Table of Contents

Key Takeaways:

- 1000 Rs a day is possible with discipline, strategy, and consistency.

- Intraday, swing trading, and long-term compounding based on your risk profile.

- Learn market analysis, risk management, and psychology to hold profits.

- Don’t gamble and make decisions based on data and research.

- Entri’s Stock Market Course can help you develop a professional trading mindset and build skills for daily consistency.

Introduction: The Reality Behind 1000 Rs a Day

Many beginners dream of making 1000 Rs a day from the stock market. It sounds small at first, but over a month, that’s 20,000 Rs or more, sometimes even a side income or full-time salary for some.

But let’s be honest, there’s no magic formula. Stock market rewards discipline, knowledge, and patience. Making consistent profits is possible, but it requires a strategy and understanding of market trends.

This blog will explore practical and proven ways to make 1000 Rs a day from trading or investing with a focus on sustainable growth and smart decision-making.

Learn Stock Marketing with Share Trading Expert! Explore Here!

Intraday Trading: The Key to Daily Earnings

When it comes to 1000 Rs daily, intraday trading is a common and popular way. Intraday trading means buying and selling stocks within the same day to cash in on price movements. The idea is to make money from small price movements in the stock market. Unlike long term investments, intraday trading has higher potential for daily earnings but also has higher risk.

Why Choose Intraday Trading?

- Quick Turnover: You don’t hold the stock overnight so there’s no risk from after-hours or next day market fluctuations.

- Leverage: Many brokers offer margin trading so you can trade bigger positions with less capital.

- Liquidity: Highly liquid stocks so you can buy and sell quickly without much price slippage.

If you want to make daily profits, you should seriously consider taking a intraday trading course. Entri has courses designed for such requirements, where you will learn technical analysis, stock selection and risk management strategies.

Developing a Trading Plan

1: What is a stock?

A trading plan is essential for consistent profits in the stock market. Without a plan trading is gambling. Your plan should cover:

- Entry and Exit Rules: Knowing when to enter and exit a trade is key. Set clear rules for this whether based on technical indicators or price levels.

- Capital Allocation: Decide how much of your capital to risk per trade. A good rule of thumb is never to risk more than 1-2% of your trading capital on a single trade.

- Risk-Reward Ratio: Always aim for a favorable risk-reward ratio like 1:2 where you are risking 1 Rs to gain 2 Rs.

A well-defined trading plan removes emotions from your decisions and helps in achieving consistent profitability. By following the trading strategies and insights from the Entri Stock Market Course, you can develop a robust trading plan.

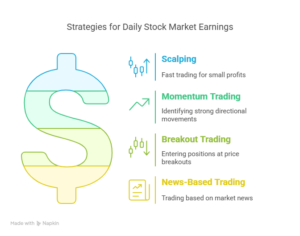

Effective Strategies for Earning Rs. 1000 Daily

To make 1000 Rs daily in the stock market, you need to use proven strategies. Here are some of them:

1. Scalping

Scalping is a fast trading strategy where traders make small profits from small price movements. It involves buying and selling stocks multiple times a day. Although the profit from each trade is small, the total profit can be big.

2. Momentum Trading

In this strategy traders focus on stocks that are moving strongly in one direction, either up or down. By identifying stocks with momentum you can make big moves in short time.

3. Breakout Trading

Breakout trading is when you enter a position when the price breaks above a resistance or below a support. Breakouts often lead to big price movements which is good for intraday traders.

4. News-Based Trading

Stocks move on news events like earnings, economic data or major announcements. By being informed you can trade these price movements.

A thorough understanding of these strategies is must for success. Entri’s Stock Market Course has extensive modules on various intraday trading strategies that can help you to achieve your daily profit target.

Managing Risk and Emotions

Risk management is very important in stock trading. Even the best of strategies can lead to losses if risk management is not done. Here are some ways to manage risk:

1. Use Stop-Loss Orders

A stop-loss order limits your loss on a trade. It will sell your position if the stock hits a certain price and prevent big losses.

2. Diversify Your Trades

Don’t put all your money in one stock or one sector. Diversify your trades to spread the risk across different assets.

3. Position Sizing

Proper position sizing ensures you are not risking too much on any one trade. Adjust your position size based on your risk tolerance and the stock volatility.

Also controlling your emotions – especially fear and greed is must for consistent trading. Emotional decision making leads to bad trades. Through Entri’s courses, you will learn the importance of psychological discipline in trading.

Learn Stock Marketing with Share Trading Expert! Explore Here!

Risk Management Techniques

Risk management is the most important part of stock market trading. Without proper risk control even the best of strategies can lead to huge losses. Top Indian traders don’t just focus on making profits but also on protecting their capital, because preserving money is as important as earning it. Here are some essential techniques to manage risk:

Set Daily Loss Limits

One of the simplest yet most powerful way to manage risk is to set a daily loss limit. This means deciding in advance the maximum amount you are willing to lose in a single trading day.

