Table of Contents

Most people often start to trade with a small account and then build their bankroll and skills as time goes by. It not only helps to limit the losses but helps to gain an experience to become more confident in this field. A small trading account requires you to make smarter stock selections since you don’t have as much capital to throw around. Embarking on a financial journey through trading often begins with a small account. The initial capital, however modest, signifies the first step towards building a potential fortune. However, growing a small trading account can be a challenging task, especially for novice traders. It requires strategic planning, understanding of the market dynamics, robust risk management, judicious use of leverage, and above all, patience and discipline. In this article, we are providing some important strategies to grow a small trading account.

What Is A Small Trading Account Strategy?

A small trading account strategy refers to the trading methods and risk management approach a trader can apply to grow a relatively small account. Starting trading with a small account means having to use leverage and making fewer trades. Thus, a small account strategy requires stringent risk management, patience, and discipline.

Trading on a small account with a small amount of capital requires a lot of work. So, you have to be patient and give yourself at least a few years if you expect to start seeing some decent profits. This means consistent hard work and paying attention to your risk management principles because any mistake can lead to blowing the trading account. It is easy to become overleveraged in pursuit of more profit, but being overleveraged can only lead to losses that exceed your initial capital.

How To Grow A Small Trading Account Successfully?

1: What is a stock?

If you want to grow a small trading account efficiently you must have right expectations, and being patient. To trade efficiently means to trade the right position size and with the right risk level. Below given are some important tips to grow a small trading account successfully:

- Gain live trading experience

- Don’t overtrade

- Define your risk management rules

- Trade only high-probability trade setups

- Increase your risk responsibly

- Let your winning trades run

- Cut your losing trades

- Stay on the trend as long as possible

- Follow market reports

- Have a technical reason to enter a trade

- Have a technical reason to close a trade

- Adjust your risk levels as your account grows

Master Stock Trading With Us – Enroll Here For A Free Demo!

Strategies For Growing A Small Trading Account

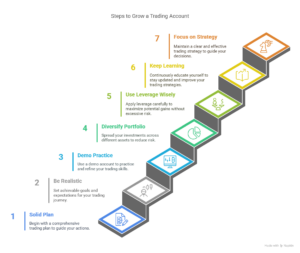

Start With A Solid Plan

Before diving into the markets, it’s crucial to have a well-thought-out trading plan. Your trading plan should encompass various elements, including your financial goals, risk tolerance, trading strategy, and a clear set of rules to follow. Your financial goals should be specific and realistic. Incorporate a risk management strategy into your plan. When you have a small trading account, preserving capital is essential.

Be Realistic

Being realistic means recognizing a few truths about trading with a small account. Most likely, your small trading account will be a practice account. It will help you hone your live trading skills, but you will not be making a living out of it any time soon. And, even if you do everything right, you will still need a long time to grow the small trading account to a size that matters.

Practice with a Demo Account

If you’re just starting out with trading—or trying out a new strategy—try your hand at it in a demo account first. That way, you can get a feel for how it works without risking any real capital. Demo accounts are a risk-free way to hone your skills and build confidence in your trading strategy. Many brokers offer them, and you can trade with virtual money. That gives you the freedom to test your strategy without worrying about losing real money.

| Achieve Financial Freedom with these courses? | |

| Stock Market Trading Course | |

| Forex Trading Course | |

| Mutual Funds Course |

Diversify Your Portfolio

Diversifying your portfolio is where the real magic happens in trading. It’s not just about trading different assets, but also about combining different strategies. Day trading, swing trading and long-term investing can work together in harmony. That balance can help you ride out a single losing trade without it taking a huge toll on your account. You can trade different stocks, commodities, currencies or time frames. And that diversity can really pay off.

Use Leverage Wisely

For small trading accounts, leverage is essential for accessing specific markets. But leverage is dangerous. Leverage can magnify both gains and losses. While it can be tempting to use high leverage to potentially grow your account faster, it can also lead to significant losses. It should not be used to increase the trade’s size (i.e. the number of shares), but should only be used to reduce the trade’s margin requirements. Misusing it can ruin your trading account, regardless of its size.

Keep Learning

It is crucial for the financial markets to evolve constantly and to stay informed. Market knowledge is a never-ending journey. Stay updated on market trends, economic indicators, and geopolitical events that can impact your trades. The world of finance is like a river, constantly flowing and changing. Dive into workshops, peruse the latest publications, or engage in trading discussions. Knowledge is your paddle in this river. This continuous learning process will enable you to adapt to changing market conditions effectively.

Focus On Your Trading Strategy

Having a well-defined trading strategy is essential for consistent success. Whether you’re a day trader, swing trader, or long-term investor, stick to your chosen strategy. Avoid chasing after hot tips or getting caught up in emotional decisions. Consistency and discipline are key to growing a small trading account.

Your trading strategy should include entry and exit rules, risk management guidelines, and clear criteria for trade selection. Test your strategy thoroughly in different market conditions before implementing it with real money.

Final Thought

Scaling a small trading account to a big portfolio in 2025 is not just about luck – it’s about being deliberate and disciplined with proven methods. Start with hands on trading to build confidence, pick selective trades over reckless volume and enforce solid risk management. Look for high probability trades, let your winners run and get out of losing trades fast to protect your capital. Stay with the trend, watch the reports and base every entry and exit on technicals. As your account grows adjust your risk wisely to keep the momentum. By committing to these principles, starting now and being consistent you can turn your small trading account into a money machine. The journey starts with your next trade – make it count! The refinement of your stock trading strategy frequently commences by investing time in specialized trading courses, which provide invaluable insights and techniques

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What is risk management?

It is a technique to help traders drastically reduce losses. Two very popular risk management tools are stop-losses and take-profit.

What qualities should stock traders have?

Two key qualities that stock traders should possess are discipline and resilience.

What are the factors that determine the price of the stock?

Price of the stock is normally determined by growth prospects and the profitability of the company. Normally, based on the attractiveness of the stock a P/E ratio is assigned by the market. Stock prices also depend on demand and supply as well as news flows.

How do I manage risk in a small trading account?

Risk management is crucial for small accounts. Use:

-

The 1% rule – Risk only 1% of your capital per trade

-

Stop-loss orders to limit losses

-

Position sizing to avoid overexposure

-

Diversification (avoiding putting all funds in one trade)

Is day trading or swing trading better for a small account?

- Day trading offers faster gains but requires active monitoring and may lead to more transaction fees.

-

Swing trading allows for holding trades longer, reducing the impact of trading fees.

-

Your choice should depend on your time availability, trading style, and risk tolerance.

How do I avoid overtrading?

Overtrading can deplete your account quickly. To prevent it:

-

Stick to a strict trading plan

-

Trade only high-quality setups

-

Avoid revenge trading after a loss

-

Set daily/weekly trade limits

Can leverage help grow a small trading account faster?

Leverage can amplify gains but also increases risk. Use leverage cautiously by maintaining proper stop losses and never overexposing your account to a single trade.

What role does psychology play in growing a small account?

Discipline, patience, and emotional control are crucial. Avoid greed, fear-driven decisions, and impulsive trades. Sticking to a trading plan helps in maintaining long-term consistency.

How long does it take to grow a small trading account?

It depends on market conditions, your strategy, and discipline. Consistent traders can grow accounts steadily over months or years rather than seeking quick gains.

Should I reinvest profits into my trading account?

Yes, compounding profits by reinvesting gains can help accelerate account growth over time. However, withdrawing a portion periodically can also help maintain financial stability.