Table of Contents

Filing your Income Tax Return (ITR) is an important task for all taxpayers in India. While the process might seem overwhelming at first, it’s entirely possible to file your ITR on your own with a little understanding of the procedure.

In this guide, we’ll show you the step-by-step process of filing an ITR on your own, explaining the necessary documents, and provide tips to ensure a smooth and error-free filing. With this step-by-step approach, you’ll be able to handle your tax filings independently and with confidence.

Key Takeaways:

- ITR Filing is mandatory for all individuals earning above the basic exemption limit of 3 Lakhs per annum.

- Filing ITR ensures compliance, helps claim tax deductions, and avoids penalties.

- With the right documents and some patience, you can file your ITR on your own using the official Income Tax e-Filing Portal.

- The last date to file the ITR is 15th September.

Who Must File ITR?

The obligation to file an ITR is broader than most people realize. The basic exemption limit is the threshold after which ITR filing is mandatory, but there are several other scenarios where filing is required, even if income is below this limit.

-

For individuals with an annual income exceeding ₹3 lakh (as of 2025), ITR filing is mandatory, regardless of whether their tax liability is zero under the new tax regime.

-

This threshold will increase to ₹4 lakh in 2026 and beyond.

Start investing like a pro. Enroll in our Stock Market course!

Why Should You File Your ITR?

1: What is a stock?

Filing your Income Tax Return (ITR) is crucial for several reasons:

-

Legal Compliance: It’s a legal requirement for anyone earning above a certain income threshold.

-

Claim Refunds: If excess tax has been deducted from your salary or income, filing ITR ensures you receive a tax refund.

-

Loans and Visa Applications: A filed ITR is often required when applying for loans or visas.

-

Avoid Penalties: Late filing of ITR can lead to penalties and interest charges, so it’s best to file it on time.

Core Distinction: Paying Income Tax vs. Filing ITR

Many people confuse paying income tax with filing an Income Tax Return (ITR), but they are two different processes.

-

Income Tax Payment: This is the actual amount of tax an individual pays to the government based on their taxable income. It can be paid directly by an individual or indirectly through Tax Deducted at Source (TDS). It is the amount you paid to the government knowingly or unknowingly.

-

ITR Filing: Filing an ITR is the process of submitting a report to the government detailing your income sources, taxes already paid (such as TDS), and any deductions you’ve claimed throughout the financial year. It’s a mandatory reporting process, even if you don’t owe any additional tax or are due for a refund. You can say it is the report card of your finances. The money you made and the tax liabilities you have.

The key difference: Paying income tax is about paying your tax dues, while filing ITR is about submitting the details to the tax authorities.

