Table of Contents

Planning to start your investment journey with mutual funds? That’s a great way to start your venture into financial freedom. However, are you aware of all the common types and terminologies of mutual funds? If not, you have reached at the right place! If yes, you can skim through to rejuvenate your memory.

Check out this video on Mutual Fund by Entri in Malayalam!

What are the different types of mutual funds in India?

SEBI had announced the re-categorization of mutual fund plans on October 6, 2017 [1]. It was intended to bring about similarities as the mutual fund houses introduced a number of mutual fund schemes. You can find investing in mutual funds very easy after this move, as investors invest in mutual fund programs such as their investment objectives and risk tolerance. Investors used to struggle to choose the right mutual fund as the AMCs introduced a number of similar mutual fund plans.

Enrol at Entri’s Mutual Funds Course to start your trading journey!

SEBI has divided the funds into the following categories:

-

Equity Funds:

SEBI has categorised equity funds into eleven broad categories

- Large Cap Fund: It invests at least 80% of the total assets in equity and equity-related instruments of large-cap companies.

- Large & Mid Cap Fund: It invests 35% of the total assets in equity and equity-related instruments of large-cap companies. It also invests 35% of total assets in equity and equity-related instruments of mid-cap firms.

- Mid Cap Fund: It invests at least 65% of the total assets in equity and equity-related instruments of mid-cap companies.

- Small Cap Fund: It invests at least 65% of the total assets in equity and equity-related instruments of small-cap companies.

- Multi Cap Fund: It invests a minimum of 65% of the total assets in equity and equity-related instruments.

What is an equity fund? An equity fund is a type of investment fund where the money from investors is pooled together and primarily invested in stocks (also known as equity). When you invest in an equity fund, you’re basically buying shares of companies through the fund.

-

- Dividend Yield Fund: It invests mainly in dividend-yielding stocks and has a minimum of 65% of the total assets in equity.

- Value Fund: It follows a value investment strategy and has at least 65% of the total assets in equity.

- Contra Fund: It follows a contrarian investment strategy and has at least 65% of total assets in equity and equity-related instruments.

- Focused Fund: It focuses on a maximum of 30 stocks. It has at least 65% of total assets in equity and equity-related instruments.

- Sectoral/Thematic Fund: It invests a minimum of 80% of total assets in equity and equity-related instruments of a particular sector or a particular theme.

- ELSS: It invests a minimum of 80% of total assets in equity and equity-related instruments (In accordance with Equity Linked Saving Scheme, 2005 notified by the Ministry of Finance).

Also read: What is a Mutual Fund and how does it Work? (Complete Guide)

-

Debt Funds

SEBI has categorised debt funds into sixteen broad categories.

- Overnight Fund: It invests in overnight securities with maturity of one day.

- Liquid Fund: It invests in debt and money market securities with a maturity of up to 91 days.

- Ultra Short Duration Fund: It invests in debt and money market instruments where the Macaulay duration of the portfolio is between three months to six months.

- Low Duration Fund: It invests in debt and money market instruments where the Macaulay duration of the portfolio is between six months to twelve months.

- Money Market Fund: It invests in money market instruments with a maturity of up to one year.

- Short Duration Fund: It invests in debt and money market instruments where the Macaulay duration of the portfolio is between one year to three years.

- Medium Duration Fund: It invests in debt and money market instruments where the Macaulay duration of the portfolio is between three years to four years.

- Medium to Long Duration Fund: It invests in debt and money market instruments where the Macaulay duration of the portfolio is between four years to seven years.

What is a debt fund? A debt fund is a type of investment where your money is used to lend to companies or the government. In return, they pay you interest over time. It’s like you’re lending money to someone, and they give you a little extra (interest) as a thank you for letting them use your money.

-

- Long Duration Fund: It invests in debt and money market instruments where the Macaulay duration of the portfolio is above seven years.

- Dynamic Fund: It invests across duration.

- Corporate Bond Fund: It invests at least 80% of the total assets in corporate bonds of the highest rating.

- Credit Risk Fund: t invests at least 65% of total assets in corporate bonds (Investment in below rated highest instruments).

- Banking and PSU Fund: It invests a minimum of 80% of total assets in debt instruments of banks, PSUs and Public Financial Institutions.

