Table of Contents

Introduction

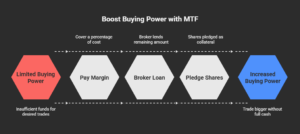

Stock trading draws people who want quick gains. Many face cash limits that cap their buys. Margin Trading Facility, or MTF, solves this. It lets you buy stocks by paying just part of the cost. Your broker covers the rest as a loan. You pay interest on that loan. In India, SEBI oversees MTF to keep things fair. Traders get up to four times leverage on over 1,000 stocks. This means Rs 25,000 can fund a Rs 1,00,000 trade. Profits multiply if prices rise. Losses do too if they fall.

MTF suits short-term bets on price swings. It needs a special account setup. Pledging shares acts as backup for the loan. Interest rates hover around 0.04% per day. Hold positions for days or months. But watch margins to avoid forced sales. This tool amps up returns for savvy players. New rules in 2025 ease some broker duties. MTF opens doors for those with limited funds but big ideas. It demands care to dodge pitfalls.

Start investing like a pro. Enroll in our Stock Market course!

What is Margin Trading Facility (MTF)?

1: What is a stock?

Margin Trading Facility stands as a broker service for stock buys. You pay a slice of the price, called margin. The broker lends the balance. Think of it as a short loan for trading. In India, it targets equity shares in cash segment. SEBI sets the rules to curb excess risk. Eligible stocks include liquid ones from Group 1. Leverage reaches 4x on many. For example, with Rs 20,000, buy Rs 80,000 worth if margin is 25%. You own the shares but pledge them to the broker. Interest kicks in from day one on the loaned sum. Rates vary by broker, often 9.69% yearly. Hold trades beyond same day, unlike intraday. Pay back by selling shares or adding cash.

If stock value drops, add more margin or face sell-off. MTF boosts buying power for market ups. It fits swing trades over days or weeks. Activation needs account tweaks and agreements. Brokers like Zerodha or Kotak offer it. Recent SEBI tweaks in 2025 relax net worth checks for brokers. This keeps MTF smooth. Understand it to trade bigger without full cash outlay.

How Does Margin Trading Work?

To better understand margin trading, let’s break it down into simple steps:

-

Opening a Margin Account: To trade on margin, you need to open a margin account with your broker. This account is different from a regular trading account as it allows you to borrow money from the broker to buy securities.

-

Margin Requirement: The broker will require you to deposit a certain amount of money in your margin account, which acts as collateral. This is known as the “initial margin” or the “down payment.” Typically, brokers may ask for an initial margin of 25% to 50% of the total value of the trade.

-

Leverage: Once you have deposited the initial margin, the broker will provide you with additional funds to buy the securities. For example, if you have ₹1,00,000 and the broker allows a 2:1 leverage, you can buy securities worth ₹2,00,000. In this case, you’re borrowing ₹1,00,000 from the broker.

-

Interest Charges: The funds borrowed from the broker are subject to interest charges. The broker typically charges interest based on the amount of margin you use, and this interest is often calculated on a daily basis. It’s important to consider these charges when evaluating the profitability of margin trading.

-

Margin Call: If the value of the securities you purchased falls below a certain threshold (known as the “maintenance margin”), the broker will issue a margin call. This means you will need to deposit more funds or sell some securities to restore the margin balance. If you fail to do so, the broker may liquidate some of your holdings to cover the loan.

Types of Margin Trading

There are generally two types of margin trading facilities:

-

Cash Margin: In this type of margin trading, you need to have cash as collateral. You borrow the funds from the broker to buy stocks, and the amount borrowed is directly proportional to the value of the collateral you have.

-

Stock Margin: In stock margin trading, you can use the securities you already hold as collateral. This allows you to borrow money from your broker based on the value of your existing portfolio, and you can then use these funds to buy more stocks.

Benefits of MTF

- Enhanced Buying Power: The primary benefit of margin trading is that you can enter larger positions without having to have the full amount of capital upfront. This can enable traders to take advantage of market opportunities that would otherwise be beyond their reach.

- Capacity for Higher Returns: Because margin lets you purchase more shares, the potential return is higher, assuming, of course, they do well. If the stocks you buy go up in value, you can sell for a profit and pay back the loan amount plus interest, pocketing the spread.

