Table of Contents

Thinking about starting an accounting career? You are just about to make one of the smartest career moves in the current financial scenario. Here is an extensive understanding to discover the potential of this secure professional pathway for a stable, relevant and long-term career.

Accounting has a great scope for a successful career with increasing job growth, competitive pay scales and opportunities for further advancements. Whether you are just exploring the options you have as a beginner or looking for the best possible leadership roles in this career, this blog has got you covered. Explore the different career streams mastering essential skills that would help you navigate the potential risks, unlock insights and convert numbers into a fulfilling career.

Unlock Your Accounting Career – Join our Online Course!

What is an Accounting Career?

An accounting career involves tracking financial transactions, data analysis, and reporting financial information to different clients. Yea, it is not just about numbers and tallying them. With an accounting career you need to ensure legal compliance, give strategic insights to different businesses and act as the key decision-maker. Accounting has, in fact, an indispensable scope to work across different industries.

Key responsibilities include:

-

Financial Analysis and Reporting:

The core job is to prepare a comprehensive statement after analysing the finances, analysing the relevant trends and providing valuable insights to businesses of all types.

-

Strategic Planning:

Having a clear sketch of the long-term future of the business you work for is important. In addition to this you should have a clear plan for budgets and forecasting the workings of the businesses.

-

Client Advisory Services:

A crucial step is to provide expert guidance to optimize business, financial decision-making and making strong tax strategies.

-

Compliance and Risk Management:

You must regulate the financial workings, detect potential risks, and make necessary precautions to rectify things internally if anything comes up.

-

Integrating Technology:

With the rapid evolution of technology happening across various fields, making use of advanced softwares, data analytics and efficiency enhancing AI tools can change your career impact.

Working across businesses big and small – individuals, companies and governments – offers flexible personal preferences. Starting with the mission-driven focus of no-profit organizations, moving through the stable financial corporate setup to the fast-paced public accounting environment, you have many options to choose from.

Unlock Your Accounting Career – Join our Online Course!

Who Should Consider an Accounting Career?

1: Accounting provides information on

You must be trying to figure out if it is the right career for you. If you enjoy solving problems, are detail-oriented and are looking for a structured and stable working environment, you should seriously consider an accounting career. In addition to a professional qualification you need to have a clear understanding of what skills you need to play the various roles to play in an accounting career. Here is a list of the roles you need to play:

Natural Problem Solvers:

It basically is about working through complex problems and finding feasible solutions to them. While encountering regular challenges in this regard, you must be able to make a logical analysis and figure things out. This might range from discrepancies in financial record to ensuring tax optimization.

Detail-oriented Professionals:

Making precise calculations while handling numbers demands attention to detail. In addition to organizing information systematically, you need a sharp skill in noticing details others might miss.

Ethical Professionals:

Building trust is non-negotiable in any accounting career role. You will be handling confidential financial information and using them to make suggestions that affect major company decisions. For this, you need to maintain the integrity of the financial reporting and management systems.

Business-minded Individuals:

The core job of the accounting professionals revolves around having a business-minded attitude throughout. Having curiosity regarding the workings of different businesses, evolving economic trends and playing some role to help companies succeed make you an eligible candidate. To be successful in this field, you need to understand the broader context of business.

Collaborative Team Player:

Being an accountant requires you to have a collaborative mindset. You need to function as a team working on audit-engagements and business initiatives where you enjoy team work and group dynamics. Building a healthy environment makes smooth functioning possible which in turn benefits the business as well as the professionals.

Strong Communicators:

You must have realized that modern accounting job roles are not just about bookkeeping and calculations. Having interactive demands you need to have very strong communication skills that would help you explain complex ideas and concepts in simple words. As building strong relationships and trust with your colleagues and clients is important, strong communication skills are on demand.

Technology Enthusiasts:

Tech-savvies always stand out in every professional space. When it comes to accountants, you need to have a sound understanding of advanced spreadsheet functions to cloud-based accounting software. Learning new software quickly and adapting to technological changes including the introduction of AI tools is inevitable.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Career Stages in Accounting

