Table of Contents

Key Takeaways:

India is seeing a paradigm shift in how retail investors interact with markets, one powered by the combination of artificial intelligence (AI) and open trading platforms. At the heart of this revolution is the integration of Perplexity, an AI-powered answer engine and browser, with Zerodha’s Model Context Protocol (MCP). This isn’t just a technical upgrade, it’s a reimagining of what research, insight, and trading can look like for millions of investors, from beginners to power users.

This post explains the Perplexity as a research co-pilot, AI integrations and trading, security, user sentiment ,and broad market implications. Whether you are an investor, fintech enthusiast, or just curious about the future of trading, this is your briefing.

Start investing like a pro. Enroll in our Stock Market course!

What is Perplexity AI?

Perplexity AI isn’t a search engine – it’s an “answer engine” that provides precise AI-driven answers to complex questions. Founded by Indian-origin CEO Aravind Srinivas, Perplexity uses large language models to synthesize information from the web and deliver concise answers with sources cited for transparency. Recently, the platform expanded into verticals like Perplexity Finance, which now has real-time data on Indian stocks from the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).

Key features of Perplexity Finance:

- Live Stock Prices and Historical Data: Downloadable charts and Excel models to track price movements.

- Case Analysis: AI-generated summaries of key market issues.

- Earnings Transcripts and News Synthesis: Real-time updates on company earnings and market news.

- Natural-Language Queries: Ask questions like “What’s the bull case for Reliance Industries?” and get instant answers.

Over 15 million users have switched to Perplexity Labs for its MCP-integrated stack, and the platform is becoming an enterprise-grade tool for productivity and finance. The recent India-focused launch and free Pro access for Airtel subscribers a signs of the company’s intent to capture the Indian market.

What Is Kite MCP and How Does It Work?

1: What is a stock?

Zerodha’s Kite Model Context Protocol (MCP) is an open standard designed for the next era of intelligent trading. With MCP, AI tools like Perplexity (Comet), Claude, and Cursor can securely connect to your Zerodha account, totally free, and deliver context-rich, personalized insights on your portfolio and the live market. Unlike old-school dashboards, insights aren’t generic; they’re tailored to your unique positions, goals, and questions.

What can AI assistants do via MCP?

-

Fetch live prices and news

-

Analyze sector and stock diversification

-

Identify top gainers and laggards

-

Set alerts or back-test strategies, all in plain, everyday language

All access is strictly read-only, protected with strong authentication (like Zerodha OAuth2 and 2FA), so you have full security and control.

What’s Brewing: Perplexity × Zerodha Potential

A recent social media spark ignited a conversation between Perplexity AI’s CEO, Aravind Srinivas, and Zerodha’s co-founder Nikhil Kamath about integrating Zerodha’s live trading data directly into Perplexity’s Comet platform.

What could this mean for users?

-

Direct access to up-to-the-minute Indian market data inside Perplexity

-

Natural language queries like “Break down my biggest holdings” or “Am I overweight banking stocks?”

-

Trend detection and comparison to benchmark indices in real time

-

Personalized trading ideas, without switching between dashboards, jargon, or multiple apps

Why Is This a Gamechanger?

Before: Investment research meant toggling between dashboards, news apps, PDFs, and Excel sheets, painful and fragmented.

Now: You can converse with your portfolio, getting a summary, context, and guidance instantly. Perplexity aims to be your research co-pilot, not your trading boss. Every recommendation is transparent, with links to fact-check and drill deeper.

User-First Examples

Scenario 1:

Arjun, a new investor, wants to understand his ₹50,000 portfolio:

-

Without MCP+Perplexity: He manually checks each holding, switches tabs, and gets lost in details

-

With MCP+Perplexity: He asks, “Show my top 5 holdings by value and sector. Am I beating the Nifty?” and gets an immediate, clear answer plus a visual report

Scenario 2:

Riya wants to plan a trade around market momentum. She asks:

-

“Which Nifty 50 stocks are seeing a volume surge and could break out?” Comet instantly fetches live data, analyzes price trends, and suggests actionable entry points.

Security & Simplicity

-

Read-only Access: No credentials stored by AI; the connection uses secure protocols and two-factor authentication.

-

User Control: Only the data you’re comfortable sharing is analyzed, with no accidental trades.

-

Beginner-Friendly: You don’t need to code or be a market expert. The power of AI meets plain English queries for an accessible trading experience.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreThe Broader Impact: User Segments, Market Ripples, and Competitive Dynamics

For Novices and Beginners

-

Safe Learning Zone: Novice investors can ask questions (“What does my portfolio performance say about risk?”) in plain language, receive clear, charted answers, and cross-verify sources immediately.

-

Faster Onboarding: No jargon or manual spreadsheeting, just conversational insight, lowering the intimidation factor.

-

Controlled Experimentation: All AI access is read-only and under user control, making it ideal for learning and experimentation.

For Power Users and F&O Traders

-

Alpha Seekers: High-frequency traders, especially those handling large F&O positions, crave real-time, bespoke insights. MCP + Perplexity offers them the ability to slice, dice, and backtest positions as fast as the market moves.

-

Workflow Efficiency: Cutting time spent across multiple research tools means faster, better trading decisions, and a real competitive edge.

