Table of Contents

Introduction

Ever wondered what it’s like to be the person who keeps a company’s finances honest? That’s an Audit Associate—part detective, part number-cruncher, and all-around problem-solver. My friend Sarah started as an Audit Associate and still talks about the thrill of catching a tiny error that saved her client thousands. This job isn’t just about spreadsheets; it’s about trust and impact. Audit Associates dig into financial records, spot mistakes, and help businesses stay on track. Their work protects investors, employees, and customers. In this post, we’ll walk you through what an Audit Associate does, the skills you need, and how to get started. Whether you’re a college student dreaming of a stable career or someone looking for a fresh start, this role offers rewards and growth. Stick around to see why being an Audit Associate could be your next big move.

Become an Accounting Pro – Learn from Industry Experts!

What Is an Audit Associate?

1: Accounting provides information on

An Audit Associate is like the guardian of a company’s financial truth. Picture yourself flipping through pages of numbers, hunting for anything that doesn’t add up. You might work at an accounting firm, a big corporation, or even a government agency. Your mission? Make sure financial statements are accurate and follow rules like GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards).

I once chatted with an Audit Associate named Mike, who described his job as solving a giant puzzle. You work under senior auditors, checking records, testing systems, and writing reports. You’re not just crunching numbers—you’re catching errors or fraud that could sink a business. You’ll talk to clients, ask questions, and explain your findings in plain English.

This job is perfect if you love details and helping people. It’s a chance to build trust and make a difference. Plus, it’s a solid start in accounting with tons of growth potential.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Key Roles & Responsibilities

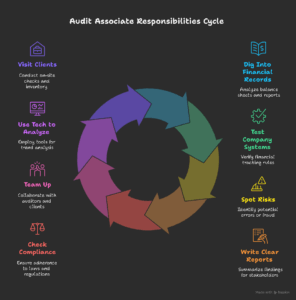

Being an Audit Associate means juggling tasks that keep a company’s finances in check. Here’s what your day might look like:

-

Dig Into Financial Records: You’ll pore over balance sheets, income statements, and expense reports. It’s like proofreading a book, but for numbers. One wrong digit could spell trouble.

-

Test Company Systems: Businesses have rules to track money. You’ll check if these work to prevent fraud or mistakes. Think of it as testing a car’s brakes before a big trip.

-

Spot Risks: You’ll find weak spots where errors or fraud could sneak in. For example, maybe a company’s expense tracking is too sloppy. You point it out and save the day.

-

Write Clear Reports: After digging, you’ll sum up your findings in reports. These help bosses or regulators make smart decisions. Clarity is key—no one likes a confusing report.

-

Check Compliance: You’ll make sure the company follows laws, like tax codes. A mistake here could mean hefty fines or bad press.

-

Team Up: You’ll work with senior auditors and talk to clients. Good communication keeps everyone happy and informed.

-

Use Tech to Analyze: Tools like Excel or audit software help you spot trends or errors fast. It’s like having a superpower for numbers.

-

Visit Clients: Sometimes, you’ll head to a client’s office to check records or count inventory. It’s a nice break from the desk and keeps things fresh.

These tasks demand focus and organization. Deadlines can be tight, but nailing them feels like crossing the finish line. Your work directly helps a company succeed.

Skills Required to Be a Successful Audit Associate

To rock the Audit Associate role, you need a mix of brainpower and people skills. Here’s what makes you shine:

-

Sharp Thinking: You’ll tackle complex data and spot patterns. Think of it like solving a mystery—quick, logical thinking saves the day.

-

Detail Obsession: Missing a decimal point could mess things up. Being super careful is your secret weapon.

-

Clear Talking: You’ll explain tricky stuff to clients or your team. Being friendly and clear builds trust, like when my cousin explained taxes to our grandma.

-

Time Management: Audits have deadlines. Staying organized is like keeping your room tidy—it just makes life easier.

-

Tech Know-How: You’ll use Excel, QuickBooks, or audit tools. Knowing data analytics is like having a cheat code for efficiency.

