Table of Contents

Every month, you work hard, and in return, your employer sends you a paycheck. It’s that satisfying moment when you see money credited to your bank account. But here’s the question: do you really understand your paycheck? Most people don’t look beyond the credited amount, missing out on important details about deductions, allowances, and how much they could actually save or invest.

A paycheck is more than just your salary; it’s a breakdown of your financial relationship with your employer. Understanding it helps you track your earnings, plan your expenses, and make smarter investment choices. In this guide, we’ll decode each component of your paycheck, discuss your rights as an employee, and show you how you can use this knowledge to grow your wealth.

And here’s the kicker: knowing how to read your paycheck is the first step, but learning how to manage and invest it wisely is the real game-changer. That’s where Entri’s Mutual Fund Course can help you make your hard-earned money work for you.

Key Takeaways:

- Your paycheck is more than your credited salary; it’s a financial statement of earnings and deductions.

- Understanding it helps in budgeting, tax savings, and avoiding payroll errors.

- Employer contributions, though invisible in net pay, add value to your total compensation.

- Investing a portion of your paycheck, especially in mutual funds, can lead to long-term financial security.

Master stock trading with us. Enroll now for a free demo!

What is a Paycheck?

1: What is a stock?

A paycheck is the document (or digital statement) you receive from your employer that shows how much you earned for a specific pay period, along with all the deductions, taxes, and contributions applied before you receive the final amount, your net pay.

Today, most companies use direct deposit, meaning you don’t physically receive a paper check, but you do get a salary slip or pay stub to review the details.

Why Understanding Your Paycheck Matters

Many employees overlook the details of their paycheck, but knowing what’s inside is crucial for:

-

Budgeting – You can plan expenses and savings better.

-

Tax Planning – You understand how much you pay in taxes and if you’re eligible for refunds.

-

Spotting Errors – Payroll mistakes happen, and they can cost you money if unnoticed.

-

Investment Decisions – Helps in determining how much surplus you can invest monthly.

Components of a Paycheck

Your paycheck contains several elements, and understanding each is key. Let’s break them down:

1. Gross Pay

This is your total earnings before any deductions. It includes:

-

Basic Salary – The fixed portion of your earnings.

-

Allowances – Such as House Rent Allowance (HRA), Travel Allowance, and Dearness Allowance (DA).

-

Bonuses or Incentives – Performance-based earnings.

2. Deductions

Deductions are the amounts subtracted from your gross pay to arrive at your net pay. Common deductions include:

-

Taxes – Income tax (TDS), Professional Tax.

-

Provident Fund (PF) – Your contribution towards retirement savings.

-

Insurance Premiums – Health or life insurance, if provided by your employer.

-

Loan Repayments – If you’ve taken any advances or loans from the employer.

3. Net Pay (Take-Home Salary)

This is the amount that actually gets credited to your account after all deductions. It’s the figure you likely focus on, but remember, understanding how it’s calculated is equally important.

4. Employer Contributions

Some benefits don’t show up in your net pay but are part of your total compensation, like:

-

Employer’s contribution to PF.

-

Health insurance premiums paid by your company.

-

Gratuity (payable after certain years of service).

How to Read Your Pay Stub

Here’s a step-by-step approach:

-

Check Personal Details – Your name, employee ID, and pay period should be correct.

-

Review Gross Pay – Ensure all components match your offer letter.

-

Verify Deductions – Cross-check tax, PF, and other contributions.

-

Calculate Net Pay – Confirm it matches what you received in your bank account.

-

Track Year-to-Date (YTD) Earnings – This shows your cumulative salary for the financial year.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreCommon Paycheck Terms You Should Know

| Term | Meaning | Why It’s Important |

|---|---|---|

| Basic Salary | Core fixed salary | Basis for calculating benefits |

| HRA | House Rent Allowance | Can reduce taxable income |

| TDS | Tax Deducted at Source | Part of your income tax |

| PF | Provident Fund | Retirement savings |

| CTC | Cost to Company | Total employer expenditure on you |

How Taxes Affect Your Paycheck

Your paycheck is directly impacted by taxation rules. In India, for example:

-

Your income is taxed according to slabs.

-

HRA, LTA (Leave Travel Allowance), and certain allowances can reduce taxable income.

-

Investing in ELSS mutual funds, PF, or NPS can help save tax.

Tips to Increase Your Take-Home Pay

-

Opt for Tax-Friendly Allowances – Restructure salary to maximise HRA, meal coupons, etc.

-

Claim Investments Under Section 80C – Up to ₹1.5 lakh deduction annually.

-

Avoid Unnecessary Deductions – Review insurance and loan repayments.

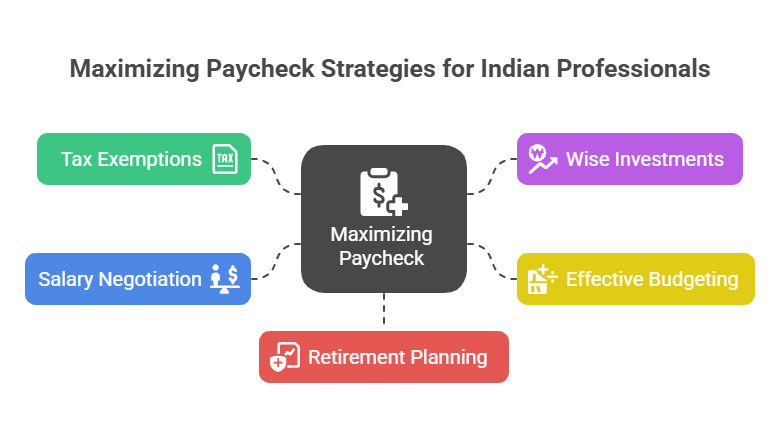

How to Maximize Your Paycheck

Understanding your paycheck is the first step; optimizing it is the next. Here are actionable strategies to boost your take-home pay and financial health, with a focus on Indian and NRI professionals.

