Table of Contents

When you think of India’s stock market, cities like Mumbai, Delhi, or Bengaluru usually come to mind. But did you know that Kerala has produced several high-performing companies that are listed in NSE and BSE, attracting investors across the country? From finance powerhouses like Muthoot Finance and Federal Bank to industrial leaders like Cochin Shipyard and Apollo Tyres, Kerala-based firms have carved a unique space in India’s equity market.

In this pillar article, we’ll explore the top Kerala companies listed in the stock market, their sectors, market capitalisation, and stock performance. We’ll also highlight why Kerala continues to be an exciting hub for businesses and investors alike.

Key Takeaways:

- Kerala has a growing number of companies listed on the NSE and BSE, contributing significantly to the Indian economy.

- Companies from Kerala span multiple sectors, including IT, finance, manufacturing, and FMCG.

- Understanding listed companies helps investors make informed decisions and explore regional investment opportunities.

- Listed companies follow strict compliance, offering transparency and credibility to investors.

- Investing in Kerala-based companies provides opportunities to participate in the growth of regional enterprises.

Start investing like a pro. Enroll in our Stock Market course!

Why Focus on Kerala Companies in the Stock Market?

Kerala is often celebrated for its tourism, remittances, and literacy rate. But beneath the surface, the state also has a vibrant industrial and financial ecosystem. The companies headquartered here contribute not just to Kerala’s economy but also play a major role in India’s corporate landscape.

A few reasons why investors look closely at Kerala-listed companies:

-

Strong financial services hub: Kochi and Thrissur are home to NBFC giants like Muthoot Finance and Manappuram Finance.

-

Legacy in manufacturing: Cochin Shipyard, V-Guard, and Kitex Garments represent Kerala’s industrial growth.

-

Banking strength: Thrissur is called the “Banking capital of Kerala” with multiple banks headquartered there.

-

Cultural and brand influence: Companies like Kalyan Jewellers leverage Kerala’s deep-rooted traditions in gold retail.

List of Kerala Companies Listed in the Stock Market (2025 Data)

Here’s a snapshot of publicly listed Kerala-based companies (NSE/BSE) with their sector, headquarters, market cap, and stock price:

| Company Name | Sector | HQ City | Market Cap (₹ crore) | Latest Stock Price (₹) |

|---|---|---|---|---|

| Muthoot Finance Ltd | Finance/NBFC | Kochi | 59,111 | 1,478 |

| Kalyan Jewellers India Ltd | Retail (Jewellery) | Thrissur | 42,937 | 416 |

| Fertilisers & Chemicals Travancore (FACT) | Manufacturing | Kochi | 41,315 | 648 |

| Federal Bank Ltd | Banking | Aluva | 36,505 | 150 |

| Cochin Shipyard Ltd | Shipbuilding | Kochi | 23,006 | 874 |

| Manappuram Finance Ltd | Finance/NBFC | Thrissur | 14,727 | 174 |

| V-Guard Industries Ltd | Manufacturing | Kochi | 13,888 | 330 |

| Apollo Tyres Ltd | Tyres & Rubber | Kochi | 23,289 | 446.4 |

| South Indian Bank Ltd | Banking | Thrissur | 7,246 | 27 |

| CSB Bank Ltd | Banking | Thrissur | 6,127 | 352 |

| Kitex Garments Ltd | Garments Export | Kochi | 3,565 | 178.7 |

| Geojit Financial Services Ltd | Finance | Kochi | 1,534 | 64 |

1. Muthoot Finance Ltd – Kerala’s Financial Titan

-

Headquarters: Kochi

-

Sector: Finance (NBFC)

-

Market Cap: ₹59,111 crore

-

Stock Price: ₹1,478

Muthoot Finance is not just Kerala’s largest listed company, but also India’s largest gold loan NBFC. With over 5,500 branches across the country, it has built trust among millions of middle-class households.

Why it matters for investors:

-

Dominant market share in the gold loan segment.

-

Consistent revenue growth supported by gold demand in India.

-

Acts as a defensive stock during inflationary cycles.

2. Kalyan Jewellers India Ltd – Kerala’s Retail Jewel

-

Headquarters: Thrissur

-

Sector: Jewellery Retail

-

Market Cap: ₹42,937 crore

-

Stock Price: ₹416

Jewellery is deeply tied to Kerala’s culture, and Kalyan Jewellers embodies that tradition. It operates a pan-India and international chain of showrooms, making it one of the country’s largest gold retailers.

