Table of Contents

In today’s world of smart money management, people are not just looking to grow their wealth, they’re also searching for clever ways to reduce their tax burden. That brings us to a popular question: Can investing in stocks help you save taxes in India? The short answer is yes, but there’s more to it than just buying a few shares and hoping for the best.

This complete guide will help you understand how, when, and where stock investments can lead to tax benefits. Whether you’re a beginner or someone looking to make your portfolio more tax-efficient, this blog will serve as your go-to resource.

Introduction

In 2025, India’s stock market is a global magnet. The SENSEX crossed 85,000, driven by tech and defence stocks. Over 10 crore investors chase gains, but tax savings are a bonus. Stock investments can reduce your taxable income under the Income Tax Act, 1961. My friend Alfred, a Bengaluru salaried employee, saved ₹30,000 last year via ELSS. His portfolio grew 12% too. Direct stocks, mutual funds, and tax harvesting offer unique benefits. With Budget 2025 increasing tax rebates, now’s the time to act. This blog dives into tax-saving strategies, risks, and steps to optimize your investments.

India’s tax regime rewards equity investors. Section 80C allows deductions up to ₹1.5 lakh. Long-term capital gains are taxed at just 12.5%. Tax harvesting leverages exemptions. But complexities like short-term capital gains (STCG) or dividend taxes need clarity. Whether you’re a salaried professional or freelancer, this guide simplifies stock-based tax saving. Curious about ELSS, defence stocks, or U.S. stocks? Let’s break down how to save taxes while growing wealth in 2025.

How Stocks Fit into Tax Saving

1: What is a stock?

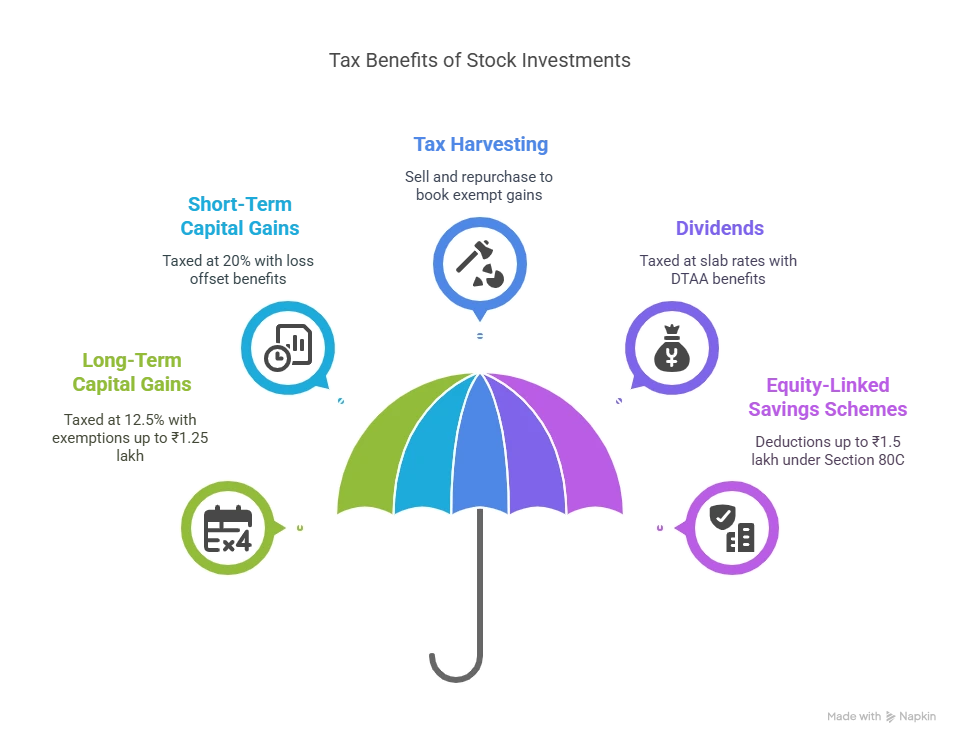

Stock investments align with tax-saving provisions in India. They offer deductions and preferential tax rates. Here’s how they work:

- Long-Term Capital Gains (LTC): Stocks held over 12 months are taxed at 12.5%. Gains up to ₹1.25 lakh are exempt.

- Short-Term Capital Gains (STCG): Stocks sold within 12 months are taxed at 20%. Losses can offset other gains.

- Tax Harvesting: Sell and repurchase stocks to book ₹1.25 lakh exempt gains annually. This resets your cost base.

- Dividends: Taxed at slab rates in investors’ hands. Double Taxation Avoidance Agreements (DTAA) reduce foreign stock taxes.

