Table of Contents

If you are an active trader or investor, it is essential to understand what is a Settlement Holiday. It is essential to know settlement holidays otherwise you might have to face unexpected delays in fund transfers and share deliveries. These holidays might not be aligned with normal trading holidays. Even then, these holidays have the ability to affect the timing of your transactions. In this blog, we will discuss what is a settlement holiday, how it affects trading, and how to remain informed about it throughout a calendar year.

Click here to learn more about the stock market course offered by Entri Elevate!

Settlement Holiday: Introduction

The stock market is a fast-paced and ever-changing world. So, it is natural that timing is very crucial in this sector. This is why experienced traders plan their trading activities around settlement cycles. They carry out transactions typically during T+1 or T+2 days (Trade date plus 1 or 2 days). However, what happens when an unexpected delay occurs due to a day when the back-end financial operations are halted?

This is a scenario in which a settlement holiday is important. Even though overlooked most of the time, settlement holidays can have a significant impact on all the following things.

- Trading Strategies

- Fund Transfers

- Portfolio Management

Whether you are a seasoned trader or a beginner just testing the waters of trading and investing, it is important to understand the concept of settlement holidays so that you will never experience unexpected delays in your transactions. This will also help you navigate the stock market more smoothly and efficiently. In this blog, we will discuss.

What is a Settlement Holiday?

1: What is a stock?

A settlement holiday is a day on which institutions that are involved in settling trades are closed even if the stock market may or may not be open for trading. These institutes are listed in the table below.

| Entity | Role in Settlement | Examples |

| Clearing Corporations | · Match and confirm trades

· Manage risk and netting · Ensure timely settlement |

· NSCCL (India)

· DTCC (U.S.) |

| Depositories | · Hold securities in Demat form

· Transfer ownership of shares · Work with brokers and clearinghouses |

· CDSL (India)

· NSDL (India) |

| Banks | · Handle fund transfers between parties

· Settle money side of transactions · May act as clearing banks |

HDFC (India)

ICICI (India) SBI (India) JPMorgan (U.S.) BofA (U.S.) |

Let us look into how the process of settlement actually takes place.

- The actual exchange of cash and securities will not happen immediately after you buy or sell shares.

- Most of the settlement authorities follow the T+1 or T+2 settlement cycle. This means that the transaction you made is actually settled one or two business days after the trade date.

- The entire settlement process will be delayed if a settlement occurs within the above-discussed window. The settlement process will be pushed to the next working settlement day.

Examples of Settlement Holidays

Settlement holidays usually align with the following days:

- Bank holidays

- Religious holidays

- National celebrations

- Days when clearinghouses are not operational

| Date | Country/Exchange | Occasion | Market Open? | Settlement Processed? | Type of Holiday |

| October 2, 2025 | India (NSE/BSE) | Gandhi Jayanti | No | No | Trading & Settlement |

| November 1, 2025 | India (NSE/BSE) | Diwali (Balipratipada) | Yes (Special) | No | Settlement Holiday Only |

| April 14, 2025 | India (NSE/BSE) | Dr. Ambedkar Jayanti (Bank Holiday) | Yes | No | Settlement Holiday Only |

| January 26, 2025 | India (NSE/BSE) | Republic Day | No | No | Trading & Settlement |

| July 4, 2025 | U.S. (NYSE) | Independence Day | No | No | Trading & Settlement |

| October 13, 2025 | U.S. (NYSE) | Columbus Day (Bank Holiday) | Yes | No | Settlement Holiday Only |

| November 11, 2025 | U.S. (NYSE) | Veterans Day (Bank Holiday) | Yes | No | Settlement Holiday Only |

| December 25, 2025 | U.S./India | Christmas Day | No | No | Trading & Settlement |

There are some important factors to note when it comes to settlement holidays. Some of them are given below.

- The stock market is open for a special Muhurat trading session on the day of Diwali. However since it is a settlement holiday, trades executed on that day are settled on the next working day.

- Stock exchanges might remain open on bank holidays in the USA. But funds cannot be transferred across accounts, so settlement is deferred.

Impact of a Settlement Holiday on Investors

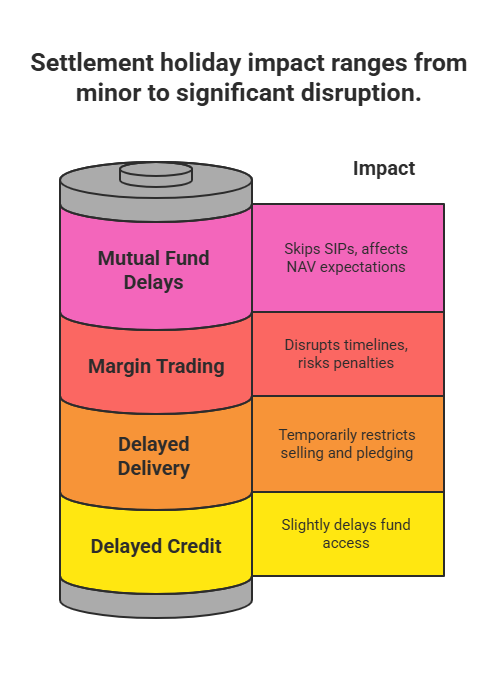

Settlement holidays may seem insignificant. But in reality, they can cause ripples across a trader’s portfolio or strategy. Some of them are mentioned in the table below.

