Table of Contents

Managing day-to-day expenses has become harder for many families. Prices of groceries, fuel, school fees, and medical costs keep going up. Depending only on one income can be risky, especially if there’s an emergency or a sudden loss of a job.

This is why being an extra source of income becomes more important. This adds a safety net, helps you save you more and give you the freedom to handle the wonder of life. In this blog we will talk about how additional revenue can support your financial goals and provide you with security.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

Introduction

It is important to have an extra source of income, and investing in the stock market or mutual funds is a good way. These options help your money grow over time, even if you start with small amounts. Instead of letting your savings be useless, you can earn and earn extra income through returns or dividends.

This extra income can really make a difference in your life.This can help you pay loans, manage sudden expenses such as hospital bills, or saves future goals as your child’s education or retirement. Over time, returns from these investments can be a stable other income. The best part is that you can continue the regular job or business while your investment is growing in the background. With little patience, plan and stability, the stock market and mutual fund investment can not only offer financial assistance, but can also cause security.

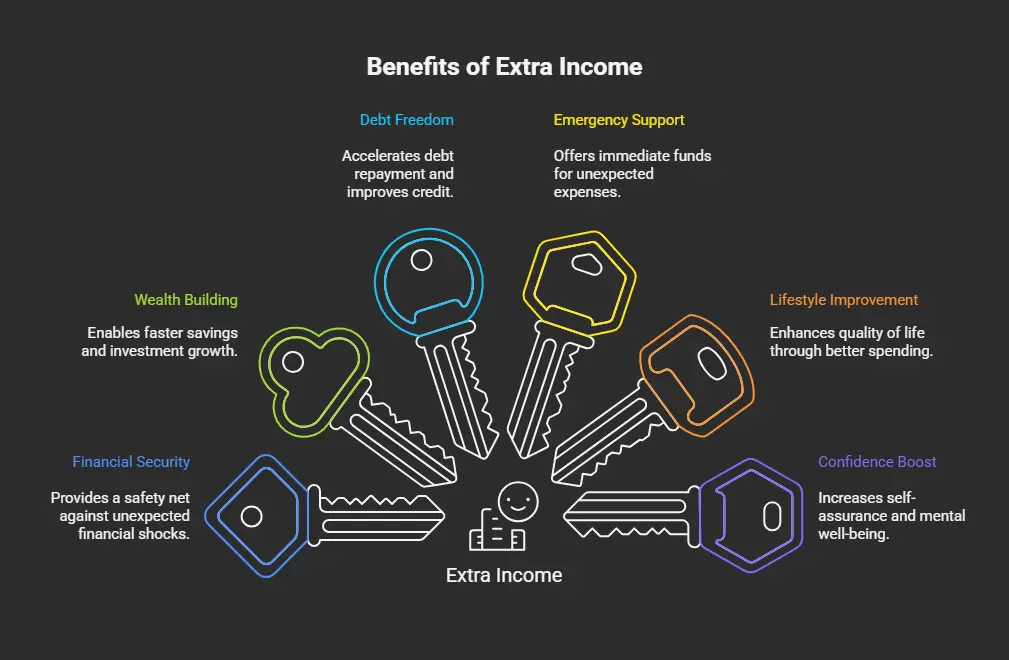

Main Benefits of Having an Extra Income Source

1: What is a stock?

In today’s world, only a salary is often not enough to meet all our needs. With the increasing life costs, thinking about unexpected expenses and future goals, having an extra source of income can provide greater relief and support. Whether it comes from investments such as a page business, freelance, online work or mutual funds and stock market, extra income gives you more control over your life.

1. Financial Security and Stability

Life is full of surprises. If you only depend on an income, sudden work loss, medical emergency or family requirements can shake finance. An additional income acts as a safety net. Even if one source is closed, the other can help you manage your basic needs. This type of financial backups brings security and helps you feel safer in everyday life.

2. Faster Savings and Wealth Building

With extra income you can save more each month. These savings can be used for short -term goals such as buying a new phone or going on a trip, or buying a house or retiring quickly. When you invest your extra income with care – in options such as Mutual funds, SIPs or shares – it grows over time and makes your money slowly and continuously. This helps you achieve your dreams faster.

3. Freedom from Debt

Many people are struggling with personal loans, credit card bills or EMIs. It can take several years to repay the loan from the same salary. But when you have extra income, you can use it to pay the loans faster. It reduces the burden of your interest and helps you live a debt -free life soon. It also improves your credit points and gives you more freedom in future financial decisions.