- Flexibility: Margin trading allows traders to have flexibility with their trading strategies. You have the borrowed funds to diversify, capitalize on short term movements, or buy the growth stocks you think have promise.

- Short Selling: Margin can also be used for short selling. Short selling is when you borrow shares from your broker to sell at the current price, hoping to then buy it back later at a lower price. That’s only possible in margin accounts, and it’s how traders can potentially make money on stocks going down.

- Leverage for Seasoned Traders: For seasoned traders who understand the market and can tame risk, margin trading can be a potent weapon. It enables them to leverage their profits and capitalize on trends.

Dangers of MTF

Although margin trading can be highly rewarding, it is also fraught with risk:

- Amplified Losses: As margin trading enables you to magnify profits, it also increases your losses. If the price of the securities you bought fall, however, you still owe the loan, and you can lose more than your original investment.

- Margin Calls: A margin call can force you to deposit more funds or sell securities to cover the margin loan if the value of your holdings falls. If you cannot satisfy a margin call, the broker can liquidate your holdings, possibly at a loss, to safeguard its loan. This can lead to heavy losses, particularly if the market is unstable.

- Interest Costs: The broker also charges interest on the borrowed funds, which can add up over time. The longer you hold onto your balance, the more interest you’ll have to pay. This can gnaw at your gains, particularly if the market turns against you.

- Complexity for Beginners Margin trading can be complex and risky, especially for beginners. Margin trading can empty your wallet if you have no experience or intuition for how leverage works. I think it’s really important to understand the markets and risk management before margin trading.

- Market Volatility: Margin trading leaves you vulnerable to sudden market declines. If the market crashes, your margin position can implode in short order.

HOW TO MANAGE RISK IN MARGIN TRADING

As with any high risk investment, risk management is key in MTF. So here are some ways to margin trade safely.

- Place a Stop-Loss: A stop-loss order will sell your securities if their price drops to a specific point, minimizing your losses. Stop-loss orders, on the other hand, can be a good tool to manage risk and keep you out of the way of devastating losses in turbulent markets.

- Limit Your Leverage: Avoid using excessive leverage. Although higher leverage can increase profits, it also exacerbates losses. It’s best to begin with lower leverage until you become more seasoned in margin trading.

- Diversify Your Portfolio: Don’t put all your borrowed funds into a single stock or sector. Diversification can minimize the effect of any one loss, spreading your risk among various assets.

- Monitor Your Margin Account: Watch your margin account and have funds available for margin calls. Checking in with your portfolio regularly can go a long way to keeping you out in front of trouble.

- Invest Only What You Can Afford to Lose: Since margin trading involves borrowing funds, it’s important to only invest money you can afford to lose. But never, ever borrow more than you’re willing to lose — the stakes are too high.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreKey Features of MTF

- Leverage Up to 4x: Buy four times your cash. Rs 10,000 funds Rs 40,000 trade. Amplifies moves.

- Interest on Funded Amount: Charged daily, like 0.027% to 0.049%. Starts T+1, includes weekends.

- Pledging Mandatory: Shares as collateral. Auto-pledge common post-2025. Fees Rs 20-25 per stock.

- Flexible Holding: Up to 365 days or more. No fixed end, but interest builds.

- Eligible Stocks: Over 1,000 liquid ones. Group 1 by exchanges. Brokers filter for risk.

- Margin Requirements: Initial 20-50%. Maintenance lower. VAR + ELM formula sets it.

- Margin Calls: Alerts for shortfalls. Add funds or sell within days.

- Auto Square-Off: If ignored, broker sells T+4 to T+7. Protects from deep losses.

- Collateral Options: Cash or pledged shares/ETFs. Instant limits from holdings.

- Interest Calculation: On borrowed sum only. Slab-based in some brokers.

- Tax Treatment: FIFO at demat. Gains as business or capital.

- Broker Tools: Calculators, picks, apps for tracking.

- SEBI Oversight: Upfront margins, net worth rules for safety.

SEBI Regulations for MTF (India-Specific Section)

SEBI guards MTF in India. It sets leverage caps at 4x max for cash stocks.

Upfront margin mandatory: At least 20% before trade.

Pledging required since Sept 2020. No hold without pledge.

Auto-pledge rolled out Feb 2025 by many brokers. No manual OTP needed.

