Table of Contents

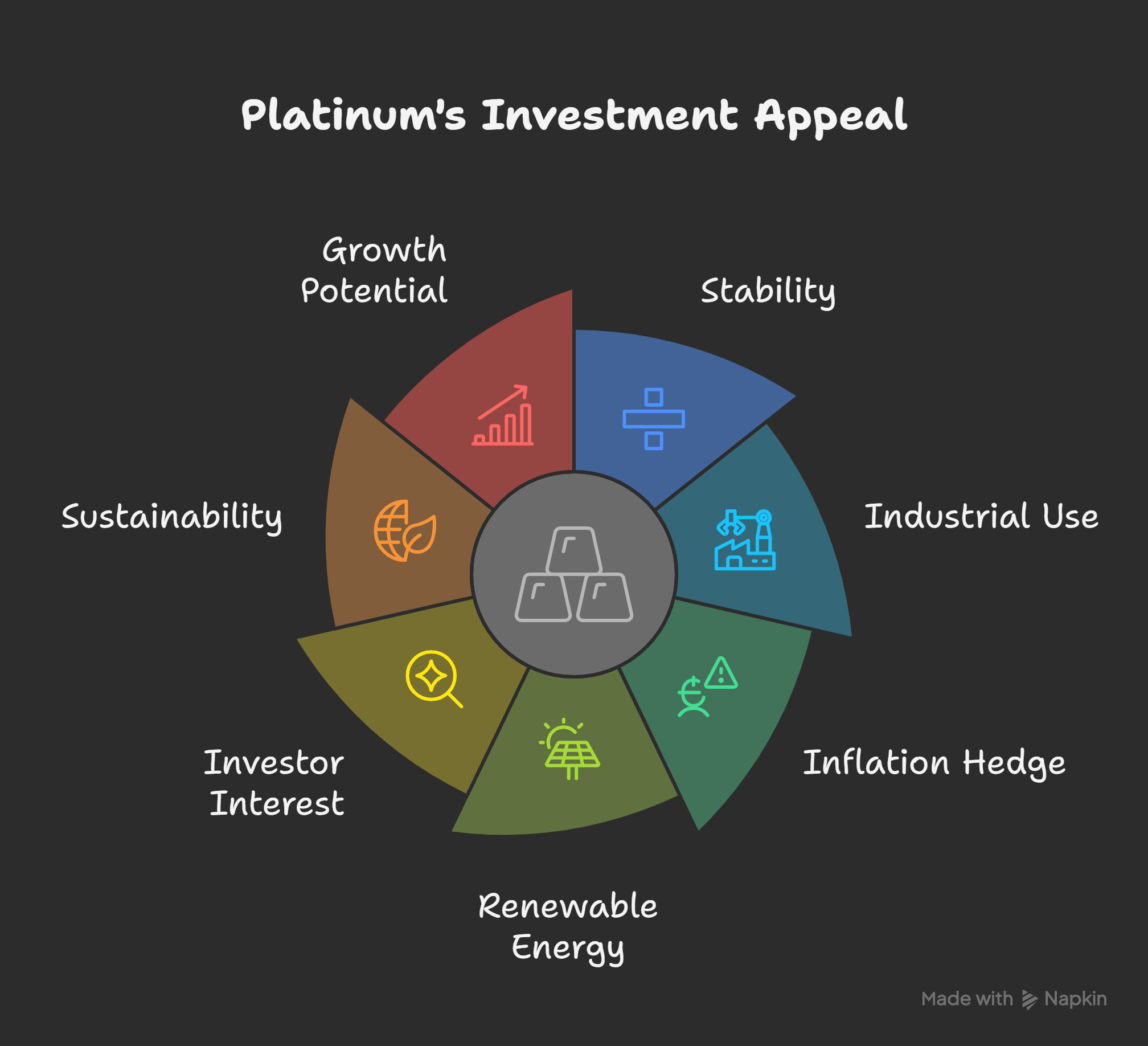

Platinum stands out for its strength. Recently, many investors are asking, is platinum a good investment? The metal’s mix of rarity and real-world use makes it special. It’s found in jewelry, cars, and green technologies alike. In uncertain times, investors look for assets with lasting value. Platinum’s steady industrial demand gives it that edge. Its price story may not shine like gold’s, but its potential runs deep. Understanding why it matters now can guide smarter investment moves.

Today, platinum feels like a metal rediscovered. Once valued above gold, it’s now surprisingly affordable. Yet, its importance in clean energy keeps growing fast. Industries rely on it for hydrogen fuel cells and converters. This dual role makes it both practical and promising. Investors use it to balance portfolios. Platinum’s mix of rarity and purpose could make it shine again.