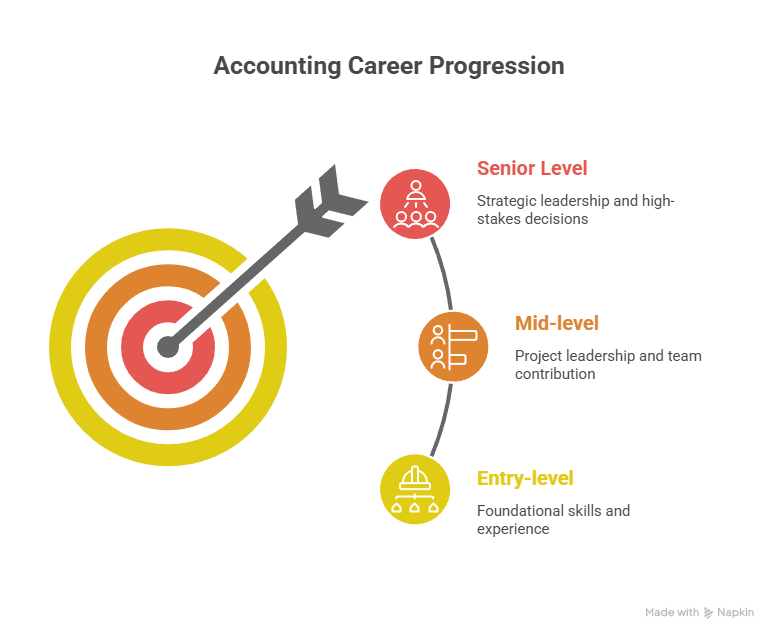

With an accounting career, you can have steady career growth based on expertise, experience and leadership roles. Here are the different career stages to set realistic goals, make the right moves and understand the earning potential in this career.

Entry-Level (0-2 years)

With the fundamental understanding of accounting and different software tools, you can begin your career as an intern or a junior accountant. These entry-level roles provide practical training in various industry-based accounting roles. Important responsibilities include assisting senior professionals in various projects, processing transactions and assisting with audit preparations.

Common Entry-level Roles

-

Junior Accountant:

Assist with preparing financial statements, and analysing financial records.

-

Accounting Assistant:

Help senior accountants with data entry, processing invoices and maintaining financial records.

-

Staff Accountant:

Work on regular accounting tasks and monthly closing procedures.

-

Accounts Clerk:

Handle cash flow by processing payments and collections efficiently.

Professional Goals

- Master fundamental accounting principles

- Proficiency in Excel and accounting software

- Experience across various accounting roles

- Build connections with fellow professionals

Mid-Level (3-7 years)

The job roles in this stage involve higher responsibilities, specialized expertise and project leadership roles. While developing wider technical knowledge in specific areas, you will master management skills as well. Handling complex projects, supervising junior staff, preparing detailed financial analyses and corresponding with various clients are the major responsibilities.

Common Mid-level Roles

-

Senior Accountant

Manage junior staff, checking on deadlines and leading tasks like preparing financial statements.

-

Finance Analyst

Analyse financial data, prepare reports and offer insights towards decision-making.

-

Accounting Manager

Supervise staff, oversee accounting departments and manage the overall accounting cycle.

-

Tax Consultant

Offering strategic plans, tax compliance and services like guidance and advice.

-

Audit Manager

Lead audit engagements and manage client relationships.

Professional Goals

- Pursue specialized credentials like CPA certification

- Build industry expertise in specific sectors

- Expand professional network

- Develop leadership and communication skills

Senior-Level (8-15+ years)

This stage involves more serious strategic decision-making, organizational leadership and high-level client correspondences. These roles demand deep financial expertise. Leading major initiatives, managing larger teams and departmental budgets are the top responsibilities. In addition to this you need to support organizational goals and develop long-term financial strategies.

Common Senior-level Roles

-

Finance Manager

Oversee financial strategy, planning, decision-making and analysis roles

-

Chief Financial Officer (CFO)

Serve as the main financial executive, reporting to the CEO.

-

Controller

Manage every accounting operations, reporting finances and other internal finance controls.

-

Partner

Taking initiatives in public accounting business practices and client relations.

Professional Goals

- Build expertise in emerging areas like data analytics

- Master advanced financial analysis

- Develop executive and presentation skills

- Expand industry influence

Unlock Your Accounting Career – Join our Online Course!

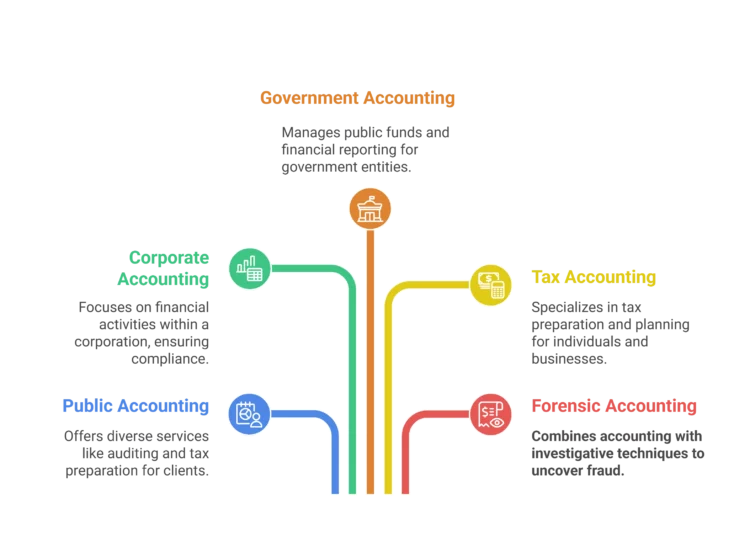

Accounting Career Streams to Choose From

There are numerous job opportunities under the accounting career streams. When you choose between different specializations, you can have various interests, skills and insights in mind. To align your personal preferences with the professional paths and market trends here is a list to check.

