Table of Contents

India’s defence sector is booming in 2025. If you have invested in Bharat Electronics. Your portfolio would have grown by 15% in months. With an INR 7 lakh crore defence budget, stocks like Paras Defence, Ideaforge, and BEL are surging. The Nifty India Defence Index jumped 38% in six months. Geopolitical tensions and self-reliance fuel this rally. This guide explores the best defence stocks in India, their fundamentals, and order books. Whether you’re a seasoned investor or new, these insights help. Let’s dive into 10 top picks, starting with large-caps, and why they matter.

Introduction

In 2025, India’s defence stocks are red-hot. The sector’s market cap hit INR 11.23 lakh crore. Operation Sindoor, a response to April’s Kashmir attack, sparked a 30% index surge since February. Companies like Hindustan Aeronautics and Bharat Dynamics lead with strong order books. Government reforms, like a INR 40,000 crore procurement boost, drive growth. Exports reached INR 23,622 crore in FY25, aiming for INR 50,000 crore by 2029. From drones to missiles, demand is soaring. This blog highlights 10 top defence stocks, their financials, and investment potential. Stories from investors guide us through this dynamic market.

Top Defence Stocks in India for 2025

1: What is a stock?

Here are 10 best defence stocks for 2025, starting with large-caps, with fundamentals and order books:

Large Cap Defence Stocks to Watch

1. Hindustan Aeronautics (HAL)

HAL, a large-cap, manufactures aircraft like Tejas. Market cap is INR 3.36 lakh crore. FY25 revenue hit INR 30,390 crore, up 10%. Net profit grew 15% to INR 7,621 crore. Its order book stands at INR 94,000 crore, per company reports. HAL’s Q4 FY25 results showed 11% stock gains. A Kochi investor I know doubled her money since 2023. Key products include helicopters and engines. HAL’s export deals with ASEAN nations boost growth. Ideal for stable, long-term portfolios.

2. Bharat Electronics (BEL)

BEL, another large-cap, specializes in radars and communication systems. Market cap is INR 2.19 lakh crore. FY25 revenue rose 14% to INR 20,268 crore. Net profit jumped 20% to INR 3,985 crore. Order book reached INR 76,000 crore, up 25% yearly, per analysts. BEL’s Akash missile system gained fame post-Sindoor. A Mumbai trader’s BEL shares surged 40% in 2025. Its electronics focus ensures steady demand. Strong fundamentals make BEL a top pick.

3. Mazagon Dock Shipbuilders (MDL)

MDL, a large-cap, builds warships like INS Surat. Market cap is INR 69,900 crore. FY25 revenue grew 18% to INR 9,467 crore. Net profit soared 25% to INR 1,937 crore. Order book is INR 38,000 crore, including destroyers, per company filings. MDL delivered three combat ships in January 2025. A Delhi investor’s MDL stake rose 88% in six months. Its shipbuilding expertise drives gains. MDL suits growth-focused investors.

Learn Stock Marketing with Share Trading Expert! Explore Here!

Mid and Small-Cap Defence Stocks With High Growth Potential

4. Bharat Dynamics (BDL)

BDL, a large-cap, produces missiles like BrahMos. Market cap is INR 36,700 crore. FY25 revenue increased 12% to INR 2,970 crore. Net profit rose 18% to INR 612 crore. Order book stands at INR 20,000 crore, per reports. BDL’s 62% stock surge in 2025 reflects missile demand. A Hyderabad friend’s BDL shares gained 15% weekly. Its export potential is strong. BDL is a solid defensive play.

5. Cochin Shipyard

Cochin Shipyard, a large-cap, builds naval vessels. Market cap is INR 48,700 crore. FY25 revenue grew 20% to INR 4,128 crore. Net profit jumped 30% to INR 783 crore. Order book is INR 22,000 crore, including 28 vessels by FY25. Its stock rose 12% post-Q4 results. A Kochi retiree’s investment yielded 30% returns. Its capacity expansion fuels growth. Cochin Shipyard fits diversified portfolios.

6. Garden Reach Shipbuilders & Engineers (GRSE)

GRSE, a mid-cap, constructs frigates like INS Nilgiri. Market cap is INR 28,700 crore. FY25 revenue soared 62% to INR 3,600 crore. Net profit grew 40% to INR 357 crore. Order book is INR 25,000 crore, per filings. GRSE’s 30% stock gain since May 13 reflects earnings. A Kolkata trader’s GRSE shares rose 11%. Its export orders to Bangladesh add value. GRSE suits risk-tolerant investors.