4. Support During Emergencies

The emergency comes without warning. It can be difficult to manage hospital bills, car repair or sudden family needs. If you have an extra income, you do not need to borrow money or use the main savings. You can use your second income to handle such situations without stress. It helps you keep you clear and calm when life throws out unexpected problems on you.

5. Improved Lifestyle

With more income you can enjoy the better quality of life. You may be able to convey better education for your children for little luxury such as better education, healthy food or eating out or taking weekends. You don’t have to stretch every rupie or feel guilty about spending things you like. Even when you are not worried about money, simple pleasures become more comfortable.

6. Boosts Confidence and Peace of Mind

Knowing that you have more than one way to make money, which assures you. You do not get stuck in a job or are more stressed over the pay day. It also opens the door to try new things – for example, starting a small business, learning a new skill or planning early retirement. Such financial freedom improves both your mental and emotional welfare.

Real-Life Scenarios where Extra Income Helps

Being an extra source of income can lead to a major change in everyday life. It’s not just about making more money – it’s about getting better clear, feeling safer and how to live more freedom. Many people do not understand how useful the second income can be before facing a difficult situation. Let’s look at some real life scenarios where additional revenue makes life easier and less stressful.

1. Medical Emergency in the Family

Imagine a situation where a family member suddenly gets sick and requires hospital care. Even if you have health insurance, there are always additional costs – such as medicines, testing or aftercare – it may not be an insurance coverage. If you have an additional income from a page business, freelance work or return on investment, you can manage these costs more comfortably or manage without breaking your savings. It gives you security in already stressful time.

2. Job Loss or Salary Cut

Losing jobs or cuts in salary can be difficult to meet, especially when you have daily expenses for Amnes, rent, tuition and management. But if you earn some extra income work, part-time teaching or through a small business-will not leave you helpless. These extra money can help meet your basic needs until you get a new job or collect the entire salary. It acts as a backup in an indefinite time.

3. Paying Off Loans Faster

Suppose you have a mortgage, car loan or personal loan. Paying EMI from your main salary can lead to very few spaces to save or use. However, if you use your extra income with care – maybe mutual funds from investment or weekend freelance – you can pay further to your loan. It will soon help you become debt -free and save money on interest. It is also very good to be free of menstrualemia.

4. Saving for Children’s Education

Many parents worry about how they use the child’s school or college tax, especially with increasing education costs. With an extra income you can start saving quickly. Whether through part -time work, investment return or a small company, extra money can be kept separate for your child’s future. When the time comes, you do not need to be dependent on debt or conflict.

5. Starting a Dream Project

Do you have a dream of opening a small cafe, launching a clothing mark or traveling to the world? Your main salary may be enough for your monthly expenses, but additional revenue gives you a chance to save your dreams. Many use page revenue to build the money required to convert their passion into a real project. This allows you to follow your interests without risking your financial stability.

6. Supporting Aging Parents

As the parents grow older, they may require more support -financial or therapy. If you have extra income, it is easy to help them with medical bills, home care or other requirements. You can give them better support without cutting your own living costs or taking extra loans.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

Popular Ways to Create Extra Income in India

Creating an extra revenue flow in India is much easier than ever. When you increase in the internet, mobile apps and online markets, you can find a way to earn more – whether through a small business, freelance, teaching or investment. You don’t need a big budget to start. Just take the first step with your skill, time or passion, and make it something meaningful and profitable.

1. Freelancing

Freelancing is one of the simplest ways to earn extra revenue by using your skills. If you are good in written, graphic design, video editing, web development or even teaching, you can find some of your time online. Websites such as Upwork, Fiverr, Freelancer, and Internshala provide many freelance opportunities. You can work from home, choose your own timing and pay for the work you do.

2. Investing in Mutual Funds or Stocks

Investment is a smart way to increase your money over time. Mutual funds and stock markets are two popular alternatives in India. You can start as ₹500 per month using SIP (Systematic Investment Plan). During these years, these small quantities can increase in a large amount. If you are learning and investing carefully, selling return shares can be a stable source of additional revenue through dividends or profits.

3. Starting a Small Business

Starting a small business from home is another great way to make extra money. Many people in India run small businesses such as home-cooked food, handmade crafts, clothes or cosmetics. You can also use online platforms such as Instagram, WhatsApp or Meesho to market and sell your products. Light investment and over time you can make your passion into profits.

4. Online Tutoring or Coaching

Education is a growing field, and if you are good in a topic, you can start online teaching. Many students and parents seek supervisors to help school subjects, oral English or competing exams. Apps such as Entri App, Byju’s, Teachmint, and WhiteHat Jr allow you to teach and earn regularly from home. It is flexible and can also be part -time with a full-time job.

