Table of Contents

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What exactly is a chit fund, and how is it different from a bank savings account?

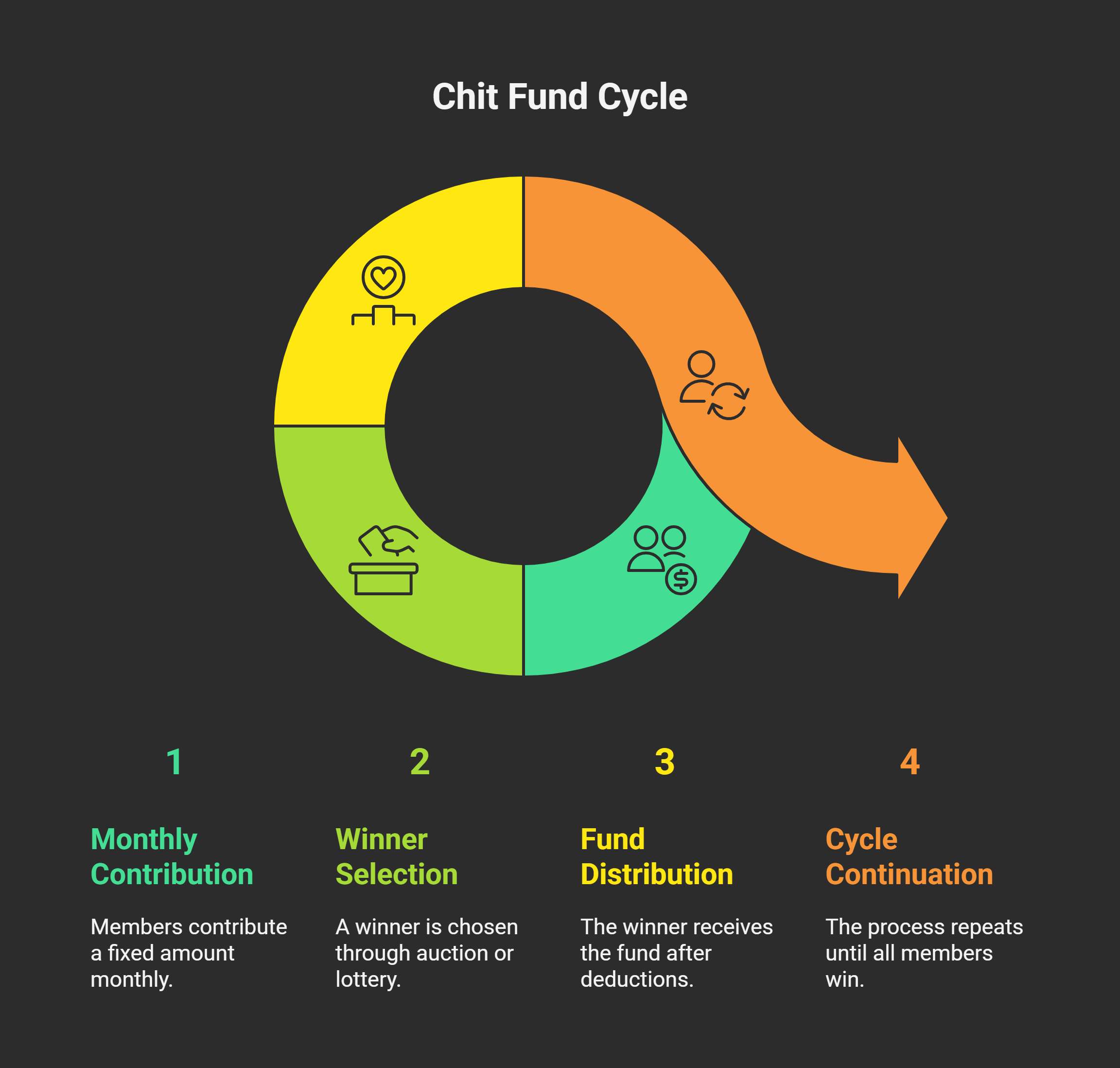

A chit fund is a type of savings and borrowing system where a group of people contribute a fixed amount of money regularly into a pool. Every month, one member wins the collected amount through an auction or lucky draw, minus a small commission for the organizer. Unlike a bank savings account that earns interest and is fully regulated, a chit fund offers access to a lump sum in earlier months but carries more risk. Bank savings accounts are insured and protected, whereas chit funds, especially unregistered ones, may lack safeguards. However, chit funds can serve as a useful alternative in communities where formal banking is limited.

