Table of Contents

Revenue cycle management (RCM) maintains financial stability, efficiency, and accuracy in healthcare institutions. It tracks all financial interactions between the patient and the healthcare organization from initial patient registration to final payment. If you want to learn about healthcare revenue cycle management, you have come to the right place! In this blog, we will discuss what is revenue cycle in healthcare, its importance, key components of revenue cycle management, how revenue cycle management works, the role of RCM software in healthcare, etc.

Explore Your Future in Hospital Administration! Enroll now

Introduction

Revenue Cycle Management (RCM) is the financial process used by healthcare organizations to track patient care episodes from registration and appointment scheduling to the final payment of a balance. Effective RCM ensures that healthcare providers are reimbursed efficiently for the services they deliver, reducing administrative burdens and improving cash flow. The complexity of healthcare billing, coupled with regulatory compliance requirements, makes RCM a critical function for hospitals, clinics, and private practices.

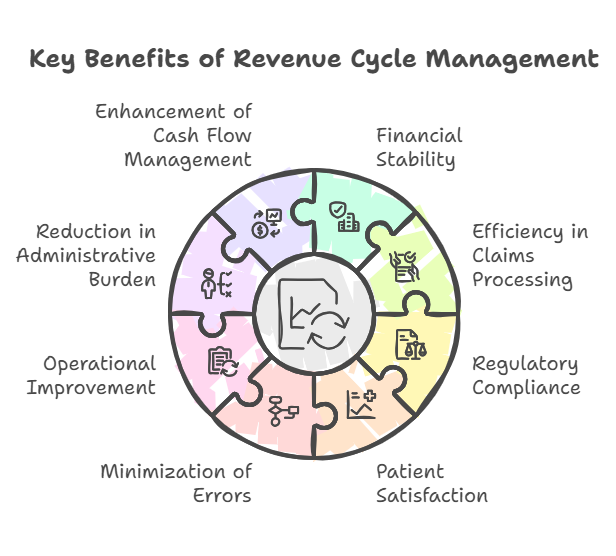

Importance of RCM

- Financial Stability

- Ensures steady revenue flow to sustain operations.

- Helps providers plan budgets and allocate resources effectively.

- Reduces financial stress by maintaining consistent income.

- Efficiency in Claims Processing

- Reduces delays in reimbursement by streamlining billing procedures.

- Ensures accurate documentation and coding to avoid denials.

- Minimizes administrative workload related to rework and appeals.

- Regulatory Compliance

- Ensures adherence to HIPAA, Medicare, and Medicaid regulations.

- Protects healthcare organizations from legal and financial penalties.

- Requires continuous updates to stay aligned with evolving industry standards.

- Patient Satisfaction

- Reduces billing-related confusion with clear and transparent communication.

- Offers flexible payment options for patients to manage expenses.

- Enhances trust between healthcare providers and patients.

- Minimization of Errors

- Prevents denied claims through accurate coding and documentation.

- Reduces miscommunication between administrative and clinical staff.

- Uses automated systems to detect and correct potential mistakes before submission.

- Operational Improvement

- Provides insights into financial performance through data analytics.

- Helps identify bottlenecks in the billing and payment process.

- Supports continuous process optimization for increased efficiency.

- Reduction in Administrative Burden

- Automates repetitive tasks to allow staff to focus on patient care.

- Reduces paperwork and manual intervention in billing processes.

- Improves workflow efficiency within revenue cycle teams.

- Enhancement of Cash Flow Management

- Reduces outstanding accounts receivable by improving payment collection.

- Ensures faster claim approvals and reduces reimbursement waiting periods.

- Helps providers manage financial obligations and investments effectively.

This article explores the key components of RCM, how it works, and the role of RCM software in optimizing the process.

Key Components of Revenue Cycle Management

1: What is the primary role of a hospital administrator?

1. Patient Registration and Eligibility Verification

- Accurate Data Entry – Ensures correct patient details for seamless billing.

- Insurance Verification – Confirms active coverage to avoid denials.

- Pre-Authorization – Secures approvals for required procedures.

- Co-Pay and Deductible Estimation – Provides upfront cost estimates to patients.

- Patient Communication – Educates patients about their financial responsibilities.

2. Charge Capture

- Service Documentation – Records all billable procedures accurately.

