Table of Contents

In trading, currency prices move in absolutely tiny increments. Forex traders to address these incredibly small price shifts as pips. It is the standardized unit measuring a change, both in terms of gain and losses, of a currency pair in the forex market. Pips provide forex market participants and traders an incredible degree of price precision when quoting exchange rates or valuing currencies. In this article, we explain in detail about pips and how to calculate pips.

Master Forex trading with us. Get a free demo!

What is Pips in Forex?

‘Pip’ is the acronym for ‘percentage in point’ or ‘price interest point’ within the forex market. It is the smallest whole unit price move that an exchange rate can make. A pip typically refers to the fourth decimal point of a price that is equal to 1/100th of 1%.

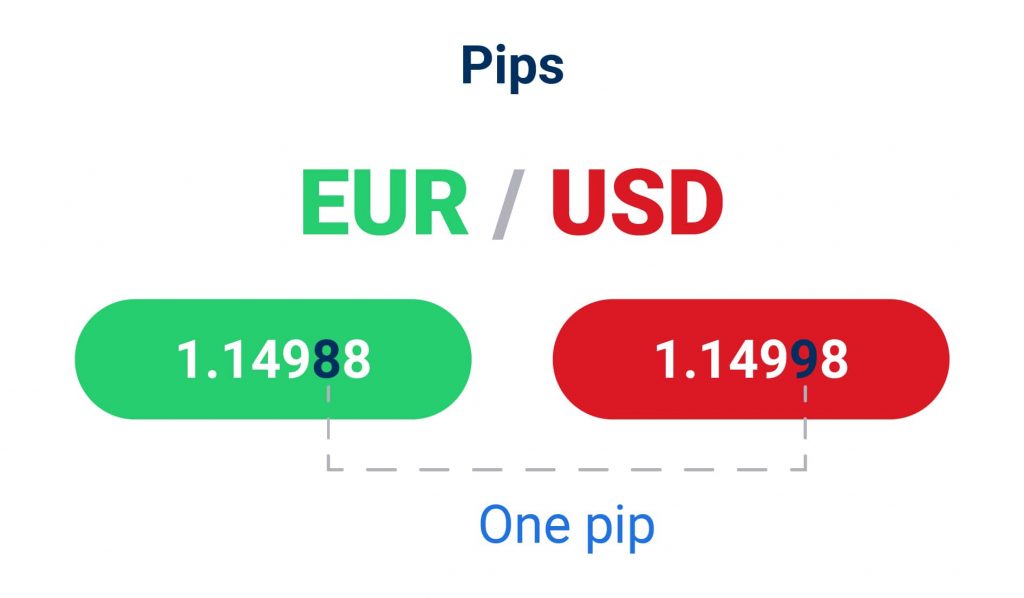

Forex traders typically use pips to calculate profits and losses when dealing with forex trading transactions. It is usually the last decimal place of a price quote. If EUR/USD moves from 1.1050 to 1.1051, the .0001 USD rise in value is one PIP.

A pip value depends on the currency pair being traded, the exchange rate of the pair, and the size of the trade. It is usually referred to when referring to the performance of a position to attribute price in forex trade, whether it’s a loss or gain.

How do pips work?

1: What is a stock?

A pip measures the amount of change in the exchange rate of a currency pair. It represents the change in the quote and value of a position in the market you may have taken.

For most of the common currency pair, it is calculated using its fourth decimal. This is the case for currencies that are denominated in pennies or cents, such as the dollar or the euro. The Japanese yen does not have smaller denominations than “one yen”. So it is calculated using the second decimal.

How to Read Pips?

If the EUR/USD moves from 1.1498 to 1.1499, that is an increase of 1 pip. If the EUR/USD moves from 1.1499 to 1.1498 that is a decrease of 1 pip.

Since Japanese Yen is an exception, if USD/JPY moves from 104. 20 to 104.60, that is an increase of 40 pips. If it goes down from 104.60 to 104. 20, that is a decrease of 40 pips.

Master Forex Trading with Industry Experts! Enroll now for a free demo!

How to calculate pips?

When you buy or sell a forex pair, the value of your trade size will decide the value of each pip . It is also calculated based on the value of your trade size. The larger the trade value and trade size, the larger the value of each pip (and vice versa).

One pip is 0.0001. To calculate the value of a pip you must first multiply one pip (0.0001) by the lot or contract size. Standard lots are 100,000 units of the base currency, while mini lots are 10,000 units.

Size of the pip x Base currency = Pip Value

Let us consider an example where the exchange rate is 1.1234 and trade size is 100,000 units. Since one pip is .0001, we have,

- 0.0001 x 1.1234 = 0.00011234 pips.

- 0.00011234 x 100,000 = 11.234.

So for this trade, one pip will be approximately be $11.23.

The formula for calculating pip is as follows:

Value traded x Quote currency pip = Pip Value

When your forex account is funded with U.S. dollars, and USD is the second of the pair (or the quote currency), such as with the EUR/USD pair, the pip is fixed at .0001.

If the USD is the first of the pair (or the base currency), such as with the USD/CAD pair, the pip value also involves the exchange rate. Divide the size of a pip by the exchange rate and then multiply by the trade value (or lot size).

Trade Value (Pip Size ÷ Exchange Rate) = Pip Value

100,000 (.0001 ÷ 1.2829) = 7.7948

Exceptions

Japanese yen (JPY) pairs are quoted with two decimal places, which is an exception to the four decimal place rule. For currency pairs such as the EUR/JPY and USD/JPY, the value of a pip is 1/100 (.01) divided by the exchange rate.

For example, if the EUR/JPY is quoted as 132.62, one pip is 1/100 ÷ 132.62 = 0.0000754.

Master Forex Strategy and Risk Management! Get Free Demo!

FAQs

What does PIP stand for?

‘Pip’ is the acronym for ‘percentage in point’ or ‘price interest point’ within the forex market.

What is a PIP?

The pip is the smallest unit of the currency in a foreign exchange.

What is the formula for calculating pip?

The formula for calculating pip is as follows:

Value traded x Quote currency pip = Pip Value

| Related Links | |

| Top 10 Forex Terms Every Trader Should Know | What do we trade in Forex? |

| Can Forex Trading make you rich? | How much do I need to start Forex trading? |

| What is pips in Forex Trading? How to calculate pips? | What is currency trading? |