-

Team Spirit: You’ll work with others daily. Being a team player makes audits smoother and more fun.

-

Honesty First: You’ll handle sensitive financial info. Being trustworthy is non-negotiable—clients count on you.

-

Roll with Changes: Every audit is different. Being flexible is like switching gears in a car—you adapt and keep going.

These skills make you a star Audit Associate. They also set you up for bigger roles down the line.

Become an Accounting Pro – Learn from Industry Experts!

Qualifications to Become an Audit Associate

Want to become an Audit Associate? Here’s what you need to get your foot in the door:

-

Bachelor’s Degree: A B.Com (Bachelor of Commerce) or BBA (Bachelor of Business Administration) is your starting point. These teach you accounting, finance, and how businesses work. I knew a guy who started with a BBA and landed a job right after graduation.

-

Master’s Degree (Optional): An M.Com (Master of Commerce) gives you an edge. It’s not a must, but it helps in competitive job markets.

-

Certifications:

-

CA Inter (Chartered Accountancy Intermediate): Big in India, this shows you’re serious about accounting and auditing.

-

ACCA (Association of Chartered Certified Accountants): A global credential that covers auditing, tax, and reporting. It’s great for international jobs.

-

CPA (Certified Public Accountant): A U.S. certification perfect for working with American clients or firms.

You don’t need to finish these certifications to start. Even partial completion can get you hired, and finishing later boosts your career.

-

-

Real Experience: Employers love hands-on practice. Internships at accounting firms or small audit projects give you a taste of the job. My friend Priya got her first gig after a summer internship—it made all the difference.

These qualifications show you’re ready for the technical stuff. They also tell employers you’re committed to growing.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Career Growth from Audit Associate Role

Starting as an Audit Associate is like planting a seed for a big career. Here’s how it can grow:

-

Senior Auditor: After 2-4 years, you might lead smaller audits. You’ll guide new associates and check their work. It’s like being the team captain.

-

Audit Manager: With 5-7 years of experience, you could run entire audit projects. You’ll manage teams and keep clients happy.

-

Partner in a Firm: After 10+ years, top performers might become partners. This means big responsibilities, like growing the firm and setting goals.

-

Corporate Jobs: You could move to roles like Financial Analyst or Internal Audit Manager at a company. These offer stability and let you focus on one business.

-

Cool Niches: Your skills can take you to forensic accounting (think catching financial crooks) or risk consulting. These are exciting and pay well.

-

Big Boss Roles: Down the road, you could aim for Chief Financial Officer (CFO). That’s where you shape a company’s financial future.

Certifications like CA, ACCA, or CPA speed things up. Networking—like grabbing coffee with a mentor—also opens doors. My buddy Alex met his future boss at a conference, and it changed his career.

Become an Accounting Pro – Learn from Industry Experts!

Conclusion

Being an Audit Associate is about more than numbers—it’s about keeping businesses honest and helping them thrive. You’ll catch mistakes, ensure trust, and make a real difference. With skills like sharp thinking, clear communication, and tech smarts, you’ll stand out. A B.Com, BBA, or certifications like CA Inter, ACCA, or CPA get you started. The role offers a clear path to growth, from Senior Auditor to CFO. It’s stable, rewarding, and full of possibilities. Imagine the pride of solving a financial puzzle that saves a company money. Ready to jump in? Grab a degree, land an internship, or start studying for a certification. Your journey as an Audit Associate could lead to something amazing. Take that first step today!

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Frequently Asked Questions

What does an Audit Associate do every day?