- Automated Charge Capture – Uses integrated technology to reduce revenue loss.

- Error Identification – Ensures all procedures are billed correctly.

- Audit and Review – Validates captured charges to prevent revenue leakage.

3. Medical Coding and Documentation

- Standardized Coding – Uses ICD-10, CPT, and HCPCS for accuracy.

- Compliance Audits – Prevents errors and ensures adherence to regulations.

- Clinical Documentation Improvement (CDI) – Enhances record accuracy.

- Regular Staff Training – Keeps coders updated on regulatory changes.

4. Claims Submission

- Electronic Filing – Accelerates processing and reduces rejections.

- Claim Scrubbing – Detects and corrects errors before submission.

- Payer-Specific Guidelines Compliance – Ensures claim format meets insurer requirements.

- Real-Time Claim Tracking – Monitors claim progress and flags delays.

5. Payment Posting

- Automated Payment Matching – Ensures payments align with expected reimbursements.

- Reconciliation – Tracks discrepancies between billed and paid amounts.

- Underpayment Identification – Detects shortfalls in insurer payments.

- Adjustments and Write-Offs – Manages necessary billing corrections.

6. Denial Management and Appeals

- Denial Analysis – Identifies common rejection reasons.

- Appeal Processes – Expedites claim corrections and resubmissions.

- Root Cause Investigation – Identifies patterns leading to claim denials.

- Denial Prevention Strategies – Improves processes to minimize rejections.

7. Patient Billing and Collections

- Transparent Invoicing – Clarifies patient financial responsibility.

- Flexible Payment Options – Reduces outstanding balances.

- Automated Payment Reminders – Notifies patients of upcoming or overdue payments.

- Financial Assistance Programs – Helps eligible patients with payment plans.

- Third-Party Collections – Engages external agencies for uncollected debts.

Explore Your Future in Hospital Administration! Enroll now

Hospital Administration Course with Assured Career Growth

Hospital Administration Course by Entri App: Master essential healthcare management skills, gain certification, and secure top roles in leading hospitals

Join Now!How Revenue Cycle Management Works

RCM is a cyclical and continuous process that ensures financial sustainability for healthcare providers. Here’s how the system functions step by step:

1. Pre-Registration and Eligibility Verification

- Capturing Patient Information – Ensures demographic and insurance details are correct.

- Pre-Authorization Handling – Secures approvals before service delivery.

- Deductible and Co-Pay Assessment – Helps patients understand their financial obligations.

2. Service Delivery and Documentation

- Accurate Record-Keeping – Ensures all treatments and services are documented.

- Medical Necessity Verification – Aligns services with payer guidelines.

- Provider Notes Integration – Links physician documentation to billing codes.

- Real-Time Documentation Updates – Reduces errors and enhances efficiency.

3. Medical Coding and Charge Entry

- Assigning Correct Codes – Uses ICD-10 and CPT codes to classify services.

- Automated Coding Assistance – Reduces human errors and speeds up billing.

- Coding Compliance Audits – Ensures adherence to industry regulations.

- Charge Reconciliation – Matches services rendered with billed codes.

4. Claim Submission and Processing

- Electronic Claims Submission – Reduces manual errors and speeds up reimbursements.

- Automated Rejection Handling – Flags errors before final submission.

- Insurance Follow-Up – Ensures payers process claims in a timely manner.

- Secondary and Tertiary Payer Coordination – Manages claims across multiple insurers.

5. Adjudication and Payment Processing

- Claim Evaluation by Payers – Determines approval or denial status.

- Automated Payment Reconciliation – Matches payments to billed charges.

- Insurance Payment Discrepancy Resolution – Identifies and corrects underpayments.

- Contractual Adjustment Application – Ensures correct reimbursement per payer agreements.

6. Patient Billing and Follow-Up

- Patient Statements and Payment Reminders – Encourages timely payments.

- Financial Assistance Programs – Helps patients manage healthcare costs.

- Online Payment Portals – Enables patients to make secure payments easily.

- Escalation Procedures for Unpaid Bills – Implements a structured collection process.

7. Performance Analysis and Optimization

- Tracking Revenue Cycle KPIs – Analyzes denial rates and accounts receivable.

- Process Optimization Strategies – Improves efficiency and cash flow.