Investor Insights:

-

Strong brand recall, especially in South India.

-

Resilience to gold price volatility due to hedging strategies.

-

Expansion into Middle East markets adds growth potential.

3. Fertilisers and Chemicals Travancore (FACT)

-

Headquarters: Kochi

-

Sector: Manufacturing (Fertilizers & Chemicals)

-

Market Cap: ₹41,315 crore

-

Stock Price: ₹648

FACT is one of India’s oldest fertiliser producers and continues to play a critical role in India’s agriculture. Being PSU-backed, it also has strategic importance.

Why investors track FACT:

-

Government support ensures steady demand.

-

Linked to India’s agricultural growth story.

-

Volatility arises due to global urea and ammonia price fluctuations.

4. Federal Bank Ltd – Kerala’s Banking Powerhouse

-

Headquarters: Aluva

-

Sector: Banking

-

Market Cap: ₹36,505 crore

-

Stock Price: ₹150

Federal Bank is a household name in Kerala and a significant player in India’s private banking sector. Known for strong NRI remittance business, it has a robust digital banking model.

Investor Value:

-

Strong NRI deposit base from Gulf countries.

-

Consistent profitability with improving asset quality.

-

Competes with mid-sized private banks nationally.

5. Cochin Shipyard Ltd – India’s Shipbuilding Giant

-

Headquarters: Kochi

-

Sector: Shipbuilding

-

Market Cap: ₹23,006 crore

-

Stock Price: ₹874

Cochin Shipyard is a PSU and one of the largest shipbuilding and maintenance facilities in India. It builds merchant ships, defence vessels, and undertakes ship repair.

Investor Takeaways:

-

Linked to India’s defence modernisation and shipping growth.

-

Order book size ensures visibility for revenue.

-

Strong PSU dividend-paying potential.

6. Manappuram Finance Ltd – The Other Gold Loan Giant

-

Headquarters: Thrissur

-

Sector: NBFC (Finance)

-

Market Cap: ₹14,727 crore

-

Stock Price: ₹174

Often considered Muthoot’s closest competitor, Manappuram Finance is another Kerala-based NBFC dominating the gold loan space.

Why it matters:

-

Market diversification into microfinance and housing finance.

-

Regional stronghold in South India.

-

Growth-sensitive to gold demand cycles.

7. V-Guard Industries Ltd – Powering Homes Since 1977

-

Headquarters: Kochi

-

Sector: Consumer Electricals & Manufacturing

-

Market Cap: ₹13,888 crore

-

Stock Price: ₹330

V-Guard is a trusted household name across India for stabilisers, pumps, fans, and wires.

Investor Perspective:

-

Rising demand for consumer durables supports growth.

-

Well-diversified product portfolio.

-

Faces stiff competition from Havells and Crompton.

8. Apollo Tyres Ltd – Kerala’s Global Brand

-

Headquarters: Kochi

-

Sector: Tyres & Rubber

-

Market Cap: ₹23,289 crore

-

Stock Price: ₹446.4

Apollo Tyres, founded in Kerala, is now a global player with operations in Europe and Africa.

Investor Value:

-

Global presence reduces dependency on Indian market.

-

Strong OEM partnerships with auto companies.

-

Sensitive to crude and rubber price movements.

9. South Indian Bank Ltd

-

Headquarters: Thrissur

-

Sector: Banking

-

Market Cap: ₹7,246 crore

-

Stock Price: ₹27

South Indian Bank is one of Kerala’s oldest banks, catering to retail, SME, and NRI customers.

10. CSB Bank Ltd

-

Headquarters: Thrissur

-

Sector: Banking

-

Market Cap: ₹6,127 crore

-

Stock Price: ₹352

Formerly known as Catholic Syrian Bank, CSB has reinvented itself with stronger governance and focus on gold loans.

11. Kitex Garments Ltd – Textile Export Leader

-

Headquarters: Kochi

-

Sector: Garments Export

-

Market Cap: ₹3,565 crore

-

Stock Price: ₹178.7

Kitex is one of the world’s largest suppliers of infant wear, exporting heavily to the US and EU.

