Table of Contents

Retirement should be peaceful, not full of stress. Everyone dreams of a secure future after work ends. But how can you make that dream real? One common goal people have is this: Get ₹1 Lakh per Month After Retirement. It sounds like a lot, but it’s possible. With early planning and smart savings, you can achieve it. You just need to know the right steps. This blog will show you how to get there.

Most people don’t realise how long retirement lasts. You may need money for 25–30 years. That means you need a strong financial base. It’s not just about saving, but investing wisely. Medical bills and inflation can drain savings fast. So planning early gives you more freedom later. Let’s explore how to build your retirement income.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

Get 1 Lakh per Month After Retirement: Introduction

Retirement is a phase we all look forward to. After decades of work, we deserve peace and stability. But peace comes with financial planning. Without income, life after retirement can feel uncertain. That’s why early planning is very important. If you want comfort and freedom later, start now. A smart goal many follow is to get ₹1 lakh per month after retirement. It may sound big, but it is possible.

Retirement is not just the end of working life. It’s the start of a new journey. But this journey needs a financial cushion. With rising costs and medical needs, savings alone won’t help. Investments and planning are your tools. Begin in your 30s or even earlier. The sooner you act, the easier it gets. This guide shows how to make that dream real.

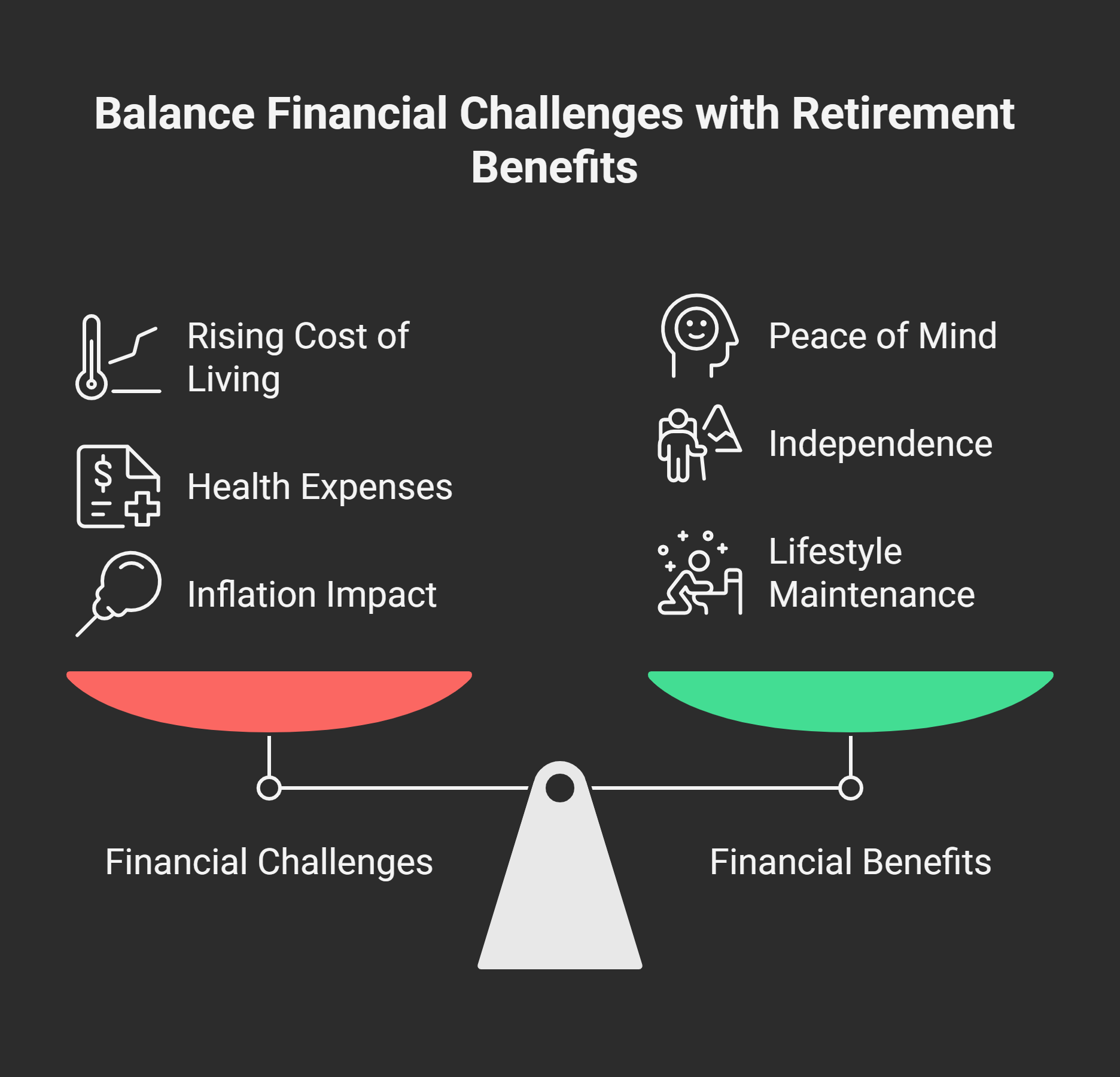

Why You Need to Plan for ₹1 Lakh/Month:

-

Cost of living keeps rising every year.

-

Health expenses grow after age 60.

-

You may live 25–30 years post-retirement.

-

Inflation eats away your savings over time.

-

Monthly income gives peace and freedom.

-

You won’t need to depend on anyone.

-

Lifestyle doesn’t need to change after retirement.

-

You can enjoy hobbies, travel, and more.

Let’s now understand what ₹1 lakh/month truly means.

