Table of Contents

Imagine waking up every morning without the burden of EMIs, credit card bills or loan statements looming over you. No more juggling due dates. No more anxiety when your phone buzzes with a bank reminder.

Being debt free isn’t just a financial goal, it’s a life change. It means freedom to choose, sleep better at night and redirect your income towards wealth building instead of interest.

In today’s fast paced world, debt creeps in silently through easy EMIs, credit card swipes or personal loans. While some debt can be strategic, excessive debt can be a trap. The good news? You can break free, with the right strategy, discipline and mindset.

Master stock trading with us. Enroll now for a free demo!

Key Takeaways:

-

Debt freedom starts with awareness: knowing exactly how much is owed, to whom, and at what interest rate is the first critical step.

-

High-interest debt kills financial growth: prioritising repayment of credit cards, personal loans, and other high-APR borrowings saves money in the long run.

-

An emergency fund is a safety net: without it, unexpected expenses will force borrowing again.

- Financial discipline is a long-term game: habits built during debt repayment lay the foundation for a debt-free, financially secure future.

This step-by-step guide will walk you through proven methods to eliminate debt, prevent it from returning, and set you on a path to long-term financial independence.

Step 1: Assess Your Current Financial Situation

1: What is a stock?

Before you start paying off debt, you need to know exactly where you stand. Treat this like your financial health check-up.

1. List All Your Debts

Create a clear list that includes:

-

Type of debt (credit card, personal loan, car loan, education loan, etc.)

-

Outstanding balance

-

Interest rate

-

Minimum monthly payment

-

Due date

2. Calculate Your Debt-to-Income Ratio (DTI)

This shows how much of your income goes towards debt repayments.

Formula:

A healthy DTI is below 35%. Anything higher needs urgent attention.

3. Identify the “Bad” Debt First

High-interest debts, especially credit cards or payday loans, are the most harmful. These will be your top priority to tackle.

Step 2: Create a Realistic Debt-Repayment Plan

Paying off debt is like running a marathon; you need pace, persistence, and a plan.

1. Choose a Repayment Strategy

There are two popular methods:

-

Debt Avalanche Method: Pay off the highest-interest debt first while paying minimums on others. This saves the most money in interest.

-

Debt Snowball Method: Pay off the smallest debt first for quick wins and motivation. Then roll that payment into the next debt.

Example:

If you owe ₹3,000 on Card A at 20% interest and ₹5,000 on Card B at 12% interest:

-

Avalanche: Pay Card A first.

-

Snowball: Pay Card A if it’s the smaller amount, motivation is the driver.

2. Automate Payments

Missed due dates mean penalties and credit score damage. Set up automatic payments to avoid slips.

3. Allocate Extra Income Towards Debt

Any bonuses, freelance income, or tax refunds should go directly to debt repayment.

Step 3: Cut Unnecessary Expenses Without Feeling Deprived

Debt freedom often comes down to controlling your cash outflow.

1. Track Every Rupee

Use expense tracking apps or a simple Excel sheet to see where your money goes.

2. Identify “Leakage Points”

These are small, often ignored expenses:

-

Multiple streaming subscriptions you don’t use

-

Frequent online food delivery

-

Impulse online shopping

3. Adopt the “Needs vs Wants” Rule

Before spending, ask yourself:

-

Do I need this right now?

-

Will this purchase delay my debt freedom?

4. Replace Costly Habits

Swap restaurant dinners for home-cooked meals, gym memberships for home workouts, and cabs for public transport.

Step 4: Increase Your Income Streams

While cutting expenses is important, earning more can speed up your journey to debt freedom.

1. Ask for a Salary Raise

If you’ve been performing well, back it up with results and request an appraisal.

2. Take a Side Hustle

Freelancing, online tutoring, content creation, or selling handmade products can bring in extra income.

3. Monetise Skills

If you’re good at photography, coding, baking, or music, turn it into a paid service.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreStep 5: Renegotiate or Consolidate Debt

Sometimes you can make debt cheaper.

1. Negotiate Lower Interest Rates

Call your lender and request a rate reduction, especially if you have a good repayment history.

2. Debt Consolidation

Merge multiple high-interest debts into one lower-interest loan. This simplifies payments and reduces total interest.

3. Balance Transfer

Move your credit card balance to a card with 0% or low interest for a limited period.

Step 6: Build an Emergency Fund

One reason people fall back into debt is unexpected expenses.

Goal: Save at least 3–6 months’ worth of expenses in a separate savings account.

This way, if you face a job loss or medical emergency, you won’t need to swipe a credit card.

Step 7: Change Your Money Mindset

Debt elimination is not just about numbers, it’s about behaviour.

1. Understand Emotional Spending

Many people use shopping as stress relief. Learn to replace this with healthier coping mechanisms.

