Table of Contents

Tax season in 2025 hits fast. Deadlines stack up. Clients stress over new IRS rules on digital assets. You stay calm because you know how to handle it. One credential helps you solve problems quickly. The other helps you build long-term authority. That’s where the Enrolled Agent vs. CPA debate gets real.

Regulations shift again with inflation updates and new energy credits. Choosing the wrong path slows your career. Choosing the right one opens better pay and stronger opportunities.

This post explains both roles, the pay differences, the job outlook, and what makes each option worth considering. By the end, you’ll see which credential gives most professionals an edge in 2025’s tighter market.

Introduction

Tax rules are shifting in 2025, and new remote-work deduction laws are causing confusion. Companies now want professionals who understand IRS rules well, which is pushing demand in accounting to about 124,000 openings a year. Credentials make a real difference. Enrolled Agents focus only on taxes, while CPAs handle all areas of accounting. Costs, training time, and pay vary, and those with credentials land better clients and faster offers.

Your choice depends on your goals. If you like tax problem-solving, EA fits. If you want broader work, CPA works better. Remote jobs and AI tools will keep growing, taking over routine tasks and rewarding strong analytical skills. Without a credential, you stay in basic prep work. With one, you earn more and gain trust. This guide breaks down both paths, current trends, and what each option offers so you can decide what fits you.

Enrolled Agents shine in tax fights. CPAs lead boardrooms. Salaries climb past $100,000 for top earners. Jobs span firms to startups. 2025’s economy favors the prepared. Inflation cools. Rates drop. Businesses expand. Tax needs grow. Choose now. Build a career that lasts. Let’s start with basics.

Who Is an Enrolled Agent (EA)?

1: Accounting provides information on

An Enrolled Agent is a tax professional licensed by the IRS. The credential gives full authority to represent clients in audits, appeals, and collections without limitations. EAs understand the tax code well and often find deductions that others overlook. In 2025, they remain in demand as tax rules grow more complex.

To become an EA, you must pass the Special Enrollment Exam. It has three parts that cover individual taxation, business taxation, and IRS procedures. Each section tests practical knowledge of the tax code. Most candidates study for about six months, and the pass rate is around 70 percent. A college degree isn’t required. Work experience also counts, and some former IRS employees qualify through their service. A background check is part of the process.

After earning the credential, EAs must renew their status every year. They also need a PTIN to file returns under their own name. Continuing education is required: 72 hours every three years. These hours usually include updates on new credits and rules, such as recent EV incentives. Many EAs join NAEA or similar groups to access jobs, training, and networking.

The daily work is straightforward. EAs prepare returns for individuals and small businesses, advise on retirement moves like Roth conversions, and respond to IRS notices. Remote work is common in 2025, and professional tax software speeds up tasks. Many EAs freelance or run their own practice, often charging around $200 per hour. Clients value their focus on taxes alone.

The benefits add up. The federal license works nationwide, so moving states doesn’t require new testing. The path is quick compared to other credentials, and the total cost is usually under $2,000, including exam fees and study materials. Most EAs can start finding clients within their first year.

There are real examples of quick growth. Sarah, a former bookkeeper, passed the exam in 2024. She now runs a home office, prepares about 300 returns a year, and earns around $85,000. She plans to take on new partnerships in 2025. EAs adjust fast to new demands, including the rise of gig-economy and crypto tax issues.

There are limits, too. EAs focus strictly on taxes, so they can’t perform audits for large corporations or offer broad financial planning. In those cases, they refer clients to other specialists. Even so, demand continues to rise. The Bureau of Labor Statistics projects about 5 percent growth and roughly 15,000 openings. The IRS also hires EAs for examiner roles.

Choose the EA path if you want a direct, practical route into tax work. Specialists are valued in 2025, and the growing complexity of areas like crypto taxation makes EAs even more essential. It’s a field where trust builds quickly, and income follows steady experience.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Who Is a Certified Public Accountant (CPA)?