What Does ₹1 Lakh Per Month Truly Mean?

1: What is a stock?

Earning ₹1 lakh per month after retirement feels ideal. But what does it really cover? Let’s break it down. A regular income after 60 brings comfort and confidence. It helps maintain your lifestyle without financial stress. You can pay bills, manage health, and enjoy life. To understand its real value, let’s look at expenses.

1. Basic Monthly Living Expenses

Your daily costs remain even after you retire. Food, utilities, and transport continue every month. For a family of two, these are essential needs.

| Category | Estimated Cost (₹) |

|---|---|

| Groceries & Kitchen | ₹15,000 – ₹18,000 |

| Electricity & Water | ₹3,000 – ₹5,000 |

| Mobile & Internet | ₹1,000 – ₹2,000 |

| Transport (car/bus/taxi) | ₹3,000 – ₹5,000 |

| Household Help | ₹2,000 – ₹4,000 |

| Total | ₹24,000 – ₹34,000 |

This covers only basic monthly needs. Lifestyle choices can raise costs more.

2. Healthcare and Medical Emergencies

Medical expenses usually increase after retirement. Even with insurance, you pay extra. Some tests, medicines, or visits may not be covered.

-

Regular health checkups: ₹2,000–₹5,000/month

-

Medicines and supplies: ₹1,500–₹4,000/month

-

Emergency fund: ₹10,000/month (average savings)

Without steady income, medical costs become stressful.

3. Leisure and Travel

Retirement is also time to enjoy your life. You may want to travel or visit family.

-

Short domestic trips: ₹10,000 – ₹20,000 per trip

-

Entertainment: ₹2,000 – ₹5,000/month

-

Dining out or hobbies: ₹2,000 – ₹3,000/month

These expenses keep life fun and balanced.

4. Supporting Family and Unexpected Costs

You might support children or grandchildren sometimes. Gifts, weddings, or sudden needs may arise.

-

Family help or gifts: ₹2,000 – ₹5,000/month

-

Festive spending: ₹3,000 – ₹7,000/month

-

Repairs or home needs: ₹2,000 – ₹4,000/month

Planning for these avoids last-minute stress.

5. Inflation and Future Value

Inflation reduces money’s power every year. ₹1 lakh today won’t feel the same later.

