Table of Contents

Introduction

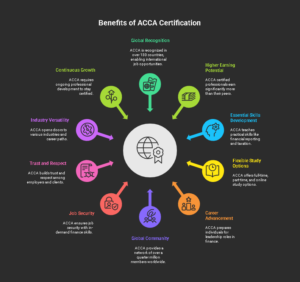

Imagine finally scoring that coveted finance job, or going around the world, or just receiving a salary that brings joy. The ACCA Certification can help you achieve that vision. It is a qualification that enjoys worldwide credibility and credentials aspiring accountants and finance pros for success. The benefits are numerous from enhancing your CV to gaining access to some of the most important companies. In this blog, we’ll breakdown the ACCA Certification, why it’s worth the effort and who should take the plunge. This credential can be a game changer if you are just out of school or looking to advance your career. Are you ready for it to impact your future? Read on to know why that means a thriving career in finance for you with the ACCA Certification.

Start your ACCA exam preparation Now! Download Entri App!

What Is ACCA?

1: Accounting provides information on

The ACCA Certification –or Association of Chartered Certified Accountants – is a gold standard certification for finance and accounting professionals. Founded in 1904, it is now celebrated in more than 180 countries around the world. Amongst other things the program educates students in financial reporting, taxes, audits and business strategy. It tracks 13 exams in three levels: Applied Knowledge, Applied Skills, and Strategic Professional. In addition, the candidates must have 3 years of actual work experience in order to hold the title.

What differentiates ACCA? It is adaptable. Your training can be full-time, part-time or online, and accommodate a busy life. Exams are held four times a year so you set the tempo. The curriculum is relevant and aligned with what employers are looking for today. You’ll learn to crunch numbers, manage budgets, and follow regulations—all of which are relevant to any finance job.

Global corporations such as PwC, KPMG are fond of ACCA students. You’ll be ready to work as a financial analyst or auditor in industries such as banking or tech. Once you pass, you get to use the “ACCA” title, which tells employers you’re serious about your craft. For anyone dreaming of a standout career in finance, the ACCA Certification is a solid first step.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Key Benefits of Getting ACCA Certification

1. Work Anywhere in the World

Ever dreamed of working in a bustling city like London or Dubai? The ACCA Certification makes it possible. Recognized in over 180 countries, it’s like a passport for finance jobs. From startups to global giants like Ernst & Young, employers trust ACCA holders. You could be an accountant in Mumbai one year and a financial consultant in Sydney the next.

This global stamp of approval gives you freedom. Skills learned through ACCA, like understanding international accounting rules, work anywhere. Imagine moving to a new country without starting over—your ACCA Certification travels with you. It’s a ticket to exciting job markets and a chance to build a career without borders.

2. Earn More Money

Who wouldn’t want a bigger paycheck? ACCA certified professionals tend to get paid premium prices. In the UK entry level salaries start between £30,000 to £45,000 and senior salaries such as a CFO can reach over £100,000. In the case of India, an ACCA certified can earn between ₹6-15 lakhs per annum, considerably higher than those without it.

Why such high salaries? The ACCA also teaches skills that employers want in the real world, such as budgeting and financial analysis. You’ll be ready to hit the ground running, getting you better pay increases and quicker promotions. Imagine a young accountant who gets their ACCA qualification and in a few years has a managerial position earning significantly more than their unqualified peers. It’s well worth the investment.

3. Learn Skills That Matter

The ACCA Certification is not simply about passing test but developing skills that you will use. You’ll learn to navigate financial reporting, taxation, and risk. For example you will learn to approach a company’s cash flow like a story that you can understand the parts of it that are strong and that need assistance.

But it’s not all quantitative. ACCA is also about teaching how to articulate complex ideas in simple terms or how to solve difficult business problems. These skills come out beautifully in meetings with bosses or clients. Unlike theoretical programs, ACCA brings together the practical and the visioning. It equips you to lead teams or consult with organizations and makes you a sought after individual in any organization.

4. Study on Your Terms

Life is busy, but ACCA fits in. You can study full-time, part-time, or online, depending on what works for you. Exams are offered four times a year, so you’re not locked into a rigid schedule. Whether you’re a student or juggling a job, ACCA gives you options.