A Certified Public Accountant is a state-licensed professional who handles the tough parts of accounting. The AICPA sets the rules, and CPAs follow them when they audit books, review mergers, handle taxes, and help companies stay compliant with SEC standards.

The process starts with school. Most people earn an accounting degree and hit the 150-credit requirement. Then comes the CPA Exam. It has four parts—Audit, Business, Financial, and Regulation. Each part takes two hours. Testing is open all year. The pass rate stays around 50 percent, so most candidates spend close to a year preparing.

After the exam, states expect one to two years of supervised work under a CPA. Public accounting firms usually cover this. Some states add an ethics test. Requirements aren’t the same everywhere; California wants 24 months, while Texas accepts 12.

Once licensed, CPAs keep up with continuing education—about 40 hours a year. The updates usually cover fraud, new audit tools, and changing rules. Many join the AICPA for extra resources. ESG reporting is a growing area where CPAs are already involved.

The work itself varies a lot. Some audit big companies. Some help with IPOs, teach in universities, or run their own firms. Remote auditing keeps growing as more work moves to the cloud. Many CPAs charge $300 or more per hour, especially when clients want both tax work and financial planning.

The credential opens doors. It builds trust, helps with promotions, and gives people a shot at leadership roles. But it’s not cheap. A degree can cost around $50,000. The exam adds another $1,500, and prep courses roughly $3,000. Many firms reimburse these costs, which helps.

A quick example: Mike graduated in 2023 and passed all exam sections on his first try. He joined Deloitte, moved up to senior associate, and now handles audits worth around $2 million. He earns about $95,000 and works on new cases tied to AI ethics.

The job has its tough spots. State rules can limit where CPAs work, and busy season often means long hours. Burnout is common for some. But demand is steady. The BLS expects 5 percent growth and roughly 91,000 openings each year. Big firms and startups both rely on CPAs.

For anyone who wants stability, variety, and long-term growth, the CPA route is still a solid choice.

Key Differences: EA vs CPA (table comparison)

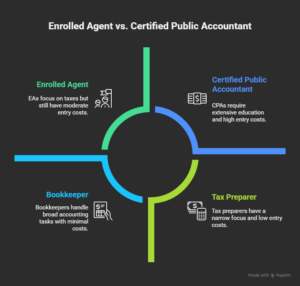

Enrolled Agent vs CPA boils down to focus and reach and EAs zero in on taxes. CPAs spread across accounting. Both rep IRS clients are one cost less time. The other pays more long-term. The table below spots gaps, Use it to weigh your fit.

| Aspect | Enrolled Agent (EA) | Certified Public Accountant (CPA) |

| Licensing Body | IRS (federal) | State boards |

| Scope of Practice | Federal taxes only | All accounting, audits, taxes, consulting |

| Education Required | None (high school ok) | Bachelor’s + 150 credits |

| Exam Details | 3 parts, tax-focused, ~100 questions each | 4 sections, broad topics, 4-5 hours each |

| Pass Rate | ~70% | ~50% |

| Experience Needed | None for exam; IRS vets optional | 1-2 years supervised |

| Representation | Unlimited IRS matters | Unlimited IRS + state agencies |

| CPE Hours | 72 every 3 years | 40 yearly |

| Cost to Obtain | ~$2,000 (exam + prep) | $50,000+ (degree + exam) |

| Mobility | Nationwide, no retest | State-specific, ethics retest on move |

| Best For | Tax specialists, quick entry | Broad careers, leadership roles |

When you compare both careers, the pace is the first thing you notice. EAs usually move quicker. Many finish the process in a few months and start working right away. CPAs take longer, but the path is solid and respected. Looking at 2025, federal tax updates lean in favor of EAs, while the rise in state audits gives CPAs more work. The better choice depends on how you like to work and what kind of career rhythm fits you.

The exams show the difference too. The EA exam is straight tax law, nothing else. The CPA exam covers more areas like ethics and accounting. Both take real effort, but most people find the EA route more manageable.

