Table of Contents

Adani Group announced one of the largest ambitions of the Indian energy space, where it will make massive USD 60bn of investment in India’s power sector by Q3 2032. The strategic investment is poised to reshape the nation’s energy industry, particularly in renewable energy, sustainable infrastructure, and green tech.

Both in scale and ambition, this commitment exemplifies Adani Group’s leadership role, not only as a producer of climate-friendly power but in helping meet India’s surging energy demand and unlocking its potential to set new benchmarks for utility-scale renewables worldwide.

Key Takeaways:

- Adani’s Investment Plan: Adani Group to invest $60 billion in India’s power sector by FY32, focusing on renewable energy, green hydrogen, energy storage and electric vehicle infrastructure.

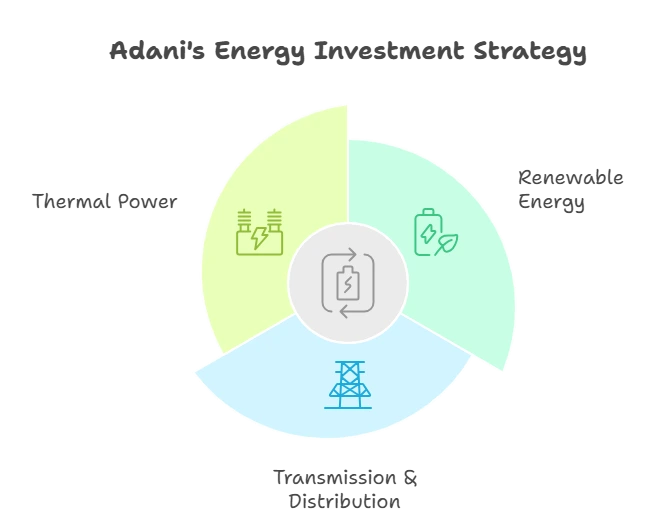

- Strategic Focus Areas: $21 billion for renewable energy to scale up from 14.2 GW to 50 GW. $22 billion for thermal power expansion to 41.9 GW by FY32. $17 billion for transmission and distribution (T&D) infrastructure to 30,000 km.

- Energy Transition: Adani’s plans align with India’s target of 500 GW of non-fossil fuel-based energy by 2030 and contribute to global decarbonization.

- Global Role: Adani Group’s foray into green energy is critical for both India and the global climate fight, making it a big player in the global energy transition.

- Challenges Ahead: Despite the big plans, the company faces challenges like land acquisition, regulatory issues, supply chain constraints and technological barriers.

Adani Group: Visionary For Green and Clean Energy

Gautam Adani established The Adani Group in 1988, and it is now one of India’s largest integrated private sector companies. The Group has participated in infrastructure, ports, logistics, and agriculture, and now it is venturing more and more into the energy sector, becoming one of the most ambitious.

The Adani Group, with its vertically integrated model, has, over time, become one of the premier groups involved in the Indian renewables story. Having an illustrious history and clear vision of the future, The Adani Group is getting ready for shaping the power sector in India with its portfolio of power projects through renewable resources, and smart grid solutions to desalination.

A $60 Billion Bet: What Does It Mean for India’s Energy?

1: What is a stock?

The $60 billion investment commitment comes at a time of major change in India’s energy sector. India has been in the midst of a large transformation of its power space, driven towards renewable energy to adhere to its climate goals. “Indian government has pledged that it would have 500 GW of non-fossil fuel-based capacity by 2030 as per its nationally determined contribution to the Paris Agreement on Climate Change.

Adani’s huge investment could be instrumental in realising this aspiration by scaling up the renewable infrastructure renewal program, bringing disruptive technologies to power generation, and expanding the capacity of transmission systems. The company’s decision follows India’s push to move away from coal power in favor of cleaner, more sustainable energy in line with global environmental and climate goals.

Start investing like a pro. Enroll in our Stock Market course!

The Areas of Adani Investment Focus

Adani’s $60 billion will go toward many dimensions of India’s energy sector. Key areas of focus include:

1. Renewable Energy (Adani Green Energy Ltd – AGEL)

Mobile and agile in focus, AGEL is slated to receive $21 billion by FY30 to elevate its renewable capacity from 14.2 GW (FY25) to 50 GW.

2. Transmission & Distribution (Adani Energy Solutions Ltd – AESL)

AESL has earmarked $17 billion to increase its T&D infrastructure to 30,000 km by FY30, up from 19,200 km in March 2025. This expansion will equip India with the backbone needed to deliver power across the country.

3. Thermal Power (Adani Power)

The group plans a $22 billion infusion into Adani Power to scale its generation capacity from 17.6 GW (FY25) to 41.9 GW by FY32. This investment underscores the continued strategic importance of coal-backed baseload power to support and stabilize the grid as renewable sources scale up.

