Table of Contents

Investing in mutual funds has become a preferred choice for Indian investors seeking diversified exposure to equity, debt, or hybrid asset classes. As per the mutual funds report monthly inflow of SIP has crossed 25000 crores per month. That is an insane 3x growth for the last 5 years. However, understanding taxation on mutual funds is crucial to optimizing net returns and ensuring compliance with Indian tax laws.

This article offers a thorough explanation of mutual fund taxation with special focus on recent changes, different fund categories, common pitfalls, and tips for smart tax planning in India.

Key Takeaways:

- Tax on mutual funds in India is divided into capital gains tax based on the holding period and the type of fund you are investing.

- There are short-term and long-term capital gains taxes that vary depending on the type of mutual fund and how long you hold it.

- Equity mutual funds are taxed differently from debt mutual funds, with equity funds offering tax benefits like exemption up to ₹1.25 lakh in long-term capital gains.

- Understanding the nuances of STT (Securities Transaction Tax), indexation, and dividend distribution tax (DDT) is crucial for efficient tax planning.

Mutual Funds and Indian Tax Law: The Basics

-

Mutual funds in India are subject to capital gains tax and, in some cases, dividend tax.

-

Tax rules differ based on the type of fund: equity, debt, hybrid, or others (gold, international, and fund-of-funds).

-

The holding period, how long the units are held, determines whether the gains are short-term or long-term.

-

As of April 1, 2025, the Indian government has revised several definitions and taxation brackets for various fund categories.

Equity Mutual Funds: Taxation Rules

1: What is a stock?

Definition

-

Equity mutual funds are schemes that invest at least 65% of their corpus in equity shares of domestic companies.

Tax Treatment

| Period Held | Type of Gain | Tax Rate | Exemption/Threshold | Notes |

|---|---|---|---|---|

| 12 months or less | Short-Term Capital Gain (STCG) | 15% | None | Surcharge and cess extra |

| More than 12 months | Long-Term Capital Gain (LTCG) | 12.5% on gains above ₹1.25 lakh | First ₹1.25 lakh tax-free | Indexation benefit unavailable |

Example

If total LTCG in a financial year equals ₹1.45 lakh, only ₹20,000 is taxable at 12.5%; ₹1.25 lakh remains exempt.

Dividend Tax

All mutual fund dividends are taxed in the hands of investors as per the applicable income tax slab.

Start investing like a pro. Enroll in our Stock Market course!

Non-Equity Mutual Funds: Taxation Rules

Definition

-

Debt mutual funds are those where more than 65% of the portfolio is invested in debt instruments, such as government securities or corporate bonds.

Latest Update (Effective April 1, 2025)

| Period Held | Type of Gain | Tax Rate | Notes |

|---|---|---|---|

| Up to 2 years | Short-Term Capital Gain (STCG) | As per the investor’s income tax slab | No indexation benefit |

| More than 2 years | Long-Term Capital Gain (LTCG) | 12.5% | No indexation benefit; earlier LTCG was taxed at 20% with indexation pre-2023 |

Older Investments

-

If the investment is made before April 1, 2023, LTCG is taxed at 20% with indexation if held for over 3 years.

-

Investments between April 1, 2023, and March 31, 2025, are taxed as per slab rate, regardless of holding period.

Dividend Tax

-

Dividends are taxed as per the individual’s income tax slab.

| Gain Financial Literacy in your Mother Tongue | |

| Stock Market Course in Malayalam | Mutual Funds Course in Malayalam |

| Stock Market Course in Tamil | Mutual Funds Course in Tamil |

| Stock Market Course | Mutual Funds Course |

Hybrid, International, Gold, and Fund of Funds

| Fund Type | STCG (Holding Period) | STCG Tax Rate | LTCG (Holding Period) | LTCG Tax Rate | Threshold/Notes |

|---|---|---|---|---|---|

| Equity-Oriented Hybrid | ≤12 months | 15% | >12 months | 12.5% (₹1.25L exempt) | ≥65% in equity |

| Debt-Oriented Hybrid | ≤2 years | As per the slab | >2 years | 12.5% | <65% in equity |

| Gold, International, FoF | ≤2 years | As per the slab | >2 years | 12.5% | No indexation benefit post-2025 |

-

International and gold funds, as well as fund-of-funds, follow the new debt fund taxation structure from April 1, 2025.

Key Taxation Concepts Explained

What Are Capital Gains?

-

Capital Gains are profits realized from selling mutual fund units. Tax treatment depends on type and holding period.

Short-Term vs. Long-Term: How Is “Period Held” Calculated?

-

Equity funds: Less than or equal to 12 months: STCG; More than 12 months: LTCG.

-

Debt funds, international, gold, FoFs: Less than or equal to 2 years: STCG; More than two years: LTCG.

Indexation

-

Indexation allows investors to adjust the purchase price by inflation, reducing taxable gains.

-

Indexation benefit is NO LONGER AVAILABLE for new investments in debt funds, international, gold, and FoFs post April 1, 2025.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreHow To Calculate Tax on Mutual Fund Gains

For Equity Mutual Funds:

-

Calculate net gain = Redemption value – (Purchase value + charges)

-

Identify holding period.

-

Apply STCG or LTCG rule:

-

STCG: Tax at 15%

-

LTCG: Up to ₹1.25 lakh tax-free; 12.5% on excess.

-

Debt Mutual Funds:

-

Determine holding period.

-

If ≤2 years: Add gain to total income, taxed by slab.

