Table of Contents

Do you know the difference between gross income and net income? Are you currently managing finances without knowing the difference between both? Learn more about gross income and net income here!

Introduction

Understanding the key difference between gross income and net income is very critical for managing the finances in 2025. Even if you are only managing personal finances, you need to have a solid understanding of the gross and net income.

This is crucial for making all the required financial decisions. While handling the business or tax payments, your firm knowledge of the nature of the income is really important. Many people often confuse these financial metrics. In budgeting and reporting, both of them have altogether different purposes.

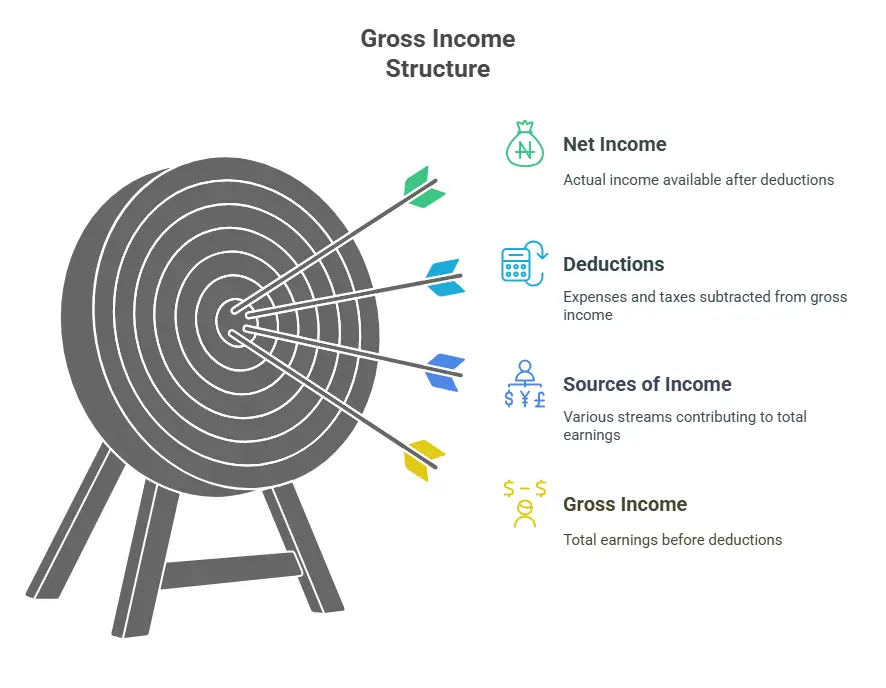

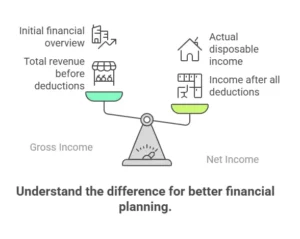

Before any deductions are taken out from the actual amount, the total earnings of a person are referred to as gross income. Gross income is the net revenue without any deductions. After the deductions, the amount left over is referred to as net income.

Taxes will be subtracted to get the net income. The financial stability of a person can be calculated only with the help of these two metrics. The job offers and benefits can be easily assessed with the help of your proper understanding of the net and gross income.

What is Gross Income?

1: What is a stock?

Gross income is a financial metric that defines the total income of a person without deducting any amount. The subtraction of any amount as tax will not be considered as gross income. The salaries, wages, and bonuses will be part of the gross income.

The earnings from investments or income from rentals can also be considered as part of gross income. The cost of goods sold is generally subtracted from the gross revenue to give the gross income in the case of large-scale businesses.

For instance, if the job opportunity provided to you pays an income of $80000 per year, that figure indicates the gross income.

The gross income is the starting point of all the financial transactions, services, and calculations. A company’s income statement is generally prepared with the help of gross income. So, a solid understanding of the gross income is really helpful to never go wrong with the financial calculations.

Gross income, in other words, defines your overall earning capacity. While considering a company, its total earning potential can also be measured and adjusted based on the gross income. The operational costs of a company, however, cannot be calculated by knowing the gross income potential of the company.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

What is Net Income?

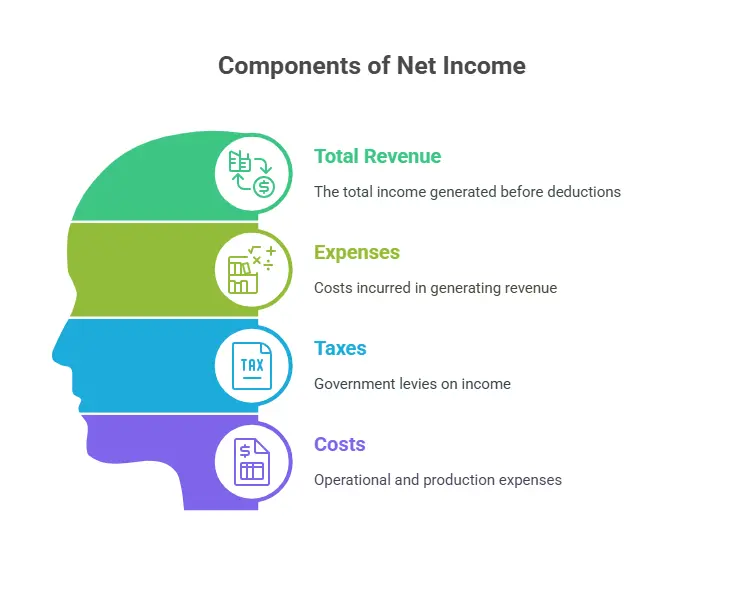

Net income is defined as the total amount you receive after multiple deductions. Multiple deductions may happen when an individual’s income is considered. This can be the deductions based on the taxes, interests, and expenses associated with the individual.

