8 Steps to Consistently Profitable Trading (Roadmap): Trading is a tricky business. For some people, it’s just a way to earn a passive income to supplement their main source. But for some others, it’s a full-time job and their only revenue source for life. The first step is always to learn the fundamentals of the trading strategies and market fluctuations. Once you get this covered you can step into the world of trading easily. What many beginners struggle with is coming up with the correct framework. So, in this article, we discuss 8 Steps to Consistently Profitable Trading (Roadmap). These steps will be useful to you even if you are not a beginner.

Learn trading from experts! Join today to learn the fundamentals of trading!

8 Steps to Consistently Profitable Trading (Roadmap)

Let us discuss some methods you can adopt to ensure your trades are consistently profitable.

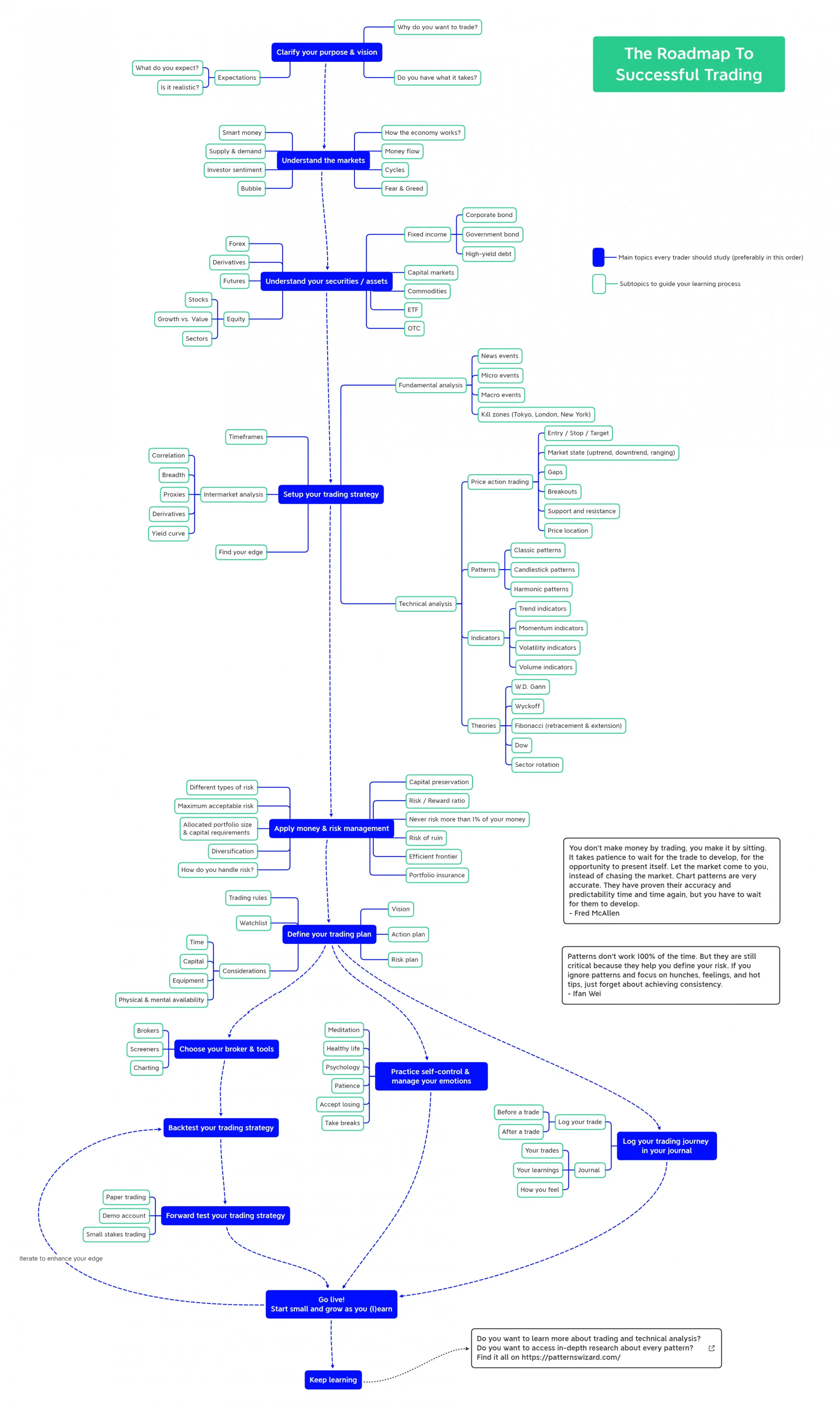

Form a Roadmap to Consistently Profitable Trading

Below given is a roadmap to consistently profitable trading. This will help you understand the topics that are important to focus on and how to make decisions based on them during the process of trading. An example of a roadmap for successful trading is provided below.

