Table of Contents

Life is full of surprise, and sometimes unexpected health problems can suddenly visit the hospital. These emergency aids often come with high medical bills, which can be stressful for many families. Whether it is an accident, surgery, or a sudden illness, such expenses can help reduce anxiety in already difficult time. In this blog, we will discover simple and practical methods to handle emergency hospitals. From saving in advance to the use of health insurance with care, you will learn useful suggestions to manage medical costs without feeling overwhelmed.

Learn Mutual Fund Investing – Join Entri’s Top Course Today!

Introduction

Medical emergencies can come with out warning and often lead to excessive clinic payments. Whether due to an accident, sudden illness or immediate surgery, the cost of remedy can positioned pressure on the price range to any own family. Being equipped and knowing your alternatives could make a large difference. Understanding how to deal with these expenses can quick help you sense greater on top of things in complicated conditions.

Understand the Real Cost of Hospital Emergencies

When there is a medical emergency, the first and most important is that proper treatment is received as soon as possible. But when the situation is under control, many families face something serious-hospital bill. Understanding the actual cost of emergency conditions for hospitals can help you improve better and avoid financial stress in difficult times.

1. Medical Costs Add Up Quickly

In emergencies, treatment is often sharp, composed and animals. A single trip to the emergency room may contain several claims:

-

Doctor’s consultation fees

-

Bed or room charges (especially in private hospitals)

-

Emergency tests and scans (like blood tests, X-rays, CT scans)

-

Surgery or special procedures

-

Medicines and injections

-

ICU or special care unit charges (if needed)

Although staying in the hospital is only for a few days, the total bill can be much higher than expected. For example, a small stay in ICU can cost thousands or lakh rupees on the basis of hospitals and city.

2. Hidden or Unexpected Charges

Apart from the visible charges on the bill, there are many extra costs that families don’t plan for. These may include:

-

Travel or ambulance charges

-

Medical equipment (like oxygen cylinders, ventilators, or walkers)

-

Follow-up visits and medicines after discharge

-

Special diets or care at home

-

Loss of income if the patient or caregiver has to take time off work

These costs are not always included in the hospital bill but can add pressure to the family’s budget over time.

3. Differences in Hospital Rates

The cost of treatment can vary widely depending on the type of hospital. Public hospitals are usually cheap or even free in many cases, but they may have long wait or limited resources. Private hospitals offer quick services and advanced facilities, but the costs are very high. Even among private hospitals, prices may vary depending on the offer of locations, marks and services.

For example, the cost of surgery in a big city such as kochi or thiruvananthapuram may double or triple the cost of a small town. Knowing this difference can help families choose the right hospital based on budget and insurance coverage.

4. Why Knowing the Costs Matters

When you understand the actual cost of emergency conditions in the hospital, you can plan better. Many people do not think about medical expenses until they face a serious health problem. When you know how expensive the emergency room can be, you are more likely:

-

Buy a good health insurance policy

-

Start a health emergency savings fund

-

Compare hospitals and treatment options in advance

-

Ask the hospital for a cost estimate or a breakdown of charges

Being informed helps you avoid shock and confusion in difficult times. It also allows you to create smart financial options before and after treatment.

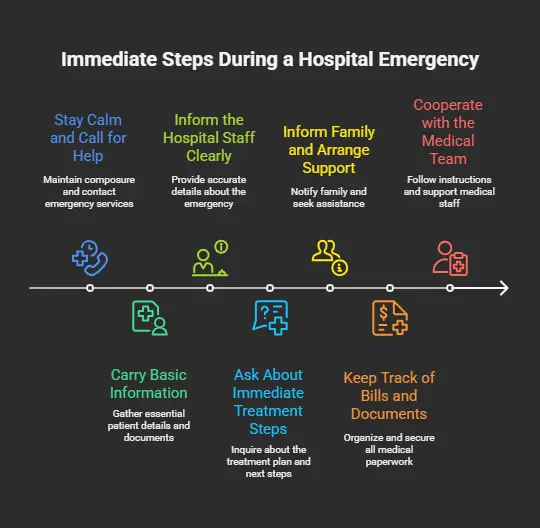

Immediate Steps During a Hospital Emergency

1: What is a stock?

A medical emergency can be sudden and disturbing. Whether it is a extreme accident or a unexpected illness, it is straightforward to sense beaten for the time being. But to be calm and recognize what to do, there may be a massive distinction between proper care and confusion. Here are the most vital steps to take under the medical institution’s emergency, that is defined in easy and smooth expertise language.

