Table of Contents

It can be exciting, fulfilling, and risky to trade stocks. When real money is at stake, getting right into real trading can be scary for people who are just starting. Now this is where mock trade comes in. You can learn the ropes there without losing any money because it is a safe place to practice. But what makes it different from real trading? On the surface, they look very much the same, but they can have very different effects on your learning, mental health, and income. We’ll talk about the main differences between mock trading and real trading in this blog post. This will help you choose which one to focus on based on your goals and level of experience.

Start investing like a pro. Enroll in our Stock Market course!

What is Mock Trading?

When you do mock trading, also called “paper trading,” you act out trading on the stock market. It lets people use fake money to buy and sell stocks based on real-time or delayed trade data. It’s mostly used by traders who are just starting out or who want to try new strategies without risking any real money.

What is Real Trading?

1: What is a stock?

When you trade in real life, you use real money to buy and sell stocks or other financial products on the live market. Losses and gains are real and have a direct effect on your cash. You need a stock account, a registered trade account, and to plan your finances well. Things like fear and greed are involved, which makes it more complicated than being in an artificial setting.

Mock Trading vs Real Trading: Key Differences

Real trading and mock trading may seem to be quite similar, but in reality, they are completely different from one another. One kind of education does not entail any danger, but the other one includes actual money and actual repercussions. In order to have a better understanding of the major differences, let’s compare them side by side.

| Feature | Mock Trading | Real Trading |

|---|---|---|

| Money Used | Virtual (No real money involved) | Real money involved |

| Risk Level | Zero risk | High risk (capital gains or losses) |

| Emotional Involvement | Low – No real consequences | High—Real money leads to emotional stress |

| Market Exposure | Simulated environment | Actual live market |

| Execution | Instant or delayed, depending on the platform | Based on real-time liquidity and demand |

| Brokerage Charges | None | Applicable |

| Ideal For | Beginners, strategy testers | Experienced traders or serious investors |

Which One Should You Use (and When)?

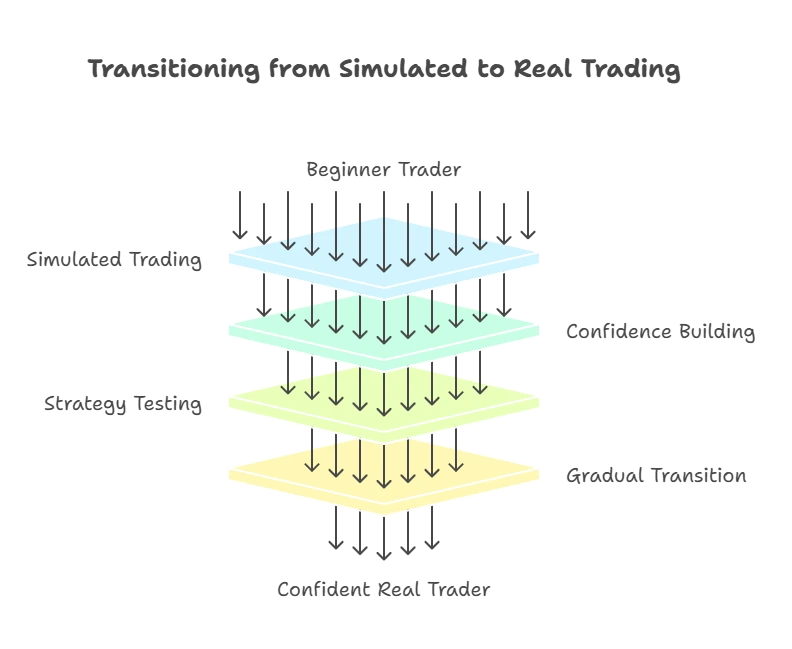

For those who are just beginning their trading careers,moke trading is your best buddy. This allows you to gain confidence without feeling any pressure, try out a variety of techniques, and get a fundamental understanding of the market. Make the transition to actual trading gradually, maybe beginning with a little amount of money, if you have reached a point where you are comfortable and have a trustworthy trading strategy. It is also the safest alternative to engage in pretend trading if you are attempting to get familiar with a new platform or testing out a new trading technique.

Limitations of Mock Trading

While mock trading is a great way to practice without financial risk, it doesn’t fully capture the realities of real trading. There are several limitations that can affect how well it prepares you for the actual market.

- There is no emotional pressure, and it does not replicate fear or greed, which are factors that impact actual judgments.

- Absence of liquid assets: The orders placed in pretend trading may be completed immediately, in contrast to the situation in actual markets.

- There are no actual stakes: Excessive self-assurance may result if initiatives are successful without causing any financial repercussions.

- The absence of brokerage or slippage refers to the absence of real-world fees, which have an impact on profitability.

Master stock trading with us. Enroll now for a free demo!

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreBenefits of Real Trading

Real trading encompasses more than just theory; it is the place where you get genuine market experience. Students learn the discipline, emotional control, and practical skills necessary to be successful in the stock market via the use of actual money, which is at stake in this activity.

- Your own experience might assist you in comprehending the functioning of the market.

- Teaching patience, stress control, and decision-making under duress are all skills that are taught via emotional discipline.

- Real money gains are the potential for returns, provided that your techniques are successful.

- Including brokerage fees, taxes, and slippages is an essential component of holistic learning, which is essential for long-term success.

Final Thoughts

Any individual who is new to the market may benefit greatly from engaging in mock trading since it provides a sandbox in which they can learn without fear of any repercussions. But actual trading is necessary if you want to develop your skills as a trader. You will be presented with authentic findings, your psychology will be challenged, and you will learn about real-world market behavior. Which strategy is the most intelligent? Begin by engaging in fake trading in order to get a basic understanding of the market, and then gradually move into actual trading as your self-assurance and readiness increase.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

Can I make real money in mock trading?

No. Mock trading is purely for practice. It uses virtual money, so any profits or losses are not real.

Are emotions involved in mock trading?

Not much. Since there’s no real money involved, traders usually don’t feel fear or greed, which are key emotional drivers in real trading.

Can mock trading help test new strategies?

Yes! It’s ideal for testing strategies in different market conditions without any risk to real capital.

How long should I do mock trading before switching to real trading?

There’s no fixed time. It depends on your learning curve. Once you consistently make informed decisions and understand risk management, you can start real trading—preferably with small amounts.

Is mock trading the same as real trading?

No. While mock trading uses real or simulated market data, it involves no real money, so there’s no actual financial gain or loss.