Table of Contents

Getting your first credit card is a big step. It gives you access to instant credit. But it also comes with serious responsibility. Many first-time users make costly mistakes. A credit card isn’t free money at all. You must repay what you spend monthly. Without proper knowledge, it leads to debt. So, understanding credit basics is very important.

This blog is a simple guide for beginners. It covers what you should know first. Learn the terms, benefits, and hidden risks. Understand how to apply the right way. Avoid common myths and spending traps. Use your card wisely from day one. Let’s begin your smart credit journey today.

Invest Smart, Learn Faster – Mutual Fund Course for Kerala

Getting Your First Credit Card: Introduction

Credit cards are powerful financial tools when used wisely. They help with purchases and build a strong credit history. But many people use them without proper knowledge. This often leads to confusion and unnecessary debt. Getting your first credit card is a key moment. It requires understanding, planning, and careful usage. Knowing the basics helps avoid costly mistakes. It prepares you for financial freedom, not trouble.

This blog will guide you step by step. You’ll learn how credit cards really work. We’ll cover pros, cons, and application tips. You’ll also find smart usage strategies for beginners. Credit cards are helpful when used with discipline. But they can cause harm if misused. So let’s learn the right way today.

Here’s what you’ll learn in this guide:

-

What a credit card really is

-

Key terms every user should know

-

Benefits of using a credit card

-

Risks and downsides to watch out for

-

Things to check before applying

-

Tips to manage your card wisely

-

Myths you should stop believing

-

FAQs for first-time credit card users

This guide will help you learn the basics before you apply for your first credit card.

🎥 Prefer watching in Malayalam? Here’s a quick video guide:

Watch this Malayalam video that explains credit card basics in simple terms.

What is a Credit Card?

1: What is a stock?

A credit card lets you borrow money from the bank. You can use it to buy products or pay bills. The bank gives you a limit to spend each month. This limit depends on your income and credit history. You can spend up to this amount anytime during the month.

At the end of the billing cycle, you get a bill. It shows how much you’ve spent and must repay. If you pay the full amount on time, no interest is charged. But if you pay late or only partially, interest adds up. This can lead to debt if not managed well.

Credit cards are different from debit cards. Debit cards use your money from the bank account. But credit cards use the bank’s money temporarily. A credit card can be helpful if used wisely. It also helps build your credit history over time.

Key Credit Card Terms You Should Know

Before using a credit card, understand some basic terms. These words often appear in bills and bank communication. Knowing them helps you manage your card better. It also helps you avoid unexpected charges or mistakes.

1. Credit Limit

This is the maximum you can spend using your card.

-

Set by the bank based on your income.

-

Stay within this limit to avoid penalties.

-

Using less than 30% is considered good.

2. Billing Cycle

It is the period your spending is recorded.

-

Usually 30 days or one month long.

-

At the end, a bill is generated.

-

The due date comes after the billing cycle ends.

3. Due Date

The last date to pay your monthly bill.

-

Pay full or minimum before this date.

-

Missing it leads to late payment charges.

-

Also affects your credit score badly.

4. Minimum Amount Due

This is the smallest amount you must pay.

-

Usually 5–10% of your total bill.

-

Paying only this leads to high interest.

-

Try to pay the full bill always.

5. Interest Rate (APR)

APR means Annual Percentage Rate on your dues.

-

Charged if you don’t pay full bill.

-

Different for purchases and cash withdrawals.

-

Ranges from 18% to 42% yearly.

6. Grace Period

The interest-free time after the billing cycle ends.

-

Usually 20 to 50 days long.

-

Only applies if you pay full dues.

-

Missed payments cancel your grace period.

7. Late Fee

Extra charge when you miss your due date.

-

Can be fixed or based on bill amount.

-

Added to next month’s bill.

-

Avoided by paying on time.

8. Cash Advance

Withdrawing money from ATM using credit card.

-

Comes with high fees and instant interest.

-

No grace period on this amount.

-

Use only in real emergencies.

9. Reward Points

Points earned for spending through your card.

