Table of Contents

Starting a new business involves many crucial decisions, but one of the most underappreciated—and crucial—is selecting the appropriate accounting system. Although early hustle may not seem critical, your accounting system sets the foundation of how you handle money, file taxes, and decide on business direction. Starting with the correct framework will save you legal hassles down the road, time, and money. In this blog post, we will dive into how to choose the right accounting structure for your startup and help you choose the best fit for your startup.

Unlock Your Accounting Potential – Enroll in Our Comprehensive Course Today!

Why Choosing the Right Accounting Structure is Crucial for Startups

Starting a business can be tempting to concentrate simply on the product, marketing, or financing, but adopting the correct accounting structure is equally crucial. Your chosen accounting system will affect your income recording, tax filing, spending control, and even investment attraction. While the correct structure lays a strong basis for financial transparency, compliance, and long-term development, a wrong decision taken early on can result in expensive blunders.

Your accounting structure directly influences:

- Tax burdens

- Stakeholder reporting

- Managing cash flows

- Compliance and regulatory needs

- Capital raising and investor preparedness

A poor choice can lead to tax inefficiencies, messy reporting, and lost growth possibilities. The proper accounting structure, however, tracks with your startup’s goals so that it is growing with you and keeping your finances spotless and open.

Overview of Common Accounting Structures

1: Accounting provides information on

Below given are the most often used accounting systems available for startups:

1. Cash Basis Accounting

- It records costs paid and income received.

- Perfect for early-stage, small businesses with simple budgets.

- Pros: Real-time cash flow view and easy management

- Cons: Limited financial knowledge; does not connect income to linked expenses.

2. Basis of Accrual Accounting

- It records income when earned and costs when incurred.

- Ideal for SaaS companies, growing startups, or those engaged in credit or inventory transactions.

- Pros: more realistic financial picture.

- Cons: More complicated; could call for an accountant or software.

3. Single-Entry method of Accounting

- It is a simple method noting every transaction once, either as income or an expense.

- Most suited for side projects or solopreneurs.

- Pros: hand manual management ease.

- Cons: Not scalable or fitting for expansion; no double-checking.

4. Double-Entry method of accounting

- Every purchase influences at least two accounts—one credit and one debit.

- Perfect for most startups past the concept level.

- Pros: Reduces mistakes; facilitates complete financial reporting; necessary for GAAP compliance.

- Cons: calls somewhat more accounting tools or effort.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Factors to Consider When Choosing an Accounting Structure

Your unique business needs will determine the appropriate structure you use. Consider the below given factors to choose the right accounting structure for your business

1. Phase of Your Business Development

Early-stage companies with few transactions could be good candidates for cash basis or single-entry. For more insights, growth-stage companies could take double-entry and accrual under consideration.

2. Company Complexity

Do you maintain merchandise, sell subscriptions, or over time supply services? In these situations, accumulating accounting will be more accurate.

3. Investors and Money Funding

Usually needing GAAP-compliant (Generally Accepted Accounting Principles) financials, most investors use double-entry systems and accrual basis.

4. Fiscal Consequences

Certain accounting systems can influence your tax payer timing and method. See a tax professional to decide which fits your startup’s financial plan most closely.

5. Tools and Programs in Software

Modern accounting systems automate double-entry transactions and manage both cash and accrual techniques, therefore simplifying the adoption of advanced structures.

Take Your Career to New Heights with Our Professional Accounting Course! Get free Demo Here!

