Table of Contents

Do you know how to manage your finances efficiently? In today’s fast-growing world, managing finances is crucial for a successful financial future. The living standards and expenses are increasing on a day-to-day basis. Understanding money management is the key aspect of a secure financial situation.

As the expenses are increasing, you should be aware of how to responsibly manage the finances. You need to find out how your money is managed.

Your money management skills can help you to save for your future. Have you heard about the expense tracker apps? If not, learn how to manage your finances thoughtfully using the expense tracker apps.

Introduction

What is an expense tracker app? Monitoring your daily expenses is essential in controlling yourself from spending too much. This is a powerful managing tool that aids in optimising your habits of spending and managing your expenses.

Monitoring your daily expenses is essential in controlling yourself from spending too much. In the fast-growing technologically advanced world, UPI transactions and digital payments take the majority of your savings. It is important to check the net income before spending too much.

The expense tracking apps will allow you to calculate the money you can afford to spend. This is an essential tool for proper budgeting. Your financial habits can be tracked effectively with the aid of expense-tracking apps. You can keep your financial habits under control using the app. Delve more to know about the benefits of expense tracker apps.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

What to Look For in an Expense Tracker App ?

1: What is a stock?

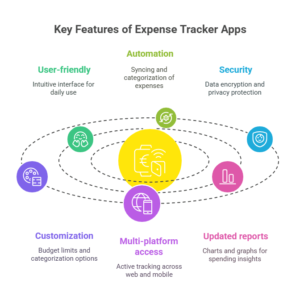

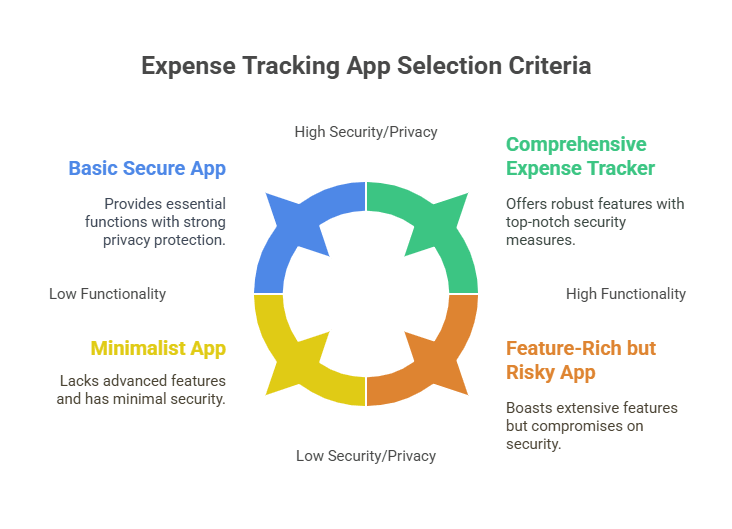

There are numerous expense-tracking apps available in the market, but choosing the right one requires more research and analysis. You have to consider the key factors while choosing the expense tracker apps.

User-friendly

Make sure that the expense tracker app you are opting for is user friendly and has an intuitive interface. This helps you to use the app on a daily basis without any hassle.

Automation

Seek for an automated app where your bank syncing and categorisation of the expense happens simultaneously. Such apps can effectively save you time.

Security

Data encryption and privacy protection settings should be active in the app you choose as your expense tracker app. A strong security system will keep your data secure.

Customization

Choose an app where customisation is possible. Budget limits can be added in the systemsonb with the categorisation options should be available in the app while you choose one.

Multi-platform access

The app you choose should have an active tracking system across the web and mobile.

Updated reports

Opt for an app where your pending pattern will be updated every time with charts or graphs to enhance your knowledge about your spending habits.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

Top Expense Tracker Apps in India (2025) – Ranked List

In India, choosing the best tracker app is important. Here is the list of the top expense tracker apps of this year.