- Gilt Fund: It invests a minimum of 80% of total assets in Gsecs across maturity.

- Gilt Fund with 10-year constant duration: It invests a minimum of 80% of total assets in GSecs where the Macaulay duration of the portfolio is ten years.

- Floater Fund: It invests a minimum of 65% of total assets in floating rate instruments.

-

Hybrid Funds

SEBI has categorised hybrid funds into seven broad categories.

-

- Conservative Hybrid Fund: It invests between 10% and 25% of the total assets in equity and equity-related instruments. It invests between 75% to 90% of the total assets in debt instruments.

- Balanced Hybrid Fund: It invests between 40% and 60% of the total assets in equity and equity-related instruments. It invests between 40% to 60% of the total assets in debt instruments. No arbitrage is allowed in this scheme.

- Aggressive Hybrid Fund: It invests between 65% and 80% of the total assets in equity and equity-related instruments. It invests between 20% to 35% of the total assets in debt instruments.

What is a hybrid fund? A hybrid fund is an investment that combines both stocks (equity) and bonds (debt) in one fund. It’s like a mix of two things: some money is used to buy stocks (which can grow a lot but are riskier), and some is used to buy bonds (which are safer but don’t grow as fast).

-

- Dynamic Asset Allocation or Balanced Advantage: It invests in equity or debt that is managed dynamically.

- Multi-Asset Allocation: It invests in a minimum of three asset classes with an allocation of at least 10% each in all three asset classes.

- Arbitrage Fund: It invests a minimum of 65% of total assets in equity and equity-related instruments. The scheme follows an arbitrage strategy.

- Equity Savings: It invests a minimum of 65% of total assets in equity and equity-related instruments. It invests a minimum of 10% of total assets in debt instruments. The minimum hedged and unhedged would be stated in the SID.

-

Solution-oriented schemes:

- Retirement Fund: You may fund these schemes having a lock-in of at least five years or till the retirement age, whichever is earlier.

- Children’s Fund: The scheme would have a lock-in of at least five years or till the child attains majority age whichever comes earlier.

-

Other Schemes:

- Index Funds/ETFs: It should invest at least 95% of total assets in securities of a particular index.

- FoFs (Domestic/Overseas): It invests a minimum of 95% of total assets in the underlying fund.

Common Types of Mutual Funds

1: What is a stock?

These common types of mutual funds can be segregated into various groups based on their respective features for easier understanding.

-

Based on Asset Class

-

Equity Funds

Equity funds primarily invest in stocks, and hence go by the name of stock funds as well. They invest the money pooled in from various investors from diverse backgrounds into shares/stocks of different companies. The gains and losses associated with these funds depend solely on how the invested shares perform (price-hikes or price-drops) in the stock market. Also, equity funds have the potential to generate significant returns over a period. Hence, the risk associated with these funds also tends to be comparatively higher.

-

-

-

Money Market Funds

Investors trade stocks in the stock market. In the same way, investors also invest in the money market, also known as capital market or cash market. The government runs it in association with banks, financial institutions and other corporations by issuing money market securities like bonds, T-bills, dated securities and certificates of deposits, among others. The fund manager invests your money and disburses regular dividends in return. Opting for a short-term plan (not more than 13 months) can lower the risk of investment considerably on such funds.

-

-

-

Debt Funds

Debt funds invest primarily in fixed-income securities such as bonds, securities and treasury bills. They invest in various fixed income instruments such as Fixed Maturity Plans (FMPs), Gilt Funds, Liquid Funds, Short-Term Plans, Long-Term Bonds and Monthly Income Plans, among others. Since the investments come with a fixed interest rate and maturity date, it can be a great option for passive investors looking for regular income (interest and capital appreciation) with minimal risks.

-

Hybrid Funds

As the name suggests, hybrid funds (Balanced Funds) is an optimum mix of bonds and stocks, thereby bridging the gap between equity funds and debt funds. The ratio can either be variable or fixed. In short, it takes the best of two mutual funds by distributing, say, 60% of assets in stocks and the rest in bonds or vice versa. Hybrid funds are suitable for investors looking to take more risks for ‘debt plus returns’ benefit rather than sticking to lower but steady income schemes.