12. Geojit Financial Services Ltd – Kerala’s Stock Broking Pioneer

-

Headquarters: Kochi

-

Sector: Financial Services (Broking & Wealth)

-

Market Cap: ₹1,534 crore

-

Stock Price: ₹64

Geojit is Kerala’s answer to stock broking and wealth management, with a growing retail investor base.

Kerala’s Unique Position in India’s Stock Market

1: What is a stock?

-

Kerala has a rare mix of banking, NBFCs, retail, manufacturing, and shipping companies.

-

Thrissur and Kochi have emerged as financial hubs.

-

The state’s strong NRI ecosystem ensures large inflows into Kerala-based banks.

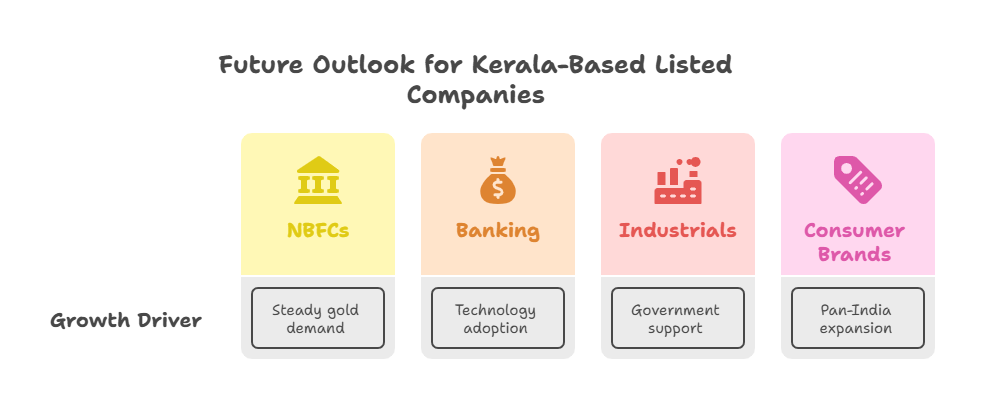

Future Outlook for Kerala-Based Listed Companies

-

NBFCs: Gold demand in India ensures steady growth for Muthoot and Manappuram.

-

Banking: Federal Bank, South Indian Bank, and CSB Bank are leveraging technology to compete with larger private banks.

-

Industrials: Cochin Shipyard and FACT are strategically important PSUs with strong government support.

-

Consumer brands: Kalyan Jewellers and V-Guard are poised for pan-India expansion.

How to Invest in Kerala’s Listed Companies

-

Open a Demat and trading account with a SEBI-registered broker.

-

Research current reports (annual, quarterly), management quality, and peer performance.

-

Observe price, volume trends, and analyst recommendations for Kerala-based stocks.

-

Emphasise a diversified approach: don’t invest only in finance or retail.

-

Compliance: Always ensure adherence to local tax, IPO, and regulatory frameworks.

Conclusion

Kerala may not be India’s largest industrial state, but its listed companies punch far above their weight in finance, retail, shipbuilding, and manufacturing. For investors, tracking Kerala companies listed in the stock market offers exposure to a unique mix of defensive NBFCs, growth-oriented retailers, and government-backed industrial firms.

If you are an investor seeking diversification, resilience, and cultural trust, Kerala-based stocks deserve a place on your watchlist.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

How many Kerala-based companies are listed in the Indian stock market?

Kerala has around a dozen notable companies listed on NSE and BSE across sectors such as finance, banking, shipbuilding, jewellery retail, manufacturing, and garments export.

Which is the largest company from Kerala listed in the stock market?

Muthoot Finance Ltd, headquartered in Kochi, is the largest listed company from Kerala with a market capitalisation of over ₹59,000 crore.

Which Kerala-based banks are listed in the stock market?

The prominent listed banks from Kerala include Federal Bank Ltd (Aluva), South Indian Bank Ltd (Thrissur), and CSB Bank Ltd (Thrissur).

Are there any jewellery companies from Kerala listed on the stock exchange?

Yes, Kalyan Jewellers India Ltd, based in Thrissur, is a major listed jewellery retailer with a market cap of over ₹42,000 crore.

Are Kerala companies good investment opportunities?

Many Kerala-based companies like Muthoot Finance, Federal Bank, and Cochin Shipyard have strong fundamentals and consistent growth. However, investment decisions should be based on individual risk appetite, company performance, and market conditions.