Table of Contents

You must have seen a lot of no-cost EMI ads in this festive season’s offers. But are they as free as they sound? Or are they hiding some catch in the fine print?. The Indian consumer is choosing to buy now and pay later due to the lure of ‘no interest,’ whether it is expensive gadgets or home appliances. This brings us to the question. Is No Cost EMI Really Cost-Free? In this blog, we will try our best to answer this question. We will discuss what No Cost EMI is, how they work, whether there are any hidden catches, and some actionable tips that you can use to get the best deals. Let’s go!

Learn stock marketing from experts in the field! Join the Entri online course now!

Is No Cost EMI Really Cost Free: Introduction

Many internet sources suggest that a good portion (as big as 30 percent) of salaries in India are spent on repaying EMIs. This is already a huge mark, but it will seem even bigger when we realize that EMIs are often used by people in middle- and lower-income classes. But the question is, is this benefiting them? Is No Cost EMI Really Cost-Free? If we think logically, they seem too good to be true. The promise of paying ‘nothing extra’ or ‘zero interest’ seems amazing, right? Let us dig a bit deeper and look at the fine print to understand the true face of this financial offer.

What is No Cost EMI?

1: What is a stock?

At a glance, the No Cost EMI (Equated Monthly Installment) looks like a lifesaver to people who could otherwise never afford many expensive products. What they offer is the opportunity to buy a product by splitting the price of the said product into monthly payments without making you pay any other amount additional to the cost listed in the price tag, such as a down payment, additional interest, or processing fees. This is how they are advertised, and hence people think that this is a good way to buy expensive things without straining their monthly budget.

How Do EMIs Work?

The EMI work in the following steps.

- The price of the product you brought is broken down into smaller equal monthly installments that need to be paid over a range of 3 to 24 months.

- They advertise that you will have to pay only the original product cost over the period. So there are no visible interests or additional charges.

- You can choose the size of your monthly payment by choosing from the various tenures available.

- Top ecommerce sites and retailers offer them at checkout. They offer it for debit card, credit card, and even cardless options.