Let’s see how:

| Years After Retirement | Required for Same Value (₹) |

|---|---|

| 5 Years | ₹1.35 Lakhs |

| 10 Years | ₹1.80 Lakhs |

| 15 Years | ₹2.43 Lakhs |

Assuming 6% annual inflation.

This means your income must also grow yearly.

Summary: What ₹1 Lakh Covers

| Expense Type | Approximate Range (₹/Month) |

|---|---|

| Basic Living | ₹25,000 – ₹35,000 |

| Healthcare | ₹5,000 – ₹15,000 |

| Leisure & Travel | ₹5,000 – ₹10,000 |

| Family/Other Support | ₹5,000 – ₹10,000 |

| Total | ₹40,000 – ₹70,000+ |

The remaining amount helps beat inflation or handle surprises.

₹1 lakh/month gives financial security and life quality. It’s not luxury — it’s financial freedom. It helps you live with dignity and independence. Planning for this goal is the smartest decision. Let’s now see how much you need to save.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

Get 1 Lakh per Month After Retirement: How Much Retirement Corpus is Required?

To earn ₹1 lakh/month, savings alone aren’t enough. You need a strong retirement corpus that generates income. A retirement corpus is the total amount you need saved. This amount should last your entire post-retirement life. It should also beat inflation and cover emergencies. Let’s now calculate how much you really need.

1. Understanding the 4% Withdrawal Rule

A common rule used in retirement planning is the 4% Rule. It says you can safely withdraw 4% yearly from your corpus.

-

With ₹3 crores, 4% gives ₹12 lakhs/year

-

₹12 lakhs/year = ₹1 lakh/month

This method ensures your money lasts 25–30 years.

2. Basic Formula to Calculate Required Corpus

To get a fixed yearly income:

Required Corpus = Annual Income ÷ Withdrawal Rate

If you want ₹12 lakhs/year:

₹12,00,000 ÷ 0.04 = ₹3 Crores

This amount can safely give ₹1 lakh/month.

3. Corpus Needed Based on Age and Retirement Length

The younger you retire, the more corpus you need. Early retirement = more years without salary.

| Retirement Age | Years After Retirement | Corpus Needed (₹) |

|---|---|---|

| 50 | 35 | ₹3.5 – ₹4 Crores |

| 55 | 30 | ₹3 – ₹3.5 Crores |

| 60 | 25 | ₹2.5 – ₹3 Crores |

Assumes inflation at 6%, returns at 8%.

4. Factors That Impact Your Retirement Corpus

Several key factors affect how much you’ll need.

a) Inflation Rate

-

Higher inflation means bigger monthly needs later.

-

Your ₹1 lakh today may need ₹2 lakhs later.

b) Life Expectancy

-

Living longer means your savings must last longer.

-

Plan till age 85–90, minimum.

c) Expected Investment Returns

-

Safer plans give 6%–8% returns.

-

Choose mix of growth and income investments.

d) Medical Costs

-

Health expenses rise with age.

-

More health issues = higher retirement needs.

5. How Much to Save Monthly to Reach Goal?

If you start early, monthly savings can be small. Let’s see how much you should save:

| Start Age | Monthly SIP Needed (12% Return) | Corpus at 60 |

|---|---|---|

| 25 | ₹7,000 | ₹3.2 Crores |

| 30 | ₹10,000 | ₹3 Crores |

| 35 | ₹15,000 | ₹2.8 Crores |

| 40 | ₹22,000 | ₹2.6 Crores |

| 45 | ₹32,000 | ₹2.5 Crores |

Earlier saving = more power of compounding.

6. What If You Have Other Income?

Other income can reduce the required corpus.

-

Pension: Monthly pension reduces withdrawal needs

-

Rental Income: Helps support daily costs

-

Part-time Work: Adds extra cash flow

Use these sources to balance your plan better.