5. Affiliate Marketing and Content Creation

If you like to create social media, blogging or video, you can make it income. With attachment marketing, you market products online (YouTube, Instagram or through your blog) and earn a commission for each sale made through your link. Content creators who grow their audience can also make money through brand parties, advertising and sponsorship.

6. Renting Out Property or Space

If you own an extra room, a small shop or country, you can rent it and earn regular income. Many people in India make extra money by renting home on platforms such as Airbnb or by paying parking space, shop space or even rental cars.

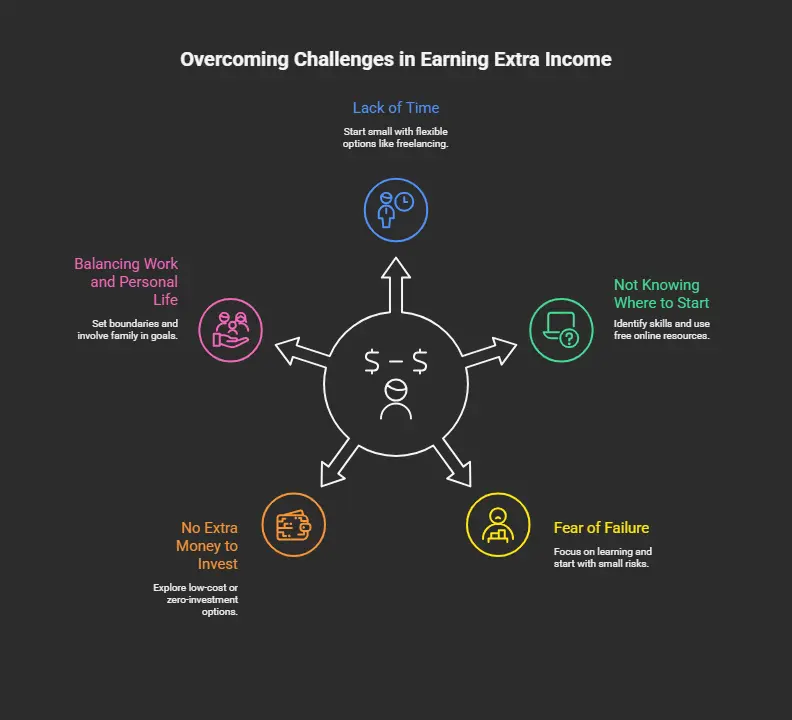

Challenges and How to Overcome them

Serving extra income is a smart grip on financial freedom, but it is not always easy. Many people face challenges when trying to find a page business, freelance start, investment or other ways to make more money. These challenges can slow down or feel like leaving you. But with the right mentality and small steps, you can overcome them and succeed.

Here are some common challenges people face while creating extra income—and how to deal with them using simple and practical solutions:

| Particulars | Challenges | How to Overcome It |

|

Lack of Time |

Many people already have full-time jobs or busy family life. It seems difficult to find time for the second source of income. | Even 1-2 hours a day can make a difference. Use weekend or early morning for side work. Choose something flexible, such as freelance or online teaching, where you check your schedule. Over time, little effort can lead to major results. |

|

Not Knowing Where to Start |

Some people want to make extra money, but don’t know what to do or where to start. | Start thinking about your skills and interests. Are you good at teaching, writing, cooking or managing social media? Use free online resources, YouTube videos or apps to learn to convert your skills into income. Start with what you like and learn as soon as you go. The first step is the most important part. |

|

Fear of Failure

|

Many people worry, “What if I fail?” This fear often prevents them from trying. | It’s okay to fail for the first time – every success story is some mistakes behind. Instead of aiming for perfection, you aim to learn. Start small, take less risk and step by step. Think of it as a journey to learn, not just the way to make money. |

|

No Extra Money to Invest |

Some extra income ideas, such as starting business or investing, require money. Not everyone has extra money to start. | See for low costs or zero investment options. For example, freelance, online teaching or material construction does not require money – just time and effort. If you want to invest, you can start with small SIPs (systematic investment schemes) in mutual funds, with less than 500 per month. Small steps can be somewhat big today. |

|

Balancing Work and Personal Life |

Trying to manage a job, side job and family life can feel heavy. |

Set clear boundaries and a weekly plan. Choose such tasks that fit your routine without harassing the main responsibility. Also bring your family in your goals – they can offer support, inspiration or even help. |

Creating an extra source of income can lead to the challenges, but it is a solution to all problems. With the right mentality, little effort and stability, you can overcome obstacles and go towards financial freedom. Remember that it’s not about how fast you start – it’s about keeping you stable, learning and growing in the way.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreHow to Start Building a Side Income (Step-by-Step)

Building a aspect income is a smart manner to enhance your economic state of affairs and gain greater freedom. Whether you want to store for destiny desires, repay debt, or have extra cash for every day needs, a aspect income can be very beneficial. The desirable news is, you don’t need a whole lot of money or experience to get began. All you want is a while, attempt, and a clear plan. Here’s a simple step-by way of-step guide to help you start.