The Truth Behind No Cost EMI

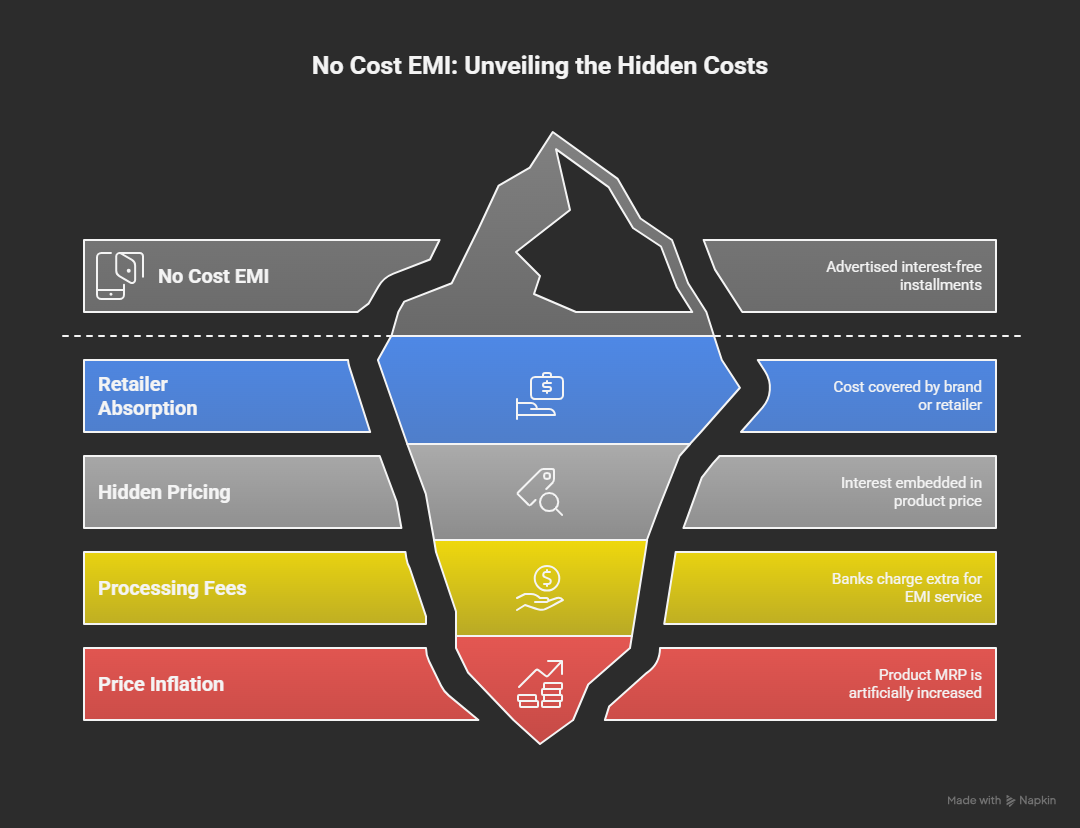

The advertised ‘no cost’ part always sounds enticing. But the truth is that for everything, there is a cost. If it’s not paid by you, then it is paid by another party that is involved in the transaction. Even RBI has warned that true zero percent interest is nonexistent in the lender world. It’s either the amount absorbed by the brand or retailer. Otherwise, it is cleverly hidden in the pricing strategy or fees or will appear as a loss of upfront discounts.

Some banks and lenders also charge a processing fee of 2-3% of the product value as well as GST (which is around 18% now). All these additional charges increase the overall cost even when the EMI amount appears “interest-free.” Another thing that we need to consider is the price inflation. Sometimes the product’s MRP is slightly inflated. In some other cases the “No Cost EMI” version is billed higher.

The seller will find a way to add a hidden interest portion to the sale price. We will provide an imagined real-life scenario below so that you will understand the things discussed here better.

| Details | Lump Sum Payment | No Cost EMI Payment |

| Smartphone MRP | ₹50,000 | ₹50,000 |

| Festive Discount | –₹10,000 | — |

| Processing Fee (2%) | ₹0 | ₹1,000 |

| GST on Fee (18%) | ₹0 | ₹180 |

| Final Outflow | ₹40,000 | ₹51,180 |

What we can understand from this table is that you could have saved ₹11,180 by paying the lump sum with a discount rather than going with the “No Cost” EMI option. RBI has issued several warnings against branding typical EMI conversion schemes as “no cost” if they are camouflaging the costs and not offering true service. The guidelines enforce that the seller should provide full disclosure of the interest rate, processing fees, and any “lost” discounts. There should be full transparency about all the extra charges, in line with its latest digital lending and personal loan regulations. It’s best if you watch out for hidden costs such as

- Loss of cashback or reward points when using credit cards for making EMI payments.

- Early Foreclosure Penalties, which are additional charges a consumer must pay if they want to close their EMI before the term. This charge effectively renders the whole scheme ‘not free.’

- GST enforced on processing fees. Even when the processing fee is a small amount, a massive 18% GST can increase the effective outflow.

| Gain Financial Literacy in your Mother Tongue | |

| Stock Market Course in Malayalam | Mutual Funds Course in Malayalam |

| Stock Market Course in Tamil | Mutual Funds Course in Tamil |

| Stock Market Course | Mutual Funds Course |

The Role of Credit Cards in No-Cost EMI

The most popular channel for EMIs, at least in India, is credit cards. There is a surge in credit card transactions via credit card, and lenders and banks are trying to take advantage of this by offering zero-interest EMI to lure credit-savvy shoppers. But how does this work? Let us see.

| Aspect | How Credit Cards Enable No Cost EMI | Why It Matters for Consumers |

| Purchase Conversion | Credit cards allow big-ticket purchases (phones, appliances, laptops) to be split into EMIs instantly at checkout. | Makes expensive items affordable without upfront payment. |

| Interest Waiver | Banks and merchants absorb the interest cost, so the customer pays only the product price. | Ensures buyers don’t pay extra beyond the listed price. |

| Partnerships with Retailers | Leading e-commerce platforms (Amazon, Flipkart, Tata CLiQ, Ajio) tie up with banks to offer No Cost EMI. | Expands access to EMI options across popular shopping sites. |

| Hidden Charges | While marketed as “no cost,” there may be processing fees, GST, or penalties if payments are delayed. | Consumers must read terms carefully to avoid unexpected costs. |

| Flexibility in Tenure | Credit cards provide multiple tenure options (3, 6, 9, 12 months). | Buyers can choose repayment duration that fits their budget. |

| Exclusive Offers | Banks often provide special discounts or cashback when using No Cost EMI. | Adds extra value beyond just installment convenience. |

| Credit Utilization | The EMI amount blocks part of the credit limit until repayment. | Important for managing available credit and avoiding overuse. |

