Table of Contents

Picture yourself trading stocks with confidence, riding the waves of India’s booming financial market. Enter Bank Nifty, a powerhouse index that’s a must-know for every Indian investor in 2025. This blog, “What is Bank Nifty? How Does it Work?” unlocks its secrets, from components to trading strategies. As a key player in the National Stock Exchange (NSE), Bank Nifty tracks top banking stocks, driving futures and options trading. Ready to master it? The Entri Stock Market Course equips you with expert skills to conquer Bank Nifty. Let’s dive into why this index is your ticket to stock market success!

Want to know more about What is Bank Nifty? Join the Entri stock market online course!

What is Bank Nifty: Introduction

The National Stock Exchange’s (NSE) index of banking equities is called Bank Nifty, or Nifty bank. The Bank NIFTY is an Indian stock index. It tracks banking stocks. It is one of the most traded indices for futures and options in the banking sector. This index is important to Indian traders and investors. It has a strong link to the Nifty. The Nifty is the NSE’s main index. Bank NIFTY’s weighting with Nifty adds to its importance.

What is Bank Nifty? How Does it Work?

1: What is a stock?

A stock market index created to monitor the banking industry is called the Bank Nifty. The NSE established Bank Nifty in September 2003 to allow unrestricted movement of the capital market performance of banking, one of India’s most important service industries.

It consists of the equities with the highest liquidity ratio and market capitalization. This category includes equities of banks in both the public and private sectors.

The free-float market capitalization, which determines the index’s overall value, is the basis for allocating weight to these stocks. This index’s stocks are rebalanced semi-annually, and depending on the qualifying requirements, a current stock may be replaced with a new stock. Real-time updates on any changes to the index’s values will be made available to market participants.

The Bank Nifty Index, which is currently the most traded instrument in the Indian market, was the first index to be made available for trading weekly options.

If you want to use the Bank Nifty index as a benchmark for your stock selections, you should understand how it works. Whether your goal is to invest in direct equities, mutual funds, or an imminent initial public offering in the banking industry, Bank Nifty can assist you in assessing the potential returns on investment. Individual investors and market intermediaries alike can make well-informed decisions because this is a weighted index. Investors can get a clear picture of the banking sector’s capital market performance due to the index.

The Bank Nifty index has many purposes. It works well when benchmarking fund portfolios, introducing new exchange-traded funds (ETFs), learning about other index funds, and comprehending complex financial products. Despite its introduction in 2003, this index uses 2000 as the base year. Real-time values and prices for Bank Nifty stocks are displayed during regular National Stock Exchange trading hours.

12 Stocks in Bank Nifty

There are 12 Banks in Bank Nifty. The top 12 stocks in the Bank Nifty index, ranked by market capitalization and weight, are listed below.

| No. | COMPANY | Industry | MarketCap | WEIGHTAGE | Price (EOD) |

| 1 | HDFC BANK LTD | Bank – Private | ₹1,161,420.0 Cr. | 29.19 % | ₹1,528.8 |

| 2 | ICICI BANK LTD | Bank – Private | ₹814,105.0 Cr | 20.46 % | ₹1,158.8 |

| 3 | STATE BANK OF INDIA | Bank – Public | ₹737,307.0 Cr | 18.53 % | ₹826.2 |

| 4 | AXIS BANK LTD | Bank – Private | ₹357,952.0 Cr | 9.00 % | ₹1,159.5 |

| 5 | KOTAK MAHINDRA BANK LTD | Bank – Private | ₹326,069.0 Cr | 8.20 % | ₹1,640.3 |

| 6 | PUNJAB NATIONAL BANK | Bank – Public | ₹151,126.0 Cr | 3.80 % | ₹137.3 |

| 7 | BANK OF BARODA | Bank – Public | ₹141,023.0 Cr | 3.54 % | ₹272.7 |

| 8 | INDUSIND BANK LTD | Bank – Private | ₹115,795.0 Cr | 2.91 % | ₹1,487.8 |

| 9 | IDFC FIRST BANK LTD | Bank – Private | ₹57,751.0 Cr | 1.45 % | ₹81.7 |

| 10 | AU SMALL FINANCE BANK LTD | Bank – Private | ₹47,453.2 Cr | 1.19 % | ₹638.9 |