An Audit Associate spends their day digging into a company’s financial records to ensure everything checks out. Picture yourself as a detective, combing through balance sheets, income statements, and expense logs to spot errors or oddities. On a typical day, you might start by reviewing a client’s financial data using tools like Excel or audit software. You’re looking for mistakes, like a $10,000 expense that doesn’t add up. By lunchtime, you could be meeting with your team to discuss findings or visiting a client’s office to check physical records, like inventory in a warehouse. My friend Sarah, an Audit Associate, once found a missing receipt during a site visit that saved her client from a tax penalty. You’ll also write reports summarizing what you found, making sure they’re clear for managers or regulators. Some days, you’re testing a company’s systems to prevent fraud, like checking how they track cash flow. The job keeps you busy with deadlines, so staying organized is key. You’ll work with senior auditors and talk to clients, which means good communication is a must. Every day is different—one day you’re at a desk, the next you’re on-site solving a puzzle. It’s a mix of focus, teamwork, and real-world impact that keeps the role exciting.

Why should I consider a career as an Audit Associate?

Choosing a career as an Audit Associate is like picking a path that’s both stable and full of growth. First, it’s a job with purpose—you help companies stay honest, protect investors, and avoid costly mistakes. My cousin Mike, who started as an Audit Associate, says he loves knowing his work keeps businesses on track. The role is also in demand; companies always need auditors to meet legal requirements. You’ll earn a solid paycheck, often starting at $40,000-$60,000 a year in the U.S., depending on the firm. Plus, it’s a stepping stone to bigger roles like Senior Auditor or even Chief Financial Officer. The skills you gain—problem-solving, tech know-how, communication—are transferable to other fields like finance or consulting. You’ll work with different clients, from small startups to big corporations, so the job stays fresh. Sure, deadlines can be tight, but the sense of accomplishment when you catch a major error is unbeatable. If you like numbers, enjoy teamwork, and want a career with clear growth, this role is a great fit. It’s a chance to make a difference while building a future you’re proud of.

What skills are most important for an Audit Associate?

To shine as an Audit Associate, you need a mix of brainpower and people skills. Top of the list is sharp thinking—you’ll analyze complex financial data and spot patterns, like noticing a weird spike in expenses. Attention to detail is huge; one wrong number can throw everything off. My friend Priya once caught a decimal error that saved her client thousands. Communication is key too—you’ll explain tricky findings to clients or your boss in a way that’s clear, like breaking down a math problem for a friend. Time management keeps you on track with tight deadlines, like juggling school projects before finals. Knowing tech, like Excel or audit software, makes your work faster and sharper. Teamwork matters since you’ll collaborate with colleagues and clients daily. Honesty is non-negotiable—you’re handling sensitive financial info, so trust is everything. Finally, being flexible helps you adapt to different audits, from a small shop to a big factory. These skills don’t just make you great at the job—they open doors to promotions and new career paths.

What qualifications do I need to become an Audit Associate?

To land a job as an Audit Associate, you need the right education and, sometimes, extra credentials. A Bachelor’s degree like a B.Com (Bachelor of Commerce) or BBA (Bachelor of Business Administration) is the starting line. These teach you accounting basics, like how to read a balance sheet. An M.Com (Master of Commerce) isn’t required but can make you stand out, especially in competitive markets. Certifications give you an edge: CA Inter (Chartered Accountancy Intermediate) is big in India, showing you know auditing inside out. ACCA (Association of Chartered Certified Accountants) is global and covers taxes and reporting, while CPA (Certified Public Accountant) is ideal for U.S. firms. You don’t need to finish these to start—partial completion often works for entry-level roles. Real-world experience, like an internship, is gold. My buddy Alex got hired after a summer at a small accounting firm, where he learned hands-on skills. These qualifications show employers you’re ready to tackle financial records and build trust. Start with a degree and maybe an internship, and you’re on your way.

How does an Audit Associate help a company?

An Audit Associate is like a financial bodyguard for a company. They check records to make sure everything is accurate and follows laws like GAAP or IFRS. This protects the business from costly mistakes or fraud. For example, imagine a company accidentally overstates its profits—investors could lose trust, and fines could pile up. An Audit Associate catches those errors early. They also test systems, like how a company tracks expenses, to prevent fraud. My friend Sarah once found a loophole in a client’s payment process that could’ve led to theft. By fixing it, she saved them a headache. Audit Associates write reports that guide managers on improving operations, like cutting wasteful spending. They also ensure compliance with tax laws, avoiding penalties. Their work builds trust with investors, customers, and regulators, making the company stronger. It’s not just about numbers—it’s about keeping a business healthy and honest, which feels pretty rewarding when you see the impact.