Who usually benefits the most from joining a chit fund?

Chit funds often benefit individuals without easy access to bank loans, such as small business owners, homemakers, and rural citizens. These people may not qualify for traditional credit due to lack of documentation or credit history. For them, chit funds act as both savings and credit tools. It helps them manage cash flow, fund expenses, or invest in small ventures. However, even salaried individuals may join to receive a lump sum early in the cycle.

What are the different types of chit funds available in India?

Chit funds can be broadly categorized into organized and unorganized funds. Registered chit funds are run by licensed companies and regulated under the Chit Funds Act. These offer better safety and legal recourse. Unregistered chit funds are informal, often operated by individuals in communities, and lack legal protections. Other types include online chit funds (like offered by digital NBFCs), private family chit funds (within relatives), and company-run funds (by finance firms or cooperatives).

Are chit funds legal in India? If so, who regulates them?

Yes, chit funds are legal in India, provided they are registered and follow the guidelines of The Chit Funds Act, 1982. The regulation is enforced by state governments, and companies must register with the Registrar of Chits. Registered chit funds also need to maintain transparency, submit accounts, and adhere to security deposits. However, many chit funds still operate without licenses, which can be risky for participants. It is always advisable to invest in regulated funds only.

How does the monthly bidding or draw work in a chit fund?

Each member contributes a fixed amount every month into the fund. At every cycle (usually monthly), a winner is selected either through open bidding (auction) or lucky draw. In a bidding system, members bid for the lowest sum they are willing to accept that month. The person who agrees to take the lowest amount wins, and the balance is distributed among members as a dividend. In lucky draw systems, selection is random, offering equal chances. Both systems help distribute the pool amount fairly.

What are the risks of investing in chit funds?

Chit funds, especially unregulated ones, can carry several risks. The organizer may mismanage funds, run away, or shut down operations suddenly. There’s also the risk of members defaulting on payments, which affects others. Lack of transparency, no legal contracts, and poor grievance redressal increase uncertainty. Even in regulated chit funds, there are no guaranteed returns like fixed deposits. Hence, one must verify the fund’s legitimacy and past performance before joining.

Can I exit a chit fund before it ends?

Most chit funds run for a fixed term, and early exit is not always allowed. If you want to leave before the cycle ends, you may have to find someone to replace you or accept a financial penalty. Some chit fund companies may offer options for transferring your position to another person. In informal chit funds, there might be no proper exit mechanism at all. It’s important to check the terms and conditions before enrolling in any fund.

What documents or proofs should I ask for before joining a chit fund?

If you are joining a registered chit fund, ask for the registration certificate, company details, and the scheme’s terms. Check the Registrar of Chits license and verify their GST number if applicable. Ask for a written agreement detailing the monthly contribution, duration, prize amount, organizer’s commission, and penalty clauses. Also, request receipts for each payment you make. Avoid any fund that operates purely on trust or verbal assurances.

What are the best alternatives to chit funds for savings?

Several safer alternatives exist today depending on your goals. For regular savings, Recurring Deposits (RDs) and Fixed Deposits (FDs) in banks offer guaranteed returns. For long-term wealth growth, Systematic Investment Plans (SIPs) in mutual funds provide flexibility and returns based on the market. Other options include Public Provident Fund (PPF), gold saving schemes, or Self-Help Groups (SHGs) in rural areas. These options are more regulated and offer legal protection.

Where can I learn more about chit funds and similar savings tools?

You can start by reading financial blogs and watching educational videos on finance. Government websites often have information on legal and regulated chit schemes. Books on personal finance and community savings can also help deepen your understanding. Talking to a certified financial advisor is another good step. Many apps and online platforms now offer free courses on savings and investments.