Table of Contents

Entrepreneurship is a large and exciting endeavor—but that means you must also look after your finances wisely. For many small business owners, accounting sounds like a complicated galaxy of esoteric jargon and difficult-to-understand regulations. But being aware of just a few simple-sense accounting concepts can go a long way toward assisting you in making better business choices, stay in compliance, and expand successfully. In this blog, we’ll break down the basic accounting concepts every entrepreneur should know—no accounting degree required!

Unlock Your Accounting Potential – Enroll in Our Comprehensive Course Today!

Basic Accounting – Key Concepts

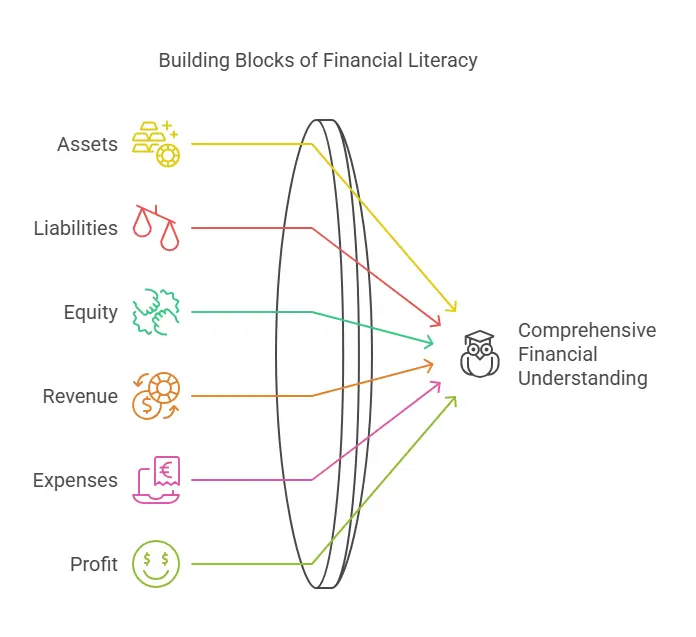

Below given are the key accounting principles on which all financial systems are built. Learning these will allow you to read the reports and grasp your company’s financial position:

1. Accrual versus Cash Basis Accounting

Cash Basis: Expenses and revenues are accounted for when cash is exchanged.

Accrual Basis: Revenues and expenses are accounted for when incurred or earned, regardless of when paid or received.

Most businesses convert to accrual accounting when they grow for a more accurate picture of finances.

2. Double-Entry Accounting

Every transaction affects at least two accounts: a debit on one and a credit on another.

This approach keeps the accounting equation balanced and reduces errors.

3. The Accounting Equation

Assets = Liabilities + Owner’s Equity

This equation is the basis of your balance sheet.

It maintains your books in balance and lets you see where your money is going and where it is coming.

4. Revenue Recognition

Revenue needs to be recognized when earned—no, not necessarily when cash is received (much more important in accrual accounting).

5. Matching Principle

Expenses need to be accounted for in the same time period as the revenue they relate to. This gives a more accurate picture of profitability.

Basic Accounting Terms

1: Accounting provides information on

Here we are providing the common accounting terms you will hear frequently.

- Assets: Cash, tools, merchandise, etc. your company owns

- Liabilities: loans, overdue invoices, etc. do company owe

- Equity: Assets less liabilities to show the owner’s portion of the company.

- Revenue: Income from offering goods or services

- Expenses: Running the company

- Profit (Net Income): Revenue minus expenses.

- Accounts Receivable: money owing to you by consumers.

- Accounts payable: money you owe to vendors or suppliers.

- General Ledger: The whole record of all financial activities

- Trial Balance: A summary of every ledger account guarantees their balance.

- Capital: Money the owners have put into the company.

Drawings: Money or items stolen from the company for personal consumption by the owner. - Inventory: Goods a company has on hand for sale.

- Fixed Assets: Long-term assets including buildings, land, and machinery utilized in commercial operations.

- Current Assets: Cash, inventory, and receivables—among other assets scheduled to be used up or converted to cash within a year.

- Current Liabilities: Short-term loans, accounts payable, and debts or commitments due within one year.

- Retained Earnings: Profits retained in the company instead of distributed as dividends.

- Cost of Goods Sold (COGS): The direct expenses resulting from a company’s goods sold production.

- Journal Entry: An accounting system record of a commercial transaction.

- Debit: An accounting entry that increases assets or expenses and decreases liabilities or equity.

- Credit: An accounting entry lowering assets or expenses and raising liabilities or equity.

- Accrual Accounting: Recording income and expenses when they are earned or incurred, not when cash is received or paid.

- Cash Accounting: Recording income and expenses only when cash is actually received or paid.

- Amortization: Spreading out the cost of an intangible asset (like a patent) over its useful life.

- Bad Debts: Customer debt that seems unlikely to be paid back.

- Break-even Point: The moment when complete income matches all expenses—no profit, no loss.

- Chart of Accounts: An enumeration of every account a corporation uses within its accounting system.

- Dividend: Some of the earnings of a corporation shared among its owners.

- Fiscal Year: Accounting uses a 12-month period, either matching or not the calendar year.

- Audit: An unbiased review of financial data meant to guarantee compliance and correctness.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Summary

Any entrepreneur would be wise to pick up fundamental accounting skills. Although mastering the principles—the accounting equation, double-entry method, cash rather than accrual accounting—will help you to maintain your company’s finances under control rather than overnight transformation into an accounting genius. The fundamentals help you to manage financial flow, swiftly monitor income and expenses, schedule taxes, and make wise, fact-based decisions. Once you understand the meaning behind popular words like assets, liabilities, income, and profit, you can better evaluate the performance of your firm and read financial reports. In essence, a fundamental knowledge of accounting helps you not only to survive in business but also to flourish confidently and assuredly.

Become a Skilled Accountant – Join Our Accredited Accounting Course Now! Get free Demo Here!

Entri Elevate – Business Accounting & Finance Certification Programme covers every major section from the fundamentals to practical experiments. This programme will provide applicable exercises and real-life examples in financial accounting to strengthen the concepts.

The course is offered entirely online, including video lectures, interactive exercises, and downloadable materials. Students can access the course content from anywhere, at any time, as long as they have an internet connection.

Accounting courses we offer |

Accounting courses in Different Cities |

| Business Accounting & Finance Certification | |

| Tally Course | |

| Taxation Course | |

| UAE Accounting Course | |

| GST Course |

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Frequently Asked Questions

Which accounting method should I use—cash or accrual?

If you’re just starting out, cash accounting may be simpler. As your business grows or if you carry inventory or work with credit, accrual accounting is typically more accurate.

What’s the easiest way to start managing my business finances?

Use beginner-friendly accounting software like QuickBooks, Wave, or Xero. They automate much of the work and help you learn accounting basics as you go.

Why should I separate personal and business finances?

Mixing finances can lead to bookkeeping confusion, inaccurate reports, and issues during audits or tax filing. Keeping them separate ensures clear records and protects your legal liability.

How can I reduce accounting errors in my business?

Stay consistent with data entry, reconcile accounts regularly, use accounting software, and consider getting a professional to review your books periodically.

Do I need to hire an accountant if I understand basic accounting?

It’s a great advantage to understand accounting yourself, but as your business grows, hiring a professional ensures accuracy, compliance, and better financial planning.

Why is the accounting equation important?

It’s the foundation of your balance sheet and ensures that your books are always in balance, which is crucial for financial accuracy and decision-making.