Table of Contents

Introduction

Are you someone trying to figure out the right trading platform for you? Well, choosing the right stockbroker can be a tiresome task. Starting or continuing the investment journey in India’s current dynamic market brings you to the numerous brokers. Of these there are these two giants, Zerodha and Angel one, that dominate the discussion among the traders and investors.

Whether you are a beginner or an established investor, these two platforms can meet your various preferences. Both Zerodha and Angel One have revolutionized discount broking in their own unique ways. You need an extensive understanding of both to find out which is the one your hard earned money should be invested in. Explore this comprehensive comparison that will help you land on the right decision.

Company Background

1: What is a stock?

Since their inception, Zerodha and Angel One have made stock marketing more user friendly and helped more investors grow. Here is a detailed understanding of the perks of each discount broker making them the right option for multiple traders.

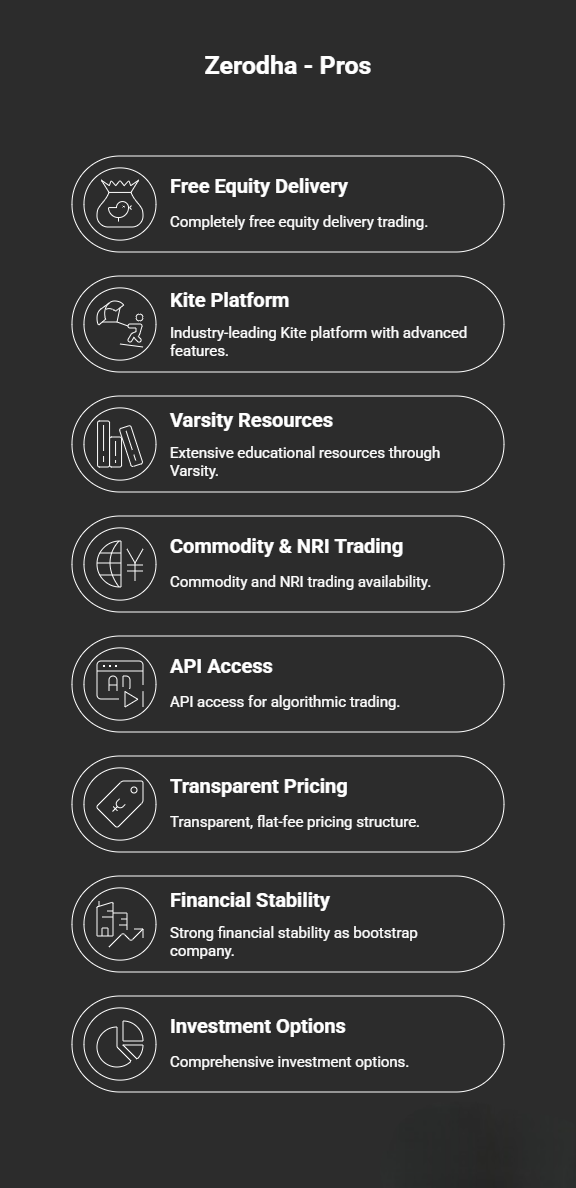

Zerodha: The Pioneer Discount Broker

Zerodha was launched in 2010 transforming India’s brokerage landscape with its flat-fee discount model. From its initial stages itself Zerodha did not raise any external funding which helped maintain its independence. They managed to keep the brokerage rate consistently low. The company prioritizes tech-first solutions and transparency in pricing. Moreover, the platform offers education choices for investors through initiatives like Zerodha Varsity. Currently Zerodha has over 12 million active clients and commands over 15 percent market share. This makes it India’s largest retail broker.

Angel One: The Evolved Service

Detailed Brokerage Comparison

Brokerage Structure

| Segment | Zerodha | Angel One |

| Equity Delivery | ₹0 | ₹20 or 0.03% per order (whichever is lower),minimum ₹2 |

| Equity Intraday | ₹20 or 0.03% per order (whichever is lower) | ₹20 or 0.03% per order (whichever is lower) |

| F&O | ₹20 per order | ₹20 per order |

| Currency Trading | ₹20 or 0.03% per order (whichever is lower) | ₹20 per order |

| Commodity Trading | ₹20 per order | ₹20 per order |

| Demat AMC | ₹300 +GST per year | ₹240 per year |

| Call and Trade | ₹50 per executed order | ₹20 +GST per sell transaction |

Best Option: Zerodha is at advantage with completely free equity delivery trading.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

Trading Platforms

Zerodha

Kite – The Flagship Platform

- Lightning-fast execution with minimal latency.

