Table of Contents

A balance sheet is a financial statement that contains detailed information about a company’s assets or liabilities at a particular time. This is one of three basic financial statements (income statement and cash flow statement are the other two) used to evaluate a company’s performance.

The balance sheet serves as a reference for investors and other stakeholders to understand the financial position of an organization. This allows them to compare current assets and liabilities to determine the liquidity of the business or calculate the rate at which the business generates profits. Comparing two or more balance sheets at different times can also show how the business has grown.

With this information, stakeholders can also understand the company’s prospects. For example, the balance sheet can be used as evidence of solvency when a business applies for a loan. By checking whether current assets exceed current liabilities, creditors can know whether the company can meet its short-term obligations and the level of financial risk the company is facing.

Unlock Your Accounting Potential – Enroll in Our Accounting Course!

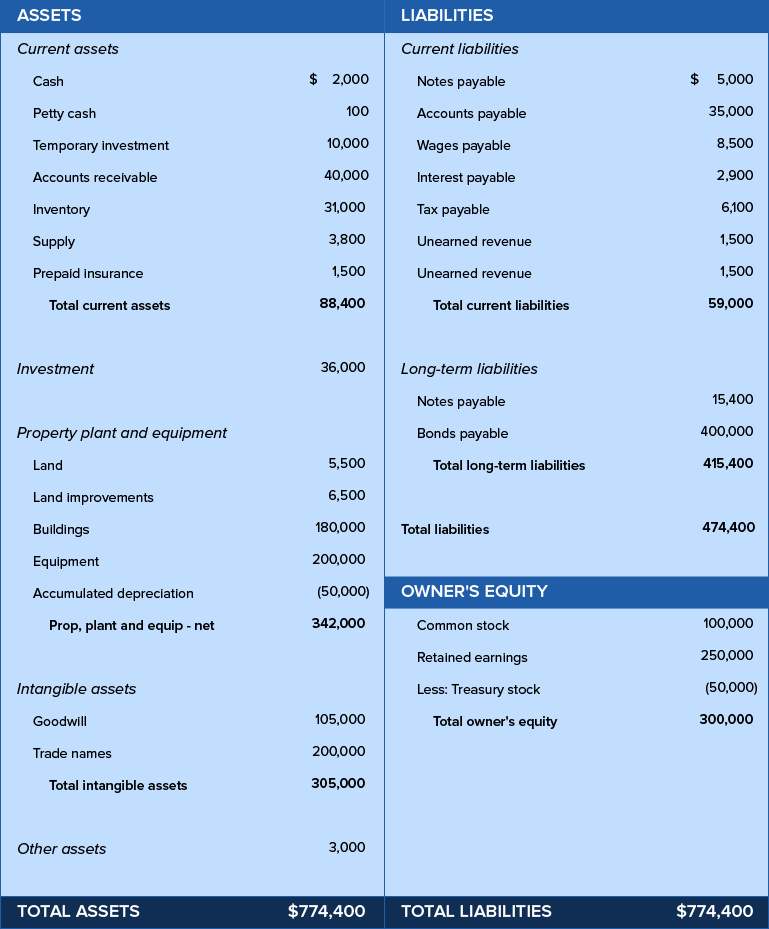

Balance sheet example with sample format

The balance sheet presents many accounts, classified into assets and liabilities. Like any other financial statement, the balance sheet will have slight variations in structure depending on the organization. Below is an example balance sheet, showing all the basic accounts classified by assets and liabilities so that both sides of the balance sheet are equal.

Key elements & components of a balance sheet

1: Accounting provides information on

A balance sheet consists of two main headings: assets and liabilities. Let us take a detailed look at these components.

Assets

Assets are things that a business owns that are beneficial to the development of the business. Assets can be classified based on their convertibility, physical existence and use.

a. Convertibility: This describes whether the asset can be easily converted into cash.

On the basis of convertibility, assets are classified into current assets and fixed assets.

- Current assets: Assets that can be easily converted into cash or cash equivalents within one year. Examples include short-term deposits, marketable securities, and stocks.

- Fixed assets: Assets that cannot be easily or readily converted into cash. For example: buildings, machinery, equipment or brands.

b. Physical existence: Assets can be of two types, tangible and intangible.

