Table of Contents

Key Takeaways:

- Data analytics is revolutionizing banking careers in India, offering diverse roles from fraud detection to credit risk modeling.

- High-impact skills include Python, SQL, Excel, and BI tools, combined with domain knowledge of finance and banking operations.

- Banks are increasingly adopting AI and real-time analytics, making data-driven decision-making crucial for career readiness.

- Avoid common pitfalls like ignoring domain expertise and lacking hands-on projects to stand out in competitive banking analytics roles.

- Leverage Entri’s comprehensive upskilling resources and courses, such as the Data Analytics Course in Kerala, to gain practical skills, mentorship, and placement support.

Introduction: Why Data Analytics Skills Are Essential for Tomorrow’s Bankers

Imagine applying for a banking job and not only managing finances, but also predicting fraud, personalizing customer offers, and optimizing loan portfolios with real-time data. Today’s banking sector is no longer built on paperwork and manual reports—it’s powered by data analytics. The rise of digital banking, fintech companies, and regulatory requirements has made data analyst roles in banks and financial services some of the most exciting and rewarding careers available.

Whether you’re a BCom, BBA, or MBA graduate, or a working professional considering a career shift, data analytics offers you a future-proof path in the banking and finance sector. So, how can banking aspirants leverage this opportunity? Let’s break it down.

Data Analytics: Transforming Banking Careers in India

Banking jobs aren’t just about cash management or loans anymore. Today, banks rely on analytics to detect fraud, manage risk, and deliver personalized services, making data skills indispensable.

Why Are Banks Hiring Data Analytics Talent?

-

Fraud Detection: Analytics tools flag suspicious transactions instantly, protecting assets and customer trust. (Read in detail over here.)

-

Risk Modeling: Predict loan defaults and credit risk using Python and advanced statistical models.

-

Customer Analytics: Segment users for tailored marketing using SQL and BI platforms.

-

Regulatory Compliance: Automate complex reporting and stay ahead of RBI/SEBI requirements.

-

Operational Efficiency: Optimize branch finances, ATM cash flows, and cost management using data insights.

Explore Free Coding Courses for you to get started on your coding journey!

Banking Analytics Career Paths: Versatile & Rewarding

-

Banking Data Analyst (SQL for financial data analysis, Python for banking analytics)

-

Business Intelligence Analyst (BI analyst in banks, banking BI career opportunities)

-

Credit Risk Analyst (credit scoring with machine learning, risk modeling in banking)

-

Fraud Prevention Analyst (banking fraud detection analytics tools)

-

MIS Executive / Reporting Analyst (financial data analysis, bank reporting analyst jobs)

-

Fintech Data Analytics Specialist (data analyst role in fintech companies)

| Role | Skills Needed | Avg. Salary (India) | Typical Employers |

|---|---|---|---|

| Data Analyst | Excel, SQL, Python | ₹3.5–7L/year | Banks, NBFCs, Fintech |

| Credit Risk Analyst | Python, ML | ₹5–10L/year | Private Banks, Credit Bureaus |

| BI Analyst | Power BI, Tableau | ₹5–9L/year | MNC Banks, Fintech |

| Fraud Analyst | Python, Domain Know. | ₹4–8L/year | Payment Firms, Banks |

Depending on your skill set and interests, you can work in public sector banks, private banks, fintech startups, or multinational banking giants.

Also read: Data Analyst Salary in Germany

High-Impact Skills & Tools for Banking Data Analytics

To stand out in a career transition to data analytics, focus on these essential tools and concepts:

-

Excel: Foundation for financial modeling and dashboards.

-

SQL: Query skills for customer segmentation, credit scoring, and reporting.

-

Python: For predictive modeling, automation, and fraud analytics.

-

Power BI / Tableau: Visualize and interpret data for strategic decisions.

-

Machine Learning Fundamentals: Basic knowledge for advanced analytics roles.

Pro Tip: Freshers should start with Excel and SQL—easy to learn and crucial for entry-level banking analytics jobs.

How Banking Aspirants Fit Into the World of Data Analytics

Banking aspirants are uniquely positioned to excel in the field of data analytics because they bring together financial expertise, domain knowledge, and an understanding of business processes—the very foundation upon which banking analytics thrives. Here’s how and why banking aspirants are a natural fit:

1. Domain Expertise & Context

Banking professionals know the ins and outs of credit, risk, compliance, customer segments, and financial products. This business context is essential for designing analytics solutions that solve the “real problems” banks face—from fraud detection to loan approvals.