Brokers must collect margins daily. MTM losses covered.

Net worth certificate for brokers. SEBI relaxed timeline Aug 2025: 60 days for audited, 45 for unaudited.

Extension for pledge/re-pledge rules Aug 18, 2025.

No cash collateral for maintenance from new rules.

FIFO taxation at demat.

No NRI, minors in MTF.

POA/DDPI needed for ops.

Risk systems: Brokers square if shortfall persists 4-7 days.

Eligible scrips: Liquid, Group 1.

Interest disclosure full.

Rights statements issued.

Circulars like CIR/MRD/DP/54/2017 guide.

2025 updates focus ease but safety.

SEBI monitors to stop over-leverage.

Penalties for shortfalls: Interest, square-off.

Brokers report margins.

This framework protects while allowing MTF.

Details: VAR + 3-5x ELM for margins.

No additional packages.

SEBI evolves for fair play.

Who Should Use MTF?

Seasoned traders thrive on MTF. They spot short swings and use leverage to max gains. With market know-how, they handle calls and interest. Swing players hold days or weeks, perfect for MTF flex. High-risk takers embrace volatility for big wins. Those with backup cash meet shortfalls quick. Disciplined folks set stops to cut losses. Short on funds but long on ideas?

MTF stretches cash. Pros in equities cash segment pick it over derivatives. Not beginners: They lack risk sense, face wipes. Long-haul investors skip due to costs. Low-risk types avoid amplified hits. Without monitoring time, pass. MTF calls for daily checks. In 2025, with easy pledges, more try it. But only if you study charts and news. Start small to test. It suits active, bold traders chasing edges.

Start investing like a pro. Enroll in our Stock Market course!

Conclusion

MTF offers power to trade big with little. It amps returns for smart plays. Balance risks with care. Use it for short bets, watch margins tight. SEBI keeps it safe. If it fits, activate and grow funds.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What exactly is Margin Trading Facility (MTF), and why do traders chase it?

Margin Trading Facility, or MTF, acts as a boost for stock buyers. It lets you purchase shares by paying only a portion of the total cost upfront. Your broker steps in to cover the rest, like a quick loan tied to the trade. In simple terms, if a stock costs Rs 100 and you want 1,000 shares, that’s Rs 1,00,000 total. With MTF at 4x leverage, you might pay just Rs 25,000, and the broker funds Rs 75,000. You own the shares right away, but you pledge them as backup for the loan. Interest starts ticking on the borrowed part, often around 0.04% per day or about 14% yearly. Traders love it because it amps up potential profits. Picture this: The stock jumps 10% to Rs 110. Your position gains Rs 10,000. After small interest, that’s a 40% return on your Rs 25,000—way better than 10% on a full cash buy. But it’s not free money. If the price drops 10%, you lose Rs 10,000, a 40% hit on your cash, plus interest. In India, SEBI caps leverage at 4x for safety on over 1,000 eligible stocks, mostly liquid ones like Reliance or HDFC Bank. Activation needs a special agreement and power of attorney with your broker. It’s ideal for short-term bets, like holding a few days to catch a price swing. New rules as of August 2025 make pledging easier with auto-options, cutting paperwork. MTF pulls in traders who spot quick ups but lack full funds. It demands sharp eyes on market moves, as small shifts hit big. If you’re tired of tiny trades, MTF opens the door to bigger wins—just handle the risks smart.

How does MTF work from start to finish, step by step?