Your retirement corpus is the base of your future life. To get ₹1 lakh/month, you need smart planning. A ₹3 crore fund is a strong goal. With time and discipline, it’s very reachable. Start early, invest right, and review yearly. Let’s now explore where to invest this money smartly.

| Gain Financial Literacy in your Mother Tongue | |

| Stock Market Course in Malayalam | Mutual Funds Course in Malayalam |

| Stock Market Course in Tamil | Mutual Funds Course in Tamil |

| Stock Market Course | Mutual Funds Course |

📽️ Watch: How to Plan for ₹1 Lakh Monthly After Retirement

Want a visual guide? Here’s a simple video in Malayalam by Entri Finacademy that explains retirement planning, smart investment strategies, and how to reach your income goal safely:

It’s beginner-friendly and packed with useful tips for working professionals and senior citizens.

Best Investment Options to Generate ₹1 Lakh/Month

To earn ₹1 lakh/month post-retirement, saving isn’t enough. You need smart investments that give steady and safe returns. These investments should beat inflation and last many years. Not all options suit retirees, so choose wisely. A mix of income and growth assets is ideal. It reduces risk and improves long-term stability. Let’s explore the best investment options for you.

1. Senior Citizen Savings Scheme (SCSS)

SCSS is a safe and government-backed scheme.

-

Only for those aged 60 years or above

-

Interest rate is around 8.2% per annum

-

Maximum limit: ₹30 lakhs (as of 2024)

-

Interest paid every quarter (3 months)

-

Tenure: 5 years (extendable by 3 years)

Why choose SCSS?

Safe, regular income with no market risk.

2. Post Office Monthly Income Scheme (POMIS)

Perfect for low-risk, fixed monthly income.

-

Interest rate around 7.4% per annum

-

Maximum investment: ₹9 lakhs (single), ₹15 lakhs (joint)

-

Interest paid monthly directly to bank account

-

Lock-in period of 5 years

Why choose POMIS?

Easy option for guaranteed monthly returns.

3. Monthly Income Plans (MIPs) – Mutual Funds

Hybrid mutual funds giving income and growth.

-

Mix of debt (bonds) and equity (shares)

-

Not fixed returns, but better than savings

-

Choose “conservative” MIPs for stable income

-

Opt for SWP (Systematic Withdrawal Plan)

-

Long-term returns: 7% – 10% annually

Why choose MIPs?

More growth potential than fixed-income options.

Invest Smart, Learn Faster – Mutual Fund Course for Kerala

4. Annuity Plans – Life Insurance Companies

Gives fixed income for life after investment.

-

One-time investment gives lifetime monthly payout

-

Choose “Immediate Annuity” for instant income

-

Rates depend on age, plan, and insurer

-

Lower returns (5%–7%), but guaranteed for life

Why choose annuities?

Peace of mind with fixed lifelong income.

5. Dividend Stocks or REITs (Real Estate Investment Trusts)

Gives income through regular dividends and rental payouts.

-

Invest in strong companies or REIT funds

-

Riskier than other options, but higher returns

-

Annual dividend yield: 2% – 6%

-

REITs pay from commercial property rentals

Why choose stocks/REITs?

Can boost income if chosen carefully.

6. Bank Fixed Deposits (FDs)

Safe and familiar choice for Indian retirees.

-

Interest rate: 6.5% – 7.5% annually

-

Senior citizens get 0.5% extra

-

Choose monthly or quarterly interest payout

-

Good for short-term or emergency fund

Why choose FDs?

Low risk and predictable income.

7. Mutual Fund SWPs (Systematic Withdrawal Plan)

Great tool for steady income from mutual funds.

-

You invest in a mutual fund lump sum

-

Then withdraw fixed monthly amount

-

Gives flexibility, tax benefits, and growth

-

Choose balanced or debt mutual funds

Why choose SWPs?

Adjustable plan with better post-tax returns.