1. Stay Calm and Call for Help

The first and maximum crucial aspect is to remain as calm as feasible. Nervousness can disclose your movements and confuse others around you. If someone is seriously damaged or subconscious, you could name emergency services or your nearby ambulance number straight away. In India you may name 108 for ambulance offerings in most states.

If the medical institution is nearby and it’s far safe to move the affected person, you can take them to the emergency room as soon as feasible. But if there are critical injuries or the individual can’t flow on, you could look forward to an ambulance.

2. Carry Basic Information

When you go to the hospital, carry the patient’s basic details if possible. This includes:

-

A valid ID card (Aadhaar, PAN, or any government ID)

-

Any medical reports or prescriptions

-

Health insurance card or policy number (if available)

-

Contact numbers of close family members

If the patient has known health conditions (like diabetes, heart problems, allergies), inform the doctor or nurse right away. This helps the hospital give the right treatment without delays.

3. Inform the Hospital Staff Clearly

When you reach the emergency room, speak clearly and explain what happened. Share details like:

-

What caused the emergency (fall, chest pain, accident, etc.)

-

When it started

-

If the patient took any medicine before arriving

-

Any past health conditions or treatments

The more accurate information you give, the faster the medical team can take action.

| Gain Financial Literacy in your Mother Tongue | |

| Stock Market Course in Malayalam | Mutual Funds Course in Malayalam |

| Stock Market Course in Tamil | Mutual Funds Course in Tamil |

| Stock Market Course | Mutual Funds Course |

4. Ask About Immediate Treatment Steps

Once the doctors begin treatment, ask about the next steps. You can say things like:

-

“What is happening right now?”

-

“Will the patient need to be admitted?”

-

“Are any tests or procedures needed immediately?”

This helps you understand what is going on and prepare for any decisions you might need to make.

5. Inform Family and Arrange Support

Call close family members or friends and tell them about the situation. It is useful to have someone with you, especially if you feel stressed or required to make quick alternatives. They can also help arrange papers, arrange money or talk to doctors when you focus on the patient.

6. Keep Track of Bills and Documents

During an emergency, the hospital can start treatment immediately and ask you to complete the registration or admission process later. Make sure you keep all bills, receipts and reports safe. These are important for insurance requirements or subsequent followers. If you have health insurance, you can inform the hospital staff so that they can start the requirement process as soon as possible.

7. Cooperate with the Medical Team

Doctors and nurses work quickly during an emergency. Collaborate with them, follow their instructions and stay close to it is said to leave. If you are unsure, you can ask questions, but remember that the medical team is trying their best to help the patient.

Learn Mutual Fund Investing – Join Entri’s Top Course Today!

Financial Options to Handle the Expense

Managing a medical emergency is already stressful, however the price of sanatorium treatment can make matters even extra tough. Bills for surgical treatment, ICU care, checking out and drugs can fast upload, and not every body has coins equipped to pay right now. This is why it is important to know the various financial alternatives available to handle hospital expenses without putting much pressure on the family savings.

Here are some simple and practical financial options to help you manage medical costs during emergencies:

1. Use Your Health Insurance

Health insurance is one of the best ways to handle hospital bills. If you or your family member is covered during a health insurance, you can inform the hospital immediately. Most of the hospitals today provide cashless treatment, where the insurance company pays the bill directly to the hospital (up to the coverage limit). You just need to pay for things that don’t join the policy.

To make the process smooth:

-

Carry your health insurance card or details.

-

Choose a hospital that is part of your insurance company’s network hospital list.

-

Talk to the hospital’s insurance desk as soon as you reach.

2. Use an Emergency Fund (If You Have One)

An emergency fund is money you set separately for unexpected events such as accidents, illness or loss of work. If you have one, it is now time to use it. This can prevent you from taking a loan or using credit cards. Economic experts often propose to continue spending at least 3 to 6 months on a separate savings account for such emergencies.

3. Ask the Hospital About Payment Plans

Some private hospitals understand that not everyone can pay a large bill at a time. Ask the hospital if they offer installment options or delayed payment schemes. Although every hospital does not give it, it is worth asking. Some hospitals also have bonds with financial institutions that provide rapid medical loans for low interest rates.

4. Use a Medical Loan or Personal Loan

If your insurance does not cover the full cost, or if you do not have insurance, a medical loan or personal loan can help. These are quick loans provided by banks or NBFCs (financial companies that are not banking) that you can use for health care costs. But remember that debt comes with interest. Therefore, only use this option if you are sure you can pay it over time.