MTF kicks off with account setup. First, pick a broker like Zerodha or Groww that offers it. Open a trading and demat account if you don’t have one—submit PAN, Aadhaar, and bank proof. It takes a day or two online. Next, enable MTF by signing the agreement and power of attorney. This gives the broker rights to pledge your shares. Fund your account with cash or pledge existing holdings for instant limits. Now, scout for stocks: Check the broker’s list of MTF-eligible ones, usually Group 1 for liquidity. Place the order on the app—select MTF as the type, enter shares, and see the margin needed. For a Rs 50,000 trade at 25% margin, pay Rs 12,500; broker covers Rs 37,500. The buy happens in real time, shares land in your demat. Pledge them by 9 PM—many brokers auto-do it post-2025 updates. Interest accrues daily on the loan, say Rs 15 on Rs 37,500 at 0.04%. Hold as long as you want, but monitor value. If the stock falls and margin dips below maintenance level (like 20%), get a call to add cash. Ignore it? Broker sells after 4-7 days to recover. To exit, sell via MTF option—proceeds repay the loan first, rest to you. Or pay full to convert to regular holding. Real example: Buy 500 shares at Rs 200 (total Rs 1,00,000) with Rs 25,000 margin. Price hits Rs 220 in a week—sell for Rs 1,10,000, gain Rs 10,000 minus Rs 210 interest (7 days at Rs 30 daily). Net profit Rs 9,790, or 39% on your cash. But if it drops to Rs 180, loss Rs 10,000 plus interest—40% gone. Corporate events like dividends go to you, but splits adjust margins. Taxes follow FIFO in demat. Brokers charge small pledge fees, Rs 20-25 per stock. MTF flows smooth for active traders, turning ideas into action fast. Master these steps, and you’ll trade like a pro without tying up all your money.

What are the main features that make MTF stand out from regular trading?

MTF packs features that crank up trading power. Leverage tops at 4x, so Rs 20,000 buys Rs 80,000 worth—multiplies every price tick. Interest only on borrowed funds, charged daily but low, like 9-15% yearly—beats personal loans. Pledging locks in security; auto-pledge from February 2025 speeds it up, no manual hassles. Hold positions flexible—days, weeks, or months, no expiry like futures. Over 1,000 stocks qualify, focusing on safe, traded ones to cut risks. Margins start at 20-50% initial, with maintenance lower; calculated via VAR and ELM for fairness. Get alerts for shortfalls via app or SMS—add funds quick to stay in. Auto square-off protects if you can’t; broker sells T+4 to T+7. Use cash or shares as collateral—pledge holdings for more limits without selling. Interest slabs vary; some brokers cut rates for big volumes. Tax as business income or capital gains, FIFO basis. Apps offer calculators to preview costs and margins. SEBI rules ensure transparency, like full interest breakdowns. Compared to intraday, MTF allows overnight holds with interest. It beats margin funding loans by tying direct to trades. For traders, these traits mean more control and punch. Say you hold a position 30 days—interest might eat 1-2% of gains, but leverage covers it on winners. Features like these draw crowds, making MTF a go-to for growth-minded folks. They persuade you to step up from plain buys, offering tools to win bigger in volatile markets.

What benefits does MTF bring to everyday traders?

MTF delivers clear wins for traders short on cash but full of ideas. It stretches your money—4x leverage means small sums fund big positions, turning Rs 10,000 into Rs 40,000 plays. Gains multiply: A 5% stock rise on leveraged trade nets 20% on your part, minus low interest. Perfect for swing trades—catch quick ups over days without full payment. Diversify wide: Spread across multiple stocks, one hit offsets costs. Interest stays affordable, 0.03-0.05% daily—hold a week, pay peanuts compared to profits. Keep cash flow free; no lock all funds in one spot. Earn dividends on held shares, even pledged. Brokers throw in extras like stock picks and real-time tracking apps. In fast 2025 markets, react to news instant—buy on dips, sell on peaks. Builds skills: Constant monitoring hones discipline and timing. For pros, ramps return on equity—invest less, earn on more. Newbies start small, learn leverage safe under SEBI caps. Example: Trader spots auto stock rally post-budget. With Rs 50,000 cash, buys Rs 2,00,000 position. 8% climb in 10 days: Gain Rs 16,000 minus Rs 600 interest—30% net return. Without MTF, just 8%. It fits volatile times, like post-election swings. Encourages bold moves but with backups. Overall, MTF boosts confidence, letting you chase opportunities others miss. It persuades with real multipliers—try it, watch your portfolio grow faster than cash-only plays.

What risks come with MTF, and how can traders dodge them?