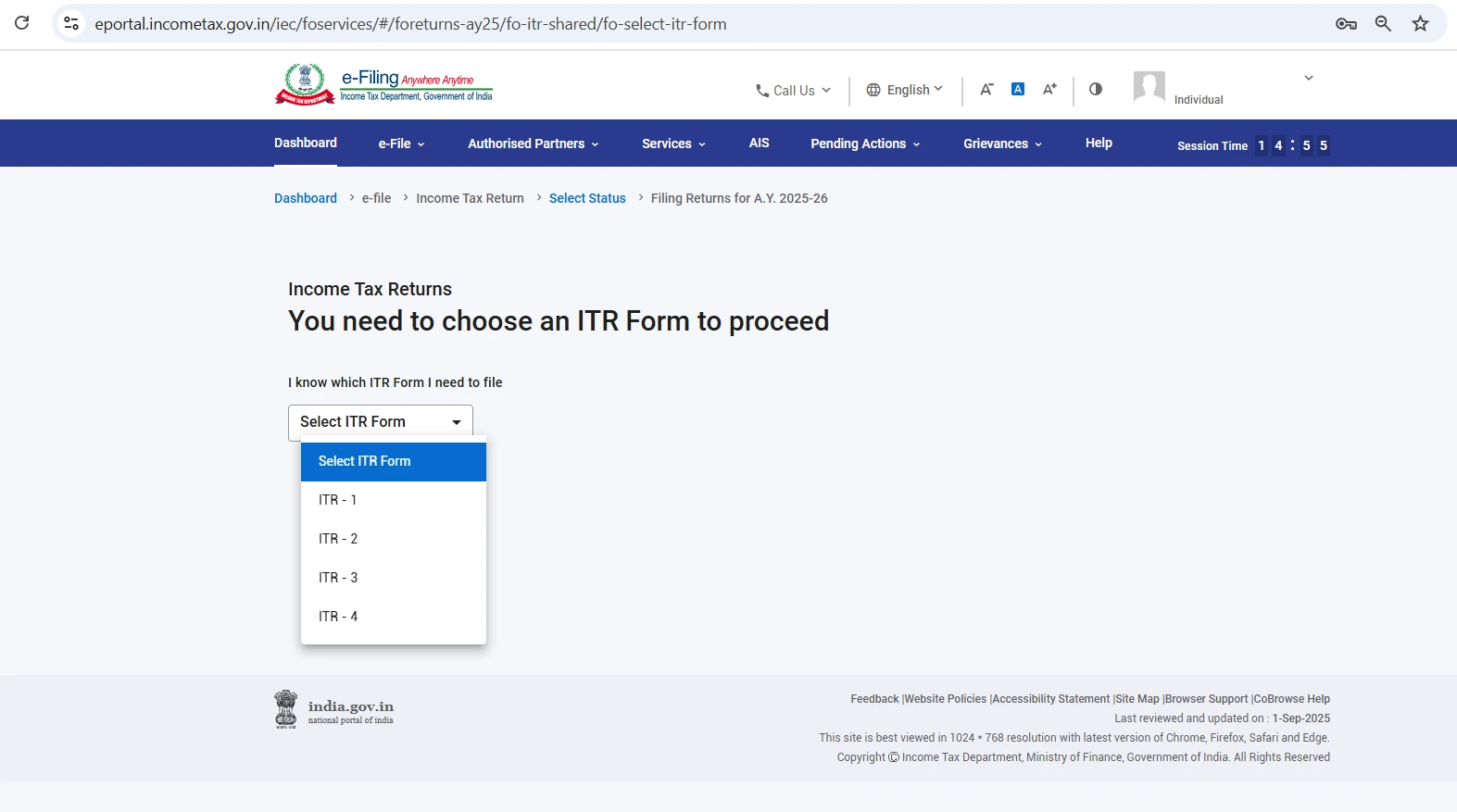

Determine Your ITR Type

The first step in filing your ITR is determining the appropriate ITR form to use. The Income Tax Department offers several types of ITR forms, and the right one depends on your income source and the type of taxpayer you are. Here’s a breakdown:

-

ITR-1: For salaried individuals, pensioners, and those with income from one house property, other sources (interest), or income up to Rs 50 lakh.

-

ITR-2: For individuals who have income from more than one house property, capital gains, or foreign assets. If you are a swing trader or an individual who does crypto trading, then you have to file ITR-2.

-

ITR-3: For self-employed individuals or professionals (business/profession income). If you are a freelancer or do FNO trading then you have to file ITR-3.

-

ITR-4: For small taxpayers who are under presumptive taxation schemes (for business/profession income up to Rs 50 lakh).

For most salaried individuals or pensioners, ITR-1 will be sufficient. If your income is more complex, such as from multiple sources, you’ll need ITR-2 or ITR-3.

| Gain Financial Literacy in your Mother Tongue | |

| Stock Market Course in Malayalam | Mutual Funds Course in Malayalam |

| Stock Market Course in Tamil | Mutual Funds Course in Tamil |

| Stock Market Course | Mutual Funds Course |

Overview and Preparatory Steps to file the ITR-1

Most individuals will be mostly a salaried or employed person, so they have to file ITR-1, so here we will be showing how to file an ITR-1 for salaried employees:

1. Understand ITR-1 Applicability:

-

ITR-1 is primarily for individuals with salary or pension income, whose total yearly income is less than ₹50 lakhs.

-

It also applies to individuals receiving interest from bank accounts or FDs, dividend income from stocks (under ₹50 lakhs), owning one house property, and having agricultural income not exceeding ₹5000.

-

Individuals with up to ₹1.25 lakh in long-term capital gains from selling shares or equity mutual funds can use ITR-1, provided they have no carried-forward capital losses from previous years.

-

If you have crypto transactions or swing trading profits/losses, you should file ITR-2, not ITR-1.

2. Gather Necessary Documents:

Before you begin, make sure to gather the following essential documents:

-

Form 16: Issued by your employer, detailing your salary and TDS deducted.

-

Form 26AS: This document gives a summary of all TDS deducted on your behalf. You can download it from the Income Tax website.

-

Annual Information Statement (AIS): This statement pre-fills your income details, such as salary, interest income, tax paid, TDS, and more. Available on the official Income Tax portal.

-

Bank Statements: For reporting any additional income not subject to TDS (e.g., freelance income, rental income).

-

Documents for Deductions: If you’re claiming deductions (especially under the Old Tax Regime), keep the supporting documents ready.

- Tax Paid Receipts: If you’ve paid advance tax or self-assessment tax, keep proof of payment.