- Equity-Linked Savings Schemes (ELSS): These mutual funds invest in stocks. Deductions up to ₹1.5 lakh are allowed under Section 80C.

Learn Stock Marketing with Share Trading Expert! Explore Here!

Direct Stock Investments and Tax Benefits

Direct stock investments in companies like HAL or Reliance offer tax advantages. Here’s the breakdown:

- LTC: Hold stocks for over 12 months. Gains above ₹1.25 lakh are taxed at 12.5% without indexation.

- STCG: Sell within 12 months, and gains are taxed at 20%. Losses can offset other STCG or LTCG.

- Loss Carry Forward: Capital losses can be carried forward for eight years. Offset against future gains.

- Tax Harvesting: Book profits up to ₹1.25 lakh annually. Repurchase to raise cost base, reducing future taxes.

- Rajiv Gandhi Equity Savings Scheme (RGESS): First-time investors with income below ₹12 lakh get 50% deduction up to ₹25,000 under Section 80CCG. Rarely used due to restrictions.

| Gain Financial Literacy in your Mother Tongue | |

| Stock Market Course in Malayalam | Mutual Funds Course in Malayalam |

| Stock Market Course in Tamil | Mutual Funds Course in Tamil |

| Stock Market Course | Mutual Funds Course |

Indirect Stock Investments: ELSS and Mutual Funds

Indirect investments via mutual funds or ETFs are popular for tax savings. ELSS stands out:

- ELSS Features: Invests in equities with a three-year lock-in. Deduct up to ₹1.5 lakh under Section 80C.

- Returns: ELSS funds average return comes to 10–13% annually, market-dependent. Higher than PPF’s 7.1%.

- Risk: Equity exposure means volatility. Suits investors with medium-to-high risk appetite.

- Flexibility: Invest via SIP or lump sum. Redeem after three years.

- Taxation: LTCG above ₹1.25 lakh taxed at 12.5%. Dividends taxed at slab rates.

My Chennai colleague invested ₹50,000 in ELSS via SIP. She saved almost ₹15,000 in taxes. Mutual funds like US-focused ETFs also diversify portfolios. US stock gains benefit from DTAA, reducing dividend taxes to 25%.

Tax Harvesting: A Smart Strategy

Tax harvesting maximizes LTC exemptions. Here’s how it works:

- Process: Sell stocks held over 12 months to book gains up to ₹1.25 lakh. Repurchase immediately to maintain holdings.

- Benefit: Gains are tax-free up to ₹1.25 lakh annually. Raises cost base for future sales.

- Example: Buy TCS at ₹3,000; sell at ₹3,800 after 13 months. Gain of ₹80,000 is tax-free. Repurchase at ₹3,800.

- Caution: Avoid frequent trades to dodge scrutiny. Transaction costs may apply.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreRisks of Stock-Based Tax Saving

Stock investments carry risks that impact tax savings:

- Market Volatility: ELSS or stocks may dip, reducing returns. Crashes like 2020 hit portfolios hard.

- Lock-In Period: ELSS has a three-year lock-in. Early exits aren’t possible.

- Tax Scrutiny: Frequent tax harvesting may raise audits. Maintain genuine intent.

- Dividend Taxation: Taxed at slab rates, reducing net returns. High slabs hit harder.

- Currency Risk: US stocks face exchange-rate fluctuations. Impacts tax calculations.

Steps to Save Taxes via Stocks in 2025

Follow these 12 steps to leverage stocks for tax savings:

- Learn Tax Rules: Study Section 80C, LTC, and STCG provisions. Knowledge prevents errors.

- Assess Risk: Choose ELSS for moderate risk or direct stocks for high risk.

- Start with ELSS: Invest up to ₹1.5 lakh via SIP or lump sum. Use platforms like Zerodha.

- Track Holdings: Monitor stocks for LTC eligibility (over 12 months). Use Groww apps.

- Plan Tax Harvesting: Book ₹1.25 lakh gains annually. Repurchase to reset cost base.

- Offset Losses: Use capital losses to reduce taxable gains. Carry forward for eight years.

- Explore RGESS: First-time investors check Section 80CCG eligibility. Limited but useful.

- Invest in US Stocks: Use DTAA for dividend tax relief. Platforms like INDmoney help.

- Stay Updated: Follow Budget 2025 changes. Read Economic Times or Mint.

- Use Tax Tools: Apps like Tax2win simplify calculations. Ensure timely ITR filing.

- Diversify: Mix ELSS, direct stocks, and ETFs. Reduces risk, maximizes savings.

- Consult Experts: Hire a CA for complex portfolios. Avoid penalties.

