Table of Contents

Starting August 1, 2025, the National Payments Corporation of India (NPCI) has implemented revolutionary new rules that will fundamentally change how millions of Indians interact with UPI services. These changes affect every single user across all platforms, from Paytm and PhonePe to Google Pay and BHIM.

If you’re among India’s 400+ million UPI users, understanding these changes isn’t optional, it’s essential for seamless digital transactions going forward.

The Seven Game-Changing UPI Rules Explained

1. Balance Check Limits: The 50-Per-Day Cap

UPI users will now be limited to 50 balance checks per app per day, marking the first time such restrictions have been implemented since UPI’s launch.

What This Means for You:

- You can check your account balance maximum 50 times daily through each UPI app

- The limit applies separately to each app (50 checks on Paytm, 50 on PhonePe, etc.)

- After reaching the limit, you’ll need to wait until the next day for additional balance inquiries

- Banks will provide alternative methods for urgent balance checks

Why This Change: Excessive balance checking was consuming significant server resources, especially during peak hours. Many users were checking balances multiple times unnecessarily, creating network congestion that affected transaction processing speeds.

Pro Tip: Plan your balance checks strategically. Check once in the morning to know your available funds, then rely on transaction confirmations and SMS alerts throughout the day.

2. Account List Access: 25 Times Daily Limit

UPI users will be able to check bank accounts linked to their mobile number only 25 times a day per app, significantly reducing from unlimited access.

Practical Impact:

- Viewing which bank accounts are linked to your UPI apps becomes limited

- Each app gets its own 25-view limit

- Users with multiple bank accounts need to be more selective about when they check linked accounts

- The restriction helps prevent unauthorized account scanning attempts

Smart Usage Strategy: Familiarize yourself with your linked accounts and only check when adding new accounts or troubleshooting payment issues.

3. Transaction Status Checks: Three Attempts Only

The status of a transaction can only be checked three times, with a mandatory gap of 90 seconds between each attempt.

Key Details:

- Maximum three status checks per failed or pending transaction

- Minimum 90-second waiting period between each check

- After three attempts, users must wait for automatic updates or contact customer support

- This prevents constant server polling that was slowing down the system

Best Practice: Wait for SMS confirmations or app notifications instead of repeatedly checking transaction status. Most UPI transactions complete within 30 seconds under normal conditions.

4. UPI AutoPay Scheduling: Fixed Time Windows

Fixed time slots are being introduced by NPCI for UPI auto pay transactions, replacing the previous random processing throughout the day.

What’s Changing:

- Scheduled payments (EMIs, utility bills, subscriptions) will process during specific time windows

- Multiple processing windows throughout the day to distribute server load

- More predictable payment timing for both merchants and customers

- Reduced chances of AutoPay failures during peak hours

Benefits for Users:

- Higher success rates for recurring payments

- More predictable deduction timing

- Better cash flow management for monthly subscriptions

- Reduced payment failures due to server overload

5. API Usage Restrictions: Controlling System Load

The NPCI recently issued a circular mandating banks and PSPs to limit the use of the most-used APIs on the UPI network to reduce system strain.

Technical Translation:

- Apps will make fewer background requests to UPI servers

- Reduced automatic account syncing and real-time updates

- More efficient use of network resources

- Users may notice slightly delayed information updates

User Experience Changes:

- Account information might take a few extra seconds to refresh

- Background app updates become less frequent

- Manual refresh actions become more important

- Overall app responsiveness improves during peak hours

6. Universal Application: All Platforms Affected

The new limits will apply to all users across all platforms, ensuring no UPI app or user receives preferential treatment.

Complete Coverage Includes:

- Paytm, PhonePe, Google Pay, Amazon Pay

- BHIM, traditional banking apps with UPI

- New fintech apps and emerging payment platforms

- Both individual and merchant accounts

Fairness Factor: These uniform rules prevent any single app from gaining unfair advantages and ensure consistent user experience across all platforms.

7. Mandatory Balance Notifications After Transactions

According to the directives of the NPCI, the issuer banks will have to notify users of the available balance in their accounts after every financial transaction.

Enhanced Transparency:

- Automatic balance updates after each transaction

- Real-time spending awareness

- Improved fraud detection capabilities

- Better personal finance tracking

Privacy Considerations: Users concerned about frequent balance notifications can adjust their SMS and app notification settings through their bank’s customer service.

Start investing like a pro. Enroll in our Stock Market course!

Summary Table of New UPI Rules

1: What is a stock?

