Table of Contents

Walking into the world of Indian stock markets, few names carry the weight of Jio Financial Services Limited (JioFin). As of now, JioFin’s share price is a hot topic for investors, fueled by its bold moves in fintech and wealth management. The recent launch of the Aladdin platform by Jio BlackRock Mutual Fund has sparked excitement, promising to redefine investing in India. With its ties to Reliance Industries and a growing financial empire, JioFin is both a beacon of opportunity and a magnet for scrutiny. In this blog post, we will explore JioFin’s share price trends, dive into the game-changing Aladdin launch, present its financial fundamentals in a clear table, and weigh whether it is a good time to buy or accumulate shares. As someone who tracked India’s financial markets with fascination, I am eager to unpack JioFin’s story for you. Let us dive in.

Jio Financial Services Share Price: Current Trends

JioFin’s share price has been a dynamic ride since its demerger from Reliance Industries in July 2023.

Disclaimer: The stock market data displayed on this widget is delayed and may not reflect real-time prices.

-

Current Price: Closed at ₹288.00 on the BSE, down 0.62% from ₹289.80, marking three consecutive days of declines.

-

Recent Performance: Surged 50% from a March 2025 low of ₹198.65, peaking at ₹304.50 in early June after Jio BlackRock’s leadership news.

-

Volatility: A 4% weekly drop reflects market weakness, with support at ₹240 to ₹260 and resistance at ₹305 to ₹308.

-

Market Sentiment: People shows optimism about JioFin’s fintech growth, But ther are people who warns about a correction after a non stop rally of almost 50% from the 52 week low.

Learn Stock Marketing with Share Trading Expert! Explore Here!

Jio BlackRock’s Aladdin Launch: A New Era for Investing

1: What is a stock?

On June 16, 2025, Jio BlackRock Mutual Fund, a 50:50 joint venture between JioFin and BlackRock, launched Aladdin in India, a move poised to transform investing. Here is what you need to know:

-

What is Aladdin?: BlackRock’s flagship platform, managing $21 trillion in global assets for 200+ institutions, offering portfolio analysis, risk management, trading, compliance, and operations tools.

-

India Launch: Tailored for Indian retail and institutional investors, leveraging Jio’s digital reach and BlackRock’s expertise.

-

Regulatory Approvals:

-

SEBI approved Jio BlackRock as an asset manager on May 26, 2025.

-

Investment advisory services cleared on June 11, 2025.

-

-

Additional Moves: Jio BlackRock filed for three debt funds, expanding its product lineup.

-

Market Impact: Investors call Aladdin a “game-changer” for mutual funds, though some question retail adoption due to its complexity.

Aladdin’s launch positions JioFin as a wealth management leader, blending cutting-edge tech with India’s growing investment appetite.

Jio Financial Services: Financial Fundamentals in Focus

JioFin, a core investment company (CIC) registered with the RBI, operates a full-stack financial services ecosystem through subsidiaries like Jio Finance, Jio Insurance Broking, Jio Payment Solutions, Jio Leasing Services, and Jio Payments Bank, alongside its Jio BlackRock joint venture. Its financial performance reflects a company scaling rapidly but navigating challenges. Below is a table summarizing key financial metrics for FY25, based on the latest consolidated data:

|

Metric |

Value (FY25) |

Notes |

|---|---|---|

|

Revenue |

₹2,042.91 Cr |

Up 10.2% YoY from ₹1,853.88 Cr in FY24, driven by lending and digital services. |

|

Net Profit |

₹1,219.77 Cr |

Down 24% YoY from ₹1,604.55 Cr, impacted by higher provisions and costs. |

|

Earnings Per Share (EPS) |

₹2.54 |

Stable from ₹2.53 in FY24, reflecting modest profit growth. |

|

Book Value Per Share (BVPS) |

₹194.39 |

Down from ₹219.02 in FY24, due to capital adjustments post-demerger. |

|

Return on Equity (ROE) |

1.30% |

Improved from 1.15% in FY24, but low, indicating capital utilization gaps. |

|

Debt to Equity |

0.03 |

Low leverage, reflecting a strong balance sheet with minimal debt. |

|

Assets Under Management (AUM) |

₹10,053 Cr |

Up 58x from ₹173 Cr in FY24, driven by Jio Finance’s expansion to 10 cities. |

|

Market Capitalization |

₹1,86,941.19 Cr |

As of June 20, 2025, reflecting strong investor interest despite volatility. |

|

Price-to-Earnings (P/E) Ratio |

115.79 |

High valuation, compared to industry P/E of 23.6, signaling growth expectations. |

|

Price-to-Book (P/B) Ratio |

1.46 |

Moderate, indicating market confidence in book value. |

Key Highlights:

-

Q4 FY25 Performance: Revenue rose 18% YoY to ₹493.24 Cr, with net profit up 1.8% to ₹316.11 Cr, per Q4 results. AUM surged to ₹10,053 Cr, fueled by Jio Finance’s digital lending and leasing growth.

-

Dividend: JioFin announced its first-ever dividend of ₹0.50 per ₹10 share, yielding 0.18%, signaling shareholder focus.

-

Strategic Moves: Acquiring SBI’s 17.8% stake in Jio Payments Bank for ₹104.54 Cr made it a wholly-owned subsidiary, boosting fintech integration.

-

Mutual Fund Stakes: MF ownership rose from 4.17% (Sep 2024) to 6.58% (Mar 2025), showing institutional confidence.

These metrics highlight JioFin’s growth trajectory but also flag concerns like declining net profit and a high P/E ratio, which we will explore in the verdict.

Strategic Developments and Market Sentiment

JioFin’s strategic moves are reshaping its role in India’s financial sector. The Jio BlackRock joint venture, formalized in July 2023, aims to democratize wealth management with tech-driven, low-cost products. The Aladdin launch, coupled with SEBI’s approvals for mutual fund operations and advisory services, positions JioFin as a formidable player. The Jio Finance app, with over 8 million users, drives digital lending, while the Payments Bank acquisition strengthens its ecosystem. Analysts like Geojit Financial project a ₹350 target, while some experts suggest buying on dips near ₹276. Overbought signals on daily charts and a high P/E of 115.79 (versus industry 23.6) raise caution, but JioFin’s net worth of ~₹25,000 Cr and low debt offer stability.

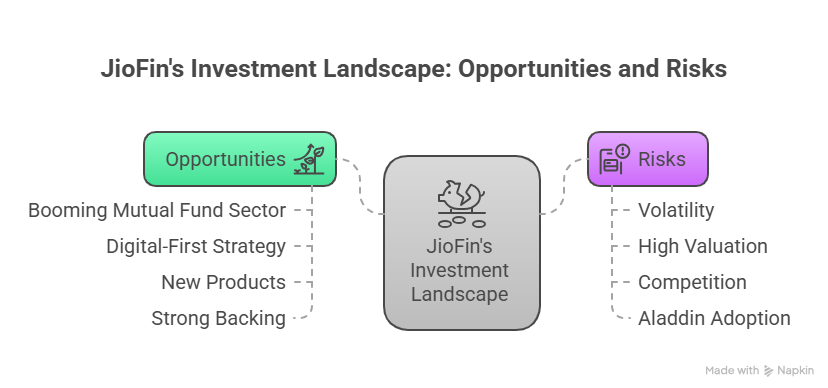

Opportunities & Risks for Investors

JioFin’s growth potential is balanced by challenges. Here is a breakdown:

Opportunities:

-

Booming Mutual Fund Sector: Rising demat accounts and wealth management demand in India favor Aladdin’s rollout.

-

Digital-First Strategy: Jio’s digital infrastructure and BlackRock’s expertise position JioFin for market share gains.

-

New Products: Debt fund filings and city expansion signal revenue diversification.

-

Strong Backing: Reliance’s brand and low debt (0.03) ensure stability.

Risks:

-

Volatility: 4% weekly share price drop and overbought signals suggest a correction to ₹240–₹260.

-

High Valuation: P/E of 115.79 vs. industry 23.6 raises overvaluation concerns.

-

Competition: HDFC AMC, Paytm, and others challenge JioFin’s fintech and mutual fund ambitions.

-

Aladdin Adoption: Retail investors may find the platform complex, delaying impact.

Want to analyse stocks as I do? Join the Entri Stock Market course to identify fundamentally strong companies and invest yourself.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreVerdict: Should You Buy or Accumulate JioFin Shares?

