Table of Contents

Zerodha vs Kodak Neo: Are you wondering which stockbroker is the best for you? The trading landscape in India is becoming increasingly competitive in 2025. Choosing between a legacy platform and a new-age app is more difficult than many might think. But alas, we must choose between them. This blog will explain both these platforms in detail and help you make the right choice.

Click here to learn stock market basics and trading fundamentals from experts! Join Entri now!

Zerodha vs. Kotak Neo: The Ultimate Comparison

As we said above, the choice is difficult to make. On one hand there is Zerodha, the pioneers of discount broking. They are well known for their reliability and low-cost structure. Then there is Kotak Neo, a modern offer from Kotak Securities. It is gaining popularity at great speed with them with zero brokerage on intraday trades and a sleek user experience. In this blog we will compare them in many important features and thus help you decide on where you can open your demat and trading account.

Company Background and Market Position

1: What is a stock?

It is important to understand the company background and market position of both these platforms first. Let us get into that.

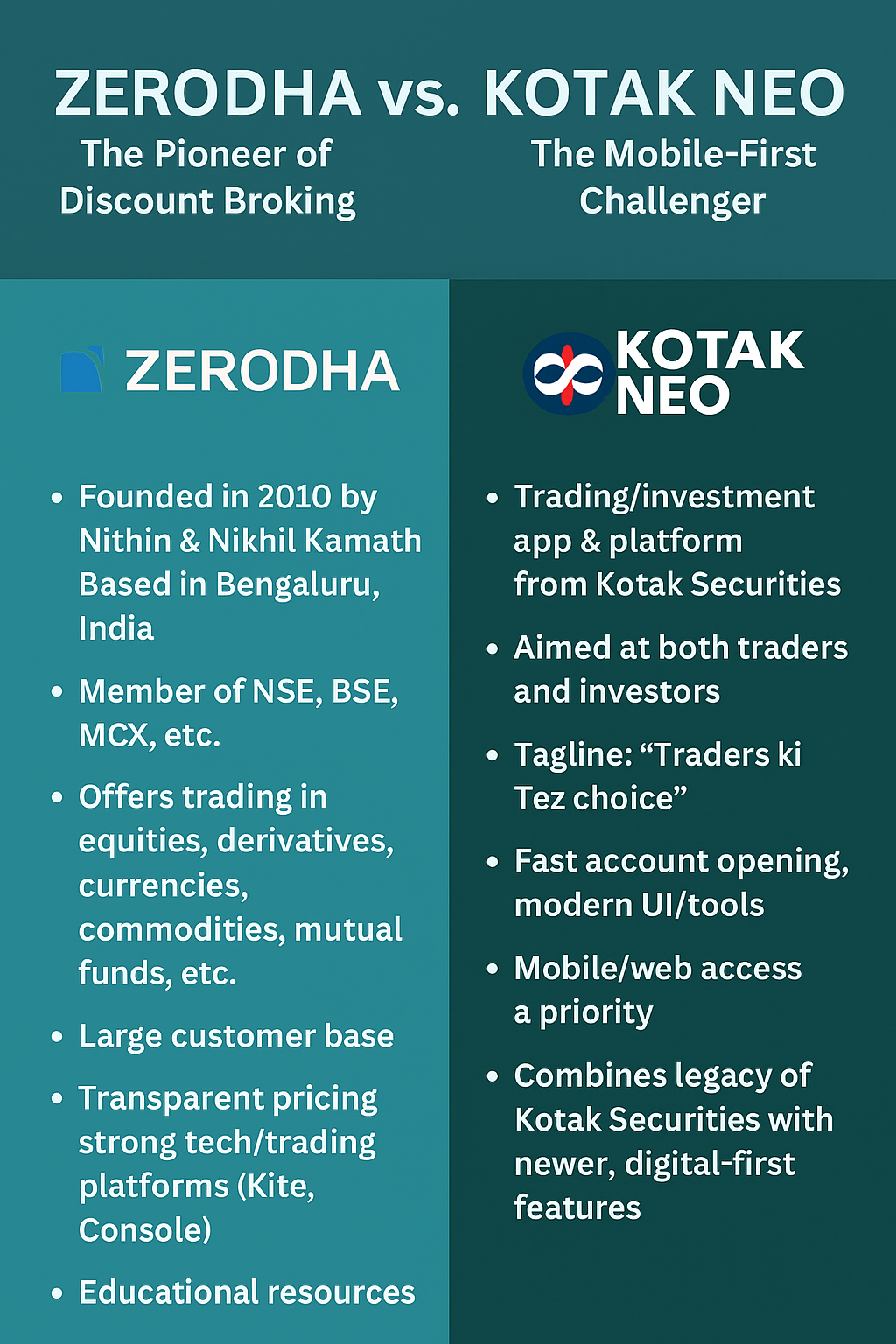

Zerodha: The Pioneer of Discount Broking

A brief idea of the company background and market position of Zerodha is given below.

- Founded in 2010 by Nithin Kamath & Nikhil Kamath.

- Based in Bengaluru, India.

- Member of NSE, BSE, MCX, etc.

- Offers trading in equities, derivatives, currencies, commodities, mutual funds, etc.

- Has a large customer base

- Known for transparent pricing and strong tech/trading platforms (e.g., Kite, Console).

- Has educational resources.

Kotak Neo: The Mobile-First Challenger

A brief idea of the company background and market position of Kotak Neo is given below.

- Kotak Neo is the trading/investment app & platform.

- It is from Kotak Securities.

- It is aimed at both traders and investors.

- Their tagline is “Traders ki Tez choice.”

- They are known for fast account opening and modern UI/tools.

- Mobile/web access is their priority.

- It competes with other discount brokers with the double advantage of the legacy of Kotak Securities and newer, more digital‑first features.

