Table of Contents

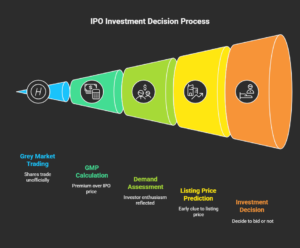

Imagine spotting a hot new stock before it hits the exchange. Whispers of big gains on day one spark excitement. That’s the pull of the grey market premium (GMP). It draws investors chasing quick wins. This post explains GMP in simple terms, covering its role in initial public offerings (IPOs). GMP shows how much extra people pay for shares in an unofficial market before official trading begins. High GMP signals strong demand and possible profits at listing. Low or negative GMP hints at weak interest. Investors track it to gauge market mood. The article breaks down GMP’s basics, how the grey market operates, calculation methods, its value to investors, risks of over-reliance, where to track it, and a wrap-up. Read on to learn how GMP can sharpen your IPO strategy and boost returns.

Start investing like a pro. Enroll in our Stock Market course!

What Is GMP in IPO?

Grey market premium, or GMP, applies to IPOs where companies sell shares publicly for the first time. In the grey market, shares trade unofficially before listing on exchanges like NSE or BSE in India. The premium is the extra amount buyers pay over the IPO price. For example, an IPO priced at 100 rupees trading at 120 rupees in the grey market has a 20-rupee GMP. This reflects investor enthusiasm. Positive GMP shows strong demand, while negative GMP, or a discount, signals low interest. GMP offers an early clue to the listing price, driven by supply and demand in this unofficial market. Brokers and investors deal off the books, outside SEBI’s oversight. Many use GMP to predict gains and decide whether to bid on an IPO. Understanding GMP helps spot winning IPOs in the rush.

How the Grey Market Works

1: What is a stock?

The grey market operates outside official stock exchanges. It’s like a back-alley trading hub where IPO shares are bought and sold before listing. Deals happen between investors and brokers, with no formal exchange involved. Sellers, often with IPO allotments, agree to transfer shares after listing. Buyers pay upfront at a set price, with settlement occurring when shares reach demat accounts.

Participants include retail investors, high-net-worth individuals, and institutions. Brokers act as middlemen, matching buyers and sellers. Trades rely on cash or informal agreements, with trust playing a big role since no formal contracts exist. The market kicks off after IPO subscription ends, fueled by news, company hype, and economic factors. Strong company growth drives higher bids, and grey market prices reflect this buzz, fluctuating daily.

For example, in 2025, Vikran Engineering’s IPO saw intense grey market activity, pushing prices up before launch. Traders locked in deals at premiums, with transfers completed on listing day. If the market price exceeds the grey deal, buyers profit; otherwise, they lose. The grey market lacks regulation, so SEBI offers no protection, and disputes settle privately. Despite risks, it thrives in India as millions track it for IPO insights.

Volume depends on IPO size. Big names like Stallion India Fluorochemicals saw heavy grey trading in 2025, while smaller IPOs drew less. Trades happen via phone, apps, or in-person meets. Brokers charge fees, and taxes apply to gains, yet the lure of quick flips attracts crowds. Grey market deals tie to the IPO process, assuming allotment success. If allotment fails, trades cancel, adding risk.

Two common deal types are “kostak” and “subject to sauda.” Kostak involves selling application rights at a fixed premium, regardless of allotment. Sauda ties to actual allotted shares. In India, hubs like Mumbai and Delhi dominate activity, with online forums sharing quotes. Economic shifts, like high inflation, cool premiums, while bull markets fuel them. For instance, Denta Water & Infra’s 2025 IPO saw a 16% grey market premium, closely matching its listing gain. Conversely, Laxmi Dental’s positive GMP led to a 20% listing drop, showing variability.

Tech advances have modernized the grey market. Apps now provide live premium quotes, but the core remains informal. Investors join via trusted brokers and networks. The grey market acts as a shadow predictor of IPO success, offering a real-time pulse on demand. Master its flow to gain an edge in spotting trends early.

How Is GMP Calculated?

Calculating GMP is straightforward. Subtract the IPO issue price from the grey market trading price to get the GMP. The formula is:

GMP = Grey Market Price – IPO Issue Price.

A positive result indicates a premium; a negative result shows a discount.

For example, an IPO at 200 rupees trading at 250 rupees in the grey market has a 50-rupee GMP. The expected listing price is the issue price plus GMP, so 200 + 50 = 250 rupees.