2. Delay Gratification

Postpone non-essential purchases for 30 days. Often, the urge will fade.

3. Visualise Your Debt-Free Life

Keep a visual tracker of your progress, like a chart or mobile app, to stay motivated.

Step 8: Improve Your Financial Literacy

The more you understand money, the less likely you’ll fall into debt again.

Ways to Learn:

-

Read personal finance books.

-

Follow credible finance blogs and podcasts.

-

Take online courses on budgeting, investments, and debt management.

- Check out the Entri Stock Market Course to learn and invest in the stock market and create a passive income source.

Step 9: Celebrate Milestones Without Overspending

Paying off your first loan or credit card is a big achievement.

Celebrate, but smartly. Choose low-cost rewards like a home-cooked special dinner or a day trip.

Step 10: Plan for the Future, Stay Debt-Free

1. Avoid Unnecessary Loans

Only borrow when it adds long-term value, like education or property.

2. Pay Full Credit Card Balances Monthly

Treat credit cards as convenience tools, not borrowing instruments.

3. Build Wealth Through Investments

Once debt-free, channel your freed-up income into mutual funds, stocks, and retirement plans.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

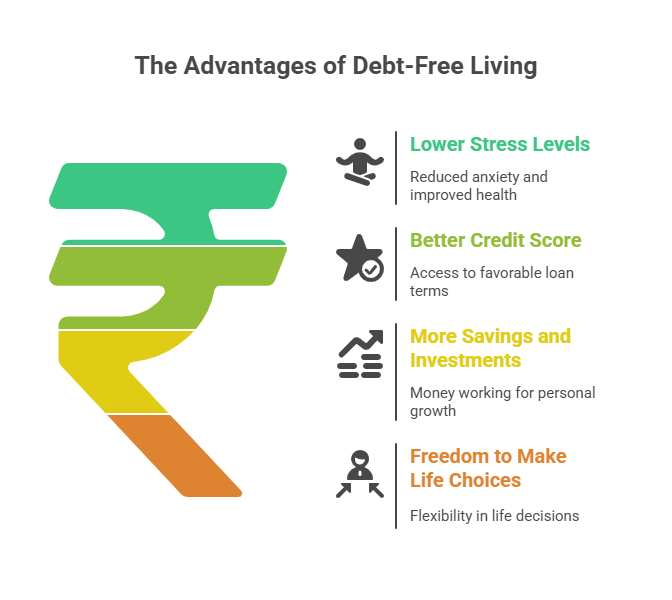

Long-Term Benefits of Being Debt-Free

-

Lower Stress Levels: Debt can cause anxiety, insomnia, and even health issues.

-

Better Credit Score: This opens doors to better loan terms when you do need them.

-

More Savings and Investments: Your money now works for you, not the bank.

-

Freedom to Make Life Choices: Travel, start a business, or retire early without financial chains.

Final Thoughts

Becoming debt-free isn’t about overnight miracles. It’s about consistent action, small sacrifices, and a shift in mindset. The steps above, when followed with discipline, can not only help you clear your current debts but also ensure you never fall into the trap again.

Start today, even if it’s with one small change. Your future self will thank you for every rupee you choose to save and invest instead of paying interest.

Debt freedom is not just a dream, it’s a plan.

Make that plan now, and stick to it.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What is the fastest way to become debt-free?

Should I invest while paying off debt?

It depends on the debt type and interest rate. High-interest debt should be cleared before investing, but for low-interest loans, small investments for essential goals can continue alongside repayment.

How can I stay debt-free once I’ve cleared all my loans?

Avoid lifestyle inflation, maintain an emergency fund, and use credit only when it can be repaid in full each month. Financial discipline is key to staying debt-free.

How much of my income should go toward debt repayment?

Financial experts recommend dedicating at least 20–30% of your monthly income towards debt repayment until all high-interest loans are cleared.

What’s the difference between the Debt Snowball and Debt Avalanche methods?

The Debt Snowball focuses on clearing the smallest balance first to build motivation, while the Debt Avalanche targets the highest-interest debt first to save more on interest over time.

Can I negotiate with banks to lower my debt?

Yes. Many lenders are open to restructuring EMIs, reducing interest rates, or offering settlement options if approached proactively with a repayment plan.

Should I use a personal loan to pay off credit card debt?

A personal loan can be a good option if it offers a lower interest rate than the credit card. However, it’s important to control spending to avoid accumulating more debt.

Is it possible to pay off debt without cutting expenses?

While earning more can help, most debt-free journeys require a combination of increased income and reduced expenses to be sustainable.

How important is an emergency fund in becoming debt-free?

It’s essential. Without it, unexpected expenses can force you to borrow again, undoing your progress toward financial freedom.

How long does it take to become debt-free?

The timeline varies based on income, debt size, and repayment strategy. With a disciplined plan, many people can clear unsecured debt in 2–5 years.