Understanding Your Financial Health

The first step a trader can take towards successful trading is having a good understanding of their financial health. Many surveys suggest that a very good percentage of successful traders actively and strictly monitor their financial health. There is indeed a definite statical relation between success in trading and active monitoring and management of finances. These include various investment accounts and cash positions which might be in different trading accounts and banks. Alternative investments like cryptocurrency, real estate, and other similar things. A lack of discipline when it comes to financial health is a sign of a future unsuccessful trader.

But what might be the reason behind this? studies suggest that a trader who actively studies and manages their overall financial health will make more level-headed decisions during the time of trade instead of giving in to the emotions of the moment. Having a good grasp of your financial health will reduce the panic when things are not going well. Keeping your emotions in check will enable you to make better trading decisions. So irrespective of your present position in the trading journey develop the good habit of regularly and thoroughly monitoring your finances and managing them accordingly. This can be done using an Excel sheet.

Understanding Your Trading Profile

The next step to being a consistently profitable trader is to understand your trading profile. For this, you have to take two things into account.

The first thing is the funds available. This means the total amount of liquid funds and investments (this includes cash as well as emergency funds) that you have. You don’t have to be willing to deposit or invest this entire amount. But knowing this amount is crucial for any understanding of your financial health.

The next thing is the time available. This is the amount of time available in hours for a trader to invest in trading or an investment undertaking. This includes the time you take to research and learn about trade opportunities and also the actual time you spend on trading. Once you have both these figured you have to decide which among the following will become your trading profile.

| No. | Trading Profile | Investable Funds | Time dedicated to trading per day |

| 1 | High Funds – High Time | More than $30,000 | more than 2 hours |

| 2 | High Funds – Low Time | More than $30,000 | less than 2 hours |

| 3 | Medium Funds – High Time | Less than $30,000 | more than 2 hours |

| 4 | Medium Funds – Low Time | Less than $30,000 | less than 2 hours |

| 5 | Low Funds – High Time | Less than $5,000 | more than 2 hours |

| 6 | Low Funds – Low Time | Less than $5,000 | less than 2 hours |

Getting a comprehensive trader profile is much more complex. But what we discussed above is a starting point.

Set Achievable and Realistic Goals

It is very important to have realistic, clear and achievable goals to succeed in any profession or business. Trading is no different. Setting a clear goal helps you to form a wise career path and then stay committed to it. Experienced traders suggest you set such goals. To do this. what you have to do first is to study the returns profile as well as the success rate of the traders that have similar trading profiles as yours. Now you have to compare this data with your current return profile. Doing this will help you clear and objective career goals. But getting such data is the actual struggle a trader faces. Helpful data collected from a study is provided below for your convenience.

| Trader Profile | Trader Count | Annual Returns | |||

| Highest | Average | Median | Lowest | ||

| Low Funds – High Time | 546 | 300% | -11% | -24% | -100% |

| Low Funds – Low Time | 242 | 24% | 3% | 1% | -89% |

| Medium Funds – High Time | 1343 | 55% | 10% | 4% | -34% |

| Medium Funds – Low Time | 1232 | 27% | 12% | 7% | -22% |

| High Funds – High Time | 756 | 47% | 13% | 6% | -32% |

| High Funds – Low Time | 1062 | 24% | 17% | 8% | -28% |

But how do we use the data provided here for setting our trading goals? A few suggestions are made below using the data given in this table.

- If the present annual returns for your profile are around the median then you have to aim to attain the highest returns in the coming 12 months.

- If your present annual returns are much lower than the median range then you’ve to attain that range within the next 12 months.

- If your present annual returns are already above the highest range then you have to aim to gain 50% more than your present level of returns.

- If your trader profile is Low Funds – High Time category then you have to aim at reaching the highest returns in this category within the next 12 months as you may have noticed that even the median returns in this category are negative.

- Another interesting factor that needs to be noticed is the fact that traders who tend to spend less time in the market while making trade decisions seem to be more profitable on average than the people who spend more time on it. The less time a person spends on the trade market the investment choices are more passive and it can be seen that the probability of positive returns is higher for passive investment choices rather than active investment choices. So, whatever your trading profile category might be or even how much time you allot to trading make sure that a portion of your investments are passive.