What’s the career path after starting as an Audit Associate?

Starting as an Audit Associate is like getting a ticket to a career with tons of possibilities. After 2-4 years, you could become a Senior Auditor, leading smaller audits and guiding newbies. It’s like being the team captain after being a player. With 5-7 years, you might step up to Audit Manager, running full projects and handling clients. My friend Mike hit this level and loved the challenge of managing teams. After 10+ years, top performers can become partners in accounting firms, where you help run the business and set goals. You could also switch to corporate roles, like Financial Analyst or Internal Audit Manager, which offer stability. Want something exciting? Try forensic accounting, where you investigate financial crimes. Down the road, you could aim for Chief Financial Officer, shaping a company’s financial future. Certifications like CA, ACCA, or CPA speed things up. Networking, like grabbing coffee with a mentor, also opens doors. The path is clear and full of growth.

Is being an Audit Associate stressful?

Like any job, being an Audit Associate has its ups and downs. The work can be intense, especially during busy seasons like tax time, when deadlines pile up. You might work long hours to finish audits on time, which can feel like cramming for a big exam. My cousin Priya said her first busy season was tough but taught her to stay organized. That said, the stress isn’t constant. Many days, you’re digging into numbers, meeting clients, or writing reports, which can be fun if you love solving puzzles. The key is managing your time and asking for help when needed. The payoff? Catching a major error or helping a client feels amazing. Plus, the skills you build—like staying calm under pressure—help in any career. If you’re someone who thrives on challenges and enjoys variety, the stress is manageable. It’s a trade-off for a stable job with growth and impact.

What tools or software do Audit Associates use?

As an Audit Associate, you’ll lean on tech to make your work faster and sharper. Excel is your best friend for crunching numbers and spotting trends, like finding a weird expense pattern. Audit software, like QuickBooks or CaseWare, helps you organize data and test financial systems. My friend Alex used CaseWare to catch a client’s misreported revenue—it saved hours of manual work. You might also use data analytics tools, like Tableau, to visualize trends, making it easier to explain findings to clients. Some firms have their own software for tracking audit progress. Knowing these tools isn’t just about speed; it shows you’re ready for modern auditing. Don’t worry if you’re not a tech wizard—most firms train you. Start with Excel in college or take a quick online course. These tools make you efficient and let you focus on the fun stuff, like solving financial mysteries.

How do Audit Associates work with clients?

An Audit Associate doesn’t just sit at a desk—they connect with clients to get the full picture. You’ll talk to company staff to gather records, like invoices or payroll data. Sometimes, you visit their office to check things like inventory or cash logs. My friend Sarah once spent a day at a warehouse counting boxes to confirm a client’s stock matched their books. You’ll ask questions to understand their processes, like how they track sales. Communication is huge—you need to explain your findings clearly, without confusing jargon. If you spot an error, you’ll walk the client through it, like showing a friend how to fix a math mistake. Building trust is key; clients rely on you to be honest and helpful. You’ll also work with your audit team to share what you learn. It’s a mix of detective work and people skills, making the job social and rewarding.

How can I prepare to become an Audit Associate?

Getting ready to be an Audit Associate starts with building the right foundation. First, aim for a B.Com or BBA degree to learn accounting basics. If you’re in school, take courses in finance or auditing. An internship is a game-changer—my buddy Priya landed her job after a summer at a small firm, where she practiced reviewing records. Start studying for certifications like CA Inter, ACCA, or CPA, even if you don’t finish them right away. These show you’re serious. Brush up on Excel; it’s used daily for data analysis. Practice communication skills—try explaining a tough concept to a friend to get better at clarity. Networking helps too—attend career fairs or connect with auditors on LinkedIn. My friend Alex met his mentor at a college event, and it led to a job offer. Stay curious and organized, and you’ll be ready to jump into this exciting career.