Why Platinum Is Gaining Attention:

-

Combines beauty, rarity, and real utility.

-

Supports the global shift toward clean energy.

-

Prices remain lower than historic averages.

-

Adds diversity to precious metal portfolios.

-

Demand rises with new technology growth.

-

Supply is limited, increasing long-term value.

-

Blends luxury appeal with industrial strength.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

Introduction

Platinum has always held a unique place in the metals market. It’s not just rare but also deeply tied to global industries. Many investors miss it while chasing gold or silver. Yet, platinum has shown quiet resilience through market ups and downs. It reflects both industrial progress and financial opportunity. With more focus on sustainable technologies, its value could rise further. Platinum might just be the next smart addition to modern portfolios.

Investing in platinum is not only about owning metal. It’s about understanding global trends that drive its worth. The demand for clean energy and advanced materials supports its rise. Economic recovery also increases the need for industrial metals like platinum. As nations rebuild, industries require materials that balance strength and efficiency. These shifts are making investors rethink where real value lies. Platinum, in that sense, fits today’s changing market perfectly.

Why Platinum Deserves a Fresh Look:

-

Offers stability beyond traditional precious metals.

-

Has growing use in modern manufacturing industries.

-

Serves as a hedge in inflationary markets.

-

Benefits from innovation in renewable energy.

-

Gains attention from investors seeking rare assets.

-

Aligns with the global move toward sustainability.

-

Holds potential for strong medium-term growth.

Understanding Platinum

1: What is a stock?

Platinum is the world’s rarest metals. It has a silvery-white shine and is resistant to corrosion. Its strength and durability makes it perfect for industries. It also has excellent conductivity and heat resistance. Because of these qualities, it is used in several key sectors. From jewelry to technology, it plays an important role. Let’s explore what truly makes platinum so unique.

1. Composition and Characteristics

Platinum belongs to the platinum-group metals (PGMs). It includes palladium, rhodium, and iridium. It is heavier and denser than gold/silver. Platinum does not stain easily, even under extreme conditions. It is non-reactive, making it suitable for chemical industries. These natural properties give it both beauty and resilience.

Key Physical Traits:

| Property | Platinum | Gold | Silver |

|---|---|---|---|

| Density | Very High | Medium | Low |

| Melting Point | 1768°C | 1064°C | 962°C |

| Corrosion Resistance | Excellent | Good | Fair |

| Conductivity | Strong | Medium | High |

| Industrial Use | Extensive | Moderate | Limited |

2. Global Sources of Platinum

Platinum is mainly mined in specific regions worldwide. About 70% of global production comes from South Africa. Russia and Zimbabwe also contribute a significant portion. Smaller amounts are found in Canada and the United States. Because supply depends on few countries, production is easily disrupted. Political or labor issues in these areas can affect prices globally.

Top Platinum-Producing Countries:

| Country | Global Share | Key Mining Areas |

|---|---|---|

| South Africa | 70% | Bushveld Complex |

| Russia | 10% | Norilsk Region |

| Zimbabwe | 8% | Great Dyke |

| Canada | 5% | Sudbury Basin |

| USA | 2% | Montana Mines |

3. Industrial and Technological Uses

Platinum is valued for both beauty and practicality. Over 40% of platinum demand comes from industrial uses. It is essential in catalytic converters for reducing emissions. The electronics sector uses it for precision components. It is also applied in medical tools and dental equipment. Platinum’s durability makes it ideal for high-temperature operations.

Main Industrial Uses:

-

Automotive: Catalytic converters and sensors.

-

Electronics: Hard disks, wires, and circuits.

-

Healthcare: Pacemakers and surgical tools.

-

Energy: Hydrogen fuel cells and electrolyzers.

4. Role in Jewelry and Luxury Goods

Platinum jewelry has timeless appeal and high prestige. It is stronger and more durable than gold. Its white luster increases the beauty of gemstones. They are used in engagement rings/watches. In Japan & China, platinum jewelry is a strong cultural symbol. Its demand grows with rising middle-class incomes globally.

Popular Uses in Jewelry:

-

Rings, bracelets, and wedding bands.

-

Luxury watches and ornaments.

-

Designer pieces for elite fashion markets.

5. Recycling and Sustainability

Recycling plays a big role in platinum supply today. Used car converters and electronics are major recycling sources. Over 25% of annual platinum demand comes from recycling. This process helps reduce environmental pressure from mining. It also supports cleaner, sustainable metal sourcing for industries. The circular economy increases platinum’s long-term value and reliability.

