Table of Contents

If you’re in your 20s, you’ve probably heard phrases like “Start early” and “Time in the market beats timing the market.” But here’s the truth, most Gen Z in India are caught between dreams of financial independence, skyrocketing living costs, and the endless temptation of instant gratification.

The good news? You have the best advantage any investor can ask for: time. By starting early, your money can work the power of compounding in a way that can’t be replicated later in life. And with India’s growing economy, digital investment platforms and increasing financial literacy, Gen Z has more opportunities to grow wealth than any previous generation.

This guide will break down everything you need to know about investing, step by step, so you don’t feel overwhelmed.

Master stock trading with us. Enroll now for a free demo!

Understanding the Basics of Investing

Before you start throwing your money into stocks or crypto, you need to know the basics.

What is Investing?

Investing is putting your money into assets with the expectation that they will grow in value over time. Unlike saving which is about safety and liquidity, investing is about generating higher returns by taking calculated risks.

Why Gen Z in India Must Invest

-

Inflation is a silent killer – A ₹100,000 savings today may not buy the same goods in 10 years.

-

Job uncertainty – With rapid automation, side hustles and investments offer a safety net.

-

Early financial independence – Many Gen Z want to retire early or achieve “work optional” lifestyles.

Setting Your Financial Foundation First

1: What is a stock?

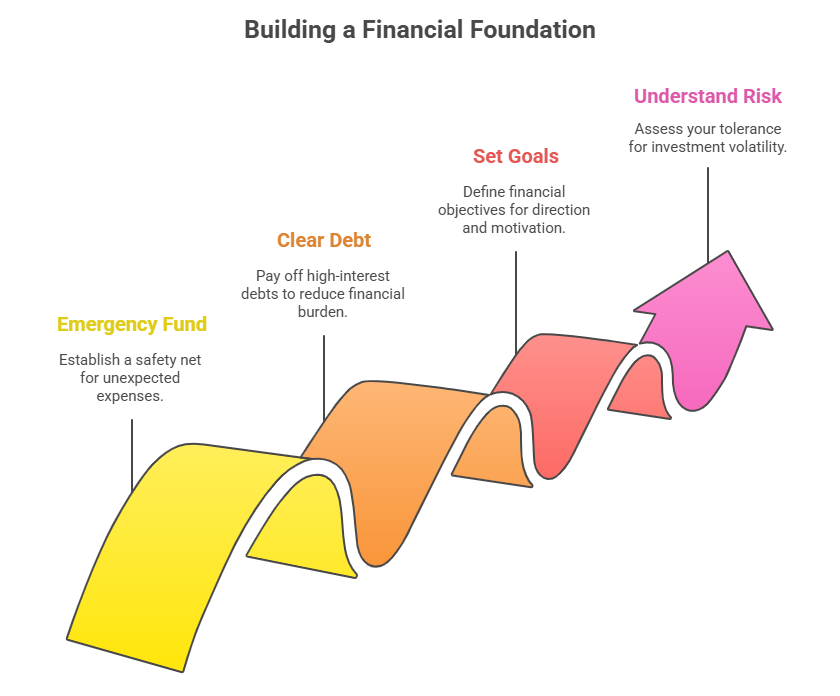

Before you invest, you need a strong foundation.

Steps to Get Started

-

Emergency Fund – Before diving into investments, you need a safety net. An emergency fund covering 6-8 months of expenses should be your first priority. This fund should be easily accessible and shouldn’t be invested in volatile instruments like stocks or equity mutual funds.

-

Clear High-Interest Debt – Pay off credit card and personal loan debt before investing aggressively. Never make debt amount more than 35% of your income.

-

Set Clear Goals – Investing without goals is like driving without a destination. Your 20s are the perfect time to define what financial independence means to you and create a roadmap to achieve it. Short-term (vacations, gadgets), medium-term (house, car), and long-term (retirement, early financial freedom).

-

Understand Your Risk Appetite – Know if you can handle high volatility or prefer safer investments. Risk in investing isn’t just about losing money; it’s also about not growing your wealth fast enough to meet your financial goals.

Popular Investment Options for Gen Z in India

Here’s a breakdown of investment avenues every young Indian should consider:

| Investment Type | Risk Level | Potential Returns (p.a.) | Liquidity | Best For |

|---|---|---|---|---|

| Equity Stocks | High | 10–15%+ | High | Long-term wealth |

| Mutual Funds (Equity) | Moderate-High | 8–12% | Medium | Diversified investing |

| Index Funds & ETFs | Moderate | 8–10% | High | Passive, low-cost investing |

| Fixed Deposits | Low | 5–7% | Medium | Risk-averse savers |

| Public Provident Fund (PPF) | Low | 7–8% (tax-free) | Low | Long-term safe investing |

| Real Estate | Moderate-High | 7–12% + capital appreciation | Low | Wealth diversification |

| Gold & Sovereign Gold Bonds | Low-Moderate | 6–8% + price appreciation | High (digital) | Inflation hedge |

| Crypto | Very High | Highly volatile | High | High-risk, speculative investing |

Use the Entri financial tools to calculate the returns of your investment.