-

Can be redeemed for gifts, vouchers, or travel.

-

Each card has its own reward system.

-

Some points expire after time.

Summary Table

| Term | Meaning | Key Tip |

|---|---|---|

| Credit Limit | Max amount you can spend | Stay below 30% for safety |

| Billing Cycle | Time period for purchases | Know your cycle start and end |

| Due Date | Last day to pay your bill | Pay on or before this date |

| Minimum Due | Smallest payable amount on the bill | Always pay full to avoid interest |

| Interest Rate | Charges on unpaid dues | Avoid interest by timely payments |

| Grace Period | Interest-free period after billing | Lost if you miss full payment |

| Late Fee | Penalty for missing due date | Set reminders to avoid charges |

| Cash Advance | ATM withdrawal using card | Avoid due to high fees |

| Reward Points | Points earned on purchases | Check expiry and redeem smartly |

Understanding these terms helps you stay in control. It reduces chances of late fees or high interest. Always read your credit card bill carefully. Knowing the terms is the first step to smart usage.

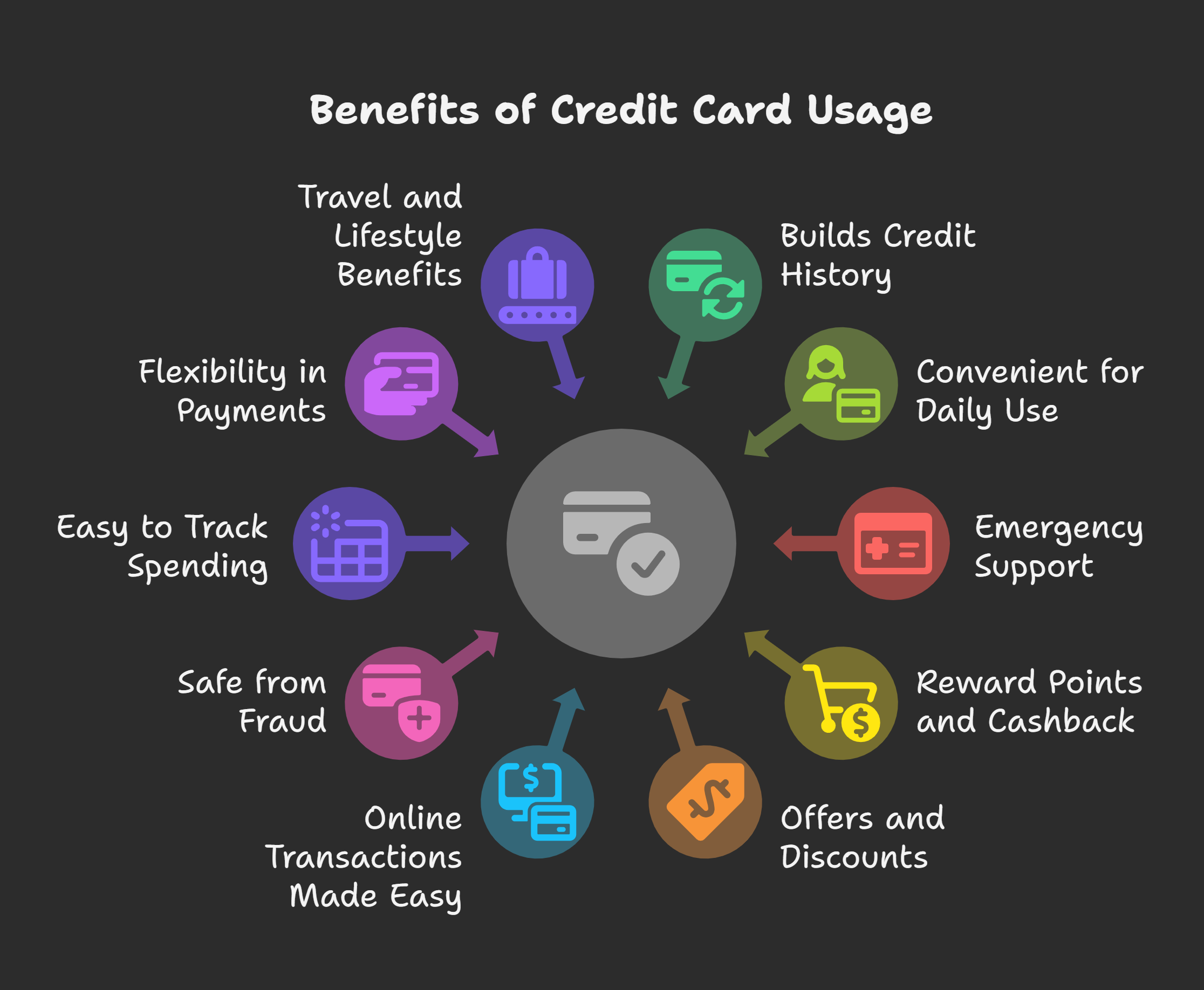

Getting Your First Credit Card: Why People Get a Credit Card (Pros)

Credit cards offer many benefits if used the right way. People choose them for convenience, rewards, and financial support. When handled wisely, a credit card becomes a helpful tool. It can also improve your financial health over time.

Let’s explore the key reasons people apply for credit cards. These advantages show how credit cards go beyond just spending power.

1. Builds Credit History

A good credit history helps you get future loans easily.

-

On-time payments improve your credit score.

-

A good score means better loan and EMI options.

-

Credit history builds with regular, smart card usage.

2. Easy and Cashless Transactions

Cards make everyday payments quick and contactless.

-

No need to carry cash always.

-

Accepted at stores, websites, and international places.

-

Safer than carrying large amounts of money.

3. Emergency Backup

Useful during urgent or unexpected expenses.

-

Helps when you’re short on cash.

-

Can cover sudden medical or travel costs.

-

Use only when truly necessary.

4. Reward Points and Cashback

Earn rewards every time you spend with your card.

-

Points on fuel, shopping, travel, and more.