Sustainability Highlights:

-

Reduces need for new mining operations.

-

Supports green technology manufacturing.

-

Lowers carbon emissions from metal production.

6. Economic and Strategic Importance

Platinum is more than a metal—it’s a strategic asset. Governments track it closely due to its industrial importance. Many industries rely on steady platinum supply for production. Price movements often reflect broader economic and energy trends. This makes platinum both an economic and geopolitical indicator. Its importance will only grow with energy transition goals.

Strategic Advantages:

-

Supports clean energy and emission control.

-

Creates industrial resilience in key sectors.

-

Reflects global demand for advanced materials.

Platinum’s rarity, strength, and versatility sets it apart. It is both a luxury metal and an industrial necessity. Understanding its structure, uses, and importance helps one see its actual potential. With technology its role in the future will continue to grow.

Historical Performance

Platinum’s journey in global markets has been full of shifts. Its price history shows cycles of strength, decline, and recovery. Unlike gold, its value depends on both industry and investment. The balance between these factors changes over time. Economic trends, supply issues, and technology all shape its price. Looking back helps investors understand platinum’s true behavior. Its past gives clues about where it may head next.

1. Early Market History

Platinum was first used in jewelry centuries ago. It gained attention in Europe during the 18th century. For years, it was seen as a symbol of luxury and status. Industrial use began in the early 20th century with new technologies. As demand grew, its price started to rise. By the mid-1900s, it became an important global commodity. This early growth built its reputation as a premium metal.

Key Historical Milestones:

| Period | Event | Market Impact |

|---|---|---|

| 1700s | Introduction to Europe | Luxury symbol |

| 1900s | Industrial applications emerge | Demand increase |

| 1970s | Auto catalytic use begins | Sharp price rise |

| 1980s | Supply disruptions in South Africa | Volatile prices |

| 2000s | Record high prices | Investment boom |

2. Platinum vs. Gold Over Time

For decades, platinum traded higher than gold. It was considered rarer and more valuable. However, after 2015, gold prices began to overtake platinum. This shift reflected changing demand and market sentiment. Investors preferred gold during economic uncertainty. Meanwhile, platinum’s dependence on industries made it more cyclical. The price gap widened but now shows signs of narrowing again.

Comparison Table:

| Year | Average Gold Price (USD/Oz) | Average Platinum Price (USD/Oz) |

|---|---|---|

| 2008 | 872 | 1576 |

| 2012 | 1669 | 1552 |

| 2015 | 1160 | 1053 |

| 2020 | 1769 | 883 |

| 2024 | 1920 | 940 |

Insights:

-

Gold remained a safe haven in crises.

-

Platinum’s prices dropped during weak industrial demand.

-

Recovery follows when auto and tech sectors rebound.

3. Major Price Fluctuations

Platinum prices have seen strong ups and downs. The 2008 financial crisis caused a steep decline. It dropped from over $2,000 to under $800 per ounce. Recovery came slowly as global industries regained strength. In 2020, pandemic shocks again pushed prices downward. Yet, as economies reopened, demand for platinum revived quickly. These shifts reveal its sensitivity to global production cycles.

Key Turning Points:

-

2008 Crash: Demand fall from auto slowdown.

-

2011 Peak: Rising green tech interest.

-

2015 Drop: Weak auto sales and mining recovery.

-

2020 Dip: Pandemic-driven global shutdown.

-

2023-24 Rebound: Renewed hydrogen energy demand.

4. Factors That Drove Past Trends

Several factors shaped platinum’s historical price movements. Economic health strongly influenced industrial demand. Political instability in mining countries also played a key role. Environmental regulations boosted demand for emission-control devices. Currency fluctuations and inflation had additional effects. Together, these forces created a pattern of rise and correction.

Main Influencing Factors:

-

Industrial Demand: Direct link with global manufacturing growth.

-

Mining Disruptions: Strikes and supply limits raise prices.

-

Environmental Policies: Boost catalytic converter demand.

-

Currency Trends: Dollar strength affects global metal pricing.

-

Market Speculation: Influences short-term investment flow.

5. Long-Term Return Analysis

Over long periods, platinum’s performance remains mixed. It has given strong returns during industrial expansions. However, it has underperformed during economic slowdowns. Investors who timed entry during lows saw better gains. Holding platinum over decades offered diversification benefits. Despite fluctuations, its real-world use ensures continued demand.