- 100+ technical indicators for advanced analysis.

- 20-level market depth (Level 3 data) for better liquidity insights.

- Multi-language support in 11 Indian languages.

- GTT (Good Till Triggered) orders for automated trading.

- API access for algorithmic trading enthusiasts.

- Advanced charting tools with extensive historical data.

The Kite mobile app parallels desktop functionality perfectly. It ensures seamless trading right away.

Complementary Platforms:

- Console: Comprehensive back-office with detailed P&L tracking.

- Coin: Direct mutual fund investment platform.

- Varsity: India’s largest free financial education resource.

Angel One

Unique Features:

- Trade on Index: Direct Nifty/Sensex trading without option chain complexity.

- Dual View Mode: Split-screen chart and order placement.

- Beginner-friendly interface with educational tooltips.

Angel One Super App

- ARQ Prime AI engine for algorithm-based investment recommendations.

- Instant Order Mode for one-tap trading directly from charts.

- TradingView integration with professional charting tools.

- Voice search functionality for quick instrument lookup.

- Single platform for stocks, mutual funds, and other investments.

- SmartAPI for algorithm trading capabilities.

Angel One prioritizes mobile-first experience with innovative design and faster onboarding.

| Platform | Zerodha | Angel One |

| Web Platform | Kite | Angel One Web |

| Mobile App | Kite Mobile | Angel One Super App |

| Back Office | Console | Angel One Dashboard |

| Mutual Funds | Coin | Angel Bee |

| Algorithm Trading | Paid API access | Free API access |

Best Option: The right option depends exclusively on your unique preferences. For Advanced Traders, Zerodha’s Kite offers superior depth with advanced tools, and robust API access. Angel One’s simplified interface and educational features make it more approachable for new investors. Angel One’s mobile-first approach provides a smoother smartphone experience.

Investment Options

Zerodha

Advanced Features:

- Margin against shares for additional leverage.

- Basket orders for portfolio strategies.

- Algorithmic trading through Streak integration.

Comprehensive Coverage:

- Equity (NSE, BSE)

- Futures & Options

- Currency derivatives

- Commodity trading (MCX)

- Government bonds & corporate bonds

- ETFs and index funds

- POs with UPI integration

- Gold bonds (SGB)

- Mutual funds (direct plans)

- NRI trading accounts

Angel One

Unique Offerings:

- Fixed deposit integration appeals to conservative investors.

- Insurance products for comprehensive financial planning.

Well-Rounded Portfolio:

- Equity (NSE, BSE)

- Futures & Options

- Currency derivatives

- Commodity trading (Limited)

- Mutual funds with advisory

- Digital gold investment

- Fixed deposits

- IPOs

- Insurance products

- NRI trading (Not available)

Best Option: Zerodha wins with broader options like commodities and NRI trading. Angel One’s integrated approach with mutual funds and insurance suits beginners seeking one-stop solutions.

Research and Guidance

Zerodha

It empowers users to make independent decisions through education rather than tips. Zerodha follows a “teach a person to fish” philosophy.

Zerodha Varsity:

- 15+ comprehensive modules covering basics to advanced concepts.

- Free certification programs to test market knowledge.

- Warren Buffett letter summaries and investment wisdom.

- Interactive learning with quizzes and practical examples.

- Mobile app for learning on the go.

Content Initiatives:

- Z-Connect blog with market insights.

- TradingQnA community forum.

- Varsity Live interactive sessions.

- Social media educational content.

Angel One

Angel One provides active guidance and recommendations:

ARQ Prime (Paid Service):

- Algorithm-based recommendations for up to 15 stocks.

- Rule-based investing without human bias.

- Live buy/sell signals with portfolio allocation advice.

- Performance tracking with detailed call history.