Enrol in the Entri Stock market course to become a successful and confident trader!

Master Trading Approach Suiting Your Goals

The key to having consistent profits is mastering trading approaches that give you the best chance of earning the highest profits. So, you must choose the strategy you are going to learn according to the results you are aiming to gain. Some trading approaches are listed below.

- Short-term trading i.e. Day trading is the approach where the holding period of your trading is shorter than a day.

- Medium term trading i.e. swing trading is the approach where the holding period of trades may range from a few days to a few weeks.

- Long-term trading i.e. position trading the approach in which the holding period of trades may range from a few months to a few years.

- Passive trading is the approach in which the time you invest in the trading process is very low.

Let’s look into the data chart showing the number of profitable traders in each category.

| No. | Trader Profile | Percentage of Profitable Traders | |||

| Swing Trading (Medium-Term Trading) | Day Trading (Short-Term Trading) | Passive Trading | Position Trading (Long-Term Trading) | ||

| 1 | Low Funds – High Time | 38% | 78% | 91% | 21% |

| 2 | Low Funds – Low Time | 45% | 11% | 94% | 36% |

| 3 | Medium Funds – High Time | 32% | 64% | 89% | 28% |

| 4 | Medium Funds – Low Time | 48% | 15% | 92% | 53% |

| 5 | High Funds – High Time | 29% | 54% | 91% | 61% |

| 6 | High Funds – Low Time | 51% | 13% | 95% | 61% |

From this, we can understand that despite the trading profile category, people who do passive trading tend to earn more positive returns. So, as it was discussed before a part of your trading should always be passive investments. It is also seen that some trading approaches are more suitable for certain trading profiles. Let’s look into the table given below.

| No. | Trader Profile | Trading Approach with Highest Success Probability |

| 1 | Low Funds – High Time | Day Trading |

| 2 | Low Funds – Low Time | Swing Trading |

| 3 | Medium Funds – Low Time | Position Trading |

| 4 | High Funds – Low Time | Position Trading |

| 5 | Medium Funds – High Time | Day Trading |

| 6 | High Funds – High Time | Position Trading |

Continuous Learning

Your aims will be different when you begin trading. But anything has to be started from the foundational skills. What you learn will influence your success in the long term when it comes to trading. For example, technical analysis is a skill that helps you determine the right entries and exits when it comes to trading. You can take the help of online trading classes to cover the gaps in your knowledge when it comes to trading. Check out the stock market course provided by the Entri App. Here all the basic and technical concepts are covered by experts in the field. Real-life simulations are provided to develop risk management as well as diversification skills. This course is suitable for all levels of students. They provide:

- Premium Community Membership

- Exclusive Live Sessions

- Practical Trading Support

- Post Market Sessions

- Live Mentor Support

- Course Certification

- Options, Intraday, Swing, Positional, Forex Trading coaching

Join the Entri App stock market Course today itself and become a more confident investor!

Selection of the Right Tools

The quality of the tool used by a worker is as important as the skill of the worker. Trading also works the same. Choosing the correct trading tools is as important as building your basic skills as a trader. The right tools to some extent decide success or at least make the path towards it easier.

Actively Monitoring the Results and Adapting

Different things indeed work for different people. So, it is very important to actively monitor your trading results and adapt accordingly. You may have been doing the trade in the approach and strategy that may have looked good in theory and graphs. But it is not 100% sure that it will work in your case. If your trading plan is not working in ways that were anticipated by you then it is necessary to change your track before losing more. And regular monitoring is essential to notice if anything is lacking in your strategy.

Follow all these 8 Steps to Consistently Profitable Trading (Roadmap) to make more gains and be a successful trader.

| Related Links | |

Start Your Stock Market Journey Today!

Learn practical strategies, minimize risks, and grow your wealth confidently. Enroll now and take your first step toward financial success!

Know moreFrequently Asked Questions

Name different trading profiles

High Funds – High Time

High Funds – Low Time

Medium Funds – High Time

Medium Funds – Low Time

Low Funds – High Time

Low Funds – Low Time

Why is it essential to monitor your results regularly in trading?

It is essential to monitor your results regularly because only then will you understand if the trading approach, strategy and tools you have chosen are giving the anticipated results. If it is proven otherwise then you have to adapt new techniques.