-

Some cards offer cashback on bill payments.

-

Redeem points for discounts or free items.

5. Buy Now, Pay Later

Split your spending without immediate pressure.

-

Pay after the due date or in EMIs.

-

Helps manage big purchases over time.

-

Best used with repayment discipline.

6. Offers and Discounts

Credit cards bring exclusive deals for users.

-

Discounts on food, movies, and shopping.

-

Special seasonal offers for cardholders.

-

Saves money on regular purchases.

7. Expense Tracking

Card statements show clear details of your spending.

-

Monthly bills show where money was spent.

-

Helps create and follow a budget.

-

Useful for managing household or travel expenses.

Summary Table

| Benefit | What It Means | Why It Helps |

|---|---|---|

| Build Credit History | Records usage and payments | Better future loan approvals |

| Cashless Payments | Spend easily without carrying cash | Safer and more convenient |

| Emergency Use | Backup for urgent money needs | Helps in unplanned situations |

| Rewards & Cashback | Earn returns on spending | Redeem for gifts or discounts |

| Pay Later Option | Delay or split your payment | Useful for big purchases |

| Discounts & Offers | Special card-only deals | Saves extra money |

| Expense Tracking | Track spending through statements | Helps plan and control budget |

Credit cards offer more than just borrowing power. They support daily life, savings, and financial planning. When used carefully, they offer long-term benefits. The key is smart, regular, and controlled usage.

What to Watch Out For (Cons & Risks)

While credit cards offer many benefits, they also carry risks. Many people fall into traps due to careless usage. High interest, late fees, and overspending are common problems. It’s important to know the downsides before using your card.

Understanding the risks helps you stay alert and responsible. Here are the key dangers you should always watch out for.

1. High Interest Rates

Unpaid balances attract very high interest charges.

-

Interest starts if you skip full payment.

-

Rates can reach 40% annually or more.

-

Always pay bills in full if possible.

2. Overspending Temptation

Easy credit may lead to careless spending habits.

-

Swiping feels easier than using cash.

-

You may spend more than you should.