Their roles separate them even more. EAs don’t deal with financial statements. CPAs do, and they can sign off on them, which opens more corporate opportunities. Still, EAs hold a strong position in tax-focused work, and many clients prefer specialists for that.

Money also plays a part. Becoming a CPA is costly, and a lot of candidates end up with loan debt. EAs usually skip that burden because the entry cost is lower. Moving around is simpler for EAs too since their license works nationwide. CPAs often need to plan ahead because each state has its own rules.

For 2025, the trend is clear. The IRS is stepping up enforcement, which puts EAs in a stronger spot. At the same time, the SEC is tightening reporting rules, giving CPAs more responsibility. Use the table to see which path matches your goals and the kind of work you want to do.

Career Opportunities

Job openings remain strong in 2025. Accounting roles are projected to grow about 5 percent, and shifts in tech continue to create more remote options. Enrolled Agents (EAs) and CPAs follow different paths, but both see steady demand.

Start with EAs. Tax preparation remains the main entry point. Companies such as H&R Block hire large numbers of seasonal preparers, and many move into full-time roles later. A typical season can involve preparing around 1,000 returns, often with performance bonuses. Some EAs transition into IRS positions, especially as examiners who review claims. These roles start near $60,000 and include government benefits such as pensions and flexible work hours.

Many EAs also succeed on their own. Running a solo practice works well because clients often arrive through referrals. The rise of gig-based work in 2025 strengthens this path, since freelancers need help with Schedule C and related tax issues. Software tools like Drake simplify the workload. Networks such as the NAEA help EAs find opportunities, and conferences often spark new ideas. Some EAs move into forensics, tracing tax-related fraud for banks and compliance teams.

Current trends continue to favor EAs. Crypto regulations are tightening, increasing demand for professionals who understand forms like 1099-B. New green-energy incentives add complexity, and EAs advise on credits for solar and other upgrades. Remote work remains common: roughly 70 percent of EA gigs can be done virtually. California leads hiring with around 500 openings, including about 70 in Los Angeles. Overall growth stays steady at about 5 percent.

CPAs follow a broader set of paths. Public accounting remains the largest employer, and the Big Four bring in thousands of graduates each year. Audit roles often include travel, which appeals to some. Private industry is the next major destination, where CPAs step into positions such as controller and oversee cash flow, budgeting, and forecasting. Salaries tend to rise quickly.

Forensics also attracts CPAs. They investigate embezzlement cases and provide expert testimony in court. Consulting firms hire CPAs for expansion planning, valuation work, and strategic reviews. AI-driven audits are growing in 2025, and these tools flag issues that CPAs then verify.

Many CPAs eventually start their own consultancies and work with startups and mid-sized companies. Organizations like NCACPA outline these career paths. Government roles are also available, including positions such as budget analyst. The BLS projects around 124,000 openings, and cities like Charlotte report more than 250 local jobs.

When comparing the two careers, EAs specialize deeply in tax and tend to find quick opportunities during tax season. CPAs are more versatile and can switch industries with ease. EAs have a strong freelance presence, while CPAs often move up corporate ladders. Both careers support remote and hybrid work in 2025.

Examples show how paths can differ. Lisa, an EA, joined a tax firm in 2024 and now serves as a tax director earning about $90,000. Tom, a CPA, shifted from audit to CFO and helped lead a merger that earned him a $150,000 bonus. Outcomes vary, but both tracks offer solid progression.

Demand is expected to remain high. EAs benefit from IRS hiring waves, while CPAs fill gaps in large firms and private companies. The choice depends on speed and goals: EAs can enter the field quickly, while CPAs often see higher ceilings over time.

The overall outlook is positive. Automation handles basic tasks, leaving more strategic work for professionals. EAs guide clients through changing tax laws, while CPAs assess risks and financial plans. Both careers stay secure in a shifting job market.