In addition, government rewards would likely assist Adani’s expansion into renewable energy and help improve the clean energy sector. The Indian government has implemented multiple funding schemes, policies, and tax incentives to incentivize the deployment of solar, wind, and other renewable energies.

The Global Picture: Adani in the Age of Energy Transition

The world energy mix is changing dramatically towards decarbonization, and countries are relying on renewables more and more to achieve their climate commitments. India, the world’s third-largest emitter of carbon dioxide, has an urgent imperative to meet its increasing need for energy, while also mitigating its carbon emissions.

India also has one of the world’s fastest-growing populations and a growing middle class, adding to energy demand. With its abundance of clean energy resources, particularly solar and wind, the clean energy transition positions India to become one of the global leaders.

Adani’s $60 billion bet is not just a story in the nation but has global echo. As India’s biggest private sector player operating in renewables, Adani can influence global energy markets and assist India in achieving its climate commitments. The firm’s ventures in green energy come as many countries seek to cut carbon dioxide emissions and fight climate change.

Adani in the context of India’s energy transition, matters not just for its economic implications but also as a major player in the world’s energy transition. Its initiative aligns with the larger objectives laid out under the UNFCCC and India’s NDC under the Paris Agreement.

Economic impact: job and local development opportunities

The enormous investment by Adani is likely to generate tens of thousands of jobs in India, from manual labor in renewable energy installations to high-tech jobs in energy storage, smart grid systems, and the production of green hydrogen. This will benefit the local economy, especially in rural and semi-urban areas where mega renewable energy projects are coming up.

Beyond creation of jobs, Adani’s growth would trigger local infrastructure as well, in the form of roads, power grids and transportation. As the company invests in power plants, wind farms, and solar projects, it will be a major force behind India’s infrastructure to contribute to the economic development of the less privileged areas of India.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreChallenges Ahead for Adani Group

Adani’s plans for India’s energy future are ambitious, but there are many hurdles ahead. Here are some of the obstacles the company is expected to encounter:

- Land Acquisition Challenges: A major barrier to doing so is acquiring land, as getting land is often a complex and long-drawn-out process, especially in rural areas.

- Regulatory Impediments: India’s energy sector is governed by a web of regulations, and alterations to policy or energy tariffs could affect the financial success of a long-term venture.

- Supply Chain Constraints: With everyone in the world transitioning to green technology, it will be a challenge to get the raw materials for solar panels, wind turbines, and energy storage systems. Projects may also be affected by supply-chain disruptions and cost inflation.

- Technological barriers: India’s demand for energy is increasing rapidly, but scaling up technologies such as energy storage, battery systems, and green hydrogen demand is overcoming significant technological and economic obstacles.

Summary Table

| Segment | Investment ($bn) | Target by FY30/FY32 |

|---|---|---|

| Renewable Energy (AGEL) | 21 | 50 GW from 14.2 GW |

| Thermal Power (Adani Power) | 22 | 41.9 GW from 17.6 GW |

| Transmission & Distribution | 17 | 30,000 km network |

| Total Investment | 60 | — |

Conclusion:

Adani Group’s $60 billion energy dream milestone for India’s infrastructure and sustainability aspirations It promises wide infrastructure upgrades in generation capacity, grid capacity, and clean energy innovation. But achieving that potential requires navigating legal headwinds and operational execution. If so, it will come to define India’s energy transition and economic story for a generation.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

How much is Adani Group investing in the Indian power sector?

Adani Group plans to invest $60 billion by FY32 across renewable energy, thermal power, and transmission & distribution infrastructure.

What portion of the investment is dedicated to renewable energy?

About $21 billion will be invested in renewables through Adani Green Energy Ltd to expand capacity to 50 GW by FY30.

How will Adani expand its transmission and distribution network?

Adani Energy Solutions Ltd will receive $17 billion, targeting a T&D network of 30,000 km by FY30.

Why is Adani still investing in thermal power?

Thermal power remains essential for baseload stability and to balance the intermittency of renewable sources.

What is the target capacity for Adani Power by 2032?

Adani Power aims to expand its generation capacity from 17.6 GW (FY25) to 41.9 GW by FY32 with a $22 billion investment.

What is the Khavda Renewable Energy Park?

It is Adani’s flagship mega-project in Gujarat, expected to become one of the largest renewable energy hubs in the world.

How does this investment align with India’s energy targets?

India’s installed capacity is projected to cross 1,000 GW by 2032, and Adani’s investments will significantly contribute to meeting that target.

What could be the impact of Adani’s plan on India’s economy?

The investment will create jobs, strengthen infrastructure, boost clean energy adoption, and enhance energy security, making it one of the largest private-sector contributions to India’s economic growth.