Table of Contents

Emergencies can happen at any point in time. Financial emergencies are sudden occurrences. When it comes to your life, it can shake you entirely. Emergency funds can act as a lifesaver at that time. An emergency can happen at any point without any notice. The emergencies can be of different types. Familiarize yourself with the emergency funds here!

Introduction

It can be medical emergencies, job-related emergencies, accidents, unexpected deaths, urgent house purchases or repairs, etc. The emergencies can be covered only with the aid of emergency funds. Financial emergencies are a reality. You need to know more about the importance of emergency funds and how to handle them properly.

What is an Emergency Fund?

1: What is a stock?

Emergency funds are essential to ensure that you are financially secure during your hardest moments. Emergency funds are necessary to keep you away from unnecessary debts and risks in life. Here are the top reasons why emergency funds are crucial for your financial stability.

An emergency fund can act as a backup for your financial emergencies. It can also be a lifesaver during the hard times. Emergency funds are the financial backbone of a person. It can act as a strong web that helps you to stand stable even at odd times. The emergency funds can save you from debts. The emergency fund can also be considered as a stress buster and financial support at the most difficult phase of your life.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

Why Emergency Funds Are Important?

The significance of the emergency fund is often overlooked. Never underestimate the power of emergency funds in the current scenario. Liquid cash can help you to sustain your life even in the uncertain geopolitical conditions.

Financial security

Emergency funds give you financial security. In the time of unforeseen financial circumstances and shocks, these emergency funds can help you.

It can help you cover essential expenses and save you from debt. The financial emergency funds can keep you from resorting to loan sharks and money lenders.

Less stress

During the uncertainty, emergency funds can save you from stress and tension. Even at the hardest financial times, your mind will be at ease.

The emergency fund will save the situation and help you recover from the crisis by logically finding solutions to your financial instability.

Avoiding debts

You might fall into debt by simply relying on the credits. With the emergency fund, you can manage the situations at hand.

Financial independence

Self-reliance is the greatest asset that comes with the emergency fund. The emergency fund will make you financially stable. You can be self-dependent even at the time of the crisis. You can make the financial decisions under such circumstances.

Smart investments

If you have emergency funds ready, you will have more control over your financial future. In the case of short-term emergencies, you don’t have to withdraw huge amounts, and you can invest more to make stable savings.

Better future

The emergency funds will help you to live tension-free. It can allow you to have more flexibility over life. Financial stability can be gained through smart investments and savings. The financial stability can be regained with the help of savings.

How Much Should You Save in an Emergency Fund?

There are no hardcore rules for how much you save as emergency funds. You can save based on your income. Here are some tips to make your savings worth the emergency fund. Make sure that you are saving money worth at least 6 months’ savings.

To save yourself financially from emergencies, you need to save money as much as possible. If your household runs based on a single income, make sure that you are investing at least 9 months’ worth of expenses as your emergency fund.

And if your household runs based on double income, 6 months’ expenses should go to the emergency fund. If you are an entrepreneur, invest more as an emergency fund. Consider at least 12 months of expenses as the emergency fund. You can also find the right amount by calculating your living expenses.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

Where to Keep Your Emergency Fund?

This question may puzzle you. Where to keep your emergency fund often confuses the public. You need to find a reliable source to keep your emergency fund safe and sound. You can opt for a savings account that is high-yielding. In such accounts, the interest rate is comparatively high when compared to the normal accounts.

- You can opt for fixed deposit options where you can derive interest while your money remains safe.

- Money market accounts can also act as a better option to save your emergency funds and use them for your future savings.

- Avoid stock market investments or mutual fund investments, as it is too risky to consider emergency funds.

- Keeping your emergency fund safe should be your priority. You should keep your emergency fund safe and easily accessible. The emergency fund should not consider high returns and should ensure liquidity.