Average Annual Returns:

| Period | Return (%) | Key Trend |

|---|---|---|

| 1990–2000 | +5.8 | Steady industrial growth |

| 2001–2010 | +12.4 | Demand boom and price surge |

| 2011–2020 | -3.6 | Decline and stabilization |

| 2021–2024 | +6.2 | Industrial recovery phase |

6. Investor Sentiment Over Time

Investor interest in platinum has shifted with economic moods. During high growth periods, confidence in platinum increases. In recessions, investors shift toward gold for safety. Still, institutions keep platinum as a diversification tool. Its correlation with global industry makes it a balanced choice. The long-term outlook depends on innovation and sustainability efforts.

Historical Investor Trends:

-

1980s: High investment during supply shocks.

-

2000s: Surge in institutional platinum holdings.

-

2010s: Drop due to weak demand outlook.

-

2020s: Renewed optimism from green energy focus.

7. Lessons from Platinum’s Past

History shows platinum reacts quickly to industrial changes. It performs best when manufacturing and energy sectors expand. Long-term investors benefit from patience during slow cycles. Price dips often create future entry opportunities. Understanding these cycles helps in timing investments better.

What History Teaches Investors:

-

Watch industrial growth indicators closely.

-

Track energy and automotive innovation trends.

-

Buy during dips for stronger future returns.

-

Balance with gold for portfolio stability.

Platinum’s history shows both volatility and value. It mirrors global shifts in industry and technology. While its past has seen ups and downs, its resilience remains. Investors who understand these patterns can make informed decisions. Platinum’s journey continues to evolve with each economic cycle.

Invest Smart, Learn Faster – Mutual Fund Course for Kerala

Why Investors Are Considering Platinum Now

Platinum is once again capturing investor attention worldwide. The metal’s unique mix of rarity and industrial strength stands out today. Its connection to green energy makes it more relevant than ever. Prices remain lower than gold, yet its utility keeps rising. Economic recovery and sustainability trends are both supporting demand growth. Investors now see platinum as a metal with renewed purpose. Understanding these drivers helps explain why it’s back in focus.

1. The Green Energy Revolution

Platinum is vital in clean and renewable energy systems. It’s a core material in hydrogen fuel cells and electrolyzers. These technologies power electric vehicles and support carbon-free transport. As countries aim for net-zero targets, platinum use is expanding fast. Energy companies and automakers now view it as an essential resource. This long-term trend could transform platinum’s demand outlook entirely.

Key Roles in Green Energy:

| Sector | Platinum Application | Impact |

|---|---|---|

| Hydrogen Energy | Fuel cells and electrolyzers | Enables zero-emission power |

| Electric Mobility | Catalysts and sensors | Supports clean fuel systems |

| Renewable Energy | Industrial catalysts | Reduces pollution and waste |

| Carbon Capture | Reaction catalysts | Aids emission reduction projects |

2. Rising Industrial Demand

Industries are returning to full capacity after global slowdowns. Its strength and heat resistance make it important in factories. It’s used in chemical, electrical, and automotive industries. With technology new industrial applications continue to emerge. This steady expansion of use cases keeps boosting its importance. Platinum’s demand, therefore, links directly to global manufacturing health.

Main Demand Drivers:

-

Automotive: Emission control systems for hybrid vehicles.

-

Chemical Plants: Catalysts for refining and synthesis.

-

Glass Industry: High-temperature melting processes.

-

Electronics: Precision components and wiring systems.

3. Supply Tightness and Mining Challenges

Global platinum supply remains limited and uneven. Over 70% still comes from South African mines. Frequent strikes, power shortages, and logistic issues affect production. Political instability in key regions further tightens global availability. Recycling covers part of the gap but cannot meet total demand. These constraints support stronger price fundamentals in coming years.

Current Supply Overview:

| Source | Global Share | Supply Challenges |

|---|---|---|

| South Africa | 70% | Labor unrest, power issues |

| Russia | 10% | Export and sanction risks |

| Zimbabwe | 8% | Political instability |

| Recycling | 12% | Limited collection systems |

Impact:

-

Supply remains concentrated in few countries.

-

Any disruption raises global price volatility.

-

Long-term scarcity increases asset appeal.

4. Attractive Price Gap with Gold

Platinum is trading well below its historical gold ratio. This makes it an appealing option for value-focused investors. Historically, platinum often commanded higher prices than gold. Its current undervaluation signals potential for strong upward correction. For investors seeking entry at lower cost, timing now seems favorable. The growing industrial demand strengthens its recovery prospects further.