-

Stay within a set monthly budget.

3. Late Payment Penalties

Missing due dates leads to heavy fines.

-

Late fees add to your next bill.

-

Your credit score also takes a hit.

-

Set reminders to avoid missing deadlines.

4. Debt Trap Risk

Unpaid dues can grow into a large debt.

-

Interest adds up every single day.

-

Paying only the minimum extends your debt.

-

Debt can affect loans and future savings.

5. Annual Fees and Hidden Charges

Some cards have fees you may not notice.

-

Annual fees apply on many credit cards.

-

Late fees, cash advance fees also apply.

-

Read terms and conditions before applying.

6. Impact on Credit Score

Wrong usage lowers your credit health.

-

Late payments reduce your score quickly.

-

Maxing your limit also affects your score.

-

Use only 30% of your credit limit.

7. Fraud and Theft Risk

Cards can be misused if lost or stolen.

-

Fraudsters may steal your card information.

-

Always report lost cards immediately.

-

Use OTP and alerts for added safety.

Summary Table

| Risk | What It Means | How to Avoid It |

|---|---|---|

| High Interest Rates | Charges on unpaid bill amounts | Pay full bill every month |

| Overspending | Spending beyond your income | Set and follow a monthly budget |

| Late Payments | Missing due dates and fines | Enable auto-pay or set reminders |

| Debt Trap | Long-term unpaid balances | Avoid paying only minimum due |

| Hidden Charges | Extra fees not clearly shown | Read all card terms carefully |

| Credit Score Damage | Score drops with poor card use | Use card responsibly every time |

| Card Fraud | Unauthorized use of your card | Use secure websites and OTP alerts |

Credit cards can help or hurt your finances. The difference lies in how you use them daily. Avoiding these risks ensures peace of mind and savings. Awareness and discipline are your best tools.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreThings to Check Before Applying

Before getting your first credit card, check a few things. Not all cards are the same or suitable for you. Each card comes with its own features, rules, and costs. Understanding these before applying helps you choose wisely.

A little research saves you from future problems and regrets. Here are the most important things to check first.

1. Your Monthly Income

Income decides your credit limit and card type.

-

Most banks need stable monthly income.

-

Low income may give lower credit limits.

-

Choose a card that suits your budget.

2. Eligibility Criteria

Each bank has its own approval conditions.

-

Check age, income, and employment type.

-

Salaried and self-employed options may differ.

-

Don’t apply if you don’t meet requirements.

3. Credit Limit Offered

Know how much you can spend monthly.

-

Low limits prevent big purchases.

-

High limits may tempt you to overspend.

-

Pick a card that matches your needs.

4. Interest Rate (APR)

Check how much interest you’ll pay on dues.

-

Rates vary from card to card.

-

Lower APR is better for beginners.

-

Avoid cards with very high rates.

5. Fees and Charges

Cards often come with many hidden fees.

-

Annual fees, joining fees, late fees apply.

-

Some cards are free for the first year.

-

Read all terms before signing anything.

6. Rewards and Benefits

Look at offers based on your spending habits.

-

Travel, shopping, and fuel cards give points.

-

Don’t choose rewards you won’t use.

-

Practical rewards are better than flashy ones.

7. Repayment Options

Check how you can repay your card bill.

-

Online, auto-debit, and app payment options available.

-

Easy payment methods avoid late fees.

-

Choose banks with smooth repayment process.

Summary Table

| Thing to Check | Why It Matters | What to Do |

|---|---|---|

| Monthly Income | Affects limit and approval | Choose a card within your range |

| Eligibility Criteria | Required to qualify for card | Match bank conditions before applying |

| Credit Limit | Sets how much you can spend | Pick a safe and suitable limit |

| Interest Rate | Impacts your cost if unpaid | Choose cards with lower APR |

| Fees and Charges | Adds to yearly card cost | Check all hidden and yearly fees |

| Rewards and Benefits | Gives value for your spending | Pick useful, relevant reward types |

| Repayment Options | Helps avoid late fees and penalties | Prefer cards with easy payment modes |

Checking these things makes your first step safe and smart. A little care before applying saves money and stress later. Choose the right card based on your lifestyle. Not all cards are good for beginners—pick wisely.