| Impact Area | Effect | How It Affects Investors |

| Delayed Credit of Funds | Funds from share sales arrive later | · Delays in withdrawals

· Missed reinvestment opportunities · Issues with IPO or EMI payments |

| Delayed Stock Delivery | Bought shares appear late in the Demat account | · Can’t sell immediately

· Can’t pledge as collateral · Inaccurate portfolio tracking |

| Margin Trading Concerns | Settlement delay disrupts broker timelines | · Margin shortfall

· Risk of penalties or forced square-offs |

| Mutual Fund and SIP Delays | Processing of mutual fund units is delayed | · SIPs may be skipped or delayed

· NAV may differ from the expectation |

Settlement Holiday vs Trading Holiday

A comparison table of settlement holidays and trading holidays is provided below so that there is no misunderstanding of them to be the same. Read to understand both concepts better.

| Aspect | Settlement Holiday | Trading Holiday |

| Market Status | · Open

· You can trade as usual |

· Closed

· No trading session at all |

| Funds/Securities Transfer | · Not processed

· No clearing or delivery happens |

· Not processed

· Settlement paused due to full closure |

| Impact on T+1/T+2 Cycle | · Yes

· Delays fund credit and stock delivery by one working day |

· Yes

· The entire cycle is shifted |

| Stock Delivery Delay | · Shares bought appear late in Demat

· Can’t sell or use as collateral immediately |

Delivery delayed until after the market reopens |

| Funds Credit Delay | · Money from share sales arrives late

· Affects reinvestments, IPOs, EMIs |

No fund credit due to full market and bank closure |

| Intraday Trading | · Allowed

· Positions must be squared off on the same day |

· Not allowed

· No trading activity |

| Mutual Fund Impact | · SIPs may be skipped or delayed

· NAV may differ from the expected |

Orders not processed at all on the holiday |

| Margin Trading Impact | · A settlement delay may reduce the available margin

· Possible penalties/square-offs |

Margin positions cannot be initiated or closed |

| Bank Operations | · Usually closed

· No fund transfers |

· Usually closed

· All linked services shut |

| Examples (India) | · Diwali (2nd day)

· Ambedkar Jayanti (bank holiday) |

· Republic Day

· Gandhi Jayanti |

| Examples (U.S.) | · Columbus Day,

· Veterans Day (banks closed, market open) |

· Christmas Day

· Independence Day |

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreHow to Check Upcoming Settlement Holidays?

If you want to plan your trades and withdrawals effectively, then it is essential that you remain informed about settlement holidays, trade holidays etc. There are many ways in which you can do this. Some of them are listed below.

| Method | What to Do | Examples/Tools |

| Stock Exchange Websites | · Visit official exchange sites

· Check the settlement/trading calendar |

· NSE India

· BSE India |

| Brokerage Platforms | · Use broker apps or portals

· Look under holiday or support sections |

· Zerodha

· Groww · Upstox · ICICI Direct |

| Market Data Portals | · Follow financial news and calendars

· Many list exchange-specific holiday info |

· Moneycontrol

· TradingView · Economic Times Markets |

| Mobile Calendar Integration | · Sync holiday lists with personal calendars

· Get alerts directly on your phone |

· Google Calendar

· Apple Calendar |

Get the best mentors to learn from! Join the Entri Elevate Stock Market online course now!

Settlement Holiday: Conclusion

Being well-informed about the dates on which settlement holidays fall is crucial for everyone participating in the market. This is especially important if you are an active trader or investor managing cash flows or using a margin. You have to plan your trade activities around them because they can cause unexpected delays in stock deliveries and fund settlements. Such setbacks can severely affect your trading strategy or investment plans. Stay informed by consulting your broker or the official exchange calendar.

Disclaimer The information provided in this article is for general informational purposes only and is not intended as investment advice, financial guidance, or an offer or solicitation to buy or sell any securities. Stock data and financial figures are sourced from publicly available information and are believed to be accurate at the time of publication; however, we do not guarantee their accuracy or completeness. Past performance is not indicative of future results. Readers should conduct their own research or consult a qualified financial advisor before making any investment decisions. The author(s) and the publisher disclaim any liability for any loss or damage arising directly or indirectly from the use of or reliance on the information provided herein.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

Do mutual fund transactions get affected?

Yes. If the transaction date or NAV date coincides with a bank or settlement holiday, the unit allocation is processed on the next business day.

What happens if my T+1 settlement date falls on a holiday?

Settlement will roll over to the next available business day, causing a delay in fund or stock transfers.

Is intraday trading affected by settlement holidays?

No. Since intraday trades are squared off on the same day, they do not require settlement. However, you can’t convert them into delivery on such days.

Can I trade on a settlement holiday?

Yes, you can place buy or sell orders, but the actual delivery of stocks or credit of funds will be deferred to the next working settlement day.