Salary Comparison

EAs often have their paychecks going upward as they enter their careers. Most make about $72,000 a year. Beginners start at about $50,000, middle-level EAs are up to $70,000, and seniors climb about $110,000. Entrepreneurs who run their own small EA business earn $120,000 or more. Freelancers charge higher rates, 150-$250 per hour.

The pay comes from experience, loyal clients and larger cities. Typically in New York, EAs are $80,000. California is $750,000 and California is 75,000.

CPAs tend to earn more money. Some of them earn more than $95,000 in base salary and sometimes $140,000 with bonuses. Recruiters typically start around $65,000, middle-career medians of $90,000, and managers at the top of the job earn $120,000. Partners often amount to some very well over $200,000.

Big Four seniors earn about $120,000 plus a 20% bonus. CPAs in DC are roughly $105,000 versus $90,000. in Texas.

| Level | EA Salary | CPA Salary (Total) |

|---|---|---|

| Entry | $50,000 | $65,000 |

| Mid | $70,000 | $90,000 |

| Senior | $110,000 | $150,000+ |

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Which One Should You Choose?

Choosing between Enrolled Agent and CPA depends on the life you want. Both careers work, but they support different goals. If you enjoy taxes and want a focused path, the EA route fits. If you want a broader career with options beyond tax, the CPA path makes more sense. With the changes happening in 2025, it’s worth weighing time, cost, and long-term plans.

The EA track suits people who want to start fast. There’s no degree requirement. Pass the exam, and you can begin working almost immediately. It’s a good fit for career changers and bookkeepers who want to move up. The costs are low, so you avoid debt. The work is specialized, and you build deep knowledge of IRS rules. Clients tend to stay, and income stays stable. You also get the freedom to freelance and choose your workload.

But the EA role has limits. You can’t handle audits for large companies, and corporate growth is slower. If you’re someone who genuinely enjoys tax work, the EA role still works well. Remote tax jobs are growing quickly in 2025, and platforms like Upwork have steady demand. EAs pick up these projects easily, earn per return, and can scale by building small teams.

The CPA path fits people who want to climb. You need a degree, and the exam requires more time and effort. Once you earn it, the range of work is wider. You can handle audits, work with large companies, consult leadership teams, or manage entire departments. The credential carries weight, and it opens doors all the way to executive roles. The pay reflects the effort, but the trade-offs are real: years of schooling, upfront costs around $60,000, heavy busy seasons, and state licensing rules that limit mobility. If you want variety and long-term growth, the CPA path is worth it. ESG reporting and new regulations in 2025 are also creating more roles for CPAs.

Your stage of life matters. If you’re under 30 and want a strong foundation, CPA provides it. If you’re over 40 and want a quicker shift, EA is more realistic. If family time matters, EA gives more flexibility. If your budget is tight, EA avoids major expenses.

Examples help. Sarah, a new graduate, chooses the CPA route because she wants management roles. She starts around $80,000. John, a tax veteran, chooses the EA path and opens his own firm. He earns about $110,000 by his second year. Both choices make sense for their situations.

Industry trends also shape the decision. The IRS is hiring more EAs for enforcement work. The SEC favors CPAs for financial reporting. Hybrid and remote models help both groups work from anywhere.

In the end, choose what interests you. Try shadowing an EA or sitting in on an audit with a CPA to see what feels right. 2025 rewards people who take action. Start preparing now. For most people, the EA path offers quicker wins, lower risk, and steady demand. However, both careers can succeed if they match your goals.

Key Takeaways

- EAs focus on taxes. Quick entry. No degree. Average $72,000 pay.

- CPAs cover all accounting. Need school. Broader jobs. $99,000 average.

- Exam ease favors EAs. 70 percent pass. CPAs at 50 percent.

- Careers split. EAs tax prep, IRS. CPAs audit, consult.

- 2025 growth 5 percent both. Remote opens doors.

- Choose EA for speed. CPA for scale.

- Costs low for EA. High for CPA but reimbursed often.

- Mobility best with EA. Federal license travels.

These points cut core. Act on one today.