- Tangible assets: Assets that you can see and touch, such as office supplies, machinery, equipment, and buildings.

- Intangible assets: Assets that do not exist physically, such as patents, trademarks, and copyrights.

c. Usage: 4,444 assets can be classified into operating assets and non-operating assets.

- Operating assets: Assets necessary to conduct business operations. For example, buildings, machinery and equipment.

- Non-operating assets: Short-term investments or marketable securities not necessary for daily operations.

Liabilities

Liabilities are what a business owes to other parties. This includes debts and other financial obligations arising from business transactions. Companies settle their debts by repaying them in cash or providing equivalent services to the other party.

Liabilities are listed on the right side of the balance sheet. Depending on the context, liabilities can be classified as short-term and current liabilities.

- Current liabilities or Short-term debt: Includes debts or obligations that must be completed within one year. Current liabilities are also known as current assets and include accounts payable, interest payable, and short-term loans.

- Non Current liabilities or Long-term debt: These are debts or obligations with a term of more than one year. Long-term debt, also known as long-term debt, includes bonds payable, long-term bonds payable, and deferred tax liabilities.

Owner’s Equity/ Earnings

Equity equals total assets minus total liabilities. In other words, it is the amount of money that can be returned to shareholders after paying debts and liquidating assets. Equity is one of the most common ways to express a company’s net worth. Part of equity is retained earnings, which is a fixed percentage of equity that must be paid out as dividends.

Equity value can be positive or negative. If shareholder equity is positive, the company has enough assets to repay its debt. If it is negative then liabilities exceed assets.

Unlock Your Accounting Potential – Enroll in Our Accounting Course!

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!General sequence of accounts in a balance sheet

According to Generally Accepted Accounting Principles (GAAP), current assets must be listed separately from liabilities. Similarly, short-term debt must be presented separately from long-term debt.

The current asset account includes cash, accounts receivable, inventory, and prepaid expenses, while the long-term asset account includes long-term investments, fixed assets, and intangible assets.

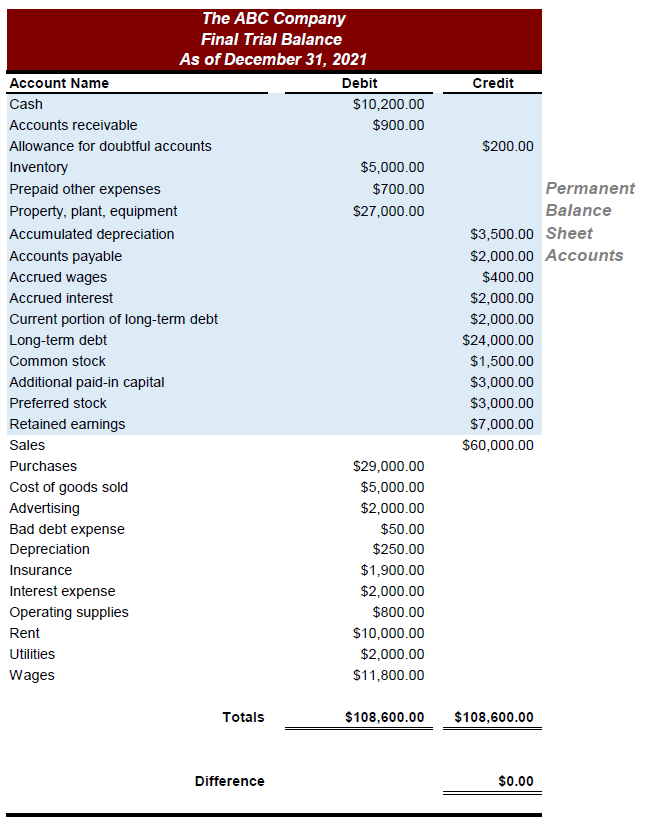

image.

In your current liability account, you may have long-term debt, interest payable, salaries, and payments to customers, while long-term debt includes long-term debt, pension fund and liabilities. Asset accounts will be listed in descending order of maturity, while liabilities will be listed in ascending order. According to equity, the accounts are listed in descending order of priority.