Money manager

- Passcode protection

- Well-structured analytics

- Quick manual entry possibilities

Walnut

- Budget tracking app

- Reminders on bills

- Reader of the bank SMS

- Automatic categorization

- Popular app

Goodbudget

- Excels in monthly budget calculations

- Budgeting based on an envelope

Bajaj Finserv App

- Insights on expenses

- Available popular tools for budgeting

- Support based on UPI

Monefy

- Simple chart-based representation

- User-friendly

- Efficient expense tracker

ET Money

- Better financial planning tools

- Tracks savings and investments

- Tracks individual spending potential

Fine Art

- Auto tracking of expenses based on SMS

- No privacy breaches

- High security

| Related Articles | |

|---|---|

| What is 50-30-20 Rule of Budgeting? | How to Develop Saving Habit in Children? |

| Best Personal Finance Books to Read | How to budget as a young professional? |

How These Apps Help You Stay Financially Disciplined?

The expense tracker app will help you keep a proper record of your expenses and your income. The records will help you to spend what you can afford. Lavish spending will be cut short, and you’ll tend to save more money for your future use. You can regularly track the expenses with the help of the expense tracker app.

These apps are more user-friendly and less expensive. Your income will be carefully managed with the help of the expense tracker app. Alerts will be given when you tend to overspend.

Such alerts will prevent you from overspending. Such apps can set a budget for you and manage your daily expenses. Knowledge about your money and how you should spend wisely can be enriched with the help of the expense tracker app.

Visual indicators, especially charts and graphs, will allow you to understand your budget and spending habits. While choosing the app, you should only choose the apps that automatically sync with the bank account. The automated app system enables you to create categorized transactions.

The expense tracker apps will help you to make better financial decisions. Better financial decisions give you the ultimate peace of mind as you are now turning yourself into a smart future investor with highly appreciable saving habits.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

Tips to Choose the Right App for You

The expense tracking apps will set the goals that are financially beneficial for your future. Your expenses will be monitored daily, and reports will be generated. This will help you to have a better understanding and clarity over your spending habits.

- Based on the personal financial status and habits of an individual, you can choose the apt expense tracker.

- Always choose the automated app system that provides ease in managing finances.

- It is wise to opt for an app that automatically categorizes the expenses.

- Make sure that the app you are choosing simultaneously syncs with your bank and expense calculation.

- Choose the app which allows you to manually enter the financial status and gives the best inputs.

- Make sure that you avoid apps that store personal details on external servers.

- While choosing the app, check whether the app adheres to the privacy policies.

- Choose the app that is secure for the users.

- If you are a user who prefers investment tracking, choose an app based on your requirements.

- Use and check whether the app is user-friendly before purchasing it.

- The best expense tracker app will never let you down.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreConclusion

In today’s technologically advanced world, choosing the right expense tracker app can provide you the freedom to free yourself from financial dependency.

You can assert your financial freedom once you start using the expense tracker app. By carefully managing your finances, you can save for the future.

Knowing how to handle your finances will allow you to empower yourself and help you make smart financial decisions for your future investments. Start tracking your expenses, and take your next step wisely!

Disclaimer The information provided in this article is for general informational purposes only and is not intended as investment advice, financial guidance, or an offer or solicitation to buy or sell any securities. Stock data and financial figures are sourced from publicly available information and are believed to be accurate at the time of publication; however, we do not guarantee their accuracy or completeness. Past performance is not indicative of future results. Readers should conduct their own research or consult a qualified financial advisor before making any investment decisions. The author(s) and the publisher disclaim any liability for any loss or damage arising directly or indirectly from the use of or reliance on the information provided herein.

| Gain Financial Literacy in your Mother Tongue | |

| Stock Market Course in Malayalam | Mutual Funds Course in Malayalam |

| Stock Market Course in Tamil | Mutual Funds Course in Tamil |

| Stock Market Course | Mutual Funds Course |

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What is the purpose of using an expense tracker app?

Monitoring your daily expenses using an expense tracker app is essential in controlling yourself from spending too much.

What is an expense tracker app?

Monitoring your daily expenses is essential in controlling yourself from spending too much.

Can I control my spending habit with the help of expense tracker app?

Yes. The expense tracker apps are powerful managing tool that aids in optimising your habits of spending and managing your expenses.

How to choose the best expense tracker app?

Based on the personal financial status and habits of an individual, you can choose the apt expense tracker.

Can expense tracker app helps in taking better financial decisions?

Yes. The expense tracker apps will help you to make better financial decisions. Better financial decisions give you the ultimate peace of mind as you are now turning yourself into a smart future investor.