MTF risks hit hard if ignored. Losses amplify—10% drop wipes 40% of your margin on 4x leverage, plus interest adds salt. Interest builds quick on long holds; a month at 0.04% daily eats Rs 900 on Rs 75,000 borrow. Margin calls surprise: Price fall below threshold demands cash fast—fail, and broker sells at loss. Volatility fuels chains of calls in crashes. Overtrading tempts; easy loans lead to too many bets, one flop sinks all. Pledge fees nibble, Rs 20-50 per trade. Tax tracking gets messy with FIFO. Limited to liquid stocks, cuts choices. Broker glitches or rule changes halt access. Emotional drain from daily watches. To dodge: Set stop-losses at 5-10% down to cut early. Keep 20-30% extra cash for calls. Hold short, under 10 days, to cap interest. Pick stable stocks, avoid penny ones. Use calculators pre-trade for what-ifs. Start with 10-20% of portfolio in MTF. Monitor apps twice daily. Example: Trader ignores dip, gets call on Rs 1,00,000 position—adds Rs 10,000, stock rebounds, saves day. But skip it? Forced sell locks 15% loss. SEBI caps help, but personal rules save more. Risks make MTF thrilling, but smart steps turn them into edges. Weigh them; if handled, rewards shine.

How do SEBI rules shape MTF in India, and what's new in 2025?

SEBI sets firm MTF boundaries for safety. Leverage maxes at 4x on cash equities. Upfront margins at least 20%—no trade without. Pledging must happen same day; auto-pledge standard from Feb 2025 eases it. Brokers collect daily margins, cover MTM losses. Net worth certificates due—August 2025 extension gives 60 days audited, 45 unaudited. Pledge/re-pledge deadlines pushed to Aug 18, 2025. No cash for maintenance margins now. FIFO tax in demat applies. Barred for NRIs, minors. Need POA or DDPI for smooth ops. Risk checks: Square-off after 4-7 day shortfalls. Only Group 1 stocks qualify. Full interest and risk disclosures required. Circulars like 2017 ones guide ops. 2025 tweaks focus ease without lax safety—auto-pledge cuts errors, extensions aid brokers. Penalties for misses: Extra interest or sells. Brokers report all to exchanges. This setup stops wild borrowing, protects small traders. Example: Pre-2020, no pledges led to defaults; now, mandatory cuts that. SEBI adapts to market needs, like post-COVID volatility. Rules persuade trust—MTF stays reliable under watch. Stay updated via SEBI site for tweaks.

Who fits best for using MTF, and who should skip it?

MTF suits active traders with market smarts. Swing folks holding days to weeks thrive on its flex. Risk lovers chase amplified wins in ups. Those with spare cash handle calls easy. Disciplined types set limits, avoid overtrades. Short on funds but idea-rich? It stretches reach. Equity cash pros pick it over complex derivatives. In 2025’s wild markets, quick reactors gain. But skip if newbie—lack of skill leads to fast losses. Long-term holders hate interest drag. Low-risk seekers dodge big hits. No time for daily checks? Pass, as ignores trigger sells. Without backup funds, calls crush. Example: Pro trader uses MTF for 20% portfolio, nets 25% yearly returns post-costs. Newbie tries full tilt, wipes 50% in a dip. It fits bold, prepared players. Test small first. If you fit, MTF unlocks growth; else, stick cash for peace.

How do you pick the right broker for MTF, and what to watch?

Choose brokers with low interest, easy apps, and big stock lists. Compare rates: 9-15% yearly ideal. Check pledge fees—under Rs 25 good. Auto-pledge post-2025 a plus. See limits: High net worth ones offer more. Tools matter—calculators, alerts, picks help. Read reviews for reliability; avoid glitchy ones. SEBI-registered only. Activation free, no min balance. Example: Zerodha for low costs, ICICI for auto-features. Watch hidden charges like processing. Test support via chat. Right pick makes MTF smooth, boosts wins. It persuades with savings—shop smart.

Can MTF mix with other strategies, like BTST or hedging?

Yes, MTF blends well. BTST (buy today, sell tomorrow) works—interest one day only. Hold longer for swings. Hedge by pairing with puts, but MTF mainly long. Diversify across sectors. Use for arbitrage on price gaps. But no short sells in MTF. Corporate actions adjust auto. Example: Buy on dip, sell next day—gain 3%, interest Rs 10 on Rs 50,000 borrow. Mix persuades more wins. Try combos for edges.

What's the future of MTF, and how to start today?

MTF grows with 2025 easings like auto-pledge, drawing more users. SEBI may add stocks, cut risks. Digital tools evolve for better tracking. Start: Open account, sign papers, fund small. Practice on demo if available. Read broker guides. Future looks bright for leverage fans. Jump in—MTF could multiply your trades now.