Sample Investment Portfolio to Generate ₹1 Lakh/Month

| Investment Option | Amount (₹) | Expected Return | Monthly Income (₹) |

|---|---|---|---|

| SCSS | ₹30,00,000 | 8.2% | ₹20,500 |

| POMIS | ₹15,00,000 | 7.4% | ₹9,250 |

| MIP Mutual Funds (SWP) | ₹25,00,000 | 8% | ₹16,700 |

| Annuity Plan | ₹30,00,000 | 6.5% | ₹16,250 |

| FDs / Debt Funds | ₹25,00,000 | 7% | ₹14,600 |

| REITs/Dividend Stocks | ₹15,00,000 | 6% | ₹7,500 |

| Total Corpus | ₹1.4 Crores | ₹84,800/month |

To reach ₹1 lakh, you’ll need ₹1.6 – ₹1.8 crores depending on return.

Final Tips for Safe Investment

-

Diversify across safe and moderate-risk products

-

Keep emergency fund of 6 months’ expenses

-

Review portfolio every 6–12 months

-

Reinvest extra income for long-term safety

-

Consult financial planner for personalised advice

Investments are key to earning even after retirement. Choose a mix that matches your risk level. With the right strategy, ₹1 lakh/month is realistic. Next, let’s discuss mistakes you must avoid.

Invest Smart, Learn Faster – Mutual Fund Course for Kerala

Get 1 Lakh per Month After Retirement: Common Mistakes to Avoid

Planning for retirement requires time, care, and smart choices. Many people start late or make poor decisions. These mistakes reduce your monthly income or increase stress. Even a small error can impact your long-term comfort. Awareness helps you stay on the right path. Let’s look at the most common mistakes people make. Avoiding them can protect your future income flow.

1. Starting Late with Retirement Planning

Time is your biggest friend in retirement planning.

-

Late starters need to save more each month

-

Missed years mean lost compounding benefits

-

Early planning builds a larger retirement corpus

-

Start in your 20s or early 30s ideally

Tip: Even small amounts grow if started early.

2. Underestimating Post-Retirement Expenses

People often think costs will reduce after retirement.

But expenses like health, bills, and lifestyle remain.

-

Medical costs may grow every year

-

Inflation raises daily living expenses too

-

Family support or sudden events may add pressure

Tip: Always overestimate, not underestimate, your future needs.

3. Ignoring the Impact of Inflation

Inflation silently reduces your money’s value every year.

What ₹1 lakh buys today may need ₹2 lakhs later.

-

Your returns must beat average inflation (5%–7%)

-

Fixed income alone may not be enough

Tip: Include inflation in every savings and investment plan.

4. Investing Only in Low-Return Products

Safety is good, but low returns hurt in long term.

Some people choose only FDs or savings accounts.

-

These may not beat inflation over 25+ years

-

They reduce your real monthly income gradually

Tip: Combine safe and growth-oriented investments smartly.

5. Not Diversifying Your Portfolio

Relying on one type of investment is risky.

If it fails or underperforms, your income drops.

-

Don’t put all funds into one scheme

-

Mix of equity, debt, and fixed income is best

Tip: Diversification spreads risk and improves stability.

6. Withdrawing Too Much Too Soon

Overspending early can drain your savings fast.

Your retirement may last 25–30 years or more.

-

Stick to 4% annual withdrawal rule

-

Avoid unnecessary large expenses post-retirement

Tip: Plan a strict monthly budget and stick to it.

7. Not Having Health Insurance

Medical emergencies can break your savings quickly.

Relying only on corpus is a big mistake.

-

Get health cover before retirement

-

Choose policies with lifelong renewals

Tip: Health insurance protects your retirement income flow.

8. Forgetting to Rebalance or Review

Markets change, and so should your portfolio.

What worked 5 years ago may not work now.

-

Review investments yearly

-

Rebalance based on performance and market trends

Tip: Set one fixed month to review every year.

9. Not Accounting for Spouse’s Needs

Many plans ignore the spouse’s future and safety.

If you pass away early, income may stop.

-

Include joint plans and nominee details

-

Plan for both lives, not just one

Tip: Retirement planning is for the whole family.

10. Ignoring Tax on Retirement Income

Some income options are taxable after retirement.

Taxes reduce your actual monthly cash in hand.