You can download Form 26AS and AIS from the income-tax portal from the e-file menu at the top banner.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreStep-by-step to file the ITR on your own

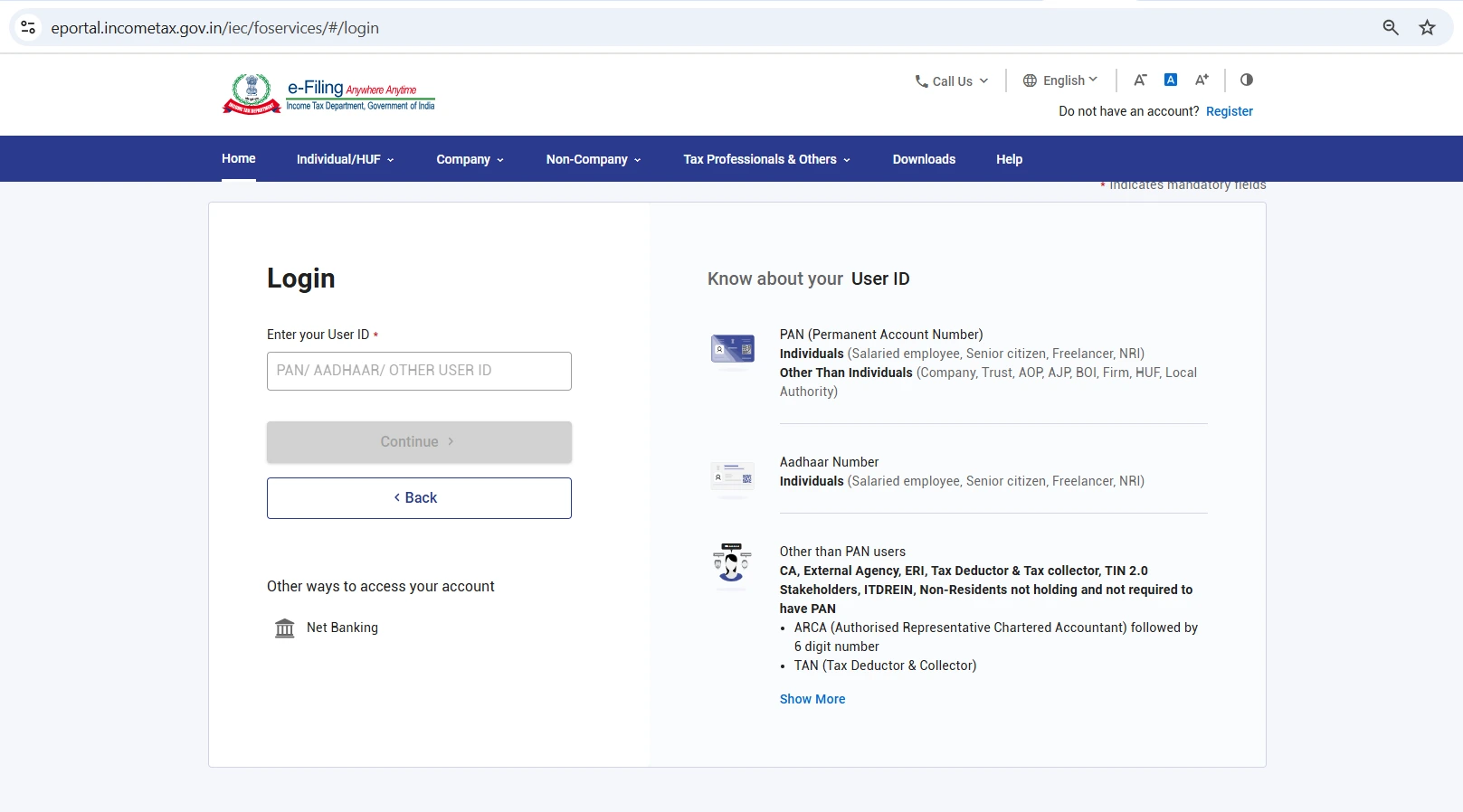

1. Register and Log in to the Income Tax e-Filing Portal

The official Income Tax e-Filing Portal (https://www.incometax.gov.in/iec/foportal/) is where you’ll file your return. Here’s what you need to do:

-

Register: If you don’t have an account on the portal, you will need to create one. You’ll need your Aadhaar card, PAN card, personal details, and Aadhaar-linked mobile number.

-

Log in: Once registered, log in with your PAN as the user ID and your password.