Getting Your First Credit Card: Tips to Use Your First Credit Card Wise

Getting your first credit card is just the beginning. What matters more is how you use it daily. Smart usage builds good credit and avoids heavy charges. Poor usage can lead to debt and stress quickly.

Here are simple tips to help you use your card wisely. Follow these to stay safe and financially confident.

1. Always Pay Full Bill On Time

-

Avoid paying just the minimum due.

-

Full payment avoids interest and fees.

-

Set reminders to never miss the date.

2. Use Only What You Can Repay

-

Treat your credit card like real money.

-

Don’t spend more than your monthly income.

-

Stick to a fixed monthly budget.

3. Keep Credit Usage Below 30%

-

Using full limit lowers your credit score.

-

Try using only 30% of your limit.

-

This shows you’re a responsible card user.

4. Avoid Taking Cash From ATM

-

Cash withdrawals charge high interest immediately.

-

No grace period for cash advances.

-

Use only for true emergencies.

5. Track Spending Every Week

-

Check statements or app regularly.

-

Know where your money is going.

-

Helps control unwanted or impulsive spending.

6. Don’t Miss Any Monthly Payments

-

Late payments attract penalties and interest.

-

They also reduce your credit score fast.

-

Automate payments to avoid missing deadlines.

7. Be Careful With Offers and Discounts

-

Not all offers are useful or real.

-

Avoid spending just to earn rewards.

-

Spend only if you actually need something.

8. Report Lost or Stolen Cards Immediately

-

This prevents misuse and fraud.

-

Block the card using your bank app.

-

Always keep customer care numbers handy.

9. Update Mobile Number and Email Always

-

Receive alerts for every transaction instantly.

-

Helps track unauthorized usage quickly.

-

Stay informed about bills and offers.

10. Review Your Statement Every Month

-

Check for errors or unknown charges.

-

Dispute anything suspicious immediately.

-

Helps avoid future billing mistakes.

Wise usage keeps your credit card a helpful tool. Start with good habits from the very first month. Discipline today builds financial strength tomorrow.

Common Myths About Credit Cards

Many people fear credit cards due to false beliefs. These myths often stop beginners from using cards smartly. Knowing the truth helps you avoid confusion and mistakes. Let’s break down the most common credit card myths.

1. Myth: Credit Cards Always Lead to Debt

-

Truth: Cards only create debt if misused.

-

Paying full bills avoids any interest.

-

Use wisely, and you stay debt-free.

2. Myth: Having One Card is Bad

-

Truth: One card is good for beginners.

-

It helps you build your credit slowly.

-

You don’t need many cards to start.

3. Myth: Paying Minimum is Enough

-

Truth: Minimum due keeps your card active.

-

But interest keeps growing on balance.

-

Always pay the full amount due.

4. Myth: Closing a Card Improves Credit Score

-

Truth: Closing cards may reduce your score.

-

Long history boosts your credit report.

-

Keep old cards open if possible.

5. Myth: Debit Cards Build Credit Too

-

Truth: Only credit card usage builds history.

-

Debit cards don’t affect your credit score.

-

Use credit cards responsibly to build trust.

6. Myth: All Credit Cards Are the Same

-

Truth: Every card has different features.

-

Check fees, limits, and rewards before applying.

-

Choose what suits your needs best.

7. Myth: You Should Use Full Credit Limit

-

Truth: Using full limit lowers your score.

-

Stay below 30% of your limit.

-

Shows responsible usage to the bank.

8. Myth: Interest is Charged on All Spending

-

Truth: No interest if you pay full bill.

-

Grace period allows interest-free use.

-

Interest starts only on pending balances.

9. Myth: Credit Cards Are Only for Big Spends

-

Truth: Use for small, daily purchases too.

-

Helps track spending and earn rewards.

-

Every swipe helps build your credit.