Say you’re a parent working full-time. You can study at night or on weekends. Or maybe you’re fresh out of college and want to speed through. ACCA’s resources, like online courses or study guides from partners like Kaplan, make it doable. This flexibility means you can chase your goals without putting life on hold.

5. Climb to the Top

Want to be the boss? ACCA sets you up for big roles. The Strategic Professional exams dive into topics like business strategy and governance—stuff CEOs and finance directors need to know. Plus, the three-year work experience requirement gives you real-world practice.

Think of it like training to run a marathon. You’re not just learning theory; you’re out there doing the work. ACCA grads often become financial managers or even company leaders. Picture yourself leading a team at a top firm, making decisions that shape the business. With ACCA, that’s not just a dream—it’s a plan.

6. Connect with a Global Community

The ACCA is more than a certification, it’s a community. You’re part of something big, with over a quarter million members and 550,000 students global. Go to events, webinars, or conferences and network with your fellow finance pros. These connections can connect you to jobs, mentors, or lifelong friendships.

Let’s say you are at an ACCA event and are speaking with a senior accountant who mentions a job that sounds like a dream position. Or even to belong to an online community to exchange advice on how to pass the exams. One is that this network helps you stay on top of what is trending in the field and provides you opportunities you never realized you needed or wanted in your professional life.

7. Stay Secure in Your Job

The need for finance skills is constant. It uses experts to manage money, keep in line with laws, and strategy growth. With respect to future-proof yourself, ACCA trains you on present-day standards such as international taxation regulations. ACCA qualified people will always be sought after, even when economies are unstable.

Also, it allows for an easy industry change. If retail is not for you, there’s always tech or healthcare. For instance, an ACCA accountant working for a sector in crisis can seamlessly transition to start-up. And that kind of flexibility guarantees you a job, regardless.

8. Build Trust and Respect

ACCA Certification establishes that you’re serious. The “ACCA” name says to your employers and clients that you have the determination and ability to succeed. It’s like a sticker that reads “I’m knowledgeable”. It helps build trust when pitching to a client or leading a team.

A small enterprise, for example, may choose to work with an accountant who is ACCA-licensed over one who is not on the basis of that performance record. That kind of trust translates into bigger projects, more clients or quicker promotions. With ACCA, you are the one who gets the job done.

9. Work in Any Industry

ACCA opens doors to all kinds of businesses. You could crunch numbers for a bank, help a hospital manage funds, or budget for a tech startup. The certification teaches universal skills that every industry needs.

This variety keeps your career fresh. Tired of retail? Try energy. Want to work for a nonprofit? Go for it. An ACCA holder can shift from one field to another without extra training. It’s like having a key that unlocks any door in the finance world.

10. Keep Growing Forever

ACCA isn’t a one-and-done deal. Members must complete yearly training to stay certified, called Continuing Professional Development (CPD). This could mean taking a course on digital finance or attending a workshop on new tax laws. It keeps your skills sharp and relevant.

For example, a tax consultant with ACCA stays updated on rule changes, giving clients better advice. This focus on learning means you’re always ready for what’s next, whether it’s a new job or a shift in the industry. ACCA helps you grow for life.

Start your ACCA exam preparation Now! Download Entri App!

Who Should Consider ACCA?

The ACCA Certification is for anyone ready to shine in finance. College grads with degrees in business or accounting should jump in. It’s a fast way to stand out to employers like Deloitte or startups. A fresh graduate with ACCA can land a job at a top firm and start climbing.

Seasoned pros looking for a boost also benefit. If you’re an accountant stuck in a rut, ACCA can push you toward senior roles like financial controller. The skills and global recognition make you a top pick for promotions or bigger responsibilities.

Entrepreneurs should take note too. ACCA’s training in budgeting and strategy helps you run a business smarter. Imagine a small business owner using ACCA skills to create a killer financial plan that wins over investors. It’s a practical edge for anyone building a company.

Love the idea of working abroad? ACCA is perfect. Its worldwide acceptance means you can move from Lagos to London or Singapore without starting over. It’s ideal for adventurers who want a career that travels with them.

Career changers can also thrive with ACCA. If you’re in marketing or engineering but want to switch to finance, this is your path. The flexible study options let you learn while keeping your day job. Picture a teacher studying part-time to become a financial analyst—it’s doable.