| 11 | THE FEDERAL BANK LTD | Bank – Private | ₹39,099.2 Cr | 0.98 % | ₹160.5 |

| 12 | BANDHAN BANK LTD | Bank – Private | ₹29,625.7 Cr | 0.74 % | ₹183.9 |

Why Only 12 Stocks in Bank Nifty?

There are primarily two reasons why only 12 stocks are included in the index. They are listed below.

- The index includes only the best-performing, market-leading banking companies.

- Not every bank has a stock listing on the exchange, and if it does not, it is impossible to monitor the price movement of the stock. That being said, not every listed banking company is included in the index. A few banks that are mentioned but not included in the bank nifty index are Union Bank, IDBI Bank, Central Bank of India, and Maharashtra Bank.

The weight of the top three bank companies together makes up 62% of the index, but no single bank stock has a weight greater than 30%.

Eligibility for Nifty Bank Index

There are certain eligibility criteria that a firm should have to become a part of the Bank NIFTY index. They are listed below.

- Businesses ought to be included in the Nifty 500.

- Businesses ought to be involved in the banking industry.

- Only firms permitted to transact in the F&O segment may be taken into account.

- They should have at least one calendar month of listing history and 90% trading frequency as the data cut-off date.

Selection Criteria for Nifty Bank Index

The selection criteria for firms to be part of the Nifty Bank index are given below.

- The average free-float market cap of each company is used to sort them in descending order.

- The inclusion criterion is met if the market capitalization of the free-floating stock is at least 1.5 times that of the smallest index participant.

- A single stock cannot have a weightage of more than 33% due to a capping of 33%.

- When rebalancing, the total weights of the top three stocks cannot exceed 62%.

Want to learn stock trading from the best join the Entri online stock trading course!

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreUses of the Bank Nifty

An in-depth understanding of the Bank Nifty index’s operation requires a connection to investors’ use of the index. Here are some key insights into how the Bank Nifty operates:

The Index as a Benchmark

Investment professionals and managers of mutual funds frequently use the Bank Nifty as a benchmark. When used as a performance benchmark, it provides investors with information about the overall performance of banking companies as well as the likelihood of gains for specific funds. Investors’ primary argument for utilizing Bank NIFTY as a good benchmark is to outperform Bank Nifty returns. Thus, you may view a fund as a profitable investment if its returns outpace those of the Bank Nifty index.

The Bank Nifty in Trading Options

Now that you are aware of what Nifty Bank is, you should be able to understand how investors and other financial experts use it. The index’s options trading feature is another application for it. Typically, the index yields returns between 2% and 3%. In light of this, investors can use a variety of techniques while trading Bank Nifty options.

Technical Analysis Using the Nifty Bank

Unlike its broad share market cousin, the Nifty 50, the Bank Nifty index exclusively includes corporate equities in the banking industry. As a result, investors can utilize technical analysis based on the Bank Nifty to evaluate performance when they want to invest exclusively in the banking industry.

Technical analysis is essential to investing because it gives investors the ability to examine trends, spot patterns, and assess the strength and consistency of trends. Investors can examine charts containing information about Bank Nifty’s performance. These charts cover several historical periods. Investors can examine the performance of banking stocks using charts that are available on a daily, weekly, monthly, quarterly, etc. basis.

Weekly and monthly charts are frequently used to assess the performance of stocks.

How is Bank Nifty Calculated?

The Nifty Bank Index is derived from the free float market capitalization technique, with a base date of January 1, 2000, and a base value of 1000. The index level represents the aggregate free float market value of all the index stocks relative to a given base market capitalization value.