How Gen Z Can Approach Stock Market Investing

Investing in the Indian stock market is easier than ever, thanks to platforms like Zerodha, Groww, and Upstox.

Beginner Tips

-

Start with blue-chip stocks (e.g., Reliance Industries, HDFC Bank).

-

Consider index funds like Nifty 50 or Sensex ETFs for easy diversification.

-

Avoid penny stocks unless you have done thorough research.

-

Use SIP (Systematic Investment Plan) for disciplined investing.

The Power of Mutual Funds

Mutual funds pool money from many investors to buy a diversified set of assets.

Types of Mutual Funds for Gen Z

-

Equity Mutual Funds – For long-term growth.

-

Debt Mutual Funds – For stability and steady returns.

-

Hybrid Funds – Mix of equity and debt for balanced growth.

-

Index Funds – Low-cost, passive option tracking market indices.

Entri Finacademy’s SEBI-compliant Mutual Funds Course helps you invest smartly using local-language learning and expert guidance.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreBuilding a Tax-Smart Portfolio

Tax efficiency is critical for long-term returns. Let’s check how we can save each penny in legal way:

Indian Tax-Saving Instruments

-

ELSS (Equity Linked Savings Scheme) – ₹1.5 lakh deduction under Section 80C.

-

PPF – Long-term safe investment with tax-free returns.

-

NPS (National Pension System) – Extra ₹50,000 deduction under Section 80CCD(1B).

Digital Tools & Apps for Gen Z Investors

Thanks to fintech, investing is just a few taps away.

Popular Apps

-

Zerodha Kite – For stock trading and investing.

-

Groww – For mutual funds, stocks, and bonds.

-

Paytm Money – For direct mutual fund investments.

-

INDmoney – For tracking investments across platforms.

Creating a Long-Term Wealth Plan

Wealth building is a marathon, not a sprint. Now, let’s check practically how you can build wealth in long term:

Steps for a Sustainable Plan

Choose Your Platform

Research and select a platform that offers direct mutual fund plans with low or no transaction fees. Consider factors like user interface, customer support, available investment options and additional features like tax-loss harvesting.

Start with Index Funds or Large-Cap Funds

For beginners, start with Nifty 50 index funds or large-cap funds. These funds invest in established companies and are less volatile than mid-cap or small-cap funds.

Automate SIPs

Automation removes the emotional element from investing. Automate your SIPs for a date shortly after your salary gets credited, and treat investments like any other expense.

Increase SIP amounts with income growth:

As your income grows, you should also step up your investment. If your salary grows 10% annually then you should do a step up of 10% of your investment amount.

Monitor and Adjust

Monitor your portfolio quarterly, not daily. Look at long-term performance, ensure your asset allocation is on track, and increase SIP amounts as your income grows.

Building Wealth Beyond Traditional Investments

Mutual funds and traditional investments are the foundation of wealth creation. But exploring more can speed up your journey to financial freedom.

Skill Development and Career Growth

Your biggest asset is your earning potential. Investing in skills, certifications and career development gives the highest returns. A programming course, digital marketing certification or MBA can increase your earning capacity by 50-100% or more.

Side Hustles and Entrepreneurship

Gig economy offers many additional income streams. Freelancing, consulting, online teaching or starting a small business can give you extra income to invest for wealth creation.

Real Estate Investment Trusts (REITs)

REITs allow you to invest in real estate without the huge capital requirements of buying physical property. Listed on stock exchanges, REITs give regular dividend income and potential capital appreciation with liquidity.

Insurance: Protecting Your Wealth-Building Journey

Insurance is not an investment, but it is essential to protect your financial goals. A medical emergency or unexpected event should not derail your investment journey.

Health Insurance: At least ₹5-10 lakhs health insurance is a must. Medical inflation in India is 10-15% annually, so adequate health cover is a must.

Term Life Insurance: If you have dependents or plan to have, term life insurance gives high coverage at low premiums. The coverage should be 10-15 times your annual income.

Do not mix insurance with investments through products like ULIPs or endowment plans. These products give lower returns than pure investment options and inadequate insurance cover.