Anyone who loves learning and finance is a great fit. ACCA’s challenging exams and focus on ethics appeal to driven people who want to keep growing. It’s tough but worth it for those ready to commit.

Start your ACCA exam preparation Now! Download Entri App!

Conclusion

The ACCA Certification is a life-changer for finance pros. It offers global job options, bigger paychecks, and skills that make you a star at work. From banking to tech, you can pick your industry and still thrive. The flexible study options and supportive community make the journey easier, while the “ACCA” title earns respect from employers and clients. Whether you’re a college grad, a seasoned accountant, or someone switching careers, this certification sets you up for success. It’s not just about passing exams—it’s about building a career that takes you places. The hard work pays off with better jobs, more money, and endless possibilities. Ready to make your mark in finance? The ACCA Certification is your key to a brighter future. Take the first step today and start building a career that’s as big as your dreams.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Frequently Asked Questions

What is the ACCA Certification, and why is it valuable?

The ACCA Certification, offered by the Association of Chartered Certified Accountants, is a globally recognized qualification for finance and accounting professionals. It includes 13 exams across three levels—Applied Knowledge, Applied Skills, and Strategic Professional—plus three years of practical work experience. The program teaches skills like financial reporting, taxation, and business strategy, preparing candidates for real-world challenges.

Its value lies in its worldwide acceptance. Recognized in over 180 countries, the ACCA Certification opens doors to jobs in banking, tech, or consulting. Employers like PwC and Deloitte trust it because it ensures expertise in international standards. Flexible study options let candidates learn at their own pace, fitting around work or school. Earning the “ACCA” title boosts credibility, helping professionals stand out for promotions or global roles. For anyone aiming to succeed in finance, this certification is a proven way to build a rewarding career with endless possibilities.

Who can pursue the ACCA Certification?

The ACCA Certification is open to a wide range of people. High school graduates with strong grades in math or commerce can start, though a college degree in business or accounting makes it easier. Working professionals, like accountants or auditors, can use it to climb the career ladder. Even those switching careers—say, from teaching or marketing—can join, thanks to flexible study options.

No prior finance experience is needed, but a passion for numbers helps. Entrepreneurs benefit too, gaining skills to manage their business finances. The certification suits anyone dreaming of international jobs, as it’s recognized in 180+ countries. For example, a graduate in India could qualify and work in London. Candidates need dedication, as the exams are tough, and three years of work experience are required. Whether starting fresh or leveling up, the ACCA Certification is a practical choice for driven individuals ready to shine in finance.

How long does it take to complete the ACCA Certification?

Completing the ACCA Certification typically takes 3–5 years, depending on the candidate’s pace. The program includes 13 exams across three levels: Applied Knowledge (3 exams), Applied Skills (6 exams), and Strategic Professional (4 exams). Most candidates take 2–3 exams per year, studying part-time or full-time. Each exam requires about 100–150 hours of preparation, so time management is key.

The three-year practical work experience requirement can run alongside studies, often through jobs in accounting or finance. For example, a full-time student might finish exams in two years and complete work experience by year three. A working professional studying part-time might take five years. Flexible exam schedules (four times a year) let candidates choose what fits their life. With commitment, the ACCA Certification is achievable without disrupting work or personal goals, making it a smart investment for a strong finance career.

How much does the ACCA Certification cost?

The cost of the ACCA Certification varies by region and study approach but generally ranges from £2,000 to £5,000 (or ₹2–5 lakhs in India). This includes registration fees, exam fees for 13 exams, and study materials. Annual subscription fees apply while studying and after qualifying as a member. Choosing self-study with online resources can keep costs lower, while courses from providers like Kaplan or BPP add to the expense but offer structured support.

Additional costs might include exam preparation books or mock tests. Some employers sponsor the certification, so it’s worth asking about funding at work. Compared to the cost, the payoff is huge—ACCA holders often earn £30,000–£100,000+ in the UK or ₹6–15 lakhs in India. The investment in the ACCA Certification leads to better jobs and higher salaries, making it worth every penny for a successful finance career.

What jobs can you get with an ACCA Certification?

The ACCA Certification unlocks a wide range of finance and accounting jobs. Graduates can become financial analysts, auditors, tax consultants, or management accountants. Roles like financial controller or CFO are within reach with experience. Big firms like Ernst & Young, Deloitte, and KPMG hire ACCA holders, as do banks, tech startups, and healthcare companies.