-

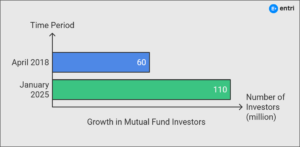

Source: AMFI

-

Based on Investment Goals

-

Growth Funds

Growth funds usually allocate a considerable portion in shares and growth sectors, suitable for investors (mostly Millennials) who have a surplus of idle money to be distributed in riskier plans (albeit with possibly high returns) or are positive about the scheme.

-

Income Funds

Income funds belong to the family of debt mutual funds that distribute their money in a mix of bonds, certificate of deposits and securities among others. Helmed by skilled fund managers who keep the portfolio in tandem with the rate fluctuations without compromising on the portfolio’s creditworthiness, income funds have historically earned investors better returns than deposits. They are best suited for risk-averse investors with a 2-3 years perspective.

-

Liquid Funds

Like income funds, liquid funds also belong to the debt fund category as they invest in debt instruments and money market with a tenure of up to 91 days. The maximum sum allowed to invest is Rs 10 lakh. A highlighting feature that differentiates liquid funds from other debt funds is the way the Net Asset Value is calculated. The NAV of liquid funds is calculated for 365 days (including Sundays) while for others, only business days are considered.

-

Tax-Saving Funds

ELSS or Equity Linked Saving Scheme, over the years, have climbed up the ranks among all categories of investors. Not only do they offer the benefit of wealth maximisation while allowing you to save on taxes, but they also come with the lowest lock-in period of only three years. Investing predominantly in equity (and related products), they are known to generate non-taxed returns in the range 14-16%. These funds are best-suited for salaried investors with a long-term investment horizon.

-

Interested in Stock Market trading? Enrol now to start your journey with Entri!

-

-

Aggressive Growth Funds

Slightly on the riskier side when choosing where to invest in, the Aggressive Growth Fund is designed to make steep monetary gains. Though susceptible to market volatility, one can decide on the fund as per the beta (the tool to gauge the fund’s movement in comparison with the market). Example, if the market shows a beta of 1, an aggressive growth fund will reflect a higher beta, say, 1.10 or above.

-

-

-

Capital Protection Funds

If protecting the principal is the priority, Capital Protection Funds serves the purpose while earning relatively smaller returns (12% at best). The fund manager invests a portion of the money in bonds or Certificates of Deposits and the rest towards equities. Though the probability of incurring any loss is quite low, it is advised to stay invested for at least three years (closed-ended) to safeguard your money, and also the returns are taxable.

-

Fixed Maturity Funds

Many investors choose to invest towards the of the FY ends to take advantage of triple indexation, thereby bringing down tax burden. If uncomfortable with the debt market trends and related risks, Fixed Maturity Plans (FMP) – which invest in bonds, securities, money market etc. – present a great opportunity. As a close-ended plan, FMP functions on a fixed maturity period, which could range from one month to five years (like FDs). The fund manager ensures that the money is allocated to an investment with the same tenure, to reap accrual interest at the time of FMP maturity.

-

Pension Funds

Putting away a portion of your income in a chosen pension fund to accrue over a long period to secure you and your family’s financial future after retiring from regular employment can take care of most contingencies (like a medical emergency or children’s wedding). Relying solely on savings to get through your golden years is not recommended as savings (no matter how big) get used up. EPF is an example, but there are many lucrative schemes offered by banks, insurance firms etc.

-

-

Based on Structure

Mutual funds are also categorised based on different attributes (like risk profile, asset class, etc.). The structural classification – open-ended funds, close-ended funds, and interval funds – is quite broad, and the differentiation primarily depends on the flexibility to purchase and sell the individual mutual fund units.

-

-

Open-Ended Funds

Open-ended funds do not have any particular constraint such as a specific period or the number of units which can be traded. These funds allow investors to trade funds at their convenience and exit when required at the prevailing NAV (Net Asset Value). This is the sole reason why the unit capital continually changes with new entries and exits. An open-ended fund can also decide to stop taking in new investors if they do not want to (or cannot manage significant funds).

-

Closed-Ended Funds

In closed-ended funds, the unit capital to invest is pre-defined. Meaning the fund company cannot sell more than the pre-agreed number of units. Some funds also come with a New Fund Offer (NFO) period; wherein there is a deadline to buy units. NFOs comes with a pre-defined maturity tenure with fund managers open to any fund size. Hence, SEBI has mandated that investors be given the option to either repurchase option or list the funds on stock exchanges to exit the schemes.