High-interest savings account

- Easy accessibility

- Safe

- Ensures liquidity

- Insurance assured by the government

Liquid mutual funds (if a slightly higher return is preferred)

- Ensures liquidity

- Low risk

- One or two days to redeem

Avoid investing in the following entities

- Stock market

- Real Estate

- Long-term Fixed Deposits

Goal: Easy access + minimal risk

Learn Stock Marketing with a Share Trading Expert! Explore Here!

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

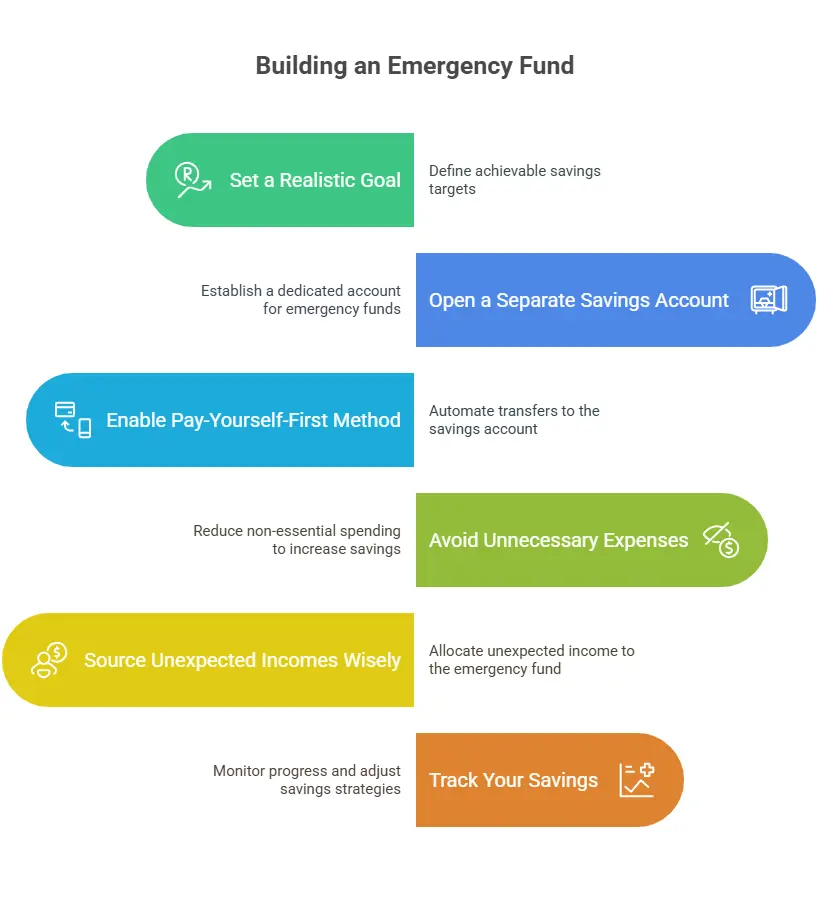

Know moreStep-by-Step Guide to Building an Emergency Fund

You have to build a strong emergency fund to back you up financially at the time of an emergency crisis. The financial crisis can hit you at any point in your life. Make sure that you are following the basic steps to build the emergency funds.

Set a goal

Make sure that you are setting a realistic goal. You don’t have to invest huge amounts; instead, small amounts can help you to start your savings. An emergency fund can help you to be self-reliant and independent. If you find it difficult to save 9 months of expenses, just ₹500, ₹1000, or ₹3000 can be your first savings.

Keep a monthly and weekly savings record. This will help to remind yourself about the savings you ought to make on a regular basis.

Savings account

If you are planning to source emergency funds, make sure that you are opening a separate savings account. This will prevent you from using the emergency fund for any other purpose.

Enable the pay-yourself-first method

Automatic transfers will monitor the automatic transfer process. This will make sure that the amount will automatically transfer to the savings account without manual transfers.

Avoid unnecessary expenses

Avoid the expenses that are unnecessary. The reduction of such expenses will enhance your contribution to the emergency fund.

