for specific roles in the financial sector.

Are there English-taught finance programs in Germany?

Yes, many universities in Germany offer English-taught finance programs, especially at the master’s level. Institutions like TUM, Frankfurt School of Finance & Management, and LMU Munich have programs designed for international students, allowing them to study finance without requiring prior knowledge of German.

What are the typical admission requirements for finance programs?

For bachelor’s programs, students need a recognized high school diploma with strong grades in mathematics, economics, and business-related subjects. For master’s programs, a relevant bachelor’s degree in finance, economics, business administration, or a related field is required. Universities also typically ask for language proficiency (TOEFL, IELTS, TestDaF, or DSH), a CV, and a statement of purpose.

How important are university rankings and accreditation?

Rankings and accreditation indicate the quality and reputation of a university. Accredited programs ensure that the curriculum, faculty, and learning resources meet recognized academic standards. Highly ranked universities often offer better research facilities, stronger industry connections, and enhanced career opportunities.

What kind of industry connections do these universities offer?

Top finance universities in Germany maintain partnerships with banks, investment firms, consulting companies, and multinational corporations. These connections allow students to access internships, live projects, networking events, and mentoring programs, which are crucial for gaining practical experience and securing jobs after graduation.

What career opportunities are available for finance graduates in Germany?

Finance graduates can pursue careers in banking, corporate finance, investment management, financial consulting, FinTech, and financial regulation. Major employers include Deutsche Bank, Commerzbank, PwC, KPMG, EY, and multinational corporations in sectors like automotive, technology, and manufacturing. Emerging areas like FinTech and sustainable finance also offer exciting opportunities.

What are the average salaries for finance graduates in Germany?

Entry-level finance graduates in Germany typically earn between €45,000 and €55,000 per year. With experience, salaries can rise to €60,000–€80,000 for mid-level roles and €90,000–€120,000 or more for senior positions like investment banker, portfolio manager, or finance director. Additional certifications like CFA, FRM, or ACCA can further boost career growth and earning potential.