Gold-Platinum Price Comparison (USD/Oz):

| Year | Gold | Platinum | Gap |

|---|---|---|---|

| 2008 | 872 | 1576 | +704 |

| 2015 | 1160 | 1053 | -107 |

| 2024 | 1920 | 940 | -980 |

Why It Matters:

-

Platinum trades far below fair historical range.

-

Reversal potential offers capital appreciation.

-

Lower cost improves accessibility for small investors.

5. Portfolio Diversification Advantage

Investors are turning to platinum for balance and variety. It behaves differently from gold, stocks, and bonds. Platinum’s correlation with industry makes it a growth-linked metal. This helps reduce portfolio risks tied to financial markets. Adding platinum creates exposure to both technology and commodities. It’s a practical hedge during inflation or currency drops.

Portfolio Benefits:

-

Diversifies metal-based investment strategies.

-

Offers industrial and financial exposure together.

-

Acts as inflation and currency hedge.

-

Enhances long-term portfolio resilience.

6. Institutional and Global Interest

Institutional investors are revisiting platinum-backed assets again. ETFs and commodity funds are seeing steady inflows. Major automakers and clean-tech firms are securing platinum reserves. Governments are also promoting hydrogen projects requiring the metal. Global coordination toward sustainable energy keeps the demand outlook bright. These institutional moves indicate growing long-term confidence.

Recent Institutional Developments:

-

Platinum ETFs expanded holdings by major fund houses.

-

Automakers signed long-term supply contracts.

-

Hydrogen projects increased global metal demand.

-

Governments supported platinum-linked innovations.

7. Market Outlook and Investor Confidence

Analysts forecast stronger platinum performance in coming years. Economic recovery and technology shifts drive consistent demand growth. The green energy sector may become its biggest consumer soon. Limited supply will continue supporting higher price levels. Investors confident in sustainability trends favor platinum’s long-term potential. It’s increasingly viewed as both a growth and protection asset.

Positive Market Indicators:

| Factor | Trend | Outlook |

|---|---|---|

| Industrial Demand | Rising | Strong |

| Green Energy Projects | Expanding | Long-term growth |

| Global Supply | Tight | Supportive of prices |

| Investor Interest | Increasing | Stable growth expected |

8. Key Reasons Behind Renewed Interest

Platinum’s comeback rests on clear global shifts. It fits modern investment logic shaped by sustainability and innovation. Investors value assets that link to real-world progress. Platinum delivers that through its industrial and environmental role. With balanced risk and strong future drivers, it stands out again.

Why Platinum Appeals Now:

-

Connects with clean energy transformation.

-

Trades at deep discount to gold.

-

Offers tangible long-term growth potential.

-

Gains support from global policy changes.

-

Blends industrial utility with investment appeal.

Platinum’s renewed popularity comes from its evolving purpose. It is no longer viewed only as a luxury metal. Instead, it represents technology, energy, and economic balance together. As the world transitions to greener systems, its role grows stronger. Investors see platinum as a rare chance to join that change early.

Risks & Challenges

While platinum shows strong potential, it also carries real risks. Its price depends heavily on industrial and geopolitical factors. Investors must understand both sides before making a decision. Market volatility, supply limits, and technological changes affect its value. These risks do not remove platinum’s appeal but demand careful timing. Knowing these challenges helps manage expectations and protect investments. Let’s look at what makes platinum both promising and unpredictable.

1. High Price Volatility

Platinum prices often swing sharply within short periods. The market reacts quickly to global economic shifts. Industrial slowdowns can reduce demand almost overnight. In contrast, sudden growth periods push prices rapidly upward. This volatility creates uncertainty for short-term investors. Even long-term holders must be prepared for wide price ranges.

Key Volatility Causes:

| Factor | Effect on Price | Frequency |

|---|---|---|

| Industrial Demand | Strong swings | High |

| Currency Fluctuations | Moderate impact | Medium |

| Political Events | Short-term surges | Medium |

| Supply Disruptions | Sharp price jumps | Low but severe |

Tip for Investors:

-

Track global production data regularly.

-

Avoid short-term speculation on sudden spikes.

-

Focus on gradual, long-term investment plans.

2. Limited Market Liquidity

Platinum markets are smaller than gold or silver markets. This means fewer buyers and sellers at any given time. During low-demand periods, selling large amounts becomes difficult. Limited liquidity can widen spreads between buying and selling prices. Institutional investors often face this challenge more than retail ones. However, exchange-traded funds (ETFs) offer better liquidity access.

Liquidity Challenges:

-

Slower trade execution for large transactions.

-

Less price transparency during quiet periods.

-

Difficulties in offloading physical holdings quickly.