Rule |

New Limit/Requirement |

|---|---|

| Daily balance checks | 50 per day per UPI app |

| Daily access to linked accounts | 25 views per day per UPI app |

| Transaction status inquiries | Maximum 3 checks, 90-second gap between each |

| Autopay execution time | Only before 10 AM, 1–5 PM, or after 9:30 PM |

| Autopay attempts | One initial + up to 3 retries |

| Beneficiary name display | Mandatory before sending |

| API usage monitoring | PSPs must regulate top 10 APIs as per NPCI policy |

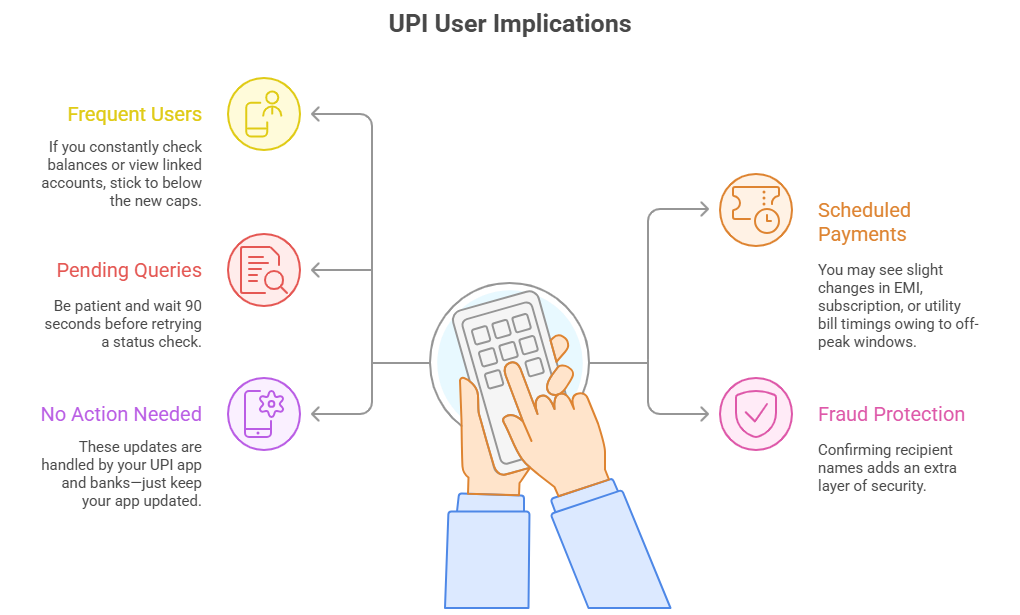

What It Means for You as a UPI User

-

Frequent users: If you constantly check balances or view linked accounts, stick to below the new caps.

-

Scheduled payments: You may see slight changes in EMI, subscription, or utility bill timings owing to off-peak windows.

-

Pending transaction queries: Be patient and wait 90 seconds before retrying a status check.

-

Fraud protection: Confirming recipient names adds an extra layer of security.

-

No action needed: These updates are handled by your UPI app and banks; just keep your app updated.

The Bottom Line: Change for Better Digital Payments

These new UPI rules mark the growth of India’s digital payment ecosystem. While they impose some restrictions, they’re designed to ensure the system continues to be the most used payment network globally.

For most users, these changes will be hardly noticeable in daily usage. The limits are big enough to accommodate normal usage and strict enough to prevent abuse and overload.

The key to navigating these changes is to understand the purpose and adapt your usage accordingly. Users who adapt to these changes and modify their habits will find their UPI experience actually gets better due to better system performance.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

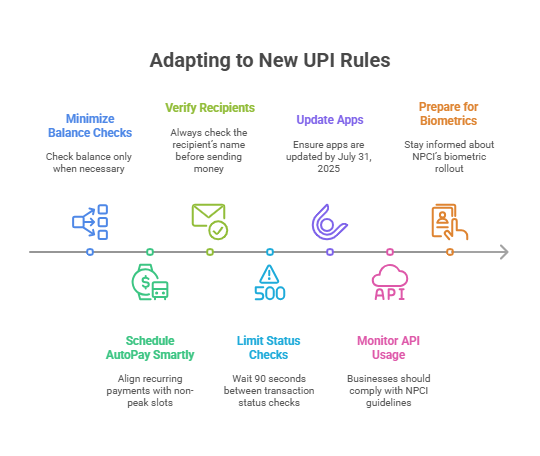

Tips to Adapt to the New UPI Rules

- Minimize Balance Checks: Check balance only when necessary. Use transaction confirmation messages for balance updates.

- Schedule AutoPay Smartly: Align recurring payments (e.g., bills, SIPs) with non-peak slots: before 10 AM, 1–5 PM, or after 9:30 PM.

- Verify Recipients: Always check the recipient’s name before sending money to avoid errors or fraud.

- Limit Status Checks: Wait 90 seconds between transaction status checks and don’t exceed three attempts daily.

- Update Apps: Ensure Paytm, PhonePe, GPay or BHIM apps are updated by July 31, 2025 for seamless compliance.

- Monitor API Usage: Businesses using UPI APIs (e.g., for bulk payments) should comply with NPCI guidelines to avoid penalties like API restrictions or onboarding bans.

- Prepare for Biometrics: Stay informed about NPCI’s biometric rollout for easier authentication, especially for elderly or rural users.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreYour Action Plan for August 1 and Beyond

Today: Review your current UPI usage and identify areas where you need to adjust. Enable banking SMS alerts and get familiar with alternative balance-checking methods. Start using UPI with the new limits in mind, track your daily usage. Evaluate how the changes impact your routine and make further optimizations

Ongoing: Stay informed about system performance improvements and future changes. India’s digital payment future is bright, and these changes will make UPI a model for the world. By understanding and adapting to these new rules, you’re not just complying with regulations, you are part of the evolution of the world’s most advanced digital payment system.

Remember, these are not restrictions on your financial freedom; these are optimisations, so when you need UPI the most, it works every single time.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

Will the new upi rules affect my normal UPI transfers?

No, standard UPI payments and transfers will continue as usual. These changes apply mainly to non-financial API requests and autopay schedules.

If I use two UPI apps, do the limits apply to each?

Yes, the daily limits are per app. You can still check balances 50 times each on both apps, though OTP and device restrictions may apply.

What happens if I exceed the daily limit?

Your UPI app will temporarily disable the specific action for that day, regular payment usage remains unaffected.

Will I be notified when my autopay happens outside peak hours?

Yes, you’ll receive a notification via your app when the autopay is executed, including details if your payment is early or delayed.

Are these changes mandatory for all UPI users?

Yes, they are mandatory guidelines issued by NPCI and apply to all UPI-based apps, banks, and users from 1 August 2025.

What happens if I exceed status check limits?

You’ll be blocked from checking transaction status until the next day. Wait 90 seconds between attempts.