Learn stock market fundamentals from the best mentors in Kerala! Join the Entri app now!

Detailed Comparison Breakdown of Brokers

In this section we will go deeper into each aspect.

Brokerage Charges

The first thing to consider when choosing between two trading platforms is the brokerage fees they charge. Let us look at the brokerage charges of both Zerodha and Kotak Neo.

| Zerodha | Kotak Neo |

|

|

Account Opening and Maintenance

The second aspect to look at is how account opening and maintenance work in each platform. Study the table below to understand the difference between Zerodha and Kotak Neo in this aspect.

| Zerodha | Kotak Neo |

|

|

Investment Options

The next thing to look for is the investment options offered by the platforms. Compare the information in the table below to understand what is offered by Zerodha and Kotak Neo.

| Zerodha | Kotak Neo |

|

|

Trading Platforms

Another important aspect you should pay attention to is the features offered in their trading platform. The features of the Zerodha and Kotak Neo platforms are listed in the table below.

| Zerodha | Kotak Neo |

New 2025 Enhancements:

|

|

Customer Service

Customer service offered by the platform is also very important when it comes to making a choice. The general reviews of Zerodha and Kotak Neo are given below.

| Zerodha | Kotak Neo |

|

|

Margin and Leverage

The margin and leverage offered by the platforms are also very important. Check out the table below to understand the offerings of Zerodha and Kotak Neo in this aspect.

| Zerodha | Kotak Neo |

|

|

User Base and Financials

It is best if you have a general understanding of the user base and financials of your platform of choice. Look at the table below.

| Zerodha | Kotak Neo |

|

|

Security and Compliance

Security and compliance are two factors that are non-negotiable when it comes to a trading platform. The features of Zerodha and Kotak Neo in this aspect are listed below.

| Zerodha | Kotak Neo |

|

|

Pros and Cons

Like anything, each trading platform too have pros and cons. Let us take a look at the pros and cons of Zerodha and Kotak Neo before taking a decision.

| Opinion | Zerodha | Kotak Neo |

| Pros |

|

|

| Cons |

|

|

Learn stock trading fundamentals from expert traders in the field! Join Entri Now!