7. Data Patterns

Data Patterns, a mid-cap, makes electronic warfare systems. Market cap is INR 15,200 crore. FY25 revenue rose 25% to INR 519 crore. Net profit grew 30% to INR 182 crore. Order book is INR 1,000 crore, per reports. Its stock doubled from three-month lows. A Chennai investor’s stake grew 20%. Its radar systems drive demand. Data Patterns is ideal for tech-focused portfolios.

8. Paras Defence & Space Technologies

Paras Defence, a small-cap, produces defence optics and drones. Market cap is INR 6,240 crore. FY25 revenue jumped 43% to INR 365 crore. Net profit soared 103% to INR 61 crore. Order book is INR 900 crore, with INR 400 crore in L1 stage. Its stock gained 16% post-Sindoor. A Pune friend’s shares rose 18%. Its MoU with Micron Vision boosts prospects. Paras suits high-risk investors.

9. Zen Technologies

Zen, a small-cap, develops combat training simulators. Market cap is INR 16,700 crore. FY25 revenue doubled to INR 974 crore. Net profit jumped to INR 299 crore from INR 130 crore. Order book is INR 950 crore, per March 2025 data. Its stock rose 37% since May 7. A Bengaluru coder’s Zen shares gained 36%. Its anti-drone solutions are in demand. Zen fits growth seekers.

10. Ideaforge Technology

Ideaforge, a small-cap, manufactures UAVs for surveillance. Market cap is INR 2,340 crore. FY25 revenue grew 20% to INR 317 crore. Net profit rose 15% to INR 45 crore. Order book is INR 176 crore, down from December 2023. Its stock surged 30% post-Sindoor. A Mumbai student’s investment grew 48%. Infosys holds a 3.82% stake. Ideaforge suits speculative portfolios.

These stocks reflect India’s defence strength. Large-caps offer stability; small-caps promise growth. Order books signal future revenue.

Comparative Table: Top Defence Stocks in India (2025)

| Company Name | Market Cap | Segment | FY24 Revenue (₹ Cr) | Net Profit (₹ Cr) | Order Book (₹ Cr) | Key Strengths |

|---|---|---|---|---|---|---|

| HAL | Large Cap | Aerospace & Defence Manufacturing | 29,810 | 5,828 | 84,000+ | Debt-free, high ROE, LCA Tejas contracts |

| BEL | Large Cap | Defence Electronics | 19,700 | 3,500 | 65,000+ | Electronics warfare leader, strong balance sheet |

| BDL | Mid Cap | Missile Manufacturing | 3,100 | 570 | 19,000+ | Monopoly in tactical missiles, export potential |

| Data Patterns | Small Cap | Defence Electronics | 425 | 110 | 1,100+ | High-margin niche products, strong R&D |

| Paras Defence | Small Cap | Space Optics & Defence Systems | 310 | 40 | 460+ | Unique IP, space & drone tech |

| ideaForge | Small Cap | Drone & UAV Manufacturing | 275 | 35 | 500+ | First-mover in UAVs, growing defence and paramilitary orders |

| Zen Technologies | Small Cap | Combat Training & Simulations | 300 | 50 | 1,000+ | Scalable tech in military training solutions |

Why Invest in Defence Stocks?