-

SWPs and annuities may have tax

-

Plan withdrawals smartly to reduce liability

Tip: Use tax-efficient products and proper withdrawal timing.

Mistakes in retirement planning are often hard to fix. A wrong step today affects your future deeply. But every mistake can be avoided with awareness. The key is to plan early and plan wisely. Use the right tools and avoid common errors. Review your strategy often and adjust when needed. Now let’s see how to prepare smartly from today.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreTips to Start Preparing Early

Starting early is the best retirement planning decision. Early action means smaller monthly savings and bigger returns later. It helps you handle inflation, emergencies, and longer life spans. With more time, you can invest better and smarter. Compound interest works best over long durations. Let’s now explore the most effective early preparation tips. These small habits can secure a strong retirement.

1. Start Saving in Your 20s

Saving early reduces financial stress later in life.

-

Begin with just ₹1,000 per month

-

Increase savings with every salary hike

-

Develop savings as a monthly habit

-

Early saving builds strong money discipline

Tip: Time matters more than how much you save.

2. Use SIPs for Consistent Investment

SIPs make investing automatic, easy, and disciplined.

-

Start with ₹500 or ₹1,000 per month

-

Choose equity mutual funds for long-term goals

-

Set a fixed date and stick to it

Tip: SIPs benefit from rupee cost averaging over time.

3. Invest in Retirement-Specific Products

Some products are made just for retirement planning.

-

NPS (National Pension System) gives monthly income later

-

PPF gives safe, tax-free long-term returns

-

Choose ELSS for tax-saving and long-term growth

Tip: Use long-lock-in products for retirement goals only.

4. Track and Reduce Unnecessary Expenses

Every rupee saved adds up over years.

-

Avoid loans for non-essential purchases

-

Cut luxury expenses and impulse spending

-

Use budgeting apps to track your money

Tip: Save first, then spend what’s left.

5. Use the Power of Compounding

Compounding grows your money faster over time.

-

Early investments grow much larger than late ones

-

Reinvest returns instead of withdrawing

-

Avoid pausing SIPs unless very necessary

Tip: Compounding needs time — so start early.

6. Upgrade Skills to Boost Income

A better income means higher savings every month.

-

Take online courses or certifications regularly

-

Learn high-paying skills like coding or marketing

-

Ask for a raise or explore new roles

Tip: Higher income leads to faster retirement planning.

7. Review Your Goals Every Year

Your goals and income may change with time.

-

Review investments and returns yearly

-

Adjust savings amount as income grows

-

Use retirement calculators for better accuracy

Tip: Track progress regularly to stay on course.

Sample Monthly SIP Needed for ₹3 Crore Corpus

| Start Age | Monthly SIP (12% return) | Corpus at 60 |

|---|---|---|

| 25 | ₹7,000 | ₹3.2 Crores |

| 30 | ₹10,000 | ₹3 Crores |

| 35 | ₹15,000 | ₹2.8 Crores |

| 40 | ₹22,000 | ₹2.6 Crores |

Tip: Earlier start = lower monthly burden, bigger benefit.

Small actions taken today bring huge results later. Early planning makes retirement smooth and stress-free. You won’t need to chase high-risk investments later. Saving consistently builds confidence and long-term security. Start small, stay consistent, and think long term. Even ₹500/month matters if started early. Now let’s wrap up with key takeaways and conclusions.

Get 1 Lakh per Month After Retirement: Conclusion

Planning early for retirement ensures peace and stability later. Getting ₹1 lakh per month after retirement is realistic. It needs smart saving, investing, and avoiding common mistakes. Time and consistency matter more than large amounts. Start early, even with small savings every month. Avoid risky decisions and monitor your progress regularly. A steady income post-retirement gives freedom and comfort.

Diversify investments to reduce risk and boost income flow. Combine government schemes, mutual funds, and annuity plans. Don’t ignore inflation, healthcare, or your spouse’s needs. Use SIPs and SWPs to manage money better. Keep reviewing your plan every year without fail. A well-planned retirement means a stress-free future life.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

Is it really possible to earn ₹1 lakh per month after retirement?