- Don’t chase losses or try to recover money on the same day. It often leads to emotional decisions and bigger losses.

- A practical rule for beginners and intermediate traders is to limit daily losses to 0.5–1% of your total capital. For example if you have a trading capital of 50,000 Rs, your daily loss limit should be between 250 and 500 Rs.

- By setting a loss limit you prevent a bad day from wiping out your progress and maintain the mental discipline to trade consistently over time.

Diversify Trades

Putting all your capital in a single stock is risky because a sudden market move against your position can result in huge losses. Diversification helps spread risk across multiple trades, reducing the impact of any single loss.

- Don’t concentrate all your money in one stock, sector or strategy.

- Spread trades across 2–3 stocks or sectors that are not correlated. For example combining a tech stock with a bank stock or a consumer goods stock can reduce overall portfolio risk.

- Diversification doesn’t guarantee profits but it reduces the severity of losses on any single position.

Position Sizing

Position sizing is about how much money to allocate to each trade based on your risk tolerance. It ensures that even if a trade goes against you the loss is manageable.

- Determine the risk per trade, which is the amount you are willing to lose if the trade hits your stop loss.

- A common practice is to risk 1–2% of your capital per trade.

- This helps in being consistent and prevents emotional decisions due to big losses.

Avoid Emotional Trading

Emotions are the biggest enemy of stock market traders. Fear, greed and impatience can lead to impulsive decisions causing unnecessary losses.* Follow your plan: Stick to your trading strategy, entry and exit rules and risk management limits. Don’t make impulsive trades based on market rumors or sudden news.

- Take a break if tired: Trading requires mental clarity. If you are stressed, tired or anxious, step away from the screen. Fatigue can cloud your judgment and lead to bad decisions.

- Keep a trading journal: Writing down trades, emotions and decisions helps you to identify patterns and avoid repeating mistakes.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

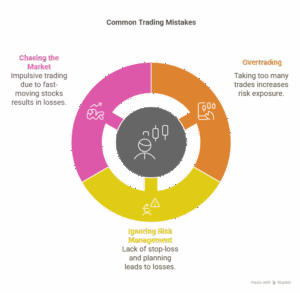

Know moreCommon Mistakes to Avoid

New traders make many mistakes that prevent them from achieving their daily earning goals. Here are a few of them:

1. Overtrading

Taking too many trades in a day can increase your risk exposure. Stick to your plan and don’t trade for the sake of trading.

2. Ignoring Risk Management

Not setting stop-loss or trading without a plan can lead to big losses.

3. Chasing the Market

Impulsive trading because a stock is moving fast can lead to losses. Be patient and wait for a clear entry.

Avoid these and you will make a big difference in achieving your goal of 1000 Rs daily in the stock market.

Learning and Adapting

Stock market is dynamic and successful traders are those who keep learning and adapting to the changing market conditions. Updating your knowledge and refining your strategies is a must.

By joining Entri’s Stock Market Course you get access to expert views, live market analysis and a community of traders. The course provides you the tools and strategies to improve your skills and adapt to the market trends.

Conclusion

Earning 1000 Rs daily in the stock market is completely possible if you trade with the right mindset, strategies, and risk management. Intraday trading, having a solid trading plan and being disciplined is the keys to success. Avoid common mistakes, manage your emotions, and keep learning to improve your trading.

Investing in your education can boost your trading returns. Entri’s Stock Market Course has the resources to help you navigate the stock market. With expert views, risk management techniques, and proven strategies, you will be able to achieve your daily profit targets.

In conclusion, trading is a journey that requires patience, practice, and continuous learning. Follow the strategies mentioned in this post and use educational resources like Entri to become a successful stock trader and earn daily profits.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

How can I make 1000 Rs daily in the stock market?

You can earn 1000 Rs daily through intraday trading, following strategic plans, managing risk, and staying disciplined with proven techniques.

What is intraday trading?

Intraday trading involves buying and selling stocks within the same day to profit from small price movements.

Is there a guaranteed way to make money in the stock market?

No, the stock market carries inherent risks. However, using proven strategies and managing risk effectively can increase your chances of success.

Can beginners earn 1000 Rs daily in the stock market?

With the right knowledge, practice, and education, beginners can achieve consistent profits. Entri’s Stock Market Course offers comprehensive training for beginners.

What are some common mistakes to avoid in stock trading?

Overtrading, ignoring risk management, and emotional trading are common mistakes that traders should avoid.

How important is risk management in stock trading?

Risk management is crucial to avoid significant losses and protect your capital. Techniques like stop-loss orders and position sizing are essential.

What are some effective strategies for intraday trading?

Scalping, momentum trading, and breakout trading are popular strategies for intraday traders.

Is Entri’s Stock Market Course suitable for beginners?

Yes, Entri’s Stock Market Course is designed for beginners as well as advanced traders, offering comprehensive training on stock trading strategies.

How can Entri help me become a successful trader?

Entri offers expert insights, live market analysis, and structured courses to help traders build successful strategies and achieve consistent profits.