Source the unexpected incomes wisely

Make sure that you are using the income that you receive unexpectedly for the emergency funds. Make sure that you are saving money as the priority.

Track your savings

Stay on track and consistently increase the savings amount. Make sure that you are investing in the savings account regularly. Keep a regular track to identify where you are lacking and what you have to do to improve yourself in saving an emergency fund.

Common Mistakes to Avoid

Here are the common mistakes that you should avoid while working on your emergency fund

- You shouldn’t use your emergency fund for vacations, routine expenses, unnecessary travel, purchases, etc.

- You have to stick to the savings mode.

- Consistency is the key; make sure that you are slowly building healthy savings for your future needs!

- Emergencies demand the complete draining of emergency funds.

- Once your emergency fund is completely drained, you have to plan on how to rebuild the fund after your use. This can be done once you stop your unnecessary spending.

- You have to find an extra source of income to support yourself. Set a short-term goal and start saving money from scratch for your next emergency.

- The emergency funds should be used for the appropriate purpose.

- The appropriate funds should be saved, and a backup plan must be made in uncertain situations.

- To save yourselves from emergency crises, which include

Medical emergencies

Unemployment

Sudden job losses

Home Purchase

Sudden vehicle losses

Home repairs

Accidents

Deaths

Unexpected travel

Lots of myths are circulating among people about emergency funds.

Credit cards can be used as emergency funds.

This is a popular myth. Keep in mind that a credit card cannot be used instead of actual funds, as it will only help in piling up the interest.

Insurance can cover your expenses.

Immediate cash emergencies cannot be effectively covered by insurance. The emergency fund should be saved instead of relying on insurance.

Less earnings to build an emergency fund

You don’t have to earn a lot of money to keep an emergency fund. All you need is to start slow, small, and steady. Any amount of money can act as emergency funds.

The emergency fund is more needed by the following set of people.

- Entrepreneurs

- Freelancers

- Parents

- Single-income families

- Families with high medical expenses

- Less financial background

- Low financial stability

Conclusion

An emergency fund can help you to survive the crisis time. Financial stability is inevitable for the financial backing at the time of emergency. With the emergency fund ready, you can approach any situation with confidence. Start with small investments as savings and later move on to big goals.

Savings should be your topmost priority. It can help you to keep yourself safe and motivated when you are hit with financial uncertainties.

Your emergency fund denotes your self-esteem and independence. You can face challenges with a brave new approach, as the emergency fund will shield you throughout your hard times!

Disclaimer The information provided in this article is for general informational purposes only and is not intended as investment advice, financial guidance, or an offer or solicitation to buy or sell any securities. Stock data and financial figures are sourced from publicly available information and are believed to be accurate at the time of publication; however, we do not guarantee their accuracy or completeness. Past performance is not indicative of future results. Readers should conduct their own research or consult a qualified financial advisor before making any investment decisions. The author(s) and the publisher disclaim any liability for any loss or damage arising directly or indirectly from the use of or reliance on the information provided herein.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What is an emergency fund?

An emergency fund can act as a backup for your financial emergencies. It can also be a lifesaver during the hard times.

What is the role of emergency fund in supporting human lives?

Emergency funds are essential to ensure that you are financially secure during your hardest moments. Emergency funds are necessary to keep you away from unnecessary debts and risks in life.

Is mergency funds are the financial backbone of a person?

Yes. It can act as a strong web that helps you to stand stable even at odd times. The emergency funds can save you from debts.

What is the connection between savings account and emergency fund?

If you are planning to source emergency funds, make sure that you are opening a separate savings account. This will prevent you from using the emergency fund for any other purpose.

What should I do if my emergency funds are used up?

Once your emergency fund is completely drained, you have to plan on how to rebuild the fund after your use. This can be done once you stop your unnecessary spending.

Where should I keep my emergency funds?

You can keep your emergency funds in high-interest savings account and liquid mutual funds