In other words, the market capitalization of individual equities is used to compute the index, taking into account the percentage of shares that are accessible for trade, or free-float. All component stocks’ free-float market capitalization is multiplied by their weightage to arrive at the Bank Nifty formula.

Advantages and Disadvantages of Bank Nifty

The advantages and disadvantages of trading Bank NIFTY are given below.

| Advantages |

Disadvantages |

|

|

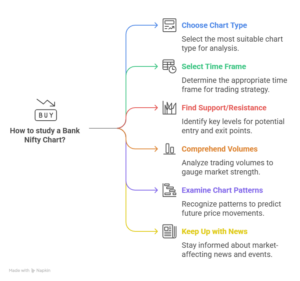

How do You Study a Bank Nifty Chart?

Instruction on how to study a Bank Nifty Chart is given below.

Choose a Type of Chart

The chart itself is the fundamental prerequisite for understanding Bank Nifty charts. Line charts, bar charts, candlestick charts, and Renko charts are just a few of the many types of charts available. These charts all have unique characteristics as well as unique advantages and disadvantages.

The candlestick chart is one of the most often used charts among traders because it offers more precise information about price movements and is more aesthetically pleasing.

Selecting a Time Frame

When examining the Bank Nifty chart, it’s crucial to keep in mind the timeframe you choose. There will be a range of periods, from weeks to minutes. Option contracts for the Bank Nifty expire every week. So, it is advised that traders employ a shorter timeframe because it facilitates their understanding of the current market trend and helps them make better trading judgments.

Traders use shorter timeframes to see the index’s direction. They can use longer timeframes to find support and resistance levels. If an investor trades Bank Nifty futures, they should consider a longer timeframe. This is because futures contracts expire monthly.

Finding the Support and Resistance Levels

Recognizing the support and resistance zones is a fundamental but crucial idea to understand while examining the Bank Nifty chart, or any other chart for that matter. Levels of support and resistance are those at which the security’s price tends to move in the other direction.

Comprehending these index levels can assist traders in determining the appropriate entry and exit points for their transactions. Furthermore, if Bank Nifty consistently breaks through levels of support or resistance, it may be a sign of a fresh market trend.

Comprehending The Index’s Volumes

Volumes can be used to verify the present market trend. A rise in volume throughout a trend indicates that it is continuing, whereas a drop in volume throughout a trend may signal that it is reversing.

As the Bank Nifty is exclusively available for purchase and sale through futures and options contracts, it is advisable to monitor the volumes and open interest in these contracts to gain insight into the potential future direction of the index.

Examining Chart Patterns

An essential component of technical analysis that can assist market participants in learning about Bank Nifty is chart patterns. Trend lines, support and resistance levels, and channels can be used to create chart patterns that can help you identify breakouts and breakdowns as well as predict the direction of the index’s movement.

Keep Up with News and Events

Events and news have a significant impact on how the Bank Nifty Charts move. The index will be volatile in response to any news about RBI announcements, corporate profits, and economic factors affecting the banking industry.

Traders can have an advantage in predicting index levels by closely monitoring these occurrences.

Performance of Nifty Bank Index

The latest reports on the performance of the Nifty Bank Index indicate the following things.

- When comparing the trailing returns to the Nifty 500, Bank Nifty has underperformed because the banking industry has not performed well over the last two to three years.

- When comparing the calendar year returns to the Nifty 500 index with those from 2020 and 2021, the bank Nifty performed terribly.

- It is an extremely volatile and dangerous index because of its high standard deviation and beta value of more than 1.

- The banking industry has not produced a strong return over the previous two to three years, which is why alpha is now declining.

- The current PE ratio is lower than that of the Nifty 500. About twelve ETFs (Exchange Traded Funds) exist, such as Nippon India ETF Bank. Beginning in May 2004, BeES has an AUM (Asset Under Management) of Rs. 10,262 crores, while Kotak Banking ETF has an AUM of Rs. 7,936 crores as of right now.