- Regular Auditing and Benchmarking – Compares performance against industry standards.

- Staff Training and Education – Ensures continued efficiency improvements.

The Role of RCM Software in Healthcare

Revenue Cycle Management software automates and streamlines the RCM process, reducing administrative burdens and improving financial performance. Here’s how RCM software benefits healthcare organizations:

1. Automation of Administrative Tasks

- Reduces manual workload by automating routine administrative processes.

- Improves efficiency by streamlining patient scheduling, registration, and billing.

- Minimizes human errors in claims processing and documentation.

| Feature | Benefit |

|---|---|

| Reduces Manual Workloads | Streamlines scheduling, registration, coding, and billing. |

| Speeds Up Claim Submission | Automates data entry

Minimizes errors |

2. Claim Scrubbing and Error Reduction

- Detects and corrects errors before claim submission to minimize denials.

- Ensures claims meet payer-specific guidelines, reducing rework.

- Enhances accuracy in medical coding and documentation.

| Feature | Benefit |

| Pre-Submission Verification | Ensures claims meet payer-specific requirements before submission. |

| Higher First-Pass Claim Approval Rates | Reduces denials and rework

Increases efficiency |

3. Integration with Electronic Health Records (EHRs)

- Provides real-time access to patient data, ensuring accurate billing.

- Reduces redundant data entry and improves coordination between departments.

- Enhances communication between clinical and financial teams.

| Feature | Benefit |

| Seamless Data Flow | Eliminates duplicate data entry

Enhances accuracy |

| Real-Time Updates | Provides immediate access to patient billing and financial information. |

4. Data Analytics and Reporting

- Tracks key performance indicators (KPIs) like claim denial rates and payment processing times.

- Provides insights into revenue trends to optimize financial decision-making.

- Helps identify areas of improvement to enhance RCM efficiency.

| Feature | Benefit |

| Identifies Revenue Trends | Helps providers make informed financial decisions. |

| Denial Management Insights | Pinpoints common causes of claim rejections

Suggests improvements |

5. Compliance and Regulatory Adherence

- Ensures compliance with healthcare regulations like HIPAA, Medicare, and Medicaid.

- Reduces risk of legal penalties through automated compliance checks.

- Provides audit trails for financial transparency and fraud prevention.

| Feature | Benefit |

| Built-in Compliance Features | Ensures adherence to Medicare, Medicaid, and HIPAA regulations. |

| Audit and Security Tools | Helps track financial transactions

Prevents fraud |

Explore Your Future in Hospital Administration! Enroll now

Conclusion

Revenue Cycle Management is a critical component of financial health in the healthcare industry. By streamlining billing, coding, claims processing, and collections, RCM ensures that providers receive timely and accurate payments.

Key Takeaways

- RCM Enhances Financial Performance

- Ensures steady cash flow and reduces revenue leakage.

- Helps organizations maintain profitability while delivering quality care.

- Efficiency in Claims Processing is Essential

- Prevents errors, denials, and delays in the reimbursement process.

- Reduces administrative workload and speeds up payment cycles.

- Regulatory Compliance Supports Financial and Legal Protection

- Helps organizations avoid penalties and legal risks.

- Ensures ethical and accurate billing practices to maintain industry standards.

- Technology and Automation Improve RCM Efficiency

- Reduces manual errors through automated billing and coding.

- Enhances productivity and accuracy, leading to faster claim approvals.

As healthcare continues to evolve, robust RCM practices will remain essential for maintaining operational stability and delivering quality patient care.

Hospital Administration Course with Assured Career Growth

Hospital Administration Course by Entri App: Master essential healthcare management skills, gain certification, and secure top roles in leading hospitals

Join Now!Frequently Asked Questions

What is Revenue Cycle Management (RCM) in healthcare?

Revenue Cycle Management (RCM) is the financial process that tracks patient care episodes from registration to final payment. It ensures healthcare providers receive timely reimbursements by managing claims, billing, coding, and collections. RCM helps minimize claim denials, reduces administrative burdens, and improves cash flow. It also ensures compliance with healthcare regulations such as HIPAA and Medicare policies. Efficient RCM systems enhance operational efficiency and patient satisfaction.

Why is Revenue Cycle Management important for healthcare providers?