Step 1: Identify Your Skills and Interests

Thinking about what you are doing well. This can be whatever – writing, cooking, teaching, designing or maybe solving things. You don’t must be an expert, just ready to examine and grow. When you pick something that suits your interests, it becomes clean to be stimulated.

Step 2: Choose a Side Income Option

Once you know your strengths, explore side income ideas that suit you. Here are a few common and easy options:

-

Freelancing – It includes writing, graphic design, web development, data entry.

-

Online tutoring – Includes teaching school subjects, spoken English, or other skills.

-

Small business – This is the way of selling homemade food, clothes, crafts, or reselling online.

-

Investing – This include starting a SIP in mutual funds or learning basic stock trading.

-

Content creation – It include Blogging, YouTube, or Instagram if you enjoy being creative.

Step 3: Start Small and Set a Goal

Step 4: Learn and Improve

No one begins out ideal. Use your unfastened time to study new things that could help growth page sales. See the YouTube education, examine the blog or take unfastened publications on structures which include Coursera, Entri App, Udemy. The more you study, the higher you get-and the more money you may make.

Step 5: Stay Consistent and Be Patient

Side income takes time to grow. You can’t earn much in the beginning, but if you stick to it, you’ll pay the bet. Try to give as a minimum 30 minutes to one hour a day for the aspect income. Even small, ordinary efforts make a large distinction over the years.

Step 6: Track Your Earnings and Time

Store a small pocket book or use an app to tune how an awful lot time you spend and what sort of cash you earn. This facilitates you apprehend what works and wherein you need to enhance. It inspires you when you see your progress.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

Conclusion

Having an extra source of income gives you more than just financial support – it gives you security, freedom and better control over your life. Whether it is working on increasing expenses, plans their children’s future or managing an emergency, another income can reduce stress and help you be ready. This lets you save more, invest in your dreams and avoid falling into debt.

The best part is that you do not need a lot of money or experience to start. Today, there are many options available-such as freelance, online work, small businesses or investments-anyone can start building extra income based on their time and skill. Even little effort, regularly made, can give rise to great results. In the long term, an extra income helps you feel safer and confident in your financial trip.

Disclaimer : The information provided in this article is for general informational purposes only and is not intended as investment advice, financial guidance, or an offer or solicitation to buy or sell any securities. Stock data and financial figures are sourced from publicly available information and are believed to be accurate at the time of publication; however, we do not guarantee their accuracy or completeness. Past performance is not indicative of future results. Readers should conduct their own research or consult a qualified financial advisor before making any investment decisions. The author(s) and the publisher disclaim any liability for any loss or da mage arising directly or indirectly from the use of or reliance on the information provided herein.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What is an extra source of income?

An additional source of income is all the money you make in addition to your main job or salary. It can come from freelance, a small company, investment, rental or even some time online. This helps you promote your total income and provides more financial assistance.

Why should I have a second income if my job pays well?

Although your job now pays well, things can change – such as sudden expenses, job shortages or emergency. Another income gives you a backup. This helps you save you quickly from your goals, such as buying a house, traveling or pulling you quickly.

How much time do I need to build a side income?

You don’t have to spend hours every day. Even it is enough to start 1-2 hours a day or a few hours on weekends. Choose something flexible as freelance, online teaching or content creation that fits your schedule.

What are some easy ways to earn extra income in India?

Some popular and simple methods include freelance (writing, design, etc.), online teaching, starting a small home business, investing in mutual funds or shares, associated with marketing or renting property. You can choose what works best for your skill and lifestyle.

. Is it possible to earn passive income?

Yes, passive income means making money without working actively at all times. Examples include rental income, mutual funds from SIP returns, or to create digital products such as ebooks or online courses. You may have to try initially, but it pays off over time.

Can students or homemakers also have an extra income?

Absolutely! Many students take freelance, teaching or online working online. Home makers can earn through small businesses such as home-cooked food, crafts or resale. With the Internet, anyone can find a way to earn from home based on their time and skill.