Expressing GMP as a percentage helps too:

GMP percent = (GMP / Issue Price) x 100. In the example, (50 / 200) x 100 = 25%.

Traders quote both absolute and percentage figures. Several factors shape the grey market price. Strong company fundamentals, like solid balance sheets, lift GMP. Bullish market conditions boost premiums, while high subscription rates signal demand. News, such as positive company reports, also spikes trades.

Brokers collect quotes from their networks and average them for daily GMP, which varies by source. In 2025, NSDL’s IPO had an issue price of 800 rupees and a grey market price of 880, yielding an 80-rupee GMP. M&B Engineering’s issue and grey prices were equal, resulting in zero GMP. Laxmi India’s grey price fell below its 158-rupee issue, indicating a negative GMP and a loss at listing.

GMP changes hourly, so frequent checks are key. Reliable sites provide data, but cross-checking multiple sources ensures accuracy.

For example, Snehaa Organics in 2025 had a 33-rupee GMP on a 122-rupee issue price, a 27% premium. Aditya Infotech’s 675-rupee issue hit 1015 in the grey market, yielding a 340-rupee GMP. These examples show real calculations in action.

Negative GMP warns of potential flops, prompting investors to avoid weak IPOs. High GMP tempts but requires verifying company strength. In 2025, some tech IPOs saw inflated GMP due to hype, but listings underperformed, like one with a 150-rupee GMP listing at an 80-rupee gain. Another had a 40-rupee GMP but gained 120 rupees. GMP alone doesn’t tell the full story. Combine it with company analysis for smarter decisions. Track it daily, as it peaks near listing, to refine entry strategies.

Why Is GMP Important for Investors?

GMP is a powerful tool for investors. It reveals market demand for an IPO, guiding smarter choices. A high GMP flags hot stocks, suggesting strong listing gains. Investors bid heavily on these to secure allotments for quick profits. For example, Stallion India’s 2025 IPO had a GMP predicting a 40% jump, delivering 65% post-listing. Denta Water’s GMP aligned with its 16% gain, showing reliability.

Low or negative GMP highlights weak IPOs, helping investors save cash for better opportunities. It predicts listing returns by adding GMP to the issue price, giving a likely opening price. This helps time trades, like selling quickly if premiums peak. For long-term investors, GMP shows initial market buzz, which can build lasting value. Retail investors gain an edge, competing with pros using grey market clues. High-net-worth individuals chase premiums for fast flips, while institutions adjust strategies based on GMP trends.

GMP reflects market sentiment better than guesses. In weak markets, it warns of risks early. In 2025, tech IPOs used GMP to check hype, avoiding overvalued picks. Even when GMP mismatches occur, they teach lessons for refining strategies. Accessible on free sites, GMP levels the playing field, boosting confidence with data-backed bids. Without it, investors risk falling for market FOMO.

In India, GMP drives IPO fever. Vikram Solar’s high GMP in 2025 fueled massive subscriptions, while Mangal Electrical’s GMP led to a 40% rise. Ignoring GMP means missing gains. It also spots sector trends, like soaring premiums in renewables during 2025. For active traders, GMP shapes intraday plans post-listing, while passive investors use it for long-term holds. Stories of success, like doubling money on Stallion’s GMP or avoiding Laxmi’s loss with negative GMP, prove its value. GMP helps balance portfolios by mixing high-GMP bets with safer picks, sharpening the edge in crowded markets.

Risks of Following GMP Blindly

Relying solely on GMP can backfire. It’s not official data and is prone to manipulation. Brokers may inflate quotes to create false hype. In 2025, a tech IPO’s 150-rupee GMP led to only an 80-rupee listing gain, while another with a 40-rupee GMP gained 120 rupees, showing unpredictability. Market shifts, like sudden news, can tank grey market prices post-trading.

The grey market lacks regulation, leaving no SEBI protection. Trades are unenforceable, so if sellers back out, buyers lose money. Taxes cut into gains without offsets, and hourly price swings add volatility. Laxmi Dental’s positive GMP in 2025 contrasted with a 20% listing drop, burning investors. Over-reliance ignores fundamentals, as hype often fades. Negative GMP can scare off solid IPOs, while bear markets make premiums unreliable.

