Table of Contents

‘SEBI’ is a term that you would’ve come across multiple times. This blog discusses what SEBI is and how Entri Finacademy is reviewed as per SEBI regulations. Read on to know more!

Check out this video by Entri in Malayalam!

What is Entri Finacademy?

Entri Finacademy is a subsidiary wing of Entri, specialising in providing courses related to finance, namely Stock Market, Forex Trading, and Mutual Funds. With features such as premium community membership, exclusive live sessions, practical trading support, post market analysis, live mentor support, and a valid certification, Entri Finacademy is the best platform to start your investment journey.

Now you might be thinking, there are tons of platforms that provide courses in investment and trading, so what makes Entri or Entri Finacademy different from them. Well, what if I told you that Entri provides its courses in the vernacular languages that are there in India? Yes, you read that right! Entri’s major goal or policy is to provide courses in various fields in the vernacular languages of India.

Start securing your journey towards financial freedom with Entri’s Mutual Fund Course

The same is applied in Entri Finacademy and has been providing courses in Malayalam and Tamil for more than two years. With a vision to expand its language bank and courses, Entri is determined to provide the best courses in an easy-to-understand manner. On that thought, due to its beginner friendly feature almost anyone can avail the course for a better income or financial freedom. With industry experts as mentors and a coverage of a wide set of investment tools, Entri Finacademy can be your gateway to financial freedom!

Also read: What is a Mutual Fund and how does it Work? (Complete Guide)

What is Monitoring by SEBI-Registered RA?

1: What is a stock?

The Securities and Exchange Board of India (SEBI) is the ‘police’ or ‘watchdog’ for the stock market in India. The major role of SEBI is to make sure that companies and investors should follow the rules and regulations to make sure that everything is in a fair and transparent flow. This way, investors are protected from frauds and scams and the whole process of trading happens in a smooth, functional manner.

Monitoring and reviewing by a SEBI-registered RA simply means following the set of rules and regulations set by SEBI. Let’s say that a company that wants to list its shares on the stock market need to follow the rules set by SEBI. This includes providing accurate and transparent information about their businesses and not hiding anything that could affect the value of their shares. The same set of rules apply to investors, to make sure that they don’t do things like insider trading (based on secret information).

Master stock market with Entri Finacademy! Enrol now!

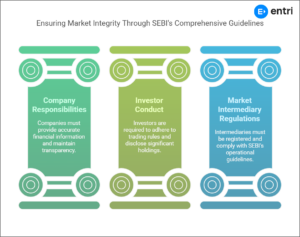

Here are some of the guidelines set by SEBI for various entities:

-

For Companies

- List all sorts of accurate information, including profits, losses, assets, and liabilities to list their shares

- Should not hide important information (like potential risks) or manipulate their financial statements.

- Company insiders like directors and employees are prohibited from trading stocks based on confidential information which is not available to the public.

- Should have strong internal controls and proper leadership- especially an independent leader to avoid conflicts of interest.

Also read: Mutual funds vs Fixed Deposits: Which is better?

-

For Investors

- Must follow rules while trading and should not manipulate stock prices or create artificial market demand.

- Those holding large stakes must disclose their holdings to SEBI to ensure transparency and to prevent market manipulation.

- Individuals or entities found violating the rules (like Ponzi schemes, fraudulent investment advice, etc.) will be dealt with strict action. This is to protect investor from frauds.

-

For Market middlemen (brokers, mutual funds, etc.)

- Brokers, mutual funds, and other financial entities must be registered under SEBI to operate. This is to ensure market integrity.

- Should maintain detailed records and provide reports to SEBI about their activities. Transparency regarding the fee they charge is also mandatory.

- Rules set by SEBI on how to operate mutual funds, how to handle investors’ money, how to provide returns, and how they must disclose their portfolios and financial services are to be followed diligently.

In addition to these, SEBI ensures a separate fund that are available to compensate investors who lost their investments due to frauds or scams. SEBI’s role as the watchdog extends to even regulating stock exchanges like Bombay Stock Exchange (BSE), and the National Stock Exchange (NSE), ensuring a safe and transparent entity for investors. Along with it, the trading hours and the settlements (the transfer of funds and securities) follow proper timelines due to SEBI’s regulations.

What are SEBI non-compliance penalties?

Based on the gravity of the non-compliance, SEBI may impose fines, cancellation of trading rights, or even criminal prosecution. For example,

-

-

If a company doesn’t disclose key financial details or misleads investors, a heavy fine may be imposed.