Balance sheet formula & equation

The balance sheet equation follows the accounting equation, where assets are on one side, liabilities and shareholder’s equity are on the other side, and both sides balance out.

Assets = Liabilities + Shareholder’s Equity

According to the equation, a company pays for what it owns (assets) by borrowing money as a service (liabilities) or taking from the shareholders or investors (equity).

Why should you create a balance sheet?

The purpose of creating a balance sheet is to know the financial position of your business, especially what it owns and what it owes at the end of the accounting period (usually every 12 months). Therefore, the balance sheet is also known as the statement of position or statement of financial position: it provides an overview of all assets and liabilities at a given time.

Using a balance sheet will benefit your business in three ways:

- It provides a basis for assessing risk and return. By comparing your current assets with your current liabilities, you can determine whether you have enough capital to cover short-term liabilities (e.g. salaries, rent) or if you need more more capital to operate its daily operations.

- It plays an important role in borrowing and investing. Most lenders and investors evaluate the balance sheet to see if your business can collect payments from customers, repay debt on time, and manage its assets responsibility.

- This demonstrates the long-term sustainability of your business. By analyzing your balance sheet and determining the appropriate financial ratios, you can evaluate your business’s position in terms of profitability, productivity and liquidity. You can also use these ratios to compare your performance with your competitors.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!HOW TO PREPARE A BASIC BALANCE SHEET

Below are the steps you can take to create a basic balance sheet for your organization. Even if all or part of the process is automated through the use of an accounting system or software, understanding how a balance sheet is prepared will allow you to detect potential errors so you can addressed before they cause lasting damage.

1. Determine the Reporting Date and Period

The balance sheet aims to describe the total assets, liabilities and equity of a business as of a specific date, commonly known as the balance sheet date. Normally the reporting date will be the last day of the accounting period.

How Often Is a Balance Sheet Prepared?

Companies, especially publicly traded ones, prepare their balance sheet reports on a quarterly basis. When this is the case, the reporting date usually falls on the final day of the quarter. For companies that operate on a calendar year, those dates are:

- Q1: March 31

- Q2: June 30

- Q3: September 30

- Q4: December 31

Companies that report annually typically use December 31 as the reporting date, although they can choose any date. It is not uncommon for the balance sheet to take several weeks after the end of the reporting period.

2. Determine your assets

Once you have determined the date and reporting period, you will need to account for your assets as of that date. Typically, the balance sheet lists assets in two ways: as individual items and then as total assets.

Breaking content into different line items makes it easier for analysts to understand what your content is about and where it comes from; it will be necessary to add them to the final analysis.

Assets will typically be divided into the following positions:

- Current Assets:

- Cash and cash equivalents

- Short-term marketable securities

- Accounts receivable

- Inventory

- Other current assets

- Non-current Assets:

- Long-term marketable securities

- Property

- Goodwill

- Intangible assets

- Other non-current assets

Current and non-current assets should both be subtotaled, and after that totaled together.

3. Identify Your Liabilities

In the same way, you will need to identify your liabilities. Again, these should be organized into both line items and totals, as shown here:

- Current Liabilities:

- Accounts payable

- Accrued expenses

- Deferred revenue

- Current portion of long-term debt

- Other current liabilities

- Non-Current Liabilities:

- Deferred revenue (non-current)

- Long-term lease obligations

- Long-term debt

- Other non-current liabilities

As with assets, these should be both subtotaled and then totaled together.

4. Calculate Shareholders’ Equity

If a business or organization is owned by a single owner, the equity will generally be quite simple. If public, this calculation can become more complicated depending on the different types of shares issued.

Common line items found in this section of the balance sheet consists of the following:

- Common stock

- Preferred stock

- Treasury stock

- Retained earnings

Unlock Your Accounting Potential – Enroll in Our Accounting Course!

5. Add Total Liabilities to Total Shareholders’ Equity and Compare to Assets

To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity. To do this, you’ll need to add liabilities and shareholders’ equity together.

Here’s an example of a finished balance sheet:

It’s important to note that this sample balance sheet is formatted according to the International Financial Reporting Standards (IFRS) that companies outside the United States follow. If this balance sheet came from an American company, it would comply with generally accepted accounting principles (GAAP).