Public Accounting

This is the most traditional career path in the accounting field. Public accountants work for independent businesses and serve multiple clients across different industries. They offer tax, audit and advisory services. This enables them to have exposure to many different clients and ensures opportunities for strong networking.

Corporate Accounting

This private accounting involves working within a single organization. The accountants manage internal financial operations and strategic decision-making. This career stream ensures stability, and industry specializations. The job roles include management accounting on budgeting and analyzing performance. This comes under the important specialization titled financial planning and analysis (FP and A).

Government Accounting

Government accountants deal with financial operations of federal, state and local agencies. They primarily ensure compliance and transparency with public sector regulations. These accountants’ services cover areas like managing budgets under federal agencies, regulatory bodies like IRS, and managing complex government contracts under military and defence. This stream offers job security, specialized expertise in government accounting.

Tax Accounting

The main focus here is on tax compliance, planning and making strategies. This stream is a high-demand and high earning accounting career choice. The job roles include optimizing individual tax situations and making strategies to minimize tax liabilities. In international tax scenarios, tax accountants handle global tax obligations for multinational companies. They might also represent clients who are in disputes with the tax authorities.

Forensic Accounting

Forensic accountants need a combination of investigative skills and accounting expertise where they analyze financial crimes and detect fraud. They find expert testimony as well as identify financial shortcomings and vulnerabilities. Their service is invaluable for legal proceedings.

Each career stream offers unique advantages as well as challenges. Understanding these in detail makes career choices transparent and direct for you. Each stream has distinct tools, skills, and impact zones – choose the ones you can thrive in.

Must-Have Skills at Each Stage

Like most career roles, accounting professionals also require a blend of technical and soft skills. Prioritizing the skills on demand with an evolving career landscape is important. In order to have efficient career advancements through different stages you need to focus on your development efforts with upgradation using new skill sets.

| Level |

Skills |

| Entry-level | Technical proficiency like Excel/Spreadsheet, basic accounting principles, attention to detail |

| Mid-level | Leadership, management skills, regulatory knowledge, financial analysis and analytics. |

| Senior-level | Strategic thinking, client relations, industry knowledge, professional networking. |

Entry-Level (0-2 years)

-

Excel and Tally proficiency

These serve as the foundation of modern accounting work. Entry-level professionals must master essential functions including formulas, pivot tables, and data analysis tools.

-

Basic knowledge of GST, TDS, Indian GAAP

Financial Statement Preparation represents core accounting competency.

-

Accounting Software Knowledge

It is essential as most organizations use specialized platforms. Familiarize yourself with accounting software like QuickBooks, enterprise-level platforms like SAP, Oracle or other ERP systems and cloud-based solutions.

-

Communication skills for reports and internal discussions

Attention to detail is inevitably important as small errors can have significant consequences. Communication skill is also a crucial factor as you interact with colleagues and clients.

Mid-Level (3-7 years)

-

Financial Analysis and Modelling

These capabilities distinguish mid-level professionals and include advanced Excel functions and financial modelling, identifying and explaining differences between budgets and actuals.

-

Regulatory Knowledge

Audit, tax planning, financial analysis in understanding federal, state, and local tax requirements.

-

Technology Integration

These skills help you leverage emerging tools like Power BI or Tableau for data visualization, implementing efficient workflows and reducing manual tasks, utilizing sophisticated features of advanced ERP functions.

-

Team Leadership

This becomes crucial as you supervise junior staff. Developing junior team members and sharing knowledge, leading complex assignments and meeting deadlines and, effectively assigning tasks and managing workload.

-

Client Relationship Management

This helps drive business development by providing strategic advice and business insights, communicating findings to executive audiences (presentation skills) and maintaining long-term client partnerships.

Senior level (8-15+ years)

-

Strategic Planning

This is critical in long-term forecasting, making resource decisions, evaluating complex transactions and in risk management.

-

Executive Communication

This is required in communicating with directors and senior leadership, managing external stakeholder communications and, demonstrating confidence and authority in high-level meetings.

-

Technology Leadership

Modern finance executives lead organization-wide technology initiatives. This helps in developing comprehensive approaches to data management and analytics.

