Table of Contents

Management of the requirements of the Health Insurance Fund can be a complex and time -consuming task for hospitals. From the submission of correct documents to tracking approval and payment, each step should be handled carefully to avoid delay and reject.

This guide is designed to help hospital administrators understand the process, avoid normal errors and to make the requirement with requirements more effective – so that your team can focus more on patient care and reduce paperwork.

Get into Our Hospital Administration Course- signup for a free demo!

Understanding Health Insurance Fund (HIF) Claims

Health Insurance Fund (HIF) claims are actually formal requests that the hospitals send to the insurance companies to get paid back for the medical care that they have provided. These claims usually include the major information such as the personal details of the patient, the type of treatment given, how much it cost, and any other necessary documents may be required to substantiate the request.

For the hospital administrators, getting a firm hold on how the HIF claims process works is important. Effective management of the claims guarantees prompt payment to the hospitals, minimizes the likelihood of claims denial, and guarantees the financial stability of the hospital. On behalf of that, having a smooth claims process makes the administrative work easier and creates good relationships among the patients, the healthcare professionals, and the insurance companies.

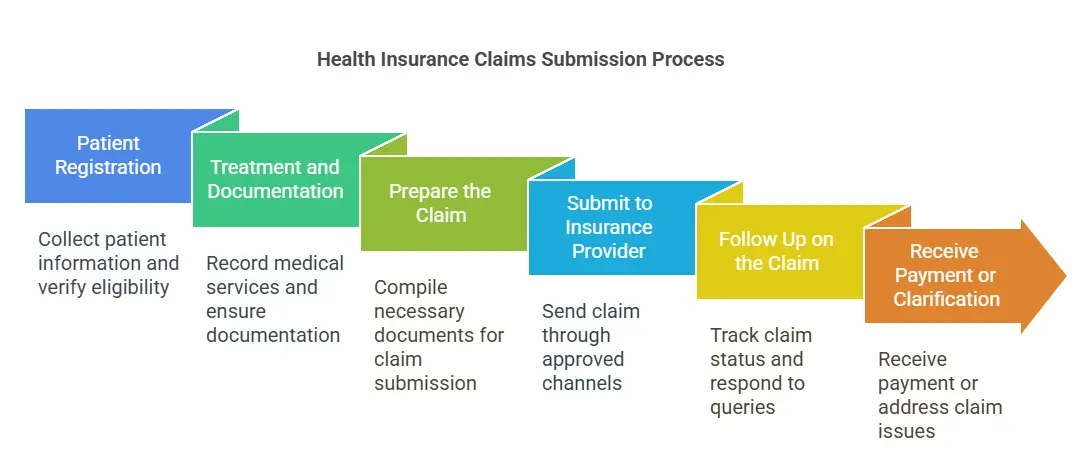

The Claims Submission Process: Step-by-Step

Submitting health insurance fund (HIF) claims involves several important steps. When done correctly, it helps ensure faster reimbursements and fewer rejections. Here’s how the process typically works:

Step 1: Patient Registration

Collect accurate patient information, including insurance details, policy number, and ID. This step ensures eligibility before treatment begins.

Step 2: Treatment and Documentation

Record all medical services, procedures, prescriptions, and diagnostics provided. Keep detailed notes and ensure all documents are signed and verified by the attending physician.

Step 3: Prepare the Claim

Create a claim file that includes the patient’s medical records, itemized bill, discharge summary (if applicable), and insurance claim form.

Step 4: Submit to the Insurance Provider or HIF

Send the claim through the approved channel—either electronically or via physical submission—following the insurance fund’s specific format and guidelines.

Step 5: Follow Up on the Claim

Track the claim status regularly. Respond promptly to any queries or requests for additional information from the insurer.

Step 6: Receive Payment or Clarification

If approved, the hospital receives payment. If denied or queried, review the reason, correct any issues, and resubmit if needed.

Get into Our Hospital Administration Course- signup for a free demo!

Tools and Software for Claims Management

1: What is the primary role of a hospital administrator?

The management of the Health Insurance Fund (HIF) manually argues that time can be taken and subjected to errors. This is why many hospitals are now dependent on special equipment and software to streamline the process of entire requirements – from data registration to keep an eye on reimbursement. These devices help to reduce paperwork, accelerate treatment and improve general accuracy.

🔷Hospital Information Management Systems (HIMS)

These all-in-one platforms manage patient records, billing, and insurance claims in one place. Many HIMS have built-in modules for submitting and tracking insurance claims.

🔷Claims Management Software

Dedicated software like ClaimBook, SimplePractice, or Practo (depending on your region) offer specific features like auto-filling forms, real-time status updates, and alerts for missing documentation.

🔷Electronic Health Record (EHR) Systems

Modern EHRs such as Epic or Cerners integrate clinical data with invoicing to present accurate and timely claims.

🔷Insurance Portals

Many insurance providers or national health funds offer online portals where hospitals can submit claims, download forms, and track approvals directly.