Advice for Investors

Investors are free to choose based on their risk tolerance and personal preferences, as the Bank Nifty Index is a thematic exchange-traded fund and has historically been more volatile and riskier than the Nifty 50. The information contained herein is meant simply as a reference and should not be interpreted as financial advice. This information is not, under any circumstances, a recommendation to purchase or sell mutual funds or stocks.

Join Entri’s online stock trading classes today! Click here to watch the demo classes!

Conclusion

This blog unlocks the power of India’s leading banking index for 2025 investors. Bank Nifty, tracking top NSE banking stocks, fuels smart trades in futures and options. From HDFC Bank to SBI, it’s your guide to stock market wins. The Entri Stock Market Course equips you to master its strategies. Ready to dive into India’s booming financial market? Join Entri today and turn Bank Nifty into your trading edge!

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What is the BNK Option Chain?

All F & O traders find the bank nifty option chain to be very helpful, if not highly popular. An option chain is a webpage or link that provides all the essential information about the stock or index option contract. It contains information about open interest, implied volatility, volume, the most recent trade price, and the quantity of both call and put options available at all strike prices.

The trader can determine the levels of support and resistance using the BNK option chain. The BNK index’s current price fluctuations will also have an impact on the chart above.

What is the expiry of the Bank Nifty?

It denotes the end of the validity period for the derivative instrument with bnk as its underlying asset.

Every month on the last Thursday, all derivatives expire. However, if this Thursday falls on a holiday, the working day preceding that Thursday will be regarded as the expiry day. The connected party must get or obtain the underlying asset in the form of cash settlement for the bnk F & O contracts to be settled.

What is the Bank Nifty lot size?

The quantity of futures and options contracts combined for trading is referred to as the lot size. There are twenty-five contracts in the lot size, all of which are grouped. Multiples of 50, 75, 100, etc. are acceptable for trade.

Many derivative contracts allow the trader to know precisely how many contracts are being bought in a trade by standardizing the contracts. Depending on the price and volume of the securities being traded, the lot size may change.

How often is the Bank Nifty determined?

Real-time calculations are made to determine the value of the Bank Nifty. All twelve stock prices are subject to real-time tracking, which is also available through your broker’s terminal. The prices fluctuate every second, or more accurately, every fraction of a second.

How much does the bank nifty cost?

The bank stocks are represented by the value of the bnk, and much like other stocks, the whole bank nifty index is updated in real-time each trading day. The most recent price and trend of the BNK index can be obtained at the NSE’s website or by contacting our brokers. The NSE maintains a record of the movements and prices of the bank stocks.

What is the NIFTY BANK Index's share price right now? Which business is the most heavily weighted in the NIFTY BANK Index?

As of April 26, 2024, the NIFTY BANK Index’s share price is ₹ 48,201.1.

According to its current market capitalization, HDFC BANK LTD has the greatest weightage in the NIFTY BANK Index at 29.19%.

Are Bank Nifty Derivatives Tradeable? Which Trading Techniques Are Applicable to Bank Nifty?

Yes, you can trade derivatives based on the Bank Nifty, including index options and futures. With the help of these products, you can track the success of the banking industry without actually owning any stocks.

Trading tactics such as day trading, swing trading, options trading, and long-term investment can all be used to trade the Bank Nifty. The approach you use will rely on your trading style, objectives, and level of risk tolerance.

What is the ideal period for Bank Nifty?

The best time frame for Bank Nifty intraday trading is thought to be between 10.15 a.m. and 2.30 p.m. since the volatility usually decreases after 10.00–10.15 a.m.

Which indicator works best when trading bank nifty options?

Individual trading techniques and preferences determine the indicator to use while trading Bank Nifty options. On the other hand, the Bollinger Bands, MACD, and RSI (Relative Strength Index) are widely used indicators in the world of options trading.

Is the intraday performance of Bank Nifty good?

Absolutely, because of its strong liquidity, volatility, and regular price swings, Bank Nifty can be a suitable choice for intraday trading. Still, to be successful in intraday trading, one must possess a strong grasp of risk management, technical analysis, and market dynamics.