1. Leverage Tax Exemptions (India)

- HRA Exemption: Claim HRA if renting (e.g., ₹20,000/month exempt if rent exceeds 10% of basic salary).

- Section 80C: Invest ₹1.5 lakh/year in ELSS, PPF, or NSC to reduce taxable income.

- Section 80D: Claim up to ₹25,000/year for health insurance premiums.

Example: A ₹12 lakh/year earner saves ₹30,000 in taxes via 80C and 80D deductions.

Tip: Consult a CA or use ITR filing apps like ClearTax.

2. Invest Wisely with Entri’s Mutual Fund Course

- Why Invest?: Channel 20% of your net salary into mutual funds for wealth creation, with 12–15% returns possible (AMFI, 2025).

- Entri’s Role: Entri’s Mutual Fund Course teaches fund selection, SIPs, and risk management, ideal for Kerala or Dubai-based professionals.

- Example: Investing ₹10,000/month in an equity fund via SIP could grow to ₹15 lakh in 10 years at 12% CAGR.

- Course Benefits: ₹5,000–15,000 fees, online access, AMFI-aligned certification.

- Tip: Start with diversified equity funds for long-term growth.

3. Budget Effectively

- 50/30/20 Rule: 50% for essentials (rent, groceries), 30% for lifestyle, 20% for savings/investments.

- Example: For a ₹83,800 net salary, allocate ₹41,900 (essentials), ₹25,140 (lifestyle), and ₹16,760 (savings).

- Tip: Use apps like Moneycontrol to track expenses.

4. Negotiate Your Salary

- Strategy: Highlight skills in your current role and negotiate with emlpoyer.

- Example: An IT professional in India negotiated a 10% raise, increasing salary from 10 LPA to 12 LPA

- Tip: Research market salaries on Glassdoor.

5. Plan for Retirement

- India: Maximize EPF contributions; consider NPS for additional tax benefits under Section 80CCD.

- Middle East: Save gratuity and invest in mutual funds via Entri’s course for post-return planning.

- Tip: Check PF balance regularly via EPFO’s portal.

From Paycheck to Prosperity: The Investment Mindset

Most people stop at receiving and spending their paycheck. But if you want to grow financially, you need to start investing early.

Here’s where Entri’s Mutual Fund Course comes in. It teaches you:

-

How to budget from your paycheck.

-

How to identify the right mutual funds based on your goals.

-

How to create a diversified investment portfolio.

-

How to balance risk and reward for long-term growth.

Instead of letting your paycheck sit idle in a savings account, investing in mutual funds can help you build wealth over time.

Example: How Investing From Your Paycheck Works

Let’s say your take-home salary is ₹50,000/month. You decide to invest ₹5,000 each month in a mutual fund with an average annual return of 12%.

After 10 years, your investment could grow to over ₹11 lakh, just from allocating 10% of your paycheck!

Conclusion

A paycheck isn’t just about money hitting your account; it’s about understanding where it comes from, where it goes, and how you can make it work for you. By reading your pay stub carefully, optimising deductions, and investing wisely, you can turn your salary into a powerful wealth-building tool.

With Entri’s Mutual Fund Course, you’ll gain the knowledge to transform your paycheck into a stepping stone toward financial freedom. Remember, understanding your earnings is the first step; putting them to work is the next.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What is a paycheck?

A paycheck is the payment an employee receives from their employer, usually in exchange for work done during a specific pay period. It may be issued as a paper cheque or a direct deposit.

What details are included in a paycheck?

A paycheck typically includes your gross pay, deductions (taxes, insurance, retirement contributions), and net pay (the amount you take home).

What is the difference between gross pay and net pay?

Gross pay is the total amount you earn before deductions, while net pay is the amount you actually receive after all deductions are applied.

Why are taxes deducted from my paycheck?

Taxes are deducted to comply with government regulations and fund public services such as infrastructure, healthcare, and education.

What is a pay check, and why is it important?

A pay stub is a document attached to your paycheck that shows earnings and deductions. It helps you track your income, verify accuracy, and plan finances better.

How often are paychecks issued?

Pay frequency depends on company policy, common schedules include weekly, bi-weekly, semi-monthly, or monthly payments.

Why is my paycheck smaller than expected?

A smaller paycheck may be due to higher tax withholding, insurance premiums, retirement contributions, or unpaid leave deductions.

How can I increase my take-home pay?

You can adjust your tax withholding, reduce voluntary deductions, earn overtime, or negotiate a raise.

What role does financial literacy play in paycheck management?

Understanding how to read your paycheck helps you budget effectively, save for goals, and invest wisely, such as through mutual funds.

How can the Entri Mutual Fund Course help me manage my earnings better?

The Entri Mutual Fund Course teaches you how to invest your earnings smartly, grow your wealth, and achieve long-term financial stability.