Possible Solutions:

-

Choose ETFs or mutual funds over direct metal.

-

Invest smaller portions for easier portfolio balance.

3. Supply Dependence on Few Regions

Over 80% of platinum comes from just three countries. South Africa alone controls most of the global supply. Any mining strike or power outage can disrupt production. This concentration risk makes prices vulnerable to local crises. It also limits flexibility when global demand suddenly increases. Investors must watch developments in mining regions closely.

Regional Dependence Table:

| Country | Share (%) | Key Risk |

|---|---|---|

| South Africa | 70 | Labor and power issues |

| Russia | 10 | Export restrictions |

| Zimbabwe | 8 | Political instability |

| Others | 12 | Low production capacity |

Why It Matters:

-

Small disruptions can cause large price spikes.

-

Long-term production forecasts stay uncertain.

4. Changing Industrial Demand

Platinum’s industrial role is shifting with new technologies. Traditional car engines use platinum for catalytic converters. However, the move toward electric vehicles reduces this need. The metal must now rely more on hydrogen fuel technologies. This transition may take years before reaching full impact. Short-term demand could therefore stay uneven across industries.

Industry Trend Comparison:

| Sector | Current Use | Future Outlook |

|---|---|---|

| Auto (Combustion) | High | Declining |

| Hydrogen Energy | Medium | Rapid Growth |

| Electronics | Steady | Expanding Slowly |

| Jewelry | Stable | Moderate Growth |

Investor Insight:

-

Watch hydrogen market developments carefully.

-

Expect mixed demand across traditional industries.

5. Technological Substitution

Platinum competes with other metals like palladium and rhodium. Companies sometimes switch to cheaper or more available materials. In catalytic converters, palladium has replaced platinum in many cases. Substitution affects long-term price stability and market share. Recovery depends on future technology that again favors platinum use.

Competitive Metal Overview:

| Metal | Key Use | Price Trend | Replacement Risk |

|---|---|---|---|

| Palladium | Auto catalysts | High | Strong |

| Rhodium | Emission systems | High | Moderate |

| Platinum | Fuel cells, jewelry | Stable | Medium |

Mitigation Approach:

-

Invest through diversified metal ETFs.

-

Follow trends in green-tech material preferences.

6. Storage and Transaction Costs

Owning physical platinum involves extra expenses. It needs specialized storage to prevent theft or damage. Insurance and vault fees can increase total investment cost. Buying and selling through dealers also involves higher transaction margins. These hidden costs reduce net returns, especially for small investors. Digital or paper-based options offer simpler alternatives.

Cost Considerations:

-

Storage Fees: Charged annually by vault providers.

-

Insurance Costs: Protects against loss or theft.

-

Dealer Premiums: Added to spot market price.

Ways to Reduce Costs:

-

Choose platinum ETFs or digital holdings.

-

Compare dealer rates before any physical purchase.

7. Regulatory and Environmental Uncertainty

Mining regulations and global policies affect platinum production. Governments often change environmental standards or export limits. These laws can increase production costs or delay supply. Stricter emission laws also change demand patterns globally. Such shifts create unpredictability in both price and availability.

Examples of Policy Effects:

-

Stricter mining rules increase supply costs.

-

Carbon policies boost demand for cleaner metals.

-

Export restrictions tighten market availability.

Investor Strategy:

-

Stay updated with global environmental policies.

-

Adjust portfolio positions during regulation changes.

8. Global Economic and Currency Risks

Platinum prices are closely linked to economic growth. A slowdown reduces industrial and jewelry demand quickly. The U.S. dollar also impacts global metal pricing strongly. A stronger dollar often pushes platinum prices downward. Economic instability in large markets creates further uncertainty. These links make platinum sensitive to worldwide economic health.

Economic Influence Table:

| Factor | Impact | Direction |

|---|---|---|

| Global GDP Growth | Demand for platinum | Positive |

| Dollar Strength | Platinum price | Negative |

| Inflation | Metal demand | Positive |

| Recession | Industrial use | Negative |

9. Investor Perception and Awareness

Platinum remains less known than gold or silver. Many small investors lack awareness of its benefits. Limited marketing and fewer investment products restrict visibility. As a result, market participation stays smaller than it could be. However, awareness is slowly improving through new ETFs and reports. Broader recognition may help stabilize prices over time.

Perception Barriers:

-

Lower media coverage than gold.

-

Few mainstream investment campaigns.

-

Limited educational content on platinum assets.

Emerging Improvements:

-

Rising focus on hydrogen energy investments.

-

Growing presence of platinum in ESG portfolios.