🔷Spreadsheet Templates & Workflow Tools

While not as advanced, well-organized spreadsheets and tools like Trello or Airtable can help small facilities track claim status and follow-ups efficiently.

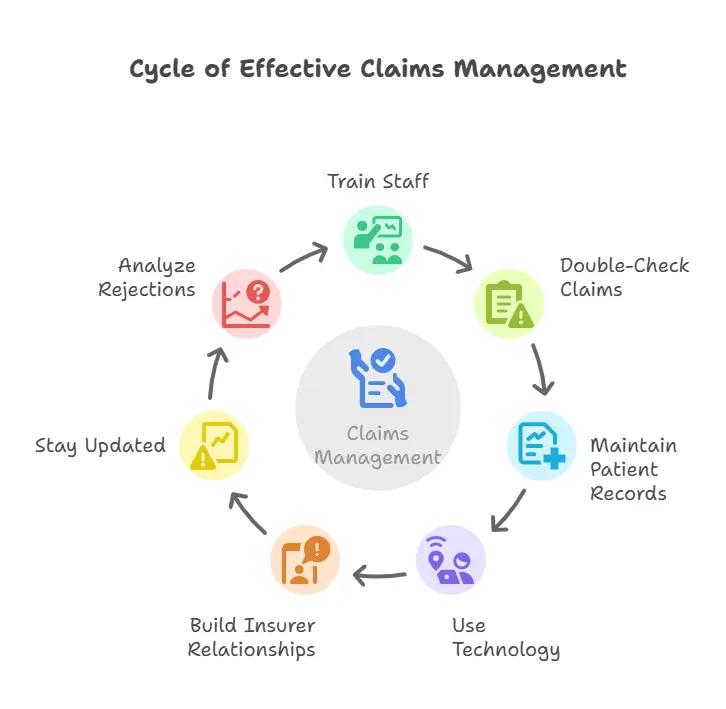

Best Practices for Hospital Administrators

Health insurance requirements require accuracy, speed and balance of teamwork to effectively manage. By following best practices, hospital administrators can reduce delays, avoid rejecting and improving the general efficiency of the requirements process.

1. Train Staff Regularly

Make sure your billing and administrators are well trained in insurance, requirements for procedures and documentation requirements. Common refresher sessions help keep everyone up to date.

2. Double-Check Before Submission

Always review claim documents for errors or missing information. A quick check can prevent rejections and speed up approvals.

3. Maintain Clear Patient Records

Exact and complete medical records are important for successful claims. Make sure all treatments, diagnosis and services are properly documented and signed.

4. Use Technology to Track Claims

Implement software to monitor claim status, set reminders for follow-ups, and keep a digital trail of submitted claims and communications.

5. Build Good Relationships with Insurers

Install open communication lines with insurance representatives. A good relationship can make it easier to solve the requirements problems quickly.

6. Stay Updated on Policy Changes

Insurance guidelines and guidelines can often be changed. Be informed about the Health Fund or the update of insurance companies to ensure compliance.

7. Analyze Rejected Claims

Don’t just resubmit—learn from it. Track reasons for denials and take steps to avoid repeat mistakes in future claims.

Get into Our Hospital Administration Course- signup for a free demo!

Conclusion

Management of the requirements of the Health Insurance Fund (HIF) can be challenging, but with the right procedures, equipment and team work, hospital administrators can make it a smooth and efficient operation. A well -operated requirement system not only ensures timely refund, but also improves the cash flow in hospitals and reduces stress for employees and patients.

By understanding the process of full requirements, using the right software, avoiding normal errors and following best practices, administrators can strengthen the hospital’s financial health and focus more on what really means – quality care.

| Also Read |

Hospital Administration Course with Assured Career Growth

Hospital Administration Course by Entri App: Master essential healthcare management skills, gain certification, and secure top roles in leading hospitals

Join Now!Hospital Administration Course with Assured Career Growth

Hospital Administration Course by Entri App: Master essential healthcare management skills, gain certification, and secure top roles in leading hospitals

Join Now!Frequently Asked Questions

What is a Health Insurance Fund (HIF) claim?

A HIF requirement is a request presented by a hospital for the reimbursement of medical services provided to the insurance provider or the National Health Fund to insure patients.

How long does it take for a claim to be processed?

It differs from the insurance company and the country, but usually everything can be taken from a few days to several weeks. Give speed to obvious documentation and quickly help things.

What are the most common reasons for claim rejections?

Missing documents, incorrect patient information, coding errors, and late submissions are among the top reasons. Double-checking all details before submitting is key.

Can technology really make a big difference in managing claims?

Yes. Claims management software can reduce errors, track progress in real time, and save your staff hours of manual work.

Do I need a dedicated claims team?

While smaller hospitals may rely on a few trained staff, larger facilities often benefit from a dedicated claims or billing team to manage volume and reduce errors.