-

Specialized Knowledge

Deep understanding of relevant laws and standards, staying current with sector-specific developments, and implementing cutting-edge approaches to financial management.

-

Professional Network

This can be achieved by participating in conferences, establishing thought leadership through speaking and writing, and building reputation through mentoring.

-

Technology Adaptation

You have to familiarize yourself with the evolving technology in the field. Staying relevant with new software and continuously upgrading technical capabilities is important.

A successful accounting career requires intentional skill development aligned with your career stage and professional goals. By focusing on the right combination of technical expertise and soft skills, you can achieve this over time.

Unlock Your Accounting Career – Join our Online Course!

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Certifications That Boost Your Career

Professional certifications ensure credibility, higher earning potential, and further opportunities. Learned certification choices can help you stand out from competitors and unlock senior-level positions that demand specialized expertise.

Chartered Accountant (CA)

This is an in-demand accounting credential, especially in India. Chartered accountants lead most accounting departments and firms. They cover services like auditing, taxation, filings and advisory.

Cost and Management Accountant (CMA)

These accountants focus on management accounting, cost control and strategising business.

ACCA

The ACCA (Association of Chartered Certified Accountants) professionals (UK based) have global expertise in IFRS, financial management and audit.

Certified Public Accountant (CPA)

This has a fast-tracked path to global roles. In India, CPA is tailored for domestic practice.

PwC Edge Course

This is a practical learning experience that focuses on the future in the career for accounting professionals. It equips accountants with the latest tools, technology, and business insights to stay relevant.

Each of the above credentials requires different learning, examinations, exposure and experience. CA remains the Indian gold standard, while ACCA/CPA open global doors.

Work Settings & Job Types

The accounting profession offers flexibility in work environments, which in turn allows you to align with your lifestyle preferences, industry interests, and professional goals. It is important that you understand the different work settings to make informed decisions about where to focus your career development plans.

- Public Accounting Firms provide audit, tax, and advisory services to clients.

- Corporate Finance handles financial planning, analysis, and reporting for companies.

- Government Agencies make financial regulations, audits, and compliance.

- Non-profit Organizations manage financial management and reporting for charitable causes.

- Consulting and Advisory Services offer expert financial advice and solutions to businesses.

- Remote and Hybrid Work opportunities are possible as flexible work arrangements with remote or hybrid options.

Long-Term Career Opportunities

Chief Financial Officer (CFO)

The CFO position stands on top of accounting careers and offers strategic leadership responsibilities.

Entrepreneurial Opportunities

Starting your own practice sets you with independence, unlimited earning potential, and professional autonomy.

Industry Leadership and Board Service

Board positions provide wider exposure, networking opportunities, and additional benefits for experienced accounting professionals.

Academic and Training Opportunities

Teaching, training and educational roles allow experienced professionals to share their knowledge and expertise with active interactions.

Specialized Executive Roles

Controller Positions offer significant responsibility for organizations’ financial operations and reporting.

The accounting profession offers unlimited opportunities for professional growth and achievement.

Tips to Succeed in Accounting

- Acquire qualifications like CA, ACCA and CMA without much delay while stepping into the accounting career.

- Prioritize gaining experience through articleship or internship as these offer hands-on training.

- Make levelling up your all-time goal including digital skills (ERP, analytics), soft skills, and new regulations.

- Network with industry associations and attend seminars or webinars.

- Once you are into accounting keep your focus on any particular stream to ensure premium roles.

- Hold on to the ethical principles as integrity and trust are valued above all.

- Adapt to advancements by embracing automation, AI, SaaS tools particularly in Indian accounting firms.

Conclusion

In the accounting career landscape you have enough opportunities to grow and make money. Being a stable career choice, it can take many different directions based on your personal preference. The most successful professionals tend to combine strong analytical skills with exceptional communication abilities. In addition to these, continuous learning, strategic relationship building, and attention to detail with innovative thinking come in handy. With the right preparation, optimized strategy, and commitment to excellence, you can transform your interest in numbers into a fulfilling career.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Frequently Asked Questions

1. What are the qualifications needed to start an accounting career in India?

BCom degree is recommended, but professional courses like CA, ACCA, CMA, or CPA are essential for growth.

2. What is the salary scale of accountants in India?

Entry-level salaries typically range from ₹2–4 lakh per annum. CAs/ACCA/CPA command ₹4.5–8L at fresher level.

3. Will automation and AI replace accountants?

Routine tasks are being automated, but demand for advisory, tax, and compliance skills is rising.

4. Which accounting certifications are popular among finance leaders?

CA, CMA, ACCA, CPA, CFA, and now courses or certifications from Big Four and industry bodies like PWC Edge.

5. What software should I learn to excel in an accounting career?

Excel, QuickBooks, SAP, Tally, and data visualization tools are the major software.