Start your EA journey confidently with Entri’s course here: Enrolled Agent Course in Kerala

Conclusion

In 2025, Enrolled Agent vs CPA can shape your career path. Both are strong, but they move at different paces. EAs get quickly in to tax work without long learning curves. CPAs do not have that time to qualify, but they are increasingly more flexible in their career opportunities. You still have job opportunities both here and there, but pay depends on skill, skill, and experience you obtain.

The industry is growing slowly. New tax rules have steadily prompted the need for trained professionals. They enable firms or clients to work remotely from anywhere. If you want to make it forward, choose a path, begin studying, clear up the exams and get into the field.

If you don’t know what to do, ask working professionals, join communities and look at everyday work. A 2025 is going nowhere for anyone. Pick your credential, stick with it and go on to build a safe career.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Frequently Asked Questions

What exactly does an Enrolled Agent do day-to-day, and how does that compare to a CPA's routine in 2025?

An Enrolled Agent spends most days on tax work. They meet clients to gather forms. Review W-2s, 1099s, and receipts. Enter data into software like Drake or UltraTax. Spot missed deductions such as home office costs for remote workers. Draft returns for individuals, LLCs, and S-corps. File electronically before deadlines. Handle IRS notices. Call the agency to resolve back taxes or liens. Prep for audits by pulling records and building cases. Advise on quarterly payments to avoid penalties. In 2025, they tackle new forms for crypto sales and green energy credits. They might spend three hours on a complex return with foreign income. Evenings bring client calls about Roth conversions or inheritance rules. Freelance EAs set their schedules, often working from home offices with video tools. They charge flat fees per return or hourly for advice. A busy EA handles 15 returns a week during peak season. Off-season focuses on planning and CPE courses on updated codes.

A CPA’s day spreads wider. Mornings start with audit checklists for public companies. Review balance sheets and income statements. Test internal controls for fraud risks. Use data analytics tools to flag odd transactions. Meet teams to discuss findings. Afternoons shift to consulting. Help a startup value assets for a merger. Build financial models in Excel. Forecast cash flow under new interest rates. Prep tax strategies but delegate filings to staff. Evenings involve client dinners or board presentations. In 2025, CPAs deal with ESG reports, tracking carbon credits in financials. They sign off on SEC filings. Big Four CPAs travel to client sites for inventory counts. Private industry CPAs manage budgets and variance reports. Hours stretch during quarter closes. A CPA might juggle three audits and two consults weekly. Variety keeps the role fresh but demands constant switches between tasks.

The core gap shows in focus. EAs dive deep into one area all day. CPAs jump across accounting fields. Both use tech, but EAs lean on tax software. CPAs master ERP systems like SAP. Choose EA for steady tax rhythm. Pick CPA for dynamic challenges.

How long does it really take to become an Enrolled Agent versus a CPA, including all steps and potential delays?

Becoming an Enrolled Agent moves fast if you study hard. First, register for the Special Enrollment Exam. IRS approves in days. Schedule three parts at Prometric centers. Study full-time for four to six months using Gleim or PassKey materials. Each part takes three hours. Pass one, then the next. Most finish exams in three months. Scores come quick. Apply to IRS with Form 23. Background check takes two weeks. Total time from start to license: six to nine months. No experience required upfront. Work as a preparer during study to build skills. Delays hit if you fail a part. Retake after 30 days. Add three months per fail. Part-time study stretches to 12 months. In 2025, online proctors speed testing. No college holds you back.

CPA path drags longer. Start with college. Four years for bachelor’s in accounting. Add 30 credits for 150 total. Online programs or community college cut costs but take 18 months extra. Graduate, then sit for CPA Exam. Four sections. Study 12 months full-time with Becker or Wiley. Pass rates low, so plan retakes. Each section windows open quarterly. Finish exams in 18 months. Gain experience next. One year minimum under a licensed CPA. Public accounting counts best. Track hours weekly. Some states demand two years. Ethics exam adds a month. Apply to state board. Reviews take 60 days. Total from college start: five to seven years. Delays from exam fails add six months each. Job switches slow experience logs. Moves between states require new applications.