-

Interval Funds

Interval funds have traits of both open-ended and closed-ended funds. These funds are open for purchase or redemption only during specific intervals (decided by the fund house) and closed the rest of the time. Also, no transactions will be permitted for at least two years. These funds are suitable for investors looking to save a lump sum amount for a short-term financial goal, say, in 3-12 months.

-

-

Based on Risk

-

Very Low-Risk Funds

Liquid funds and ultra-short-term funds (one month to one year) are known for its low risk, and understandably their returns are also low (6% at best). Investors choose this to fulfil their short-term financial goals and to keep their money safe through these funds.

-

Low-Risk Funds

In the event of rupee depreciation or unexpected national crisis, investors are unsure about investing in riskier funds. In such cases, fund managers recommend putting money in either one or a combination of liquid, ultra short-term or arbitrage funds. Returns could be 6-8%, but the investors are free to switch when valuations become more stable.

-

Medium-risk Funds

Here, the risk factor is of medium level as the fund manager invests a portion in debt and the rest in equity funds. The NAV is not that volatile, and the average returns could be 9-12%.

-

High-Risk Funds

Suitable for investors with no risk aversion and aiming for huge returns in the form of interest and dividends, high-risk mutual funds need active fund management. Regular performance reviews are mandatory as they are susceptible to market volatility. You can expect 15% returns, though most high-risk funds generally provide up to 20% returns.

-

Also read: What Is the Difference Between ELSS and Mutual Funds?

-

Specialized Mutual Funds

-

Sector Funds

Sector funds invest solely in one specific sector, theme-based mutual funds. As these funds invest only in specific sectors with only a few stocks, the risk factor is on the higher side. Investors are advised to keep track of the various sector-related trends. Sector funds also deliver great returns. Some areas of banking, IT and pharma have witnessed huge and consistent growth in the recent past and are predicted to be promising in future as well.

-

Index Funds

Suited best for passive investors, index funds put money in an index. A fund manager does not manage it. An index fund identifies stocks and their corresponding ratio in the market index and put the money in similar proportion in similar stocks. Even if they cannot outdo the market (which is the reason why they are not popular in India), they play it safe by mimicking the index performance.

-

Is forex trading your cup of tea? Enrol now at our Forex trading course to attain financial freedom!

-

-

Funds of Funds

A diversified mutual fund investment portfolio offers a slew of benefits, and ‘Funds of Funds’ also known as multi-manager mutual funds are made to exploit this to the tilt – by putting their money in diverse fund categories. In short, buying one fund that invests in many funds rather than investing in several achieves diversification while keeping the cost down at the same time.

-

Emerging market Funds

To invest in developing markets is considered a risky bet, and it has undergone negative returns too. India, in itself, is a dynamic and emerging market where investors earn high returns from the domestic stock market. Like all markets, they are also prone to market fluctuations. Also, from a longer-term perspective, emerging economies are expected to contribute to the majority of global growth in the following decades.

-

-

-

International/ Foreign Funds

Favoured by investors looking to spread their investment to other countries, foreign mutual funds can get investors good returns even when the Indian Stock Markets perform well. An investor can employ a hybrid approach (say, 60% in domestic equities and the rest in overseas funds) or a feeder approach (getting local funds to place them in foreign stocks) or a theme-based allocation (e.g., gold mining).

-

Global Funds

Aside from the same lexical meaning, global funds are quite different from International Funds. While a global fund chiefly invests in markets worldwide, it also includes investment in your home country. The International Funds concentrate solely on foreign markets. Diverse and universal in approach, global funds can be quite risky to owing to different policies, market and currency variations, though it does work as a break against inflation and long-term returns have been historically high.

-

Real Estate Funds

Despite the real estate boom in India, many investors are still hesitant to invest in such projects due to its multiple risks. Real estate fund can be a perfect alternative as the investor will be an indirect participant by putting their money in established real estate companies/trusts rather than projects. A long-term investment negates risks and legal hassles when it comes to purchasing a property as well as provide liquidity to some extent.