- Smart Beta strategy implementation.

Angel Platinum (Paid Service):

- 25-35 stock recommendations for long-term portfolios.

- Fundamental analysis focus for wealth creation.

- Weekly and quarterly reports via email.

- Personalized advisory sessions.

Free Services:

- Daily stock picks across intraday, short-term, and long-term horizons.

- Commodity and currency recommendations.

- Performance transparency with 90-day track records.

- Market updates and research reports.

Best Option: Zerodha’s Varsity is unmatched for building fundamental market knowledge. Angel One’s advisory services provide actionable recommendations for investors seeking professional guidance.

Customer Support

Zerodha

Support Channels:

- Email support with detailed query resolution.

- Phone support available (Call & Trade at ₹50 per order).

- Comprehensive support portal with extensive FAQs.

- Community forums for peer-to-peer help.

- Z-Connect blog for updates and announcements.

Strengths:

- Extensive self-help resources.

- Detailed documentation and tutorials.

- Active community engagement.

Limitations:

- Peak hour response times can be slower.

- Limited real-time chat support.

Angel One

Modern Support Channels:

- Live chat support with quick response times.

- Email support for detailed queries.

- Relationship managers for premium clients.

- Local sub-broker network for personalized assistance.

- Social media support for quick resolutions.

Strengths:

- Faster digital response times.

- Human touch through relationship managers.

- Multiple touchpoints for assistance.

Limitations:

- No dedicated phone support line.

- Chat support quality can vary.

Best Option: Zerodha’s comprehensive resources and community forums excel. Angel One’s relationship manager model and chat support provide more human interaction.

Account Opening and Maintenance

Zerodha

Opening Experience:

- Time Required: 1-3 working days.

- Process: Comprehensive KYC with detailed verification.

- Documentation: Robust compliance ensuring SEBI requirements.

- Cost: Free account opening.

Maintenance:

- Annual Demat AMC: ₹300 + GST

- Trading AMC: Free

- Overall approach: Thorough but traditional

Angel One

Opening Experience:

- Time Required: Minutes to hours with e-KYC.

- Process: Fast digital onboarding using Aadhaar.

- Documentation: Streamlined mobile-first approach.

- Cost: Free

Maintenance:

- Annual Demat AMC: ₹240 (first year free).

- Trading AMC: Free

- Overall approach: Speed and convenience focused.

Best Option: Angel One’s instant digital onboarding wins for immediate market access. Zerodha’s detailed verification builds long-term trust and compliance.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

Technology and Innovation

Zerodha

Innovation Highlights:

- Kite Connect API: Robust developer ecosystem

- Low latency execution: Sub-second order processing

- Data reliability: Extensive historical data availability

- Mobile optimization: Seamless cross-platform experience

- Security: Bank-grade encryption and safety measures

Recent Innovations:

- AI integration for portfolio insights

- Enhanced charting capabilities

- Trade from charts functionality

- Redesigned market watch with 25 watchlists

Angel One

Tech Strengths:

- AI-powered ARQ engine: Smart investment recommendations

- Voice search: Natural language instrument lookup

- Instant order placement: One-tap trading from charts

- Modern UI/UX: Contemporary design language

- Cloud infrastructure: Scalable and reliable systems

Cutting-Edge Features:

- Machine learning for personalized experiences

- Advanced order types and strategies

- Real-time portfolio analytics

- Integrated investment ecosystem

Best Option: Zerodha leads with comprehensive APIs and advanced charting. Angel One excels in intuitive design and AI-powered features.

Security and Compliance

Both platforms excel in security.

Common Security Features:

- SEBI Registration: Both are fully regulated brokers

- CDSL Depository: Secure holding of securities

- 256-bit Encryption: Bank-grade data protection

- Two-factor Authentication: Enhanced login security

- Insurance Coverage: Client fund protection

Additional Measures

|

Zerodha |

Angel One |

| Self-clearing member status reduces counterparty risk | Advanced fraud detection systems |

| Transparent fund segregation practices | Real-time transaction monitoring |

| Regular security audits and updates | Dedicated cybersecurity team |

Best Option: Both platforms maintain excellent security standards with SEBI compliance and modern encryption. Your funds are equally safe with either broker.