Zerodha vs Kotak Neo: Comparison Table

An overall comparison table of Zerodha and Kotak Neo is given below for your easy reference. You can compare all the important aspects of these two trading platforms here easily and come to a conclusion about the question of which is the best for you.

| Feature | Zerodha (2025) | Kotak Neo (2025) |

| Delivery Equity Brokerage | ₹0 | ~0.25% under Trade Free; Minimum ₹20 per order in that plan |

| Intraday Brokerage | Standard (≈ ₹20 per executed order or 0.03%, whichever lower) | ₹0 with Trade Free Plan |

| F&O Brokerage (Carry‑forward) | Rates like ₹20 per order (depending on type), like other brokers. | ₹20 per order for carry‑forward F&O in Trade Free Plan |

| Account Opening Fee | ₹0 | ₹0 |

| Subscription Fee for Plans | N/A (no monthly subscription for basic) | Trade Free Pro: ₹249 + GST/month for those who opt in; basic Trade Free is free. |

| AMC / Maintenance / Other Charges | Demat AMC, regulatory fees etc. (standard) | No extra for app; delivery AMC etc. as per plan; some minimum brokerage etc. |

| App / Platform Features | Order slicing; market depth in order window; improved Marketwatch; MTF improvements etc. | Solid mobile + web; features improving; but fewer publicly disclosed large‑feature additions compared to Zerodha in 2025. |

| Margin & Leverage | Higher MTF limits; more stocks allowed; better collateral usage; lower haircuts. | Margin facilities available; details depend on instrument and plan. |

| Customer Support Reliability | Established but occasional outage / glitches reported. | Growing; can differ by volume/load etc. |

Who Should Use Which Broker?

Which trading platform you should choose depends entirely on the features and offers you need to work with. Some examples are given below.

- If you wish to trade in intraday / F&O and require zero brokerage in that area, then Kotak Neo’s Trade Free Plan is the right option for you.

- If you are someone who holds equities long‑term (delivery) and hence requires stability, frequent feature upgrades, and a mature ecosystem, then Zerodha is the right choice for you.

- If you are a newbie to trading or are cost‑sensitive for frequent trades, the Kotak Neo is the best option because they provide immediate savings under certain usage levels.

- f you want advanced features like collateral, high MTF leverage, more stocks eligible, low haircut, etc., and trusted infrastructure, then Zerodha is the best choice.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFinal Recommendations

Some tips to keep in mind while choosing your trading platform are discussed here.

Understand Your Usage

The first thing to do is to compare your typical usage. Ask yourself questions like ‘How many trades per month do I do?’ and ‘What mix (delivery vs intraday vs F&O) do I work with?’. Make essential calculations. You will find that sometimes “free intraday” doesn’t save you much if your delivery trades cost more elsewhere.

Read the Fine Print.

Read the fine print of any plan you think of subscribing to. Look out for features like

- Minimum brokerage

- Charges in special cases

- Interest on margin

- Subscription fees (as in pro plans)

- Regulatory fees

Reaction to Instability

You should ensure the stability of the platform during high‑volatility periods. This is because even small outages can cost more than brokerage savings.

If you are a high-volume trader, i.e., a power user, then test both the platforms. It is certainly possible for you. A trial run can reveal which platform might work best with your trading style and give better net gains after all costs.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What should I watch out for apart from brokerage?

The charges you should watch out for, apart from brokerage costs, are

- Subscription fees (if choosing Pro or premium plans).

- Hidden fees/regulatory/clearing/settlement/STT, etc.

- Interest on margin or debit balances.

- Platform reliability & user experience.

What is MTF, and how is it changing in 2025?

MTF i.e., Margin Trading Facility, which allows you to take positions by pledging securities. Zerodha has expanded eligible stocks, reduced haircuts, and increased limits.

What are “carry forward F&O” trades, and how are they priced?

These are F&O positions held beyond one day. Under Kotak Neo’s Trade Free Plan, these are charged a flat ₹20 per order. Zerodha has similar charges but depending on the product and segment.

Has Zerodha reduced any charges recently?

Yes, for example, for NRI non‑PIS accounts, they’ve reduced trading charges and streamlined onboarding.

Is Kotak Neo totally “zero brokerage”?

Not in all cases. For intraday, yes, under the Trade Free Plan. But delivery trades, carry forward F&O, ETFs, etc., may have charges under that plan.