Legal risks exist in this unregulated space, and emotional traps lead investors to chase highs and buy at peaks. In 2025, claims of GMP being “dead” misled many. Vikram Solar’s high GMP didn’t prevent a post-listing dip, and Mangal Electrical’s hype overstated gains. External factors like interest rates or global events further distort GMP. To avoid losses, use GMP as one signal, not the sole guide. Verify sources, research company strength, and risk only disposable capital. Balance GMP with analysis and diversify to manage risks effectively.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreWhere to Track GMP?

Tracking GMP is easy with reliable sources. Chittorgarh.com provides daily GMP updates, including kostak rates. InvestorGain.com offers live tables for current and SME IPOs. Trendlyne screens top performers, while 5paisa lists recent IPOs with GMP data. Upstox and INDMoney provide weekly updates and live quotes. Findoc offers detailed calculations, and the Envest app delivers real-time GMP with ratings.

Brokers share GMP via apps or direct messages. Online forums and investor groups discuss trends, but cross-checking multiple sources ensures accuracy. Daily monitoring catches price swings, especially near listing. Most platforms offer free access, making GMP tracking accessible. In 2025, these sites covered all major IPOs, helping investors stay informed. Build a habit of checking trusted platforms to set alerts and refine IPO strategies.

Start investing like a pro. Enroll in our Stock Market course!

Conclusion

GMP unlocks insights into IPO demand, guiding investors to smarter picks. High premiums signal strong listing potential, while low ones warn of risks. Tracking GMP on trusted sites sharpens strategies, but balancing it with research cuts losses. Avoid blind reliance to sidestep manipulation and volatility. Master GMP to spot trends, time trades, and boost returns in the fast-moving IPO market.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What is Grey Market Premium (GMP) in IPOs?

Picture this: A new company launches its shares to the public. Excitement builds. Prices start moving before official trading. That’s where Grey Market Premium enters. GMP refers to the extra price investors pay for IPO shares in an unofficial market before they list on stock exchanges. It shows market demand in real time. In India, GMP thrives around IPOs on NSE and BSE. Shares trade off the books. Buyers and sellers agree on prices above or below the issue price. Positive GMP means high interest. Negative signals weak appeal.

Take Vikran Engineering’s 2025 IPO. It had a GMP of Rs 12 on an issue price of Rs 92-97. This hinted at a 12% gain at listing. Investors jumped in. GMP acts as a sneak peek. It helps spot hot stocks. For example, if an IPO issues at Rs 100 and grey trades hit Rs 120, GMP sits at Rs 20. This predicts a strong open. But GMP lacks rules. SEBI does not watch it. Deals rely on trust. Still, it draws crowds. Millions check it daily.

GMP ties to IPO basics. Companies raise funds via IPOs. Shares allot after bids close. Grey market starts then. It reflects hype from company news, economy, and trends. In 2025, tech and green energy IPOs saw high GMP. JSW Cement had a 3% GMP, showing mild buzz. Shivashrit Foods GMP was Rs 1, modest but positive.

Why care? GMP guides bids. High values mean quick flips. Low ones warn off. It levels the field for retail folks against big players. Track it to win. But mix with research. Company health matters more than hype. GMP sparks action. Use it to build wealth in IPOs. Recent cases prove it. Mangal Electrical’s Rs 32 GMP led to strong lists. Classic Electrodes swung from Rs 11 to Rs 22 GMP. Spot patterns. Act fast. GMP turns guesses into plans.

How does the Grey Market operate for IPO shares?

Ever wonder about secret trades before stocks go live? The grey market makes it happen. It runs as an informal space. IPO shares swap hands before listing. No exchange oversees. Brokers link buyers and sellers. Deals seal via phone or apps. Trust binds them. No papers often.

Market fires up post-IPO bid close. Subscription data fuels it. High bids push prices. Sellers with allotments offer shares. Buyers pay premium now. Transfer hits after list. If price rises, profit rolls in. Risks lurk. No backup if deals flop.

In India, Mumbai leads. Online tools spread quotes. Types include kostak: Sell bid rights fixed. Sauda: Based on allotments. Factors like news sway. Strong firms spike GMP.

Look at 2025. Anlon Healthcare GMP at Rs 70 on Rs 260-275 issue. Trades buzzed pre-list. Sugs Lloyd GMP Rs 5.5. Abril Paper Tech Rs 4. Volume ties to size. Big IPOs draw more.