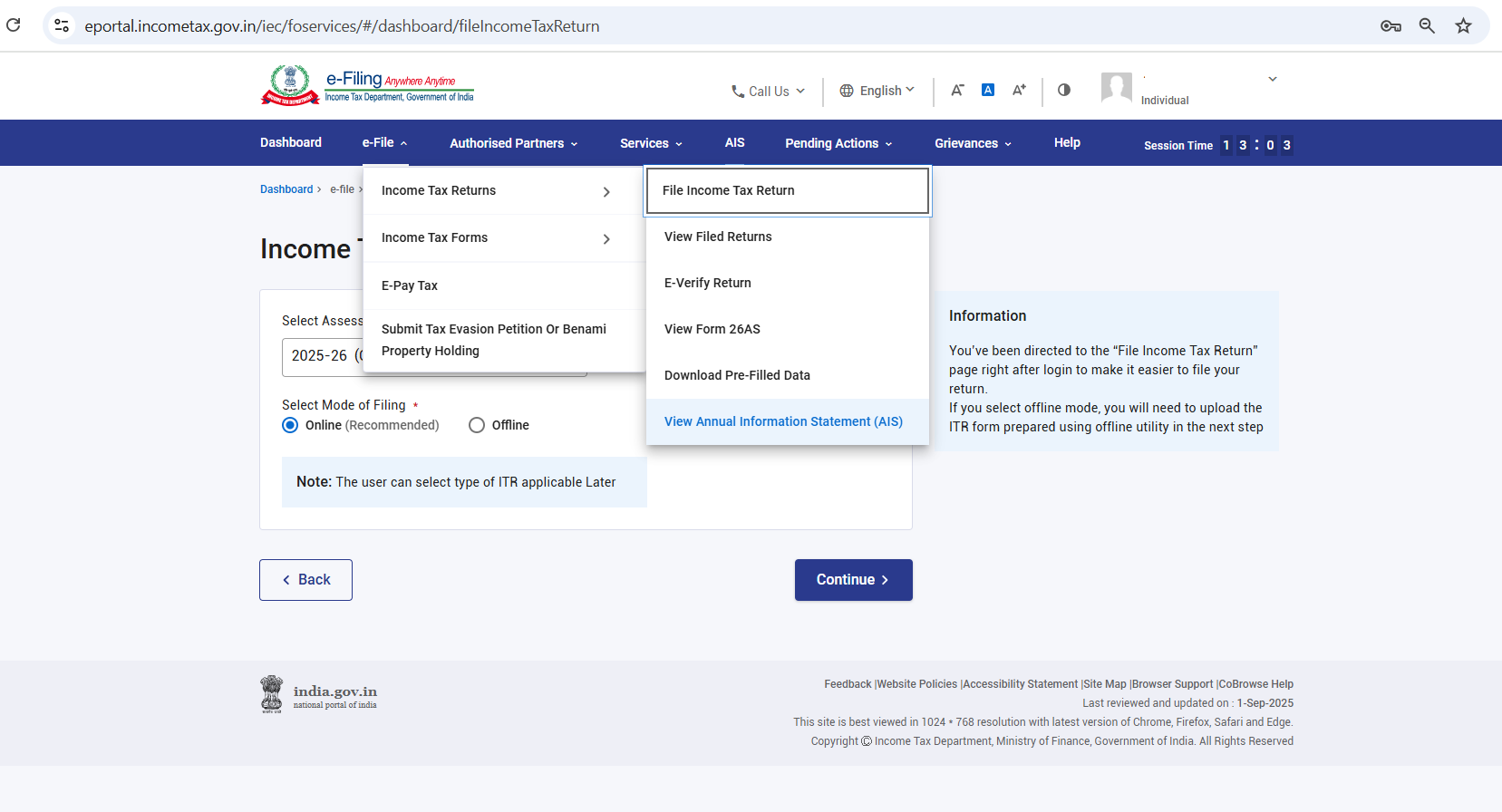

2. Download Form 26AS and AIS:

-

Go to the Income Tax Dashboard and click “File” → “Income Tax Returns” → “View Form 26AS”.

-

Select the Assessment Year (e.g., 2025-26 for FY 2024-25), choose “View As HTML”, and then download it as a PDF.

-

To download AIS, click on the “AIS” tab, then click “Download AIS”. The AIS PDF is password-protected; the password is your PAN number (in lowercase) followed by your date of birth (DDMMYYYY).

3. Initiate ITR-1 Filing:

-

From the homepage, click “File Income Tax Return” or navigate via “File” → “Income Tax Returns” → “File Income Tax Return”.

-

Select the Assessment Year (2025-26), then choose “Online” as the mode of filing.

-

Click “Start New Filing”

-

Choose “Individual” as the type of taxpayer and select ITR-1.

-

Click “Proceed with ITR-1” to start the filing process.