-

If an entity is found violating SEBI’s rules repeatedly, their trading rights may be cancelled or suspended.

-

Why is Monitoring by SEBI-Registered Research Analyst Important?

Let’s have a look as to why monitoring and reviewing by SEBI-Registered RA is relevant and important for the market:

- Reviewing and monitoring help in making sure that investors are protected from fraud, insider trading, and market manipulation to build trust in the financial system.

- Due to the enforcement of transparency and fairness, SEBI ensures that markets remain stable and reliable and thus encouraging both domestic and international investment.

- SEBI believes in a fair level field for its investors by eradicating any activities that may lead to an abuse of the market.

- When investors are aware that companies and entities follow the regulations and rules, they would naturally feel more secure about their investments.

Interested in Forex? Enrol now to earn your fortune in currency trading!

Entri Finacademy is now reviewed and monitored by an SEBI-registered RA!

Over the past two years, Entri Finacademy has focused on providing top-quality courses to individuals in a language of their choice. The drive to deploy courses in vernacular languages has led to a huge number of individuals who are financially independent and making a difference in their lives. To enhance the quality and value of the courses provided, Entri Finacademy’s courses and services are now reviewed and monitored by a SEBI-registered Research analyst to ensure alignment with regulatory standards.

Also read: Opportunities in Forex Trading in 2025

This come in the wake of mandatory compliance regulations established by SEBI, to ensure the authenticity of companies nationally. Entri Finacademy has joined hands with Mr. Sujith S, a seasoned SEBI Registered RA, who reviews and monitors all educational services provided by Entri Finacademy to maintain the highest standards of quality and regulatory adherence.. With a boastful comprehensive experience in stock market of 10 years, Mr. Sujith specializes in daily trading, short-term, and long-term investment strategies.

A proven track record of delivering insightful market analysis and actionable investment recommendations, are the abilities that distinguishes him. He has a diverse career history. He worked in advisory at AAA Profit Analytics and was a broker at DBFS Broking Firm. Sujith also managed portfolios at MOAT Financials Service. This makes him a great addition to Entri Finacademy.

His expertise includes fundamental and technical analysis. He also specializes in risk management and client relationships. Sujith has a strong record of navigating the Indian stock market. He is known for delivering profitable investment strategies. Entri Finacademy is ready to soar the heights with Mr. Sujith’s guidance.

SUJITH S

CEO

Insight Research Analytics

SEBI REGISTERED RA : No. INH000015330

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreConclusion

Reviewing and monitoring by SEBI RA is crucial for maintaining transparency, trust, and security in the Indian financial market. It regulates and keeps a watch on whether companies and individuals follow the establishes rules or not. For companies like Entri Finacademy, being reviewed and monitored by SEBI RA not only guarantees legitimacy. But also enhances the quality of their educational services, strengthening their trust and reliability among the users.

When commitments like providing financial education in vernacular languages meets with dedication to be SEBI compliant, trustworthy and high-quality financial knowledge is the product. With the expertise of seasoned professionals like Mr. Sujith guiding the way, Entri Finacademy is in a position to provide and help individuals attain financial freedom through well-informed, ethical investment strategies.

By this, the investment journeys of the aspirants are rooted in strong, reliable and transparent foundation. As the platform grows and expands its reach, it will undoubtedly continue to provide valuable education to the investors and learners, and thus, contribute to a more informed and financially independent society!

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

Who is the SEBI Registered RA associated with Entri Finacademy?

Mr. Sujith S, an experienced SEBI Registered Research Analyst, oversees and monitors the educational offerings of Entri Finacademy. Also the teachers who teach here are all SEBI registered.

What courses does Entri Finacademy offer?

Entri Finacademy offers courses in Stock Market, Forex Trading, Mutual Funds, and other finance-related topics, available in vernacular languages like Malayalam and Tamil.

How does SEBI monitoring benefit learners at Entri Finacademy?

Monitoring by a SEBI Registered RA guarantees quality, authenticity, and adherence to regulations, enhancing the trustworthiness of courses.

Can beginners enroll in Entri Finacademy courses?

Yes, courses are beginner-friendly and designed to help learners at all levels acquire financial knowledge and investment skills.

Are Entri Finacademy courses available in regional languages?

Yes, Entri Finacademy provides courses in Malayalam, Tamil, and plans to expand to other Indian vernacular languages.