Platinum’s future looks bright but not without challenges. Its market structure demands patience and awareness. Investors who understand these risks can plan smarter entry points. Long-term success with platinum lies in careful monitoring and diversification. With balance and timing, its potential can still outweigh its pitfalls.

Invest Smart, Learn Faster – Mutual Fund Course for Kerala

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreInvestment Options

Investing in platinum can be done in several ways. Each option has its own benefits and level of risk. Investors can choose based on their goals, time frame, and comfort level. Some prefer physical ownership, while others opt for digital exposure. Understanding each option helps in building a balanced portfolio. Let’s explore the main ways you can invest in platinum today.

1. Physical Platinum

Owning physical platinum means buying bars, coins, or jewelry. It gives direct ownership and no counterparty risk. However, it needs safe storage and comes with premiums.

Pros:

-

Tangible and easy to verify.

-

No reliance on market intermediaries.

-

Offers long-term value security.

Cons:

-

Storage and insurance costs apply.

-

Liquidity may be lower than gold.

-

Buying premiums can reduce short-term gains.

| Physical Platinum | Pros | Cons |

|---|---|---|

| Bars & Coins | Real ownership | High premiums |

| Jewelry | Easy resale | Lower purity |

| Bullion | Stable value | Needs storage |

2. Platinum ETFs (Exchange-Traded Funds)

ETFs track the price of platinum without owning metal. They are suitable for investors who want quick liquidity. ETFs are traded like stocks on major exchanges.

Pros:

-

Easy to buy and sell.

-

No need for physical storage.

-

Offers transparent pricing.

Cons:

-

Subject to management fees.

-

No physical possession of metal.

-

Dependent on market performance.

3. Platinum Mining Stocks

Investing in mining companies provides indirect platinum exposure. Returns depend on both platinum prices and company performance. Mining stocks often show higher risk but greater potential gains.

Pros:

-

High potential during price rallies.

-

Offers dividend income opportunities.

-

Reflects industry growth trends.

Cons:

-

Affected by operational and geopolitical risks.

-

Volatile due to market speculation.

-

Requires research on company stability.

| Investment Type | Risk Level | Liquidity | Return Potential |

|---|---|---|---|

| Physical Platinum | Low | Moderate | Moderate |

| ETFs | Moderate | High | Moderate |

| Mining Stocks | High | High | High |

4. Platinum Futures and Options

Futures allow investors to trade platinum at set future prices. They are for advanced investors comfortable with higher risk. Leverage can boost profits but also increase losses.

Pros:

-

Enables profit from price movement.

-

Useful for hedging against volatility.

-

Short-term opportunities available.

Cons:

-

Requires market knowledge and experience.

-

Can lead to high losses with leverage.

-

Not ideal for casual investors.

5. Digital and Tokenized Platinum

Digital assets represent ownership of real-world platinum. They are stored securely and traded online with transparency. This new form suits modern investors seeking convenience.

Pros:

-

Easy to trade globally.

-

Backed by physical reserves.

-

No need for physical handling.

Cons:

-

Still an emerging market.

-

Requires trust in the platform.

-

Regulation is still developing.

Summary Table: Platinum Investment Options

| Option | Accessibility | Risk | Physical Ownership | Ideal For |

|---|---|---|---|---|

| Physical Platinum | Moderate | Low | Yes | Long-term investors |

| ETFs | High | Moderate | No | Beginners |

| Mining Stocks | High | High | No | Risk-takers |

| Futures & Options | Low | High | No | Experienced traders |

| Digital Platinum | High | Moderate | Partial | Tech-savvy investors |

In short: Platinum offers diverse ways to invest safely and smartly. Each method suits different investor needs and comfort levels. Choosing the right mix can balance risk and reward.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

Future Outlook

Platinum’s future looks bright yet complex. The metal’s demand is shifting with global technology and energy trends. Its role in hydrogen fuel and clean mobility gives it long-term strength. Investors see platinum as both a traditional and futuristic asset. With new industries emerging, its value could rise steadily. However, growth depends on innovation, policy, and global production balance. Understanding future trends helps investors prepare for changing market patterns.

1. Growth in Green Technologies

Platinum is essential in hydrogen fuel cell systems. These systems power electric vehicles and clean industries. As countries invest in hydrogen energy, platinum use will rise. Demand from green tech could become platinum’s biggest driver soon.

Key Drivers:

-

Global hydrogen projects expanding every year.

-

Automakers using platinum in new electric designs.

-

Nations funding clean energy transitions.

Impact:

-

Steady rise in industrial demand.