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know morePros and Cons of No Cost EMI

Like any other credit method, no cost EMIs also has pros and cons. Look at the table below.

| Pros | Cons |

| Makes big purchases affordable | Hidden charges (processing fees, GST) |

| No extra interest cost | Reduced discounts or inflated product price |

| Easy on monthly budget | Credit limit gets blocked until repayment |

| Flexible tenure (3–12 months) | Limited tenure options compared to loans |

| Widely available on e-commerce & retail | Risk of overspending due to easy access |

| Quick approval & checkout | Penalties for late payments |

When Should You Opt for No Cost EMI?

There are instances in which you should opt for no cost EMI and ones in which you should avoid it. Look at the table below to understand more.

| Opt For No Cost EMI | Avoid No Cost EMI |

| Buying big‑ticket items (phones, laptops, appliances) | If hidden charges like GST or processing fees apply |

| Managing monthly cash flow without upfront burden | When product price is inflated or discounts are removed |

| Short repayment tenure (3–12 months) suits your budget | If EMI blocks too much of your credit card limit |

| Confident about timely repayments (no late fees risk) | When tempted into impulse or unnecessary purchases |

| Extra perks like cashback or bank offers are included | If repayment discipline is uncertain |

Alternatives to No Cost EMI

Some alternatives you can opt for instead of no cost EMIs are discussed below.

| Option | How It Works | Best For |

| Standard EMI on Credit Card | Interest is charged on monthly installments | Buyers okay with paying interest for longer tenure |

| Debit Card EMI | EMI linked directly to your savings account | Those without credit cards but with steady bank balance |

| Consumer Durable Loans | Offered by NBFCs or banks for appliances/electronics | Shoppers wanting flexible repayment outside credit cards |

| Buy Now, Pay Later (BNPL) | Short‑term credit, repay in weeks/months | Small purchases or quick cash flow needs |

| Personal Loan | Lump sum loan repaid in EMIs with interest | Larger expenses beyond retail shopping |

| Zero‑Interest Financing Offers | Retailer/bank absorbs interest for promotional period | Seasonal deals or festival shopping |

| Saving & Paying Upfront | Delay purchase until savings are sufficient | Avoiding debt and interest completely |

Join Entri online course to learn stock marketing fundamentals from experts in the field!

Is No Cost EMI Really Cost Free: Conclusion

In this blog we have clearly answered the question “Is No Cost EMI Really Cost Free?”. It is not. So go for no cost EMI only in the following cases

- Product price is genuine

- Repayment tenure suits your budget

- You are confident about timely payments.

No cost EMIs are a smart tool for planned purchases. But never ever use them for your impulsive purchases. It will become a huge hit on your credit score and cashflow in long-term. Alternatives like BNPL and Debit cards are useful for short term needs. But you will need personal loans to meet bigger expenses. Saving up for sometimes and paying upfront is always the safest choice if you want to stay debt free.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

When should I choose No Cost EMI?

For planned, high‑value purchases where upfront payment is difficult, and you’re confident about timely repayments.

Is No Cost EMI really “no cost”?

It’s interest‑free, but the “cost” may appear as reduced discounts or inflated product prices.

Can I foreclose or pay off my No Cost EMI early?

Many banks allow foreclosure, but terms vary. Some may charge a small fee.

Does No Cost EMI affect my credit card limit?

Yes. The total EMI amount blocks part of your credit limit until repayment is complete.

Are there hidden charges in No Cost EMI?

Sometimes yes — processing fees, GST on interest, or late payment penalties may apply. Always check the fine print.

How does No Cost EMI work on credit cards?

Banks and retailers absorb the interest cost, so you pay only the product’s listed price in EMIs.