How to Transition Between Accounting Structures as Your Startup Grows

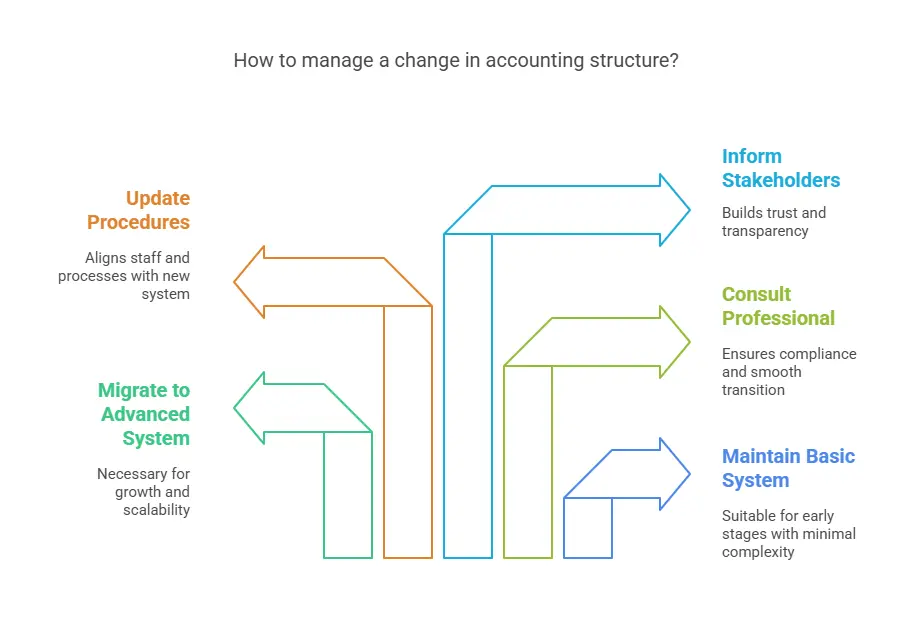

Many times starting with a basic system, startups change with time. Here’s how to handle a change in direction smoothly:

- Starting with thorough records will help to simplify the migration.

- Use programs that let you quickly move between accrual and cash approaches.

- See a professional accountant to help you make the change without running across regulatory concerns.

- Change your procedures and staff such that everyone fits the new system.

- Tell stakeholders explicitly about changes, particularly if you are getting ready for audits or funding.

Common Accounting Structure Mistakes to Avoid

-

Delaying the decision – Waiting too long to build a suitable framework could lead to anarchy later.

-

Mixing personal and business finances – Keeping personal and corporate funds separate always helps to preserve compliance and clarity.

-

Choosing what’s easiest over what’s right – Making decisions about what’s easier rather than what’s right Simple may be effective today, but with time it won’t be.

-

Not planning for growth –Your accounting should expand with your startup, not restrict it; you are not preparing for expansion.

-

Failing to consult a professional – Ignoring the advice of a professional. A quick review can prevent later expensive mistakes.

Learning accounting can be a daunting task, but the rewards of mastering this skill can be invaluable. With Entri, you can learn accounting in an effective and efficient way to maximize the benefits of mastering this skill. Entri provides comprehensive and engaging courses that make learning accounting easier than ever before. With Entri, you can become an expert in accounting and unlock many potential opportunities. We offer

- Recorded & Live Sessions

- Personal Mentorship

- Expert Training

- Course Certificate

- Guaranteed Internship

- Placement Assistance

- 100+ Hiring Partners

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Conclusion

Choosing the right accounting structure is completely one of the most critical aspect of starting a company,. It affects everything, including your tax filing and how you manage daily transactions as well as how you document earnings to stakeholders. A good accounting system lowers financial risk, brings discipline, and provides insightful analysis to direct strategic decisions. Your accounting needs will change as your company grows; so, flexibility and readiness to change your structure are also rather important. Whether you’re bootstrapping or preparing for a fundraising round, investing time into knowing and building the correct accounting structure now will help your startup be positioned for scalable, sustained success and avoid future problems.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Frequently Asked Questions

Which accounting structure is best for early-stage startups?

For many early-stage startups, a cash basis with single-entry accounting may suffice. However, if you’re seeking funding or managing complex finances, accrual basis and double-entry are more appropriate.

What role does accounting software play in choosing a structure?

Modern accounting tools like QuickBooks, Xero, or Zoho Books can handle both cash and accrual methods and automate double-entry transactions, making complex systems easier to manage.

How do I know when it’s time to change my accounting structure?

It’s time to upgrade when you start scaling, dealing with investors, managing inventory, handling large expenses, or needing more detailed financial insights than your current system provides.

Can I manage accounting myself or do I need an accountant?

If your finances are simple and you’re comfortable with bookkeeping, you can start on your own using software. But for proper setup, growth planning, or switching methods, consulting a professional is highly recommended.

Is double-entry accounting necessary for small startups?

While not mandatory, double-entry accounting helps catch errors and gives a clearer financial picture. It becomes increasingly valuable as your startup grows or if you work with outside investors.