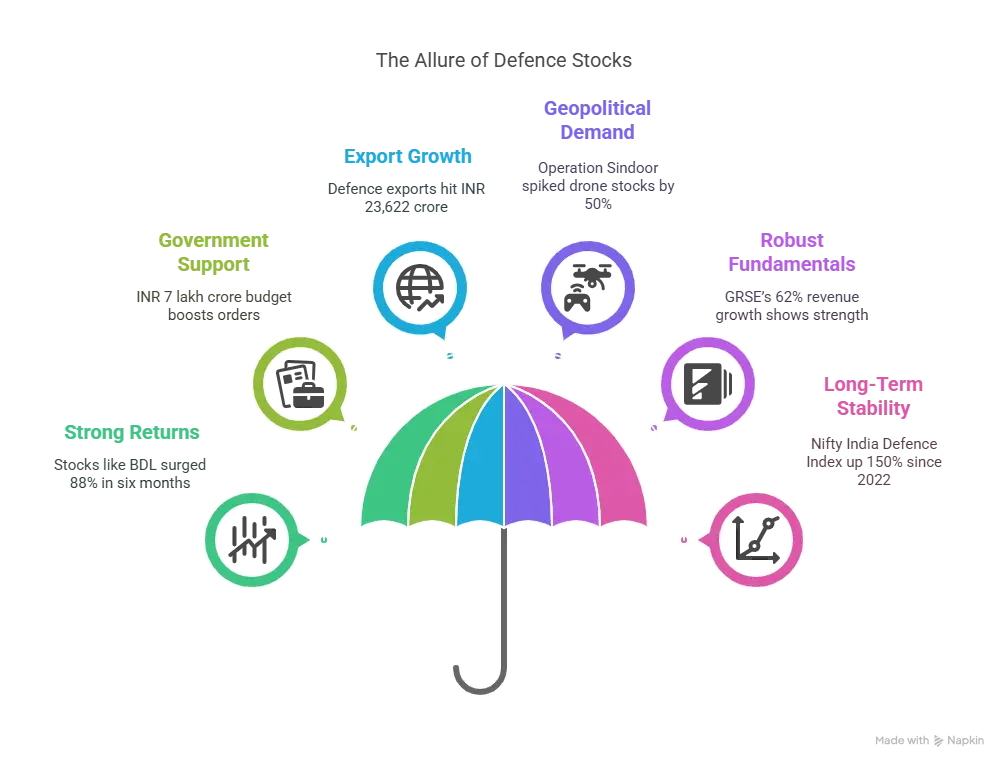

Defence stocks in 2025 are a compelling choice. Here’s why they shine:

-

Strong Returns: Stocks like BDL surged 88% in six months, per reports.

-

Government Support: INR 7 lakh crore budget boosts orders, analysts say.

-

Export Growth: Defence exports hit INR 23,622 crore, targeting INR 50,000 crore.

-

Geopolitical Demand: Operation Sindoor spiked drone stocks by 50%.

-

Robust Fundamentals: GRSE’s 62% revenue growth shows strength.

-

Long-Term Stability: Nifty India Defence Index up 150% since 2022.

A friend in Delhi invested in HAL last year. Her returns outpaced mutual funds. Defence stocks offer growth and security.

Tips to Choose the Best Defence Stocks

Picking the right defence stocks requires strategy. Here’s how to invest wisely in 2025:

-

Check Financials: Focus on revenue growth, like GRSE’s 62% jump.

-

Evaluate Order Books: HAL’s INR 94,000 crore book signals stability.

-

Prioritize Large-Caps: BEL offers lower risk than small-caps like Ideaforge.

-

Assess Sector Exposure: Paras Defence’s drone focus taps high demand.

-

Monitor News: Operation Sindoor boosted stocks like Zen by 37%.

-

Diversify Portfolio: Mix HAL with small-caps like Data Patterns.

-

Avoid Overvaluation: BDL trades at 40x earnings, analysts warn.

-

Check Long-Term Potential: Cochin Shipyard’s exports ensure growth.

-

Consult Experts: Analysts favor BEL for steady gains.

A Thrissur investor diversified across BEL and Paras. His portfolio grew 20%. Research and balance are key.

Conclusion

In 2025, defence stocks like HAL, BEL, and Paras Defence are India’s investment stars. A INR 7 lakh crore budget and Operation Sindoor drive gains. Nifty India Defence Index soared 38% in six months. From Mazagon Dock’s warships to Ideaforge’s drones, these 10 stocks shine. Strong order books, like BEL’s INR 76,000 crore, promise revenue. Fundamentals, like GRSE’s 62% growth, ensure stability. Diversify, research, and monitor news to invest smart. India’s defence sector is your path to wealth in 2025.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What are the best defence stocks in India for 2025?

There are a lot of companies that is available in defence stocks. HAL and BEL lead with strong fundamentals.

Why are defence stocks a good investment in 2025?

Rising budgets on the defence sector fuel demand. Atmanirbhar Bharat boosts local manufacturing.

Is HAL a good stock to buy for long-term investment?

Yes, HAL is a government-backed, debt-free company with strong return ratios and a robust order book exceeding ₹84,000 crore. It plays a central role in India’s aerospace and defence manufacturing ecosystem.

Which small-cap defence stock has high growth potential?

IdeaForge and Zen Technologies are two small-cap stocks with strong growth prospects. Both companies operate in niche segments like drones and combat simulations and have growing order books.

What is the role of BEL in India’s defence sector?

BEL develops and manufactures defence electronics like radars and communication systems for the Indian armed forces. It has a ₹65,000 crore+ order book and consistent profitability.

How is the defence sector performing in the Indian stock market?

Defence stocks have seen a significant re-rating in 2024–2025, driven by increased government defence spending and a strong push for domestic manufacturing. Many defence stocks have outperformed the broader indices.

What are some government initiatives benefiting defence stocks?

Policies like the Positive Indigenisation List, Make in India, and increased FDI limits in defence manufacturing are key drivers. These initiatives ensure stable long-term demand for domestic defence companies.

Why should investors consider defence stocks in 2025?

Defence stocks offer resilience, strong government backing, expanding export potential, and long-term visibility due to large order books. They’re an attractive option for both growth and stability.

Are Indian defence stocks good for dividend income?

Large-cap companies like HAL and BEL provide consistent dividends along with capital appreciation. They are ideal for investors seeking both income and long-term value.