RCM ensures financial stability by managing reimbursements efficiently and reducing lost revenue. It streamlines claims processing, reducing errors and delays that lead to denied claims. Compliance with healthcare regulations is maintained through accurate documentation and adherence to industry standards. Automated RCM processes also reduce administrative workload, allowing healthcare staff to focus more on patient care. Ultimately, it enhances cash flow and the overall financial health of healthcare organizations.

What are the key components of RCM?

The key components of RCM include patient registration, charge capture, medical coding, claims submission, payment posting, denial management, and patient collections. Patient registration ensures accurate data collection for seamless billing and verification of insurance eligibility. Medical coding translates patient diagnoses and procedures into standardized codes for claim submission. Payment posting reconciles payments from insurers and patients, while denial management corrects and resubmits denied claims. Finally, patient billing and collections ensure that outstanding balances are recovered efficiently.

How does RCM software improve healthcare revenue cycle management?

RCM software automates administrative tasks, reducing manual errors and improving efficiency in scheduling, billing, and claims processing. It enhances claim scrubbing by detecting and correcting errors before submission, minimizing denials. The software integrates with Electronic Health Records (EHRs), ensuring real-time access to patient data and improving billing accuracy. Data analytics tools provide insights into financial performance, helping healthcare providers optimize their revenue cycle. Additionally, automated compliance checks ensure adherence to industry regulations, reducing legal risks.

What are the most common challenges in RCM?

One major challenge is denied claims due to incorrect coding, missing information, or lack of pre-authorization. Compliance with constantly changing healthcare regulations can also be difficult, requiring continuous updates to policies and procedures. Inefficient billing processes may lead to delays in payments, impacting cash flow. Patient payment collections can be challenging, especially with rising healthcare costs and complex insurance policies. Additionally, manual administrative tasks increase the risk of human errors, reducing the efficiency of revenue cycle operations.

How does claim scrubbing help in RCM?

Claim scrubbing is the process of reviewing and correcting claims before submission to reduce errors and denials. It ensures that claims meet payer-specific requirements, such as accurate patient information, medical codes, and documentation. By catching mistakes early, claim scrubbing increases the chances of first-pass claim approval, speeding up reimbursements. Automated claim scrubbing tools help detect missing information and inconsistencies, reducing administrative workload. This process significantly improves revenue collection and minimizes financial losses for healthcare providers.

How does RCM impact patient experience?

A well-managed RCM system provides patients with clear billing information and transparent cost estimates, reducing confusion about medical expenses. Efficient claim processing ensures that insurance coverage is correctly applied, preventing unexpected charges. Automated billing and flexible payment options make it easier for patients to manage their healthcare costs. By reducing administrative errors and claim denials, RCM helps avoid financial disputes between patients and providers. Ultimately, a smooth financial process enhances patient trust and satisfaction with healthcare services.

How does RCM ensure compliance with healthcare regulations?

RCM ensures compliance by adhering to federal and state regulations such as HIPAA, Medicare, and Medicaid guidelines. Automated compliance features in RCM software help detect regulatory violations before claims are submitted. Proper documentation and accurate medical coding reduce the risk of legal penalties and audits. Audit trails and security tools track financial transactions, ensuring transparency in billing practices. Regular staff training on compliance updates helps maintain adherence to industry standards.

What role does data analytics play in RCM?

Data analytics in RCM helps healthcare providers track key performance indicators (KPIs) such as claim denial rates, payment processing times, and revenue trends. It identifies inefficiencies in billing processes and provides insights into improving financial performance. Predictive analytics can forecast cash flow, helping providers make informed financial decisions. Analyzing claim rejection patterns allows organizations to refine coding and documentation practices. Ultimately, data-driven decision-making enhances revenue cycle efficiency and maximizes reimbursements.

How can healthcare providers improve their revenue cycle management?

Healthcare providers can improve RCM by implementing automated software to streamline billing, claims processing, and payment collections. Regular staff training on medical coding and compliance reduces errors and ensures accurate claim submissions. Enhancing patient engagement through transparent billing and flexible payment plans improves collections. Conducting routine audits helps identify inefficiencies and areas for improvement in financial workflows. Finally, leveraging data analytics provides actionable insights to optimize revenue cycle performance.