-

If >2 years (for investments post-April 1, 2025): 12.5% tax, no indexation benefit.

SIPs (Systematic Investment Plans):

-

Each SIP installment is treated as a separate investment for determining the holding period and tax applicability.

Dividend Taxation

-

Post-April 2020, dividends are added to investors’ income and taxed as per their income tax slab (no Dividend Distribution Tax at the fund level).

-

TDS (Tax Deducted at Source) at 10% applies if the dividend payout exceeds ₹5,000 in a financial year for resident individuals.

Securities Transaction Tax (STT)

STT is applicable to transactions of equity mutual funds on the stock exchange.

-

Tax Rate: 0.1% on both buying and selling equity mutual funds through an exchange.

| Type of Fund | Tax on Transactions | STT Rate |

|---|---|---|

| Equity Mutual Funds | On buying/selling units | 0.1% |

| Debt Mutual Funds | Not applicable | N/A |

TDS Rules for NRIs

-

For NRIs, TDS is deducted at 20% for equity-oriented and 30% for non-equity schemes, including cess and surcharge, on capital gains and dividend payouts.

-

A rebate or refund can be claimed at the time of filing returns if the actual tax liability is lower.

Tax Filing and Compliance Tips

How to Report Mutual Fund Gains in ITR

-

All capital gains, short or long term, must be disclosed in the appropriate schedules of your ITR (ITR-2/3 for individuals with capital gains).

-

Fund houses usually provide capital gain statements that help in reporting the correct figures.

-

One must also report dividend income separately under the head ‘Income from Other Sources’.

Important Considerations

-

For investments held jointly, tax liability belongs to the first holder as per PAN details.

-

Losses from mutual funds, short-term or long-term, can be set off against gains of the same nature and carried forward up to 8 years.

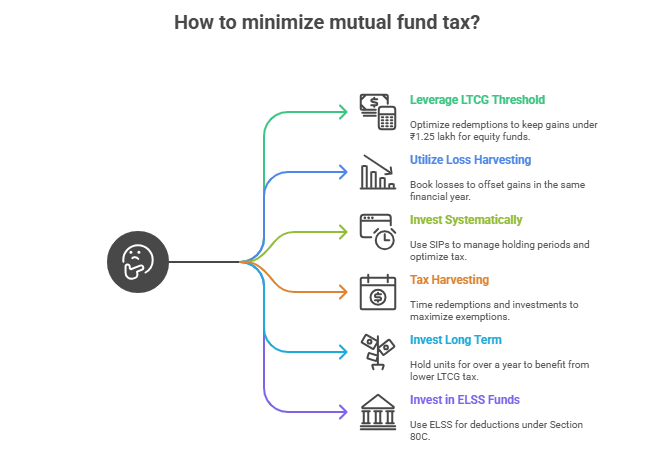

Expert Tips on Minimizing Mutual Fund Tax

-

Leverage LTCG Threshold: Optimize redemptions to keep annual long-term capital gains under ₹1.25 lakh for equity funds.

-

Utilize Loss Harvesting: Book losses where suitable to offset gains in the same financial year.

-

Invest Systematically: SIPs provide flexibility to manage holding periods, optimizing between STCG and LTCG.

-

Tax Harvesting: Time redemptions and new investments to maximize tax exemption limits and minimize slab-based liability.

- Invest for the Long Term: Holding equity mutual fund units for more than 1 year allows you to benefit from LTCG tax at 10% (above ₹1 lakh), which is more favorable than STCG tax at 15%.

- Invest in Tax-Saving ELSS Funds: Equity Linked Savings Schemes (ELSS) are eligible for deductions under Section 80C of the Income Tax Act, offering a tax-saving option up to ₹1.5 lakh annually.

Recent Changes: What’s New for 2025?

-

LTCG exemption for equity mutual funds raised to ₹1.25 lakh per year (previously ₹1 lakh).

-

LTCG on debt mutual funds (and similar) is standardized to 12.5% without indexation for new investments after April 1, 2025.

-

Revisions in the definition of what qualifies as debt and hybrid funds (as per new mandates).

Conclusion

By mastering mutual fund taxation, you can cultivate your fortune properly for the long term, a must as an investor. Whether you’re putting money in equity or debt mutual funds, knowing about short and long-term capital gains taxes and dividend rules can help you make more informed choices.

If you implement sound tax strategies such as holding for long-term, ELSS tax-saving funds, and SIPs, you can eliminate the tax bite and accelerate your wealth-building.

Keep track of tax law changes, like tax rates and exemptions can change over, time and it’s worth consulting a tax professional for tailored advice.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

Is SIP investment tax-free?

No, SIP returns from mutual funds are subject to capital gains tax as per the respective holding period and fund type. Each SIP installment is a separate investment.

How are hybrid funds taxed?

Depends on the equity component:

-

≥65% in equity: Treated as equity fund

-

<65% in equity: Treated as a debt fund for taxation.

Do mutual fund gains attract TDS?

Only if the payee is an NRI or if the dividend income exceeds ₹5,000 for residents. No TDS on capital gains for resident individuals.

What is the tax rate on equity mutual fund gains?

Short-term capital gains (STCG) on equity mutual funds (units held for 12 months or less) are taxed at 20%. Long-term capital gains (LTCG) on equity mutual funds (held for more than 12 months) are taxed at 12.5% on gains above ₹1.25 lakh per year.

Is indexation benefit available for debt mutual funds?

No. Effective April 2025, the indexation benefit is not available for new investments in debt mutual funds.