2. Ability to Bridge Business and Technology

Data analytics isn’t just about crunching numbers; it’s about translating data-driven insights into meaningful business actions. Banking aspirants can bridge the gap between data science teams and business decision-makers, ensuring analytics projects align with regulatory requirements and strategic objectives.

3. Rich Data Environments

Banks generate massive amounts of data—transactions, KYC documents, loan applications, customer feedback, etc. Aspirants comfortable in banking environments are well-prepared to leverage this data to create predictive models, track trends, and optimize processes.

4. Rising Demand for Hybrid Roles

Today, banks are hiring for roles that combine finance knowledge with technical analytics skills. Titles like “Credit Risk Analyst,” “Fraud Detection Analyst,” “BI Analyst,” and “Financial Data Scientist” reflect this shift. Banking aspirants can upskill in tools like Excel, SQL, Python, and Power BI to become competitive candidates for these in-demand hybrid roles.

5. Problem-Solving for High-Value Challenges

Banks face multi-million rupee challenges—preventing fraud, predicting loan defaults, improving cross-sell strategies, and ensuring compliance. Banking aspirants who embrace analytics become key players in solving these challenges using predictive modeling, segmentation, and automation.

6. A Clear Path to Career Growth

With India’s banking sector rapidly digitizing, professionals who blend finance and analytics skills will find more career advancement opportunities—moving into leadership roles, consulting, product development, or fintech innovation.

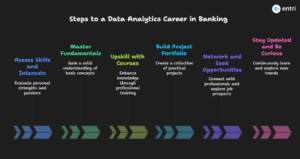

How to Kickstart Your Data Analytics Career in Banking

Launching a data analytics career in the banking sector isn’t intimidating when you break it down into actionable steps. Here’s how banking aspirants—whether freshers, finance graduates, or career-switchers—can build momentum:

1. Assess Your Skills and Interests

Reflect on your strengths:

-

Are you detail-oriented and comfortable with numbers?

-

Do you enjoy solving puzzles, finding trends, or experimenting with tech tools?

-

If you have a finance or commerce background, your domain knowledge is a huge plus!

2. Master the Fundamentals

Start with the basics:

-

Excel: Perfect for learning data visualization, formulas, pivot tables, and reporting.

-

SQL: Fundamental for querying databases and analyzing large volumes of transaction data.

-

Python: Widely used for automation, machine learning, and predictive analytics in banking.

-

Power BI/Tableau: Visual tools that turn raw data into actionable business insights.

Pro Tip: Focus on one skill at a time for maximum impact. Many entry-level banking analyst roles begin with Excel and SQL before progressing to Python or BI tools.

3. Upskill with Professional Courses

Choose a course that combines theory, hands-on practice, and placement support:

-

Entri’s Data Analytics Course in Kerala is tailored for banking and finance, offering real-world projects, mentorship, and job readiness.

-

Look for modules covering financial modeling, credit risk analysis, fraud detection, and customer segmentation.

4. Build a Project Portfolio

Demonstrate your skills:

-

Create dashboards or models for loan approvals, fraud detection, or ATM cash forecasting.

-

Use sample bank datasets or open-source data for practice.

5. Network and Seek Opportunities

-

Connect with banking and fintech professionals on LinkedIn.

-

Participate in webinars, analytics meetups, and online communities.

-

Apply for internships or entry-level roles—don’t wait for “perfect” skills, practical learning happens on the job.

6. Stay Updated and Be Curious

Banking analytics is constantly evolving.

-

Follow blogs like Entri’s How to Start a Career in Data Analytics in Kerala and Data Analyst Career Path.

-

Read up on the latest tech trends, new tools, and regulatory developments in the finance sector.

Success in banking analytics is all about continuous learning, showcasing real skills, and making smart career moves.

Industry Trends & Future Outlook in Banking Data Analytics

The banking sector in India—and internationally—is moving rapidly towards greater integration of data analytics, AI, and advanced digital tools. Here are the key trends:

-

AI and Predictive Analytics: Banks are leveraging predictive analytics and machine learning to anticipate customer needs, detect fraud, and personalize offerings at scale. For example, advanced credit scoring models make loan approvals more accurate and inclusive.

-

Real-Time Analytics: The proliferation of IoT devices and faster processing now enables instant decisions, from branch cash management to customer engagement.