EA wins on speed. Enter workforce years earlier. CPA demands patience but opens more doors later. Factor your timeline. Need income soon? EA fits. Plan long game? CPA builds.

What are the total costs to get an EA credential compared to CPA, and where can you save money on each?

EA costs stay low. Exam fees $206 per part. Three parts total $618. Study materials like books and practice tests run $400 to $800. Online courses add $300. PTIN renewal $30 yearly. Background check $50. Total upfront: $1,500 to $2,500. No tuition. Self-study cuts to $1,000. Used books on eBay save $200. Group study shares costs. In 2025, free IRS webinars cover basics. NAEA student membership $100 yearly offers discounts. No loans needed. Start earning right away to recoup.

CPA costs pile high. College tuition averages $40,000 for public in-state. Private hits $120,000. Online degrees $25,000. Extra 30 credits $10,000. Exam fees $1,000 total for four sections. Review courses $2,500 to $4,000. Ethics test $200. License application $300 per state. Experience supervision free if employed. Total: $50,000 to $150,000. Save with community college transfers. Scholarships cover 20 percent. Employer tuition aid up to $5,000 yearly. Big Four reimburse exams fully after hire. Join firm as associate first. Pass while working. Cuts personal outlay to $10,000.

EA saves thousands upfront. Ideal for budget limits. CPA invests heavy but firms often pay back. Weigh debt tolerance. EA avoids it. CPA bets on future returns.

Can an Enrolled Agent represent clients in all IRS matters, and does a CPA have any extra powers there?

Enrolled Agents hold unlimited IRS representation rights. They speak for clients in audits, collections, appeals. File offers in compromise to settle debts. Attend hearings. Sign agreements. Handle payroll tax issues for businesses. Cover all federal tax forms. No limits on case size. A small EA fights a $1 million corporate audit same as a $500 personal one. In 2025, they tackle crypto audits with Form 1040 Schedule 1. Power comes from IRS directly. Federal scope means no state barriers.

CPAs match on IRS matters if they hold PTIN. Unlimited rights too. But state license adds layers. Represent in state tax boards for income or sales taxes. Handle franchise tax appeals. Some states restrict non-CPAs. CPAs file in all agencies. Extra power in court for tax cases if admitted. Most CPAs stick to advisory. They prep docs but let EAs or attorneys argue in complex fights.

Both strong at IRS. CPAs edge on state levels. Pick EA for pure federal battles. CPA for mixed state-federal needs. Most clients care only IRS. EA suffices.

What salary growth can you expect as an EA over 10 years versus a CPA in different work settings?

EA salary starts at $45,000 in small firms. Year three hits $60,000 with 200 clients. Own practice by year five: $90,000 net after costs. Add staff, reach $150,000 by year 10. Niche in crypto or expat taxes boosts to $200,000. IRS examiner path: $55,000 start, $95,000 senior by year 10. Bonuses small. Freelance caps vary. 500 returns yearly at $300 each gross $150,000. Subtract software and marketing $20,000. Growth steady but plateaus without scale. In 2025, remote EAs in high-tax states like New York average $110,000 mid-career.

CPA starts higher at $70,000 in public accounting. Year three $85,000 as senior. Manager by year six $120,000. Partner track year 10 $250,000 plus profits. Private industry controller $110,000 mid, $180,000 CFO by 10. Consulting partners hit $400,000. Big Four accelerate. $100,000 year four, $300,000 year 10. Bonuses 15 to 50 percent. Equity adds wealth. Growth exponential with promotions. In 2025, AI-savvy CPAs in tech firms see $150,000 mid-career.

EA grows linear. Reliable but capped solo. CPA curves up sharp in firms. Settings matter. EA freelance flexible. CPA corporate structured. Aim high? CPA compounds.

Are there specific industries in 2025 where EAs have a clear edge over CPAs for job openings?