A Delhi freelancer saved almost ₹20,000 via ELSS and tax harvesting. Strategic planning pays off.

Taxation of US Stocks for Indian Investors

US stocks like Apple or Tesla offer diversification. Tax rules differ:

- LTC: Held over 24 months, taxed at 12.5% in India. No US capital gains tax.

- STCG: Held under 24 months, taxed at slab rates. Varies by income.

- Dividends: US withholds 25% tax. Offset via DTAA in India.

- Exchange Rates: Use SBI TT buying rate for INR conversion. Impacts tax liability.

- Compliance: Report foreign assets in ITR. Non-compliance risks penalties.

A Hyderabad investor saved ₹10,000 via DTAA on Amazon dividends. US stocks enhance portfolios.

Comparing Stocks with Other Tax-Saving Options

Stocks compete with PPF, NPS, and FDs. Here’s a comparison:

- ELSS: 12–18% returns, three-year lock-in. High risk, high reward.

- PPF: 7.1% returns, 15-year lock-in. Low risk, tax-free interest.

- NPS: 8–12% returns, lock-in till 60. Additional ₹50,000 deduction under 80CCD(1B).

- FDs: 6–7% returns, five-year lock-in. Low risk, taxable interest.

- Home Loans: Deduct ₹1.5 lakh principal (80C) and ₹2 lakh interest (24(b)). Long-term commitment.

Stocks suit risk-tolerant investors. PPF or FDs fit conservative ones.

Practical Tips for 2025

Maximize tax savings with these tips:

- Start Early: Invest in ELSS at fiscal year start. Spread SIPs for better averaging.

- Monitor Markets: Track defence stocks like BEL. Budget 2025 boosts demand.

- File ITR Timely: Report gains and losses accurately. Use ITR-2 for stocks.

- Avoid Speculation: Intra-day trades are speculative. Taxed as business income.

- Leverage Technology: Apps like Tax2win or ClearTax ease compliance and help you file itr easily.

Learn Stock Marketing with Share Trading Expert! Explore Here!

Tax Filing and Documentation Tips for Stock Investors

Filing taxes as a stock investor requires careful documentation.

Documents You’ll Need:

-

Capital Gains Statement (from broker or mutual fund house)

-

ELSS investment proof

-

AIS (Annual Information Statement)

-

Form 26AS

-

Dividend Income Report

Key Takeaway

In 2025, stock investments are a powerful tax-saving tool. ELSS offers ₹1.5 lakh deductions under Section 80C. Tax harvesting leverages ₹1.25 lakh LTC exemptions. US stocks benefit from DTAA. With Budget 2025 raising rebates, stocks like HAL or TCS blend growth and savings. Risks like volatility or lock-ins need caution. Start with ELSS SIPs, track holdings, and file ITRs on time. Stories like Neha’s show the potential. Build wealth and cut taxes with stocks today.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

Can stock market investments really help in saving taxes in India?

Yes, certain stock market-linked instruments like ELSS (Equity Linked Savings Schemes) offer tax deductions under Section 80C. Additionally, long-term capital gains (LTCG) up to ₹1 lakh per year are exempt from tax.

What is ELSS and how does it help in tax saving?

ELSS stands for Equity Linked Savings Scheme, a mutual fund investing primarily in equities. It qualifies for a tax deduction of up to ₹1.5 lakh under Section 80C and has a lock-in period of just 3 years.

Is the ₹1 lakh LTCG exemption available every year?

Yes, the ₹1 lakh exemption on long-term capital gains from equities resets every financial year. Gains above ₹1 lakh are taxed at 10% without indexation.

What is tax harvesting and how does it work?

Tax harvesting is the strategy of selling stocks or mutual funds to realise long-term capital gains up to ₹1 lakh (tax-free limit), then repurchasing them to maintain your investment position, effectively resetting your cost base.

Are dividends from stocks and mutual funds taxable?

Yes, dividends are now taxable in the hands of the investor as per their applicable income tax slab. This change was implemented starting FY 2020-21.

Do I need to pay tax even if I don’t withdraw or sell my stock investments?

No, capital gains tax is applicable only when you sell your investments and realise a gain. Unrealised gains are not taxed.

Can I offset losses from stocks against gains to reduce tax liability?

Yes. Short-term capital losses can be offset against both short- and long-term gains, while long-term capital losses can be adjusted only against long-term gains. You can also carry forward losses for up to 8 years.

Is ELSS better than traditional tax-saving options like PPF or NSC?

ELSS has a shorter lock-in period (3 years) and historically offers higher returns. However, it comes with market risks, unlike PPF or NSC which are government-backed and safer.