4. Answer Initial Questions:

-

A prompt will ask if you wish to use the New Tax Regime, select “OK”.

-

Confirm your filing reason (e.g., “Income is more than the basic exemption limit”).

-

Ensure all pre-filled data is accurate, as you are responsible for its accuracy.

5. Complete the Five Sections:

-

Step 1: Personal Information

-

Confirm your personal details, contact information, and address.

-

Choose your Nature of Employment (e.g, private employment).

-

Select Tax Regime (New or Old) and Filing Section (139(1) for timely filing).

- The preferred one is the new tax regime.

-

Provide Bank Account Details for refund (if applicable).

-

-

Step 2: Gross Total Income

-

Verify salary income from Form 16 and check for discrepancies.

-

Review other income sources (e.g., interest, rental income).

-

If you have additional income (e.g., freelance, insurance payouts), manually add it using Bank Statements.

-

Confirm all entered details.

-

-

Step 3: Total Deductions

-

If using the New Tax Regime, there will likely be few deductions.

-

However, if you have NPS contributions, add that under the deductions section.

-

Confirm the details.

-

-

Step 4: Tax Paid

-

The section will pre-fill TDS from Form 16 and Form 26AS.

-

If you’ve paid advance tax or self-assessment tax, enter those details manually.

-

Confirm the section.

-

-

Step 5: Verify Your Tax Liability

-

Review your total income, tax calculations, rebates, and total tax paid (TDS).

-

If you owe tax, it will show as “Tax Payable Now,” or if you are due a refund, it will show as “Refund Due”.

-

6. Submit the ITR

After entering all the details, you can now submit your ITR. The e-filing portal allows you to e-verify it directly. Here’s what to do:

-

Verify and Submit: Double-check all your details and click on Submit once everything is correct.

-

e-Verify Your ITR: You can e-verify your ITR using one of the following methods:

-

Aadhar OTP: Quick and easy method if you have linked Aadhar with PAN.

-

Net Banking: Use your net banking account to verify.

-

Other Methods: Use a digital signature or send a signed physical copy to the Income Tax Department (for physical verification).

-

Once e-verified, the system will accept your ITR. And that’s it, you have successfully filed your ITR returns.

Check ITR Status

After submission and once it is verified, you can check the status of your ITR filing on the e-filing portal. The statuses to watch for are:

ITR Processed: Your return has been processed successfully, and a refund will be provided soon.

Intimation/Assessment Order: In case there are discrepancies or any other information required, you will receive an intimation from the tax department.

Refunds: If you are eligible for a refund, it will be deposited directly into your bank account.

Common Errors While Filing ITR

Common mistakes or errors people make while filing ITR are listed below:

Wrong Form Selection: Filing problems could happen if the wrong ITR form is selected. Be certain to use the proper form.

Not Including Income: Be sure to double-check all of your income sources (freelancing, rent, interest, etc).

Not Availing Deductions: Always remember to avail of tax-saving deductions you are eligible to claim under section 80C, 80D, etc.

Wrong Bank Details: Make sure your bank details are correct for a tax reimbursement.

Late Filing: Late filings may incur penalties. So, file your ITR timely and don’t incur additional fees.

Watch the full content here in video format:

Conclusions

Filing your ITR is not a nightmare. ITR can be filed by yourself quite easily if you have the proper documents. E-filing makes the whole process simpler and provides transparency and convenience.

So, it is very important to file your ITR as it makes you eligible for refunds and other deductions. You may want to hire a professional if you’re not savvy about procedures or if your income is convoluted. But with the right support and resources, preparing your own ITR can be an empowering and rewarding experience.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

Who needs to file an Income Tax Return in India?

Any Indian resident whose total income exceeds the basic exemption limit (₹2.5 lakh under old, ₹3 lakh under new regime) must file an ITR.

What are the ITR filing deadlines for FY 2024-25?

For most individuals, the due date is 15th September 2025. Businesses needing audit get time till 31st October 2025.

Which documents do I need for ITR filing?

Prepare PAN, Aadhaar, bank statements, Form 16, TDS certificates, investment proofs, and interest statements.

What is the difference between paying income tax and filing ITR?

Paying income tax is the actual payment made to the government based on income, whereas filing ITR is a mandatory report that documents all income, taxes paid, and deductions claimed.

What happens if I miss the ITR filing deadline?

If you miss the deadline, you may face late filing fees of up to ₹5,000 and potentially receive income tax notices for non-compliance.

Can I claim a refund if I don’t file ITR?

No, you cannot claim any refund for excess tax paid (TDS) if you do not file your ITR. Filing is necessary to claim refunds.