Is JioFin a smart investment in 2025? Here is a balanced perspective:

-

Why Buy?:

-

Growth Metrics: 18% Q4 revenue growth, 58x AUM increase to ₹10,053 Cr, and low debt signal strength.

-

Analyst Outlook: Targets of ₹300 to ₹350 (4–22% upside from ₹288.00), with buy-on-dip calls at ₹276 to ₹274.

-

Institutional Trust: 6.58% MF stake and ₹0.50 dividend reflect confidence.

-

Aladdin Potential: Could disrupt India’s mutual fund space, boosting JioFin’s profile.

-

-

Why Be Cautious?:

-

Volatility Risks: 4% weekly decline and overbought signals hint at a correction.

-

High Valuation: P/E of 115.79 suggests stretched pricing.

-

Profit Dip: 24% YoY net profit drop in FY25 due to provisions and costs.

-

Adoption Hurdles: Aladdin’s retail success is unproven.

-

Verdict: Long-term investors may consider accumulating on dips (₹276 to ₹274) to leverage JioFin’s growth in India’s financial sector, especially with Aladdin’s potential. Short-term traders should monitor support at ₹240–₹260, as volatility persists. Always consult a certified financial advisor, as markets are unpredictable. Jio Finance’s bold moves make it a stock to watch, but timing is critical.

Wrapping Up: JioFin Place in India’s Financial Future

Jio Financial Services is carving a unique path in India’s financial landscape, blending Reliance’s digital muscle with BlackRock’s global expertise. Its share price tells a story of ambition tempered by market swings, while the Aladdin launch and strong fundamentals keep investors intrigued. I have watched JioFin rise with a mix of awe and caution, marveling at its potential to reshape investing. Whether you are eyeing a quick trade or a long-term stake, JioFin demands attention. What is your view on its future? Join our community and share your thoughts, and let us keep the market conversation alive!

Investors should however assess their risk appetite and financial goals before investing. If you want to improve your stock market knowledge and gain confidence in making investment decisions, a Stock Market Course is the way to go. Stay informed, invest smart and watch your wealth grow with Reliance Industries Share in your portfolio.

Disclaimer The information provided in this article is for general informational purposes only and is not intended as investment advice, financial guidance, or an offer or solicitation to buy or sell any securities. Stock data and financial figures are sourced from publicly available information and are believed to be accurate at the time of publication; however, we do not guarantee their accuracy or completeness. Past performance is not indicative of future results. Readers should conduct their own research or consult a qualified financial advisor before making any investment decisions. The author(s) and the publisher disclaim any liability for any loss or damage arising directly or indirectly from the use of or reliance on the information provided herein.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What is Jio BlackRock’s Aladdin platform?

Aladdin is BlackRock’s tool for portfolio analysis and risk management, launched in India on June 16, 2025. It simplifies investing for retail and institutional clients.web:0,12,14,19

Why is Jio Finance share price volatile?

A 50% rally from March 2025 and a recent 4% drop reflect market swings. Support at ₹240–₹260 and resistance at ₹305–₹308 drive fluctuations.

What are Jio Finance key financial fundamentals?

FY25 revenue grew 10.2% to ₹2,042.91 Cr, but net profit fell 24%. AUM surged to ₹10,053 Cr, signaling strong growth potential.

How does Jio BlackRock impact Jio Finance outlook?

Jio BlackRock’s Aladdin and debt funds enhance Jio Finance wealth management role. It leverages Jio’s digital reach and BlackRock’s global expertise.

What recent moves has Jio Finance made?

Jio Finance acquired Jio Payments Bank’s 17.8% stake for ₹104.54 Cr in 2025. The Aladdin launch strengthens its fintech ecosystem.

Is Jio Finance a good stock to buy in 2025?

Analysts target ₹300 to ₹350, recommending buys at ₹276. High P/E and volatility suggest consulting a financial advisor.

What risks does Jio Finance face in 2025?

High P/E (115.79) and competition from HDFC AMC pose challenges. A potential correction to ₹240–₹260 adds short-term risk.

How does Aladdin benefit Indian investors?

Aladdin offers advanced analytics for portfolio and risk management. It’s accessible via Jio’s platform for retail and institutional investors.

What’s the market sentiment on Jio Finance shares?

Investors are bullish on Aladdin’s potential but cautious about corrections. Analysts see long-term growth with buy-on-dip strategies.