Some features of medical loans include:

-

Fast approval (sometimes within 24 hours)

-

No need for collateral

-

Flexible repayment options

5. Use Credit Cards (as a Last Option)

In the emergency, the use of a credit card can be useful if you need to pay quickly. However, credit cards usually charge high-of-the-rate rates if you do not pay the full amount by the due date. Use this option only when there is no other option and try to repay the amount as soon as possible.

6. Reach Out for Support

In serious situations, do not hesitate to seek help from family or close friends. Many people are ready to support medical emergency conditions. Some of the difficult times turn into crowdfonding platforms to raise money. Sites like Milap, Keto or Gofundme (globally) allow you to share your story and raise money for treatment.

What to Do If You Don’t Have Insurance or Savings

A medical emergency can be stressful-especially if you do not have a health insurance or savings fund. Hospital bills can come in the form of a shock, and without financial backup you can feel helpless. But don’t worry. Even if you do not have insurance or savings, there are ways to manage medical expenses at emergency rooms. You just need to be calm, discover the options and work quickly.

Here are some simple and practical steps you can take:

1. Don’t Panic – Focus on Immediate Care

In emergencies, the most important thing is that the patient has health. Hospitals will usually start treatment, even if you cannot pay the full amount. Be aware of recruiting the patient and stabilizing first. Once things have fallen asleep, you can start looking for ways to handle costs.

2. Talk to the Hospital Administration

Many hospitals, especially private, have a billing or patient support team. Go to the hospital invoicing counter or help desk and explain your position honestly. Ask if they can:

-

Offer a discount or reduce some of the charges

-

Allow you to pay in installments

-

Suggest any government schemes or charity support available in the hospital

3. Apply for a Medical Loan

If you need immediate funds and do not save, a medical loan or personal loan can help a bank or NBFC (non-bank financial company). These loans are especially created for emergencies and are usually approved quickly. Before using, you can compare the interest rates and read conditions carefully. Use this option only when you are convinced to repay the loan over time.

-

No need for collateral

-

Quick processing (sometimes within 24 hours)

-

Flexible repayment plans

4. Use Your Credit Card (If Available)

If you have a credit card, it can be used to insert hospitals or buy medicines. But be careful – if you do not pay the full amount by the due date, the credit card rates are very high. Try to use it just as a final option or for short -term requirements. If possible, change the payment to EMI (monthly payment) to make the payment more manageable.

5. Ask for Help from Family or Friends

It is okay to reach family members or close friends during the emergency. Many people are ready to help when they know this is a situation of life or death. Even small contributions from different people can help you handle the hospital bill without taking heavy loans.

6. Use Crowdfunding Platforms

In recent years, many families have used online crowdfunding platforms to raise money for emergency treatment. Sites like Milap, Ketto and Impactguru in India let you share their history and get donations from people across the country.

-

It’s free to start a campaign

-

You can raise money quickly

-

Many people are willing to help when they know your situation

7. Check Government Health Schemes

If you belong to a group of low income or have a ration card, you may be eligible for free or concessional treatment under state health schemes. Some examples include:

-

Ayushman Bharat (PM-JAY) – for families with low income

-

State health cards or BPL cards – in many states like Kerala, Tamil Nadu, etc.

-

ESIC benefits – for employees working in registered companies

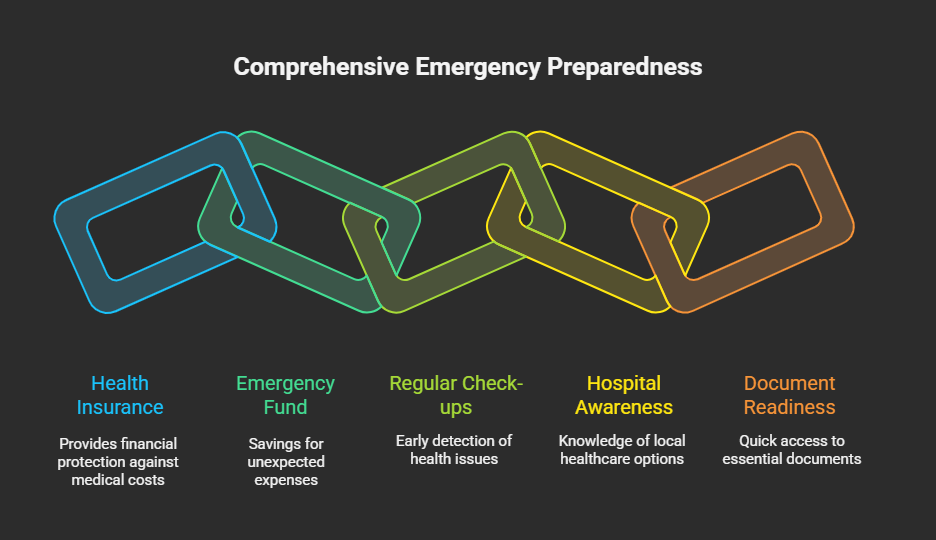

Preventive Measures for the Future

Medical emergency is unpredictable and can occur with anyone at any time. Although we cannot stop the emergency from arising, we can take smart steps to reduce the stress they provide – especially financial stress. Being premature preparation can lead to a big difference and can help you handle future emergencies with more confidence and less anxiety.