-

Commodity-focused Stock Funds

These funds are ideal for investors with sufficient risk-appetite and looking to diversify their portfolio. Commodity-focused stock funds give a chance to dabble in multiple and diverse trades. Returns, however, may not be periodic and are either based on the performance of the stock company or the commodity itself. Gold is the only commodity in which mutual funds can invest directly in India. The rest purchase fund units or shares from commodity businesses.

-

Market Neutral Funds

For investors seeking protection from unfavourable market tendencies while sustaining good returns, market-neutral funds meet the purpose (like a hedge fund). With better risk-adaptability, these funds give high returns where even small investors can outstrip the market without stretching the portfolio limits.

-

-

-

Inverse/Leveraged Funds

While a regular index fund moves in tandem with the benchmark index, the returns of an inverse index fund shift in the opposite direction. It is nothing but selling your shares when the stock goes down, only to repurchase them at an even lesser cost (to hold until the price goes up again).

-

Asset Allocation Funds

Combining debt, equity and even gold in an optimum ratio, this is a greatly flexible fund. Based on a pre-set formula or fund manager’s inferences based on the current market trends, asset allocation funds can regulate the equity-debt distribution. It is almost like hybrid funds but requires great expertise in choosing and allocation of the bonds and stocks from the fund manager.

-

Gift Funds

Yes, you can also gift a mutual fund or a SIP to your loved ones to secure their financial future.

-

Exchange-traded Funds

It belongs to the index funds family and is bought and sold on exchanges. Exchange-traded Funds have unlocked a new world of investment prospects, enabling investors to gain extensive exposure to stock markets abroad as well as specialised sectors. An ETF is like a mutual fund that can be traded in real-time at a price that may rise or fall many times in a day.

-

| Gain Financial Literacy in your Mother Tongue | |

| Stock Market Course in Malayalam | Mutual Funds Course in Malayalam |

| Stock Market Course in Tamil | Mutual Funds Course in Tamil |

| Stock Market Course | Mutual Funds Course |

Mutual Fund Terminologies

1. Net Asset Value (NAV)

NAV is basically the price of one share of the mutual fund. Think of it in this way: When you buy a mutual fund, you are actually buying a piece of that fund. The NAV tells you what is the price of that piece at the end of the trading day. The formula for NAV is as follows:

sum of value of everything it owns(stocks, bonds, etc.) / number of shares

So, if the NAV goes up, the fund’s value is also going up and vice-versa.

2. Expense Ratio

The expense ratio in mutual funds refer to the fees that is required for managing the fund that you invested. For example, if you have invested ₹1000 and the expense ratio is 1%, around ₹10 would be deducted as expenses. It includes expenses like fund manager’s salary, research, and other cost. You’ll be able to benefit more if the expense ratio is less, as higher expense ratios may eat up your returns.

3. Assets Under Management (AUM)

AUM is the total amount of money that a mutual fund manages for all its investors. Imagine a large pool filled with everyone’s money. The more people invest, the higher the value of AUM. This helps to show how big or small the fund is.

Source: Mordor Intelligence

4. Asset Management Company (AMC)

AMCs are the companies that create and manage mutual funds. AMC is regarded as the ‘boss’ of mutual funds, as it decides which investments to buy or sell along with managing day-to-day operations, and making sure everything runs smoothly. Some of the well-known AMCs in India are:

- HDFC Asset Management Company

- ICICI Prudential Asset Management Company

- SBI Mutual Fund

- Axis Mutual Fund

- Kotak Mahindra Asset Management

5. Systematic Investment Plan (SIP)

SIP is a method to invest in mutual funds regularly, like putting aside a specific amount for investing once every one month. Instead of investing a lumpsum amount, you can set a fixed amount (like ₹500 or ₹1000) and the mutual fund automatically deducts it form your bank every month to buy units of the fund. Since you’ll be investing regularly, you can leverage something known as rupee cost averaging, wherein more units are bought when the price is low and vice-versa.

6. Systematic Transfer Plan (STP)

STP is for transferring your fund in one mutual fund to another one. For example, if you have money in a low-risk fund, but you want to move it to a high-risk one. In this case, you can set up an STP to transfer a fixed amount of money regularly instead of moving it altogether. This is considered to be less stressful, as you don’t have to time the market or anything as such.