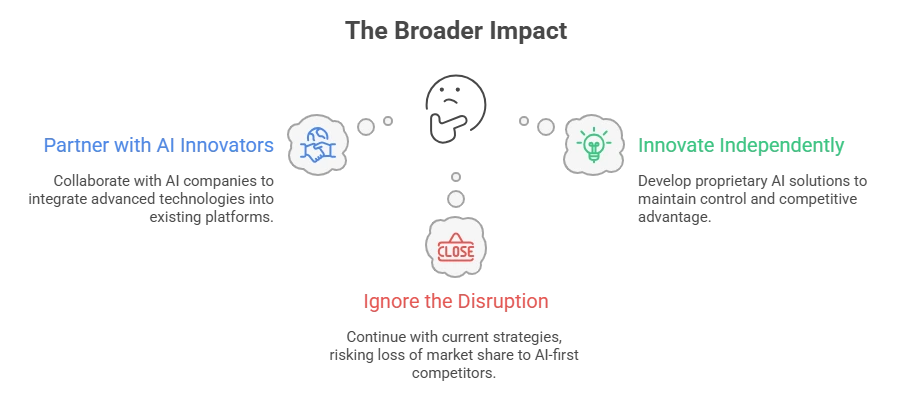

For Financial Institutions and Legacy Brokers

-

Disruption Warning: The open standard means anyone, be it Perplexity, Claude, or the next-gen AI engine, can build cross-platform co-pilots. Forward-thinking brokers will partner or innovate quickly, or risk losing power users to flexible AI-first competitors.

-

Example from Abroad: Robinhood’s “Cortex” AI in the US has already shown the power of embedded research bots, setting a benchmark for Indian brokers to emulate.

Looking Ahead: AI, Open Standards, and Next-Gen Trading

-

The Comet Browser: Perplexity is not just a trading AI but a full browser with finance-specific modules, including watchlists, price alerts, and instant cross-market comparisons.

-

Bigger Ambitions: With bids for browser market share and persistent expansion globally, Perplexity aims to be the new research hub for the world.

-

Open Future: Open standards like MCP mean that today’s innovation in India could soon be the global template, where your favorite AI connects to any broker, anywhere, elevating user experience and putting decision-making back in your hands.

Benefits of AI Insights in Trading

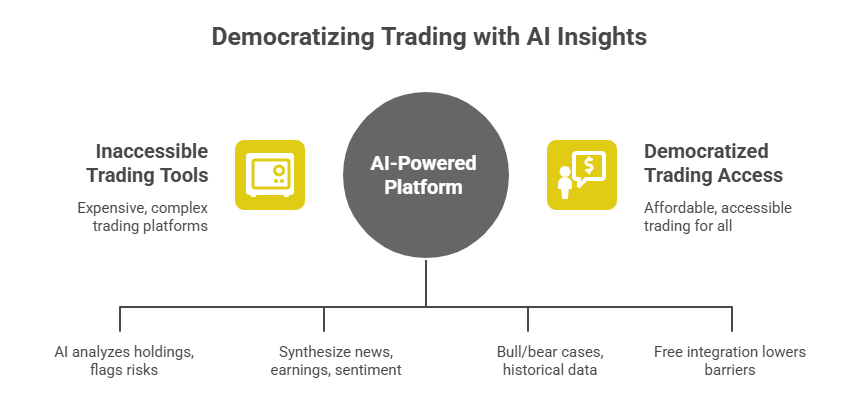

The real magic lies in how this duo is democratizing sophisticated trading tools. Traditional platforms like Bloomberg terminals cost thousands, but Perplexity × Zerodha MCP offers similar capabilities for free or at low cost.

Personalized Portfolio Management

- AI analyzes your holdings in real-time, flagging risks like overexposure to a sector.

- Get custom recommendations, such as “Based on your Zerodha portfolio, consider adding mid-cap stocks for better diversification.”

Real-Time Market Intelligence

- Synthesize news, earnings calls, and sentiment analysis instantly.

- Features like price alerts and natural-language screening (e.g., “Find NSE stocks with P/E under 15 and growing revenue”) make research effortless.

Enhanced Decision-Making

- Bull/bear cases help weigh pros and cons without bias.

- Historical data visualization aids in spotting patterns, potentially improving returns.

Accessibility for All

- Ideal for India’s 100+ million retail investors, many of whom are new to trading.

- Free MCP integration lowers barriers, fostering financial literacy.

Users are already raving about the potential, with requests for deeper integrations flooding timelines. One trader noted it could turn Perplexity into a “one-stop investment cockpit” for India.

Watch the blog content in video format here:

Conclusion: A New Era of Smart Trading

The Perplexity × Zerodha MCP collaboration is more than a tech tie-up, it’s a revolution in how we trade. By fusing AI insights with real brokerage data, it empowers users to make informed decisions faster and smarter. If you’re a Zerodha user, keep an eye on updates for native integration; for Perplexity fans, dive into Finance today.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What is MCP?

It’s an open protocol that allows AI assistants to securely access your live Zerodha portfolio and market data for real-time analysis, all in a read-only mode.

What will Perplexity (Comet) be able to do with Zerodha data?

It can summarize your holdings, analyze trends, detect risks, answer questions, and suggest strategies using natural language, all powered by real-time market data.

Is zerodha x perplexity integration safe?

Yes. All data shared is strictly read-only, accessed via Zerodha’s secure protocols. No credentials are stored, and trades can’t be executed by AI unless expressly authorized for GTT orders.

How does this benefit beginners?

Beginners can get portfolio breakdowns, learn sector diversification, and receive trade planning guidance through simple conversation, no market jargon required.

Will there be any costs for users?

Zerodha’s MCP is free for users. Future AI integrations may offer both free and premium features.

How does Perplexity ensure data privacy?

No, login details are never handled by AI. Access is provided only with user consent and through encrypted channels.

Can I place trades using Perplexity and MCP?

By default, AI can’t place trades. For any execution, explicit GTT (Good Till Triggered) instructions will be required.

How does this make investing less intimidating?

It lets you interact with your portfolio in simple language, understand risks and opportunities instantly, and make decisions confidently, even if you’re just getting started.

Can I use Perplexity with other brokers?

Currently, MCP is built for Zerodha, but as standards grow, more brokers may join for wider AI tool compatibility.