Common Mistakes Gen Z Investors Make

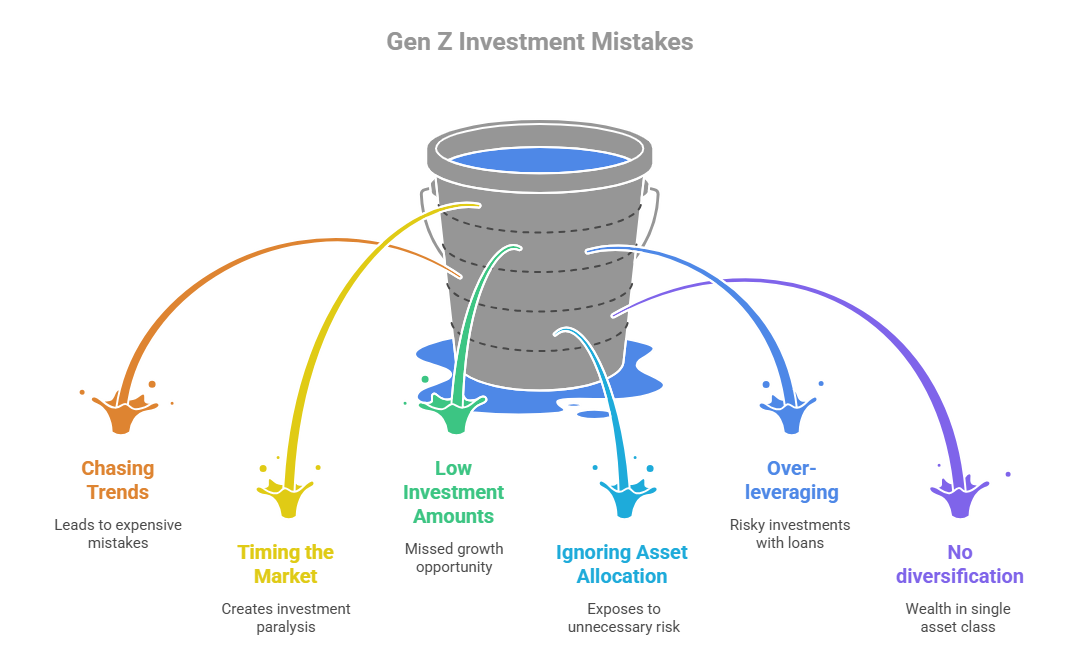

Chasing Hot Tips and Trends

Social media has made everyone an investment expert. Your college friend posting about his crypto gains or that uncle sharing “guaranteed” stock tips can lead you down expensive paths. Successful investing is boring – it involves consistent, disciplined investing in diversified instruments over long periods.

Trying to Time the Market

Waiting for the “right time” to start investing is one of the biggest mistakes. Markets will always have uncertainty – elections, global events, economic concerns. The best time to start investing was yesterday; the second-best time is today.

Not Increasing Investment Amounts

Starting with a ₹1,000 SIP is great, but not increasing it as your salary grows is a missed opportunity. Ideally, you should increase your investment amount by 10% annually or whenever you get a salary hike.

Ignoring Asset Allocation

Putting all money in one type of investment – whether it’s just equity funds or just fixed deposits – exposes you to unnecessary risk. Diversification across asset classes helps balance risk and returns.

Over-leveraging

Avoid taking loans for risky investments. Always do risky investments with the money that you can lose. Never use margin or leverages to make investment.

No diversification

Spread across asset classes. There is a saying that never put all your eggs in one bucket, which means you should diversify your wealth in stocks, mutual funds, gold, real estate etc.

Ignoring research

Always know what you’re investing in. Be prepared to face all the consequences of the investment. You should be aware of the financials of the company you invest. Never buy or sell stocks on others’ recommendations. Check out Entri’s course to help you research and find the best investment for you.

-

Mutual Funds Course – Learn fund types, tax benefits, and portfolio techniques.

-

Stock Market Course – Designed for beginners to understand trading strategies, indexes, and risk.

-

Online Forex Trading – Entri Skilling also includes courses in Forex trading and personal finance essentials.

These courses include recorded and live classes, quizzes, notes, and mentor support—all designed to help you invest confidently.

Final Words: Gen Z’s Golden Opportunity

Gen Z in India is entering an era of digital finance, global investment access, and rapid economic growth. Start now with small amounts and build wealth that gives you freedom, security, and the ability to live life on your own terms.

Building wealth is a marathon, not a sprint. The choices you make in your 20s about money will impact your life in your 40s, 50s, and beyond. Start early, stay consistent, avoid major financial mistakes, and you will create wealth over time.

Investing is not about getting rich quickly – it’s about getting rich surely. Time, compound interest, and disciplined investing have created more millionaires than any other strategy.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

Why is it important for Gen Z in India to start investing early?

Starting early allows Gen Z to benefit from the power of compounding, build wealth over time, and achieve financial independence sooner.

What is the best first investment for Gen Z beginners in India?

A Systematic Investment Plan (SIP) in a diversified mutual fund is a safe and simple starting point for beginners.

How much should Gen Z save before starting to invest?

Experts recommend saving at least 3–6 months of living expenses in an emergency fund before starting investments.

Can Gen Z invest with small amounts in India?

Yes. With options like SIPs, digital gold, and fractional shares, Gen Z can start investing with as little as ₹100–₹500.

What investment options are risk-free for Gen Z in India?

Public Provident Fund (PPF), National Savings Certificate (NSC), and bank fixed deposits are low-risk investments.

Should Gen Z focus on short-term or long-term investments?

Gen Z should primarily focus on long-term investments for wealth creation but keep a small portion for short-term goals.

How can Gen Z reduce risk in investments?

By diversifying across asset classes like equity, debt, gold, and real estate, and avoiding over-concentration in one type of investment.

Is stock market investment safe for Gen Z?

The stock market carries risks, but with proper research, a long-term approach, and small starting amounts, it can be rewarding.

How can Gen Z learn about investing in India?

Gen Z can join online courses like the Entri Stock Market Course to gain practical and theoretical investment knowledge.