The certification’s global recognition means jobs aren’t limited to one country. For example, an ACCA-certified professional in Nigeria could work as an auditor in Canada. It also suits diverse industries—retail, energy, or nonprofits all need finance experts. Starting salaries often range from £30,000–£45,000 in the UK or ₹6–10 lakhs in India, with senior roles paying much more. The ACCA Certification equips candidates with skills to handle budgets, audits, or financial planning, making them valuable in any workplace and setting them up for a dynamic, rewarding career.

Is the ACCA Certification difficult to pass?

The ACCA Certification is challenging but doable with effort. The 13 exams test topics like financial reporting, taxation, and business strategy, requiring 100–150 hours of study per exam. Pass rates vary, typically 40–60% per exam, depending on the level. Strategic Professional exams are the toughest, focusing on advanced skills like corporate governance.

Success comes down to preparation. Study resources, like ACCA’s online materials or courses from BPP, help a lot. Candidates with strong time management and a study plan—say, tackling two exams every six months—tend to do well. The three-year work experience requirement adds practical know-how, easing the transition to real-world tasks. While it’s not a walk in the park, thousands pass each year. For those ready to commit, the ACCA Certification is a rewarding challenge that pays off with a standout career.

How does the ACCA Certification compare to other qualifications?

The ACCA Certification stands out for its global reach and flexibility compared to qualifications like CPA or CIMA. Recognized in 180+ countries, ACCA suits those eyeing international careers, unlike CPA, which is more US-focused. CIMA emphasizes management accounting, while ACCA covers a broader range—financial reporting, audits, taxes, and strategy.

ACCA’s 13 exams and three-year work experience requirement are rigorous but practical, preparing candidates for real jobs. Its study options (full-time, part-time, or online) fit busy schedules, unlike some programs with stricter timelines. ACCA also offers a huge network of 250,000 members, connecting professionals worldwide. For example, an ACCA holder can work in London or Dubai with ease, while other credentials may need extra certifications. For versatility and global opportunities, the ACCA Certification is a top choice for finance pros.

Can you study for the ACCA Certification while working?

Absolutely, the ACCA Certification is designed for busy people. Its flexible study options let candidates learn part-time or online, perfect for those with full-time jobs. Exams are offered four times a year, so you can schedule them around work. For example, a marketing assistant could study evenings and take one exam every three months.

Study resources, like ACCA’s online platform or courses from Kaplan, make it easier to prepare during spare hours. The three-year work experience requirement can often be met through your current job, especially if it involves finance tasks. Many employers value ACCA and may even offer study leave or funding. Balancing work and study takes discipline, but thousands do it every year. The ACCA Certification’s flexibility means you can grow your career without quitting your job or sacrificing family time.

What support does ACCA offer to candidates?

ACCA provides plenty of support to help candidates succeed. Official study resources include textbooks, practice questions, and online learning tools. The ACCA website offers exam tips, past papers, and study guides to prepare effectively. Candidates can also join study groups or forums to connect with others, sharing advice and motivation.

ACCA partners with providers like BPP and Kaplan for structured courses, both online and in-person. Events, webinars, and workshops offer insights from industry pros. For example, a candidate might attend a webinar on tax law updates to ace an exam. The global community of 250,000 members provides networking opportunities, like meeting a mentor at an ACCA conference. Practical work experience is supported through approved employers who guide candidates. With these tools, the ACCA Certification journey feels less daunting and more like a team effort toward success.

Why is the ACCA Certification worth the effort?

The ACCA Certification is a game-changer for anyone serious about finance. It opens doors to high-paying jobs, with salaries of £30,000–£100,000+ in the UK or ₹6–15 lakhs in India. Its global recognition in 180+ countries means you can work anywhere—from a tech startup in Bangalore to a bank in New York. The skills learned, like budgeting and financial analysis, make you a star at work.

The effort—13 exams and three years of experience—pays off with job security and respect. Employers trust the “ACCA” title, giving you an edge for promotions or new roles. Plus, the flexibility to study at your own pace fits any lifestyle. Imagine being a financial manager leading a team, thanks to ACCA. The hard work builds a career that’s exciting, stable, and full of opportunities, making the ACCA Certification a smart choice.