Additionally, the most common and significant deductions include health insurance, social security contributions, and pension contributions. While considering the overall potential of the company, the net income includes the profit derived after all the deductions from the total revenue, which includes the operational expenses of the company, state and federal taxes, interest, etc.

The net income is the in-hand income that you can use for your needs or save for your future. If your gross income is ₹80,000 and your taxes and interest include -₹30,000, then your net income is calculated as ₹50,000.

Net income gives you an overall outlook on in-hand money and thereby a clear picture of your financial prospects. Net income helps you to have a better picture of your finances. Your savings, spending, and calculations should be based on your net income.

Key Differences- Gross vs. Net Income

Here is the key difference between gross income and net income. The difference between both should be carefully considered while dealing with the financial affairs.

| Gross Income | Net Income |

| Total income earned by the individual | Income after the deductions |

| Includes salary,commissions, bonuses | Includes salary after paying tax, insurance, PF |

| Appears on offer letters and tax forms | Appears on bank statements and payslips |

| Based on which the tax calculations are done | Based on which the spending and saving are calculated |

| Used for loan applications | Used for budgeting |

Why It Matters to Know the Difference?

While you deal with financial affairs, it is important to have a solid understanding and grip on the gross income and net income. Here are the key reasons why you should know the difference between the two.

Job offers evaluation

When you are selected for any particular job but are confused about which one to join, you should evaluate the gross salary and net salary that the particular job offers.

The gross salary offered by both companies might be similar, but the net salary might be different. Your familiarity with both terms will help you to look into the lower tax obligations and benefits offered by the job roles. This is helpful when choosing job offers.

Budgeting

The net income is quintessential in the creation of a budget. Whether it is a personal budget or a business budget, calculating the financial stability and potential is really important. The gross income is not capable of measuring the overall financial capacity, as it may mislead you, as it is not about the in-hand income.

Credit applications

How much you can afford to lend from the lenders can only be determined by knowing your net income. The overborrowing can be easily prevented once you understand the amount you can afford to spend or pay back.

Well-structured business plans

Net income indicates the profit that you gain. Whereas the gross income gives you an overall idea about the financial strength. The financial strength is often understood by measuring the net income of an individual.

Tax filings

Never opt for filing taxes without knowing the difference between the net income and gross income. Tax liabilities can also be calculated without making mistakes. The unnecessary mistakes while filing taxes can be avoided with a proper understanding about tax filing.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreCommon Confusions and Mistakes

Even after understanding the real difference between gross income and net income, most people often get confused and commit mistakes.

Here are some common mistakes that the people come across:

- Making plans for their life expenses without considering the net income

- Overspending without minding the net income

- Keeping gross income as the yardstick to plan the daily expenses

- Evaluating salary based on the gross income without considering the deductions

- Profitability and revenue are connected.

- Considering gross income as the overall profit

- Less familiarity with the tax amounts deducted from the gross income

- Misapplication of gross income and net income in the financial documents

- Confused about whether gross or net income is apt on the reports to be submitted for financial verifications

If you could avoid the mistakes related to the gross income and net income will help you to get clarity on the financial terms and conditions.

Calculation Examples

Here are a few examples that can demonstrate the real difference between the gross and the net income:

Let’s consider Pooja. She works in a company, and her annual salary is ₹90000. The deductions from salary are as follows:

- Health tax- ₹1136

- Social security- ₹5000

- State tax- ₹4000

- Federal tax- ₹10000

- Health insurance- ₹2780

- The total deduction amount is ₹12916

Net income is therefore- ₹77084

Business income

- Total revenue of a company: -₹800000

- COGS- ₹300,000

- Gross Income: ₹800,000-₹300,000= ₹500,000

- Operating expenses- ₹3450000

- Taxes and other expenses- ₹60,000

Net income= ₹30,10,000

The gross income gives an indication of the production cost. The actual profit is the net profit, and this should be considered while reporting the financial stability.

Conclusion

The fundamental financial metrics that are essential for the measurement of financial stability and performance are gross and net income. Both of the financial metrics are crucial for the financial system.

Be it personal or business finance, gross income provides an outline of the total income of the individual or company, and net income shows the amount after deduction.

Based on the net income, you can decide how much money you can spend and save for the future. Better financial decisions can be made based on your valuable knowledge regarding gross and net income.

Disclaimer The information provided in this article is for general informational purposes only and is not intended as investment advice, financial guidance, or an offer or solicitation to buy or sell any securities. Stock data and financial figures are sourced from publicly available information and are believed to be accurate at the time of publication; however, we do not guarantee their accuracy or completeness. Past performance is not indicative of future results. Readers should conduct their own research or consult a qualified financial advisor before making any investment decisions. The author(s) and the publisher disclaim any liability for any loss or damage arising directly or indirectly from the use of or reliance on the information provided herein.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What is gross income?

Gross income is a financial metric that defines the total income of a person without deducting any amount. The subtraction of any amount as tax will not be considered as gross income.

Is salary part of gross income or net income?

The salaries, wages, and bonuses will be part of the gross income.

What is net income?

Net income is defined as the total amount you receive after multiple deductions. Multiple deductions may happen when an individual’s income is considered.

What is the key difference between gross income and net income?

Be it personal or business finance, gross income provides an outline of the total income of the individual or company, and net income shows the amount after deduction.

Why is understanding net income important for budgeting?

The net income is quintessential in the creation of a budget. Whether it is a personal budget or a business budget, calculating the financial stability and potential is really important.