-

Stable pricing from long-term contracts.

-

Potential shortage if supply lags behind.

2. Emerging Market Demand

Developing nations are driving fresh industrial needs. Platinum use in refineries and catalysts is increasing fast. More factories and vehicles mean more platinum consumption.

Trends to Watch:

-

Industrial recovery across Asia and Africa.

-

Urbanization increasing use in transportation.

-

Expanding jewelry demand in new economies.

| Region | Main Use | Growth Trend |

|---|---|---|

| Asia | Auto & Industry | High |

| Europe | Hydrogen Energy | Strong |

| North America | Investment & Industry | Moderate |

3. Limited Supply and Mining Challenges

Platinum is rare and mining is resource-intensive. Most production comes from South Africa and Russia. Any disruption there impacts global prices heavily.

Current Challenges:

-

Labor unrest and power shortages in key regions.

-

High extraction costs reducing mining expansion.

-

Environmental concerns slowing new projects.

Possible Outcomes:

-

Supply tightness may support higher prices.

-

Recycling will play a bigger role.

-

New technology might ease mining costs.

4. Role in Global Investment Portfolios

Platinum is finding a stable place in diversified portfolios. It balances risk during inflation and market uncertainty. Investors combine it with gold and silver for stability.

Benefits for Investors:

-

Offers protection in currency volatility.

-

Adds industrial edge to precious metal baskets.

-

Works well in long-term sustainability portfolios.

| Asset | Inflation Hedge | Industrial Demand | Long-Term Stability |

|---|---|---|---|

| Gold | Strong | Low | Very High |

| Silver | Moderate | High | Moderate |

| Platinum | High | Very High | Strong |

5. Future Predictions (2025–2035)

Experts expect gradual recovery and value growth for platinum. Hydrogen demand could redefine its market position globally. Digital trading platforms will attract younger investors. Industrial dependence will secure steady base demand.

Forecast Snapshot:

| Year | Expected Trend | Main Driver |

|---|---|---|

| 2025 | Moderate Rise | Green Tech Growth |

| 2028 | Strong Upswing | Hydrogen Adoption |

| 2030 | Stable Pricing | Wider Industrial Use |

| 2035 | High Valuation | Limited Supply |

In summary: Platinum’s future is tied to innovation and sustainability. With expanding green technology, tighter supply, and growing industrial needs, it could shine brighter than ever.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

Why is platinum considered a good investment today?

Platinum is gaining attention due to its industrial and sustainable uses. It plays a key role in clean energy, especially hydrogen fuel cells. Its limited supply and rising demand make it a strong long-term asset. Investors view it as a balance between precious metal stability and industrial growth.

How is platinum different from gold and silver as an investment?

Platinum is rarer and more industrially used than gold or silver. Its price depends more on manufacturing and technology demand. Gold is a safe-haven asset, while platinum reflects global economic activity. This makes platinum more volatile but potentially more rewarding.

What are the main industries that use platinum?

Platinum is used in automotive, jewelry, and green energy industries. It’s a key component in catalytic converters that reduce emissions. Hydrogen fuel cells also depend on platinum catalysts. These growing applications drive strong industrial demand.

How has platinum’s price performed historically?

Platinum once traded higher than gold but later declined due to weak demand. The price fell after 2014 but started recovering recently. Global clean energy efforts have revived investor interest. Historical trends show potential for future growth when industrial demand rises.

What are the risks involved in investing in platinum?

Platinum prices can fluctuate due to industrial and economic factors. Mining disruptions in major producing countries can affect supply. Limited liquidity compared to gold is another concern. Investors should weigh these risks before committing large funds.

What are the best ways to invest in platinum?

You can invest in physical platinum, ETFs, or mining stocks. Futures contracts and digital platinum options are also available. Each method has different risks and liquidity levels. Choose based on your experience and long-term goals.

Is platinum a good hedge against inflation?

Yes, platinum can act as an inflation hedge. Like gold, it retains value when currency weakens. However, its industrial demand gives it extra growth potential. Diversifying with platinum helps protect purchasing power over time.

What factors affect platinum’s market price?

Platinum’s price is driven by supply, demand, and global production levels. Economic recovery boosts industrial use, raising prices. Power shortages or strikes in mining countries can tighten supply. Technological and policy changes also influence price movements.

How does the hydrogen economy impact platinum’s future?

Hydrogen fuel cell growth strongly supports platinum demand. It’s a key material for clean-energy systems worldwide. As governments promote green mobility, platinum use will rise. This makes it a strategic investment for the future energy transition.