Gig economy booms in 2025. Platforms like Uber and DoorDash create millions of 1099 workers. They need Schedule C experts. EAs fill roles fast. Tax prep chains hire thousands seasonal. H&R Block adds 5,000 EAs yearly. Crypto firms seek token tax pros. EAs advise on NFT sales and staking income. Small businesses under $5 million revenue prefer EA focus. Cheaper than full CPA firms. Real estate investors want rental deduction masters. EAs handle 1031 exchanges daily. Expat services grow with remote work. EAs file FBARs and fatca reports. Non-profits need grant tax help. EAs ensure compliance without audit overhead.

CPAs dominate large corps and public markets. But EAs own niches. Job boards show 2,000 EA tax specialist posts monthly. Upwork lists 500 remote EA gigs. Edge clear in pure tax volume. Industries shift to specialists. EAs grab share.

How does continuing education work for EAs and CPAs, and what happens if you miss requirements?

EAs need 72 CPE hours every three years. Minimum 16 yearly. Two hours ethics. Topics cover tax law changes, like 2025 digital asset rules. Options include webinars, conferences, self-study. NAEA offers packages $200 yearly. IRS provides free VITA training. Track via PTIN account. Miss deadline? Pay $100 late fee. Complete makeup hours. Repeated fails suspend status. Lose rep rights until fixed.

CPAs require 40 hours yearly. Varies by state. 20 minimum some years. Four hours ethics often. Covers accounting standards, fraud, tech. AICPA courses $500 package. Firm-sponsored free. Miss? State suspends license. Fines $500. Makeup needed plus penalty hours. Big Four track for you. Independents log manually.

EA flexible with three-year cycle. CPA stricter annual. Both enforce to protect public. Plan ahead. Miss hurts income fast.

Can you switch from being an EA to a CPA later, or vice versa, and what credits transfer?

Switch EA to CPA possible. EA status waives no exam parts. But IRS experience counts toward CPA requirement in some states. California accepts three years EA work for one year experience. Still need 150 credits and pass exam. Study broad topics anew. Time adds two years minimum. Cost exam plus school if short credits.

CPA to EA easier. Pass SEE exam. CPA experience exceeds needs. Often exempt from parts if recent tax work. IRS grants based on CPA license. Total switch six months. Keep CPA active or let lapse.

Transfers limited. EA path quicker add-on. CPA rarely drops to EA. Build on one. Dual rare but powerful for full service firms.

What remote work options exist for EAs and CPAs in 2025, and how do they impact earnings?

Remote EAs thrive. Prep returns via secure portals. Video consults replace offices. Tools like RightSignature for e-sign. Serve clients nationwide. No state limits. Earnings rise with lower overhead. Home office deducts $5 per square foot. Market to expats abroad. Platforms pay $100 per return. Top EAs handle 400 yearly remote, net $120,000. 2025 sees 80 percent EA jobs hybrid or full remote.

CPAs remote in audits via cloud shares. Review docs on SharePoint. Virtual inventory via drones. Consulting calls on Teams. Big Four mandate two days office. Private firms full remote. Earnings steady but travel bonuses cut. Controllers manage global teams. Pay $140,000 remote mid-career. Limits on signing physical docs.

Both viable remote. EAs gain more freedom. CPAs tied to firm policies. Location independence boosts EA appeal.

How do client perceptions differ between hiring an EA or a CPA for tax help in 2025?

Clients see EAs as tax experts. Trust for IRS fights. View as affordable specialists. Small business owners pick EAs for $300 returns. Appreciate direct IRS power. Perceive as focused and fast. Word spreads in local groups. 2025 reviews highlight crypto saves.

Clients view CPAs as full advisors. Trust for big pictures. Pay $500 plus for complex needs. See as business partners. Corps require CPA sign-offs. Perceive prestige. Boardrooms demand it.

Perception matches scope. EA wins pure tax trust. CPA broader authority. Match client type. Individuals lean EA. Enterprises CPA. Both respected in roles.