As the name suggests, SWP allows you to withdraw a certain amount regularly without putting everything on the line. It’s like getting a regular pay check from your mutual fund without having to sell everything at once.

8. Asset allocation

Asset allocation is the process/strategy of diversifying your investment portfolio across various asset categories such as equity, bonds, cash, gold, etc. For example, a mutual fund may invest 60% of you money in a stocks (riskier, but higher returns) and 40% in bonds (less risky, lower returns). The major goal is to spread the risk, so that even if one type of investment doesn’t work, the other would serve as a backup.

9. Bonds

These are loans given to companies or government. When you invest in a mutual fund that holds bonds, you are essentially lending money to entities for a fixed amount of time. In return, an interest is paid to you, along with the full capital at the end of the loan period. Bonds are usually safer and provides you a steady modest income as compared to stocks.

10. Bear Market

It is a period when prices of most stocks and investments are falling, usually by 20% or more. Investors get tensed and start selling off their stocks and shares at a low price, resulting in a cumulative low price spread across the market. However, some people consider this as a good time, to buy more especially when the prices are low.

Also read: Performance Evaluation of Mutual Funds

11. Bull Market

To put it simply, the opposite of bear market. It is a period when when prices are going up and the market is doing really well. The investors tend to be optimistic and keep buying more, resulting in an increase in the price of the entities.

12. Benchmark

Benchmarks are like a measuring stick, used to gauge the performance of a specific fund. It is usually an index, like the Nifty 50 or Sensex, which represents the overall market or a specific type of investment. To understand, check if your mutual fund is better or worse than the index. If it’s better, it means the fund is doing well and vice-versa.

13. New Fund Offer (NFO)

NFO is essentially the launch of a new mutual fund. It offers investors a one-time subscription option, where the fund can be acquired in a special introductory price. Think of it like a “grand inauguration” of a new mutual fund store! After the NFO period, the funds start trading at its market price based on the value of the investments.

14. Capital Gains

Capital gains are the profits you make, when the value of the investments goes up and you sell it. For instance, if a stock is bought at ₹100 and then sells it for ₹150, the ₹50 is the profit or the capital gain in this context. There are two types of capital gains:

- Long-term capital gains: If you hold the fund for a longer period (more than 3 years), the profit is long-term and the taxes are lower.

- Short-term capital gains: Selling the fund within 3 years, the profit is considered as short-term and the taxes are higher.

15. Exit Load

An exit load is the fee that you pay when you sell your mutual fund investment before a certain period. It is usually a small percentage that will be deducted so that it discourages people from buying and selling too quickly. The exit load is usually low, like 1%, but is considered as a penalty for not holding on to your investment.

16. Liquid Funds

These type of investments are short-term and mainly invests in safe, low-risk instruments like government securities or short-term bonds. They offer short-term savings account for your money with a potential for slightly higher returns and a quick access to it as well.

17. Lock-In Period

A lock-in period is the time during which you cannot sell or withdraw from a mutual fund. For example, if you are opting for a fund with a 3 year lock-in period, you cannot take out the money until 3 years is done. This is usually seen in ELSS, which are tax-saving mutual funds. This period makes sure that investors stay for a longer time and let the mutual fund grow.

18. Cut-off Time

Cut-off time is a fixed deadline by which you need to put up your investment or sale request for it to, be processed in the same day pricing. For example, if your cut-off time is at 4 pm and you place an order before 4, your purchase or sale will be done in the same-day pricing. If it is after 4, the next day’s pricing will be considered.

Also read: Mutual funds vs Fixed Deposits: Which is better?

Mutual Funds; Now or Never

By now you would have an idea as to what all types of mutual funds are out there. We suggest that you bookmark this so that you can always refer when in doubt. Also, the terminologies may seem a bit complex, but if you put your heart into, you can easily strike a fortune! (quite literally!) Now is the best time to start investing and create your journey into financial freedom. If you lack the motivation, think about how your life would have been if you risk a bit.

All investment types and platforms advice to research and study on the investment type before trading. Mutual funds come with calculated and uncalculated risks and having a mind that can understand this is the fundamental necessity for this venture. We suggest that you check out our mutual funds course from Entri with industry experts and top-notch materials to guide you in this journey. So why wait? Enrol now and earn more.