Yes, it is absolutely possible with proper planning, disciplined saving, and smart investing. To generate ₹1 lakh per month, you’ll need a sizable retirement corpus—typically ₹1.6 to ₹2 crores depending on your investment returns. If you start early and diversify your portfolio using tools like mutual funds, annuities, SCSS, and REITs, you can comfortably achieve this income goal. The key is consistency and revisiting your plan every few years.

How much money do I need to retire with ₹1 lakh/month income?

The retirement corpus required depends on your expected rate of return and inflation. For example, if you aim for a 7% annual return, you’ll need around ₹1.7 crores to generate ₹1 lakh per month. If your investments return 8%, the required corpus would be slightly lower—about ₹1.5 crores. However, to stay safe and account for inflation, most experts recommend targeting a corpus of ₹2 crores or more.

Which are the safest investment options for retirees?

Safe investment options include government-backed schemes like the Senior Citizen Savings Scheme (SCSS), Post Office Monthly Income Scheme (POMIS), and bank fixed deposits. These offer predictable returns with low risk. You can also consider annuity plans from life insurers, which provide guaranteed income for life. These are ideal for conservative investors who prioritize capital safety and steady monthly payouts.

What is the role of mutual funds in retirement income?

Mutual funds, especially through Systematic Withdrawal Plans (SWPs), can be a great way to generate retirement income. By investing in balanced or debt-oriented mutual funds, retirees can withdraw a fixed amount monthly while allowing the remaining capital to grow. Mutual funds also offer better inflation-adjusted returns than traditional savings products. However, since they involve some market risk, proper fund selection and diversification are essential.

How can I ensure my retirement income lasts 25–30 years?

To make your income last through retirement, you must avoid overspending and stick to a sustainable withdrawal strategy. The commonly recommended rule is the 4% annual withdrawal rule, which means withdrawing 4% of your total corpus in the first year and adjusting for inflation thereafter. Investing in a mix of growth and income-generating assets also helps your corpus grow while providing regular payouts. Rebalancing your portfolio every year is also crucial.

Can I still reach this goal if I start late?

Yes, but the later you start, the more aggressively you’ll need to save and invest. If you begin in your 40s or 50s, you may need to save a larger portion of your income and consider higher-return investments like equity mutual funds. You might also need to reduce your retirement spending goals or extend your working years. While challenging, disciplined action and expert financial guidance can still help you reach a ₹1 lakh/month income.

How does inflation affect my retirement planning?

Inflation reduces the real value of your money over time. This means ₹1 lakh today may not be enough 10–20 years from now. That’s why it’s important to factor inflation into your planning and choose investment options that offer inflation-beating returns, such as equity mutual funds or REITs. Your retirement corpus should not only provide for current needs but also support increasing expenses in the future.

What mistakes should I avoid while planning for retirement?

Some common mistakes include starting too late, underestimating future expenses, investing only in low-return assets, ignoring inflation, and not having health insurance. Many also forget to include their spouse’s needs or fail to plan for taxes on retirement income. A lack of diversification and irregular portfolio reviews can also derail your goals. Avoiding these mistakes increases your chances of maintaining a stable post-retirement income.

Is it necessary to consult a financial advisor?

While it’s not mandatory, consulting a certified financial planner is highly recommended—especially for retirement planning. Advisors help tailor your strategy based on your income, goals, risk appetite, and life expectancy. They also help select the right mix of investments and manage your taxes effectively. A financial advisor can provide valuable guidance, particularly when you’re close to retirement or have multiple income sources.

What is the best age to start planning for retirement?

The best time to start is in your 20s or early 30s. Starting early means you can contribute smaller amounts and still reach your goal, thanks to compounding. Even investing ₹5,000–₹10,000 monthly from age 25 can build a corpus of ₹2+ crores by age 60. However, if you missed that window, the second-best time is now. The earlier you start, the less financial pressure you’ll face later.