10. Myth: Applying for Cards Hurts Your Score Badly

-

Truth: One or two applications won’t harm much.

-

Multiple rejections may impact your score.

-

Apply only when needed, with care.

Credit card myths can stop smart financial growth. The truth is—cards are tools, not traps. Use them wisely and learn the facts.

Getting Your First Credit Card: Conclusion

Getting your first credit card is a big step. It brings both power and responsibility together. Used wisely, it supports your daily financial life. But misused, it can lead to unwanted debt. Start slow and learn how credit works. Read terms carefully before you sign anything. Track your spending to avoid unpleasant surprises. Build good habits from your very first swipe.

Think long-term when using your first credit card. Pay full bills to avoid interest charges. Stay within your budget every single month. Use alerts to monitor card activity in real time. Choose offers that match your lifestyle and needs. Don’t get carried away by flashy rewards. Let the card serve you, not trap you.

Every smart swipe helps build your credit journey strong. Your card is a tool, not free money. Keep payments timely and usage low always. Research before applying to find the right match. Ask questions if something seems unclear or risky. Learn the facts, not just social media myths. Stay aware, stay responsible, and swipe smart.

| Gain Financial Literacy in your Mother Tongue | |

| Stock Market Course in Malayalam | Mutual Funds Course in Malayalam |

| Stock Market Course in Tamil | Mutual Funds Course in Tamil |

| Stock Market Course | Mutual Funds Course |

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

Is it a good idea to get a credit card as a beginner?

Yes, getting a credit card can be a smart move if you’re financially disciplined. It helps build your credit history, offers cashless convenience, and comes with rewards and benefits. However, it’s important to understand how it works, repay on time, and avoid overspending. If used wisely, your first credit card becomes a strong financial tool rather than a burden.

What’s the minimum income required to apply for a credit card?

The minimum income requirement varies by bank and card type. Some basic cards are available for those earning ₹15,000–₹25,000 per month. Premium cards need higher income levels. Always check the specific card’s eligibility criteria before applying, and never give false information as it can lead to rejection or legal issues.

Will getting a credit card hurt my credit score?

No, simply getting a credit card does not harm your credit score. In fact, responsible usage (like timely payments and low credit utilization) improves your score over time. However, missing payments, maxing out your limit, or applying for too many cards at once can negatively impact your credit.

What happens if I only pay the minimum due?

Paying only the minimum amount due keeps your account active but leads to high-interest charges on the remaining balance. It may seem convenient but can result in a growing debt over time. It’s always better to pay the full outstanding amount every month to avoid interest and build good credit habits.

Are credit cards safer than debit cards?

Yes, credit cards generally offer more protection against fraud than debit cards. In case of unauthorized transactions, you can raise a dispute and avoid liability in most cases. Debit card fraud directly affects your bank balance, while credit cards allow time to resolve the issue before payment.

Can students or unemployed individuals get a credit card?

Yes, some banks offer student credit cards or secured credit cards against fixed deposits. These are designed for those without a regular income or credit history. They come with lower limits and fewer features but are a good way to start building credit responsibly.

How can I choose the right first credit card?

Consider factors like annual fees, interest rates, credit limit, rewards, and repayment flexibility. Pick a card that matches your lifestyle—like a shopping card, fuel card, or basic card with no annual fee. Always read the terms and conditions carefully before applying.

What fees and charges should I be aware of?

Credit cards may include joining fees, annual fees, late payment fees, cash withdrawal charges, and foreign transaction fees. Also, interest is charged on unpaid balances. Understanding these charges beforehand helps you avoid surprises and manage the card better.

Can I increase my credit limit later?

Yes, banks often allow credit limit increases after a few months of responsible usage. This includes making full payments on time and maintaining a good credit score. You can also request a limit increase, but approval depends on your income, repayment history, and card usage.

What should I do if I lose my credit card?

If your card is lost or stolen, immediately contact your bank’s customer care and block the card. Most banks also allow you to block it through their mobile app. After that, request a replacement card. Prompt action helps prevent unauthorized transactions and protects you from financial loss.