-

AI-Driven Customer Insights: Artificial intelligence extracts actionable insights, helping banks understand customer behavior, preferences, and sentiment more deeply.

-

Enhanced Risk Management: Data analytics tools are helping banks to assess and manage credit, market, and operational risks in real time.

-

Regulatory Compliance & Fraud Detection: Banks are using analytics for anti-money laundering, KYC, and compliance monitoring—making regulatory reporting more streamlined.

-

Data Monetization: Indian banks increasingly monetize data assets—for example, offering analytics-driven products to third parties.

-

Blockchain in Banking Analytics: Blockchain is emerging as a powerful tool to drive security, transparency, and process efficiency in business intelligence, identity verification, and transaction processing.

-

Adoption Rates: Around 73% of banks globally now use data analytics to support decision-making, and this is expected to reach 80% by year-end as personalized banking becomes the new standard.

Relevant Entri Reads:

Common Mistakes Banking Aspirants Make When Transitioning to Data Analytics

Starting your journey in banking analytics comes with unique challenges—a few mistakes can hold you back:

-

Focusing Only on Technical Tools: Many aspirants jump straight into Python or SQL without learning banking trends, compliance, or core business concepts. Balance technical upskilling with domain knowledge and free foundational materials.

-

Neglecting Project Experience: Recruiters want to see real dashboards, workflows, and value addition. Build a personal portfolio with banking use cases—don’t rely on theoretical study alone.

-

Overlooking Soft Skills: Communication, business acumen, and presentation matter as much as coding. Practice explaining complex analysis in simple terms.

-

Ignoring Practice and Hands-On Learning: Reading and watching tutorials aren’t enough. Engage with mock tests, hands-on problem solving, and case studies.

-

No Research on Role Requirements: Each analytics job may demand different tools or knowledge. Tailor your learning and prepare for role-specific interviews.

-

Lack of Continuous Learning: Banking analytics trends change quickly. Stay updated through blogs, newsletters, and online communities.

Also read: How To Become A Data Analyst in Kerala

Conclusion: Why Now is the Perfect Time to Enter Banking Analytics

Banking isn’t just moving online—it’s becoming smarter, faster, and more data-driven than ever. The ability to crunch numbers, spot fraud, predict risk, and deliver personalized financial services is quickly overtaking traditional banking roles. As a result, banking data analytics jobs in India are soaring in demand, with banks and fintechs looking for candidates who can merge financial savvy with tech skills.

Upskilling today means:

-

Accessing new-age careers that pay well and challenge you intellectually.

-

Standing out in job interviews—analytics is a skill set banks value highly.

-

Having the flexibility to move into roles in credit, risk, BI, fraud, operations, or even fintech.

Entri’s Data Analytics Course in Kerala supports you at every step, providing expert mentorship, practical projects, and placement assistance specifically for the finance sector. Whether you’re a fresher or a seasoned pro looking to pivot, Entri helps turn your ambitions into real impact.

So, why wait? The future of banking is data-driven, and your analytics journey starts here. Join Entri’s community of data innovators—unlock new roles, new skills, and the confidence to lead India’s banking transformation.

|

Related Articles |

|

| Can Digital Marketing Professionals Switch Into A Data Analytics Career? | |

Frequently Asked Questions

Can someone from a non-technical banking background become a data analyst?

Yes. Many banking aspirants with finance or commerce backgrounds successfully transition by learning key analytics tools like Excel, SQL, and Python, and understanding banking domain concepts.

What are the must-have skills for data analytics jobs in banking?

Core skills include Excel, SQL for data querying, Python for automation and modeling, Power BI or Tableau for visualization, plus an understanding of financial products and compliance requirements.

Will certification help in getting banking data analytics jobs?

A relevant certification, such as Entri’s Data Analytics Course specialized for banking aspirants, can significantly boost employability, provide practical experience, and help clear interviews faster.

What roles can I target after learning banking data analytics?

Roles include Data Analyst, Business Intelligence Analyst, Credit Risk Analyst, Fraud Analyst, and analytics roles in fintech startups or digital banking.

How do I avoid common mistakes when switching to analytics in banking?

Balance technical skills with domain knowledge, build a portfolio of projects, develop communication skills, and stay updated with industry trends. Avoid focusing only on tools without applying them in banking contexts.

Are there internship or entry-level opportunities in banking analytics?

Yes, many banks and fintech firms offer internships and entry-level roles for candidates with foundational data analytics skills, supported by practical coursework and certifications.