Pros and Cons

Zerodha

|

❌Cons |

|

₹300 annual AMC charges Steep learning curve for beginners No personalized investment advice Call & Trade charges ₹50 per order Limited research recommendations |

Angel One

|

❌Cons |

|

Charges on equity delivery trades (₹20 or 0.1%) No commodity trading options NRI trading not available Limited advanced charting compared to Kite Occasional technical glitches reported Advisory services require additional payment |

The Right Broker for You

Choose Zerodha If You Are:

- Long-term investor making frequent delivery trades.

- Active trader needing advanced charting and analysis tools.

- Technology enthusiasts wanting API access and customization.

- Self-directed investor preferring education over advice.

- Commodity trader requiring MCX access.

- NRI investors needing international trading capabilities.

- Cost-conscious trader prioritizing lowest possible fees.

- Options strategist requiring advanced F&O tools.

Choose Angel One If You Are:

- A beginner as an investor who needs guidance and a simple interface.

- Advisory-seeking trader wanting stock recommendations.

- Mobile-first user preferring smartphone-based trading.

- Conservative investor interested in FDs and insurance.

- Time-pressed individual wanting instant account opening.

- Millennial investor seeking modern, AI-powered features.

- Casual trader making occasional transactions.

- Research-dependent investor relying on professional analysis.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreConclusion: The Ultimate Decision

Zerodha and Angel One emerged as two excellent choices for Indian investors. In the competitive broker landscape, these two discount brokers serve different preferences and purposes. You just need to tailor your understanding of trading and investment and settle on your preference and priority to pick the right one among these.

If you are a serious long-term investor and an active trader you can go for Zerodha. This also suits technology focused users seeking advanced traders. Along with these if you prioritize lowest fees being cost-conscious Zerodha is the best option. Above all you can get educated about trading and stock marketing with this platform.

Angel One is the best choice for beginners who prefer simplicity and guidance options. If you are a trader depending on an advisor wanting recommendations, it emerges as the right pick. Mobile-first users looking for modern interfaces and investors wanting integrated financial services can go for Angel One. Along with your experience level, your choice should align with your trading style and service preferences. Start with small investments to test each platform and pick the one that suits your needs.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

|

RELATED POSTS |

|

| Groww vs Angel One: Ultimate Comparison | |

| Zerodha vs Fyers: Ultimate Comparison | |

|

Entri Finacademy is Now Monitored by a SEBI Registered Advisor! |

|

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

Which broker offers insurance and banking products?

Angel One offers insurance products integrated with its trading platform, whereas Zerodha focuses exclusively on investment instruments with no banking or insurance products.

Can users escalate issues to higher management with either broker?

Both brokers provide escalation paths. Zerodha lists detailed escalation procedures on its support pages, while Angel One allows escalation through branch offices or via the relationship manager for quick redressal.

Is mutual fund investing possible on both platforms?

Zerodha offers direct mutual funds through Coin, while Angel One integrates advisory with mutual fund investment.

Can I invest in foreign stocks with these discount brokers?

Yes. Angel One allows investment in foreign stocks. However, Zerodha does not directly offer this option.

Which broker offers faster live support for urgent issues in stock marketing?

Angel One’s live chat and branch access typically provide faster real-time support. Zerodha depends more on asynchronous communication (email/ticket system).

Is a three-in-one account available with Zerodha or Angel One?

Neither provides a three-in-one account (integrated trading, demat, and banking); they focus on demat and trading accounts.

Is there a support community or forum for queries on trading in these platforms?

Zerodha maintains TradingQnA, a popular public forum for peer support. Angel One focuses on in-house support channels and direct customer engagement.

Can I use API or automated trading?

Zerodha is known for more flexibility in APIs and integrating with third-party tools. Angel One also provides APIs but with possibly more gating depending on plans.

Which app is better: Kite (Zerodha) or Angel One’s app?

Kite is lean, fast, and best for active traders. Angel One’s app is broader in scope, integrating research and advisory features.

Does either broker have offline branches?

Angel One does maintain offline presence and branch support. Zerodha is digital-only.