Here are some simple and practical preventive measures to protect yourself and your family in the future:

1. Get a Good Health Insurance Policy

One of the most important steps you have for buying a health insurance. It acts as an economic shield when a medical emergency occurs. A good policy can cover hospital bills, testing, surgery and even some medications. You don’t have to worry about arranging a large amount at once. Make sure the policy also covers family members. A family flow scheme is a good alternative if you want coverage for everyone under a plan.

Look for a policy covering:

- Emergency

- Major diseases (such as heart problem or cancer)

- Pre -and after hospital care

- Cashless treatment in network hospital

2. Build an Emergency Fund

An emergency fund is just the money saved for unexpected conditions, such as hospital bills, accidents or sudden loss of work. Try to save a small amount each month-even 500rs 1000rs too. Over time it can grow in an aid fund. Keep this money on a separate savings account that is easy to reach, but is not used for regular expenses. Economic experts propose to save the basic life cost of at least 3 to 6 months.

3. Regular Health Check-ups

Prevention is always better than cure. Common health surveys can help you capture health problems early before they become serious and expensive for treatment. Many diseases such as diabetes, high blood pressure or heart conditions can be better controlled if found early. Many hospitals and laboratories provide full body check packages at cheaper prices. One is a smart and healthy habit every 6 to 12 months.

4. Know the Hospitals and Schemes Around You

Take the time to find out which hospitals are near your house and whether they deliver emergency services. In addition, you can check if they are part of the health insurance provider’s network hospital for cashless treatment. You should also learn about state health schemes in your area. In India, programs such as Ayushman bharat or State Health Card provide free or reasonable treatment for qualified families.

5. Keep Documents Ready

In an emergency, all important documents in one place can save valuable time.

- Health Insurance Card or Insurance

- ID Proof (like Aadhaar card)

- Medical history and prescriptions

- Emergency contact number

Learn Mutual Fund Investing – Join Entri’s Top Course Today!

Conclusion

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What should I do first when a medical emergency happens?

In a medical emergency, your first step should remain calm and get medical help immediately. Call an ambulance or attend the nearest hospital. When the patient is treated, you can inform the hospital staff about insurance. If possible, take important documents such as ID proof, medical history and your health insurance cards. Quick thinking and being calm can help avoid confusion and save valuable time.

How can I pay for hospital expenses if I don’t have health insurance?

If you do not have insurance, there are still ways to handle medical costs. You can ask the hospital if they provide discounts, installments or financial assistance. You can also apply for medical or personal loans through bank or NBFC, or use your credit card if necessary. In severe cases, reaching family, friends or using crowdfunding platforms such as keto or milaap can help raise money quickly.

How does cashless health insurance work during emergencies?

Cashless insurance can be decided directly by the insurance company in network hospitals. During the emergency, you must inform the hospital insurance desk and share your health insurance card or your insurance number. The hospital will send a request to your insurance company, and when approved, the treatment will continue without the need for full payment on your part. You may still have to pay for goods that are not covered by your insurance, such as consumer goods or registration fees.

Can I use a credit card for hospital expenses?

Yes, credit cards can be useful in emergencies when you do not have cash in your hand. Many hospitals accept card payments for deposits, medicines or even surgical costs. However, use the credit card with care – if you do not pay the full amount in time, it applies much higher interest rates. Some banks allow you to convert large payments to EMIs, which can reduce the monthly load.

Are there any government schemes that help with hospital expenses?

Yes, India’s government runs several health schemes to support low -income families. For example:

- Ayushman Bharat (PM-JAY) provides free treatment up to £ 5 lakh for qualified families.

- State health insurance schemes (like Karunya in Kerala) also provide help.

- ESIC benefits are available to employees of registered companies.

Ask the hospital if you qualify for such a scheme and take the ID certificate as a ration card, Aadhaar card or proof of income.

How can I prepare for future medical emergencies financially?

The best way to prepare is now to take preventative steps. Buy a good health insurance for yourself and your family. Set an emergency fund by saving a small amount monthly. In addition, you can go for regular health checks to get problems quickly. When you know which hospital and support options are available in your area, you will also help to work quickly during emergencies.