Fees add costs. Taxes too. Yet pulls quick cash. No SEBI shield. Scams possible. But info gold. Predicts mood. Use networks. Join via brokers. Grey bridges hype to reality. Master it for edge. Recent trends show bull runs pump it. Weak times drop. Track daily. Win big.

How is GMP calculated for an IPO?

Simple math unlocks GMP secrets. Grey price minus issue price equals GMP. Positive: Premium. Negative: Discount. Example: Issue Rs 200. Grey Rs 250. GMP Rs 50. Percent: (50/200)*100 = 25%.

Expected list: Issue plus GMP. Rs 250 here. Brokers average network quotes. Varies source to source.

Factors: Fundamentals lift. Subscriptions boost. News spikes.

In 2025, NSDL might show Rs 80 GMP on Rs 800. Wait, from search: Vikran Rs 12 on Rs 97 max. Mangal Rs 32 on Rs 561.

Changes hourly. Check often. Sites list both absolute and percent.

Discounts warn. Avoid. High tempt. Verify.

Tech IPOs inflate on buzz. 2025 saw mismatches. One Rs 40 GMP, actual Rs 140 list.

Mix with analysis. GMP aids picks. Practice on live. Sharpens skills.

Why should investors pay attention to GMP?

Ignore GMP at your loss. It shouts demand. High GMP means list pops. Bid hard. Gain fast.

Stallion 2025 GMP 40%. Delivered 65%. Denta 16% match.

Predicts returns. Times sales. Long term: Buzz builds value.

Retail edges pros. HNI flips. Institutions tweak.

Sentiment over guess. Weak market warns.

2025 tech: Hype check.

Free info. Boosts bids.

Drives fever. Vikram subscriptions soar.

Spots trends. Renewables high.

Active: Intraday plans. Passive: Holds.

Stories: Double on Stallion. Skip Laxmi loss.

Balances portfolio. Sharp edge.

What are the risks associated with relying on GMP?

GMP fools easy. Manipulation rife. Fake quotes pump.

2025 tech: Rs 150 GMP, 80 gain.

Shifts quick. News tanks.

No rules. No protect. Deals bust.

Taxes cut. Swings wild.

Laxmi positive GMP, 20% drop.

Ignores basics. Hype dies.

Negative scares gems.

Bear drops. 2025 “dead” claims.

Legal gray. Emotion traps.

Vikram dip post high.

Rates, global sway.

Verify. Research. Risk little. Diversify.

Where can investors track live GMP updates?

Sites deliver fast. InvestorGain live GMP.

IPOWatch GMP price.

Chittorgarh list, GMP.

Chanakya updates 31 Aug.

IPOCentral GMP, kostak.

IPOPremium upcoming.

Finowings live.

Envest real-time.

NiftyTrader today.

Brokers apps. Forums talk.

Cross check. Daily. Free most. Alerts set. 2025 coverage full.

How does GMP influence IPO subscription rates?

GMP fires bids. High draws crowds. Oversubscribe.

Vikram high GMP, 191x QIB.

Signals strength. Retail piles.

Low cools. Save for others.

Hype loop. GMP rises with subs.

2025 Mangal GMP Rs 32, strong bids.

Predicts allot odds. Low GMP, better chance.

Guides strategy. Bid max high GMP.

Boosts market. More IPOs.

Use for timing. Win allotments.

Can GMP predict listing gains accurately?

GMP hints well. Often close. But not always.

Stallion 40% GMP, 65% gain.

Denta match 16%.

Mismatches happen. Tech 150 GMP, 80 gain.

Laxmi positive, 20% loss.

Average 70-80% right. Mix factors.

News post grey changes.

Use as guide. Not sure bet.

2025 trends show better in bull.

Sharpens if combined research.

What factors affect the GMP of an IPO?

Demand key. Strong company lifts.

Subs high boost.

Market bull pumps.

News positive spikes.

Sector hot: Green 2025 high.

Size: Big draw more.

Economy: Inflation cools.

Broker nets sway quotes.

Hype from promo.

2025 JSW 3% GMP mild.

Classic swings on buzz.

Watch these. Predict GMP.

How has GMP trended in recent 2025 IPOs?

2025 GMP mixed. Strong in SME.

Vikran Rs 12, 12%.

Anlon Rs 70.

Shivashrit Rs 1.

Mangal Rs 32.

JSW 3%.

Classic Rs 11-22.

Sugs Rs 5.5.

Abril Rs 4.

Bull favors. Tech volatile. Renewables up. Track for patterns.