Table of Contents

Stepping into the Indian stock market in 2025 can be both thrilling and terrifying. You’ve got the Nifty 50 giants, mid-caps on the rise-and the small-caps that will either make or break your portfolio. Where do you even start with that kind of choice🤔? Figuring out where to put your hard-earned money💰 is a challenge many new investors face. This guide is designed to help you and the rest of the beginners out there to choose your first stocks with confidence. We’ll walk you through the essentials of building a portfolio on the NSE and BSE, from understanding what you want to achieve to researching the companies you’re interested in. Ready to get started🚀? Let’s look at the strategies that really work for new investors in 2025.

Choosing your first stocks

There are multiple ways to prudently choose your first stock to invest in. It depends on certain core factors which include:

- Your targeted outcome

- Your attitude while facing risk elements in investment

- Available resources

- Your invested time

- Capital

Picking up the best stocks as a beginner seems to be challenging, but exciting at the same time. Thoroughly understanding the pulse of the market is the initial criterion. You have to be very keen on understanding the fundamental aspects of the value of the stock. This also includes the technical analysis to familiarise the value of stocks in the market.

Master stock trading with Trading Experts. Enroll now for a free demo!

Tips for the new investors

1: What is a stock?

You have to have a strong sense of knowledge about how your prospects in business are paralleling with your business ethics and goals. You have to apply the stock analysis skills that you learned to find the best stocks to invest in. As a new investor, you might be confused about the value of stocks. To avoid such confusion, you have to use qualitative and quantitative analysis.

- Find the best approach that fits your taste

- Investment decisions should be free of emotional distress

- You have to be emotionally independent while making investments

- Don’t rush to buy or sell stocks based on the current hype

- Run a thorough study before investing in the stock market

- Stock market poses a threat when you make random investments

- You have to diversify your portfolio to avoid getting into unnecessary risks while investing in stocks

- You have to do research before seriously investing in stocks

In short, as a beginner, you have to be careful while picking up the stocks

You should do the following steps to avoid mistakes

- Research

- Analysis

- Avoid risk factors

- No to an emotional approach

To reinvest, most investors usually prefer to enlarge the holding size. They only prefer the dividend stocks or the stocks that usually pay as dividends. It depends on the initial amount deposited by the investor along with the capital growth. This also depends upon the dividends that are amassed while the investment is open. Choose the stocks with dividends.

Picking the stocks using qualitative and quantitative analysis can help a beginner to invest and expect more returns.

Start investing like a pro. Enroll in our Stock Market course!

A stock’s intrinsic value must be considered while you estimate the market value. Be careful to do quantitative and qualitative research on the current status of the market, economy, and industry.

You have to consider the financial events that are in trend, the news from top-notch companies about the stock values, along with the personnel changes.

While you’re deeply interested in investing in a particular company, you need to have a thorough knowledge of the company. The news about a particular company can affect the buying and selling of the stocks. If it is bad news, it results in the fall of the stock price,e forcing them to sell stocks. This can adversely affect the demand, supply, and, thereby the share value of the stocks

Management restructures are important for personnel changes while you are looking to invest in stocks. The perception of the market is crucial. The personnel changes have a direct and indirect influence on the stock prices.

You have to be very careful about the current financial events while you try to invest in stocks. The market is unpredictable and uncertain. The major economic indicator events have a massive influence on the stock value in the market

As a beginner, try to be more prudent about the changes in the market management, decisions regarding interest rates, and highly impactor financial events.

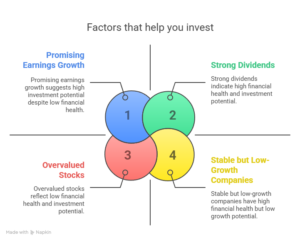

Factors that help you invest wisely

The quantitative factors that can help you to invest better include the ratio, dividend, sheets of balance, and releases of earnings.

Company earnings💹

Company earnings are part of the essential analysis as the investors and traders shall keep a keen eye on that part. You have to make sure that the stock price reflects the market value.

Balance Sheet 📑

The balance sheet will help you to list the liabilities and assets. If the balance sheet is strong, it means that the stock price is strong. The earnings potential is highly visible with the stock price. The earnings can, directly and indirectly, impact the earnings.

Dividends 💰

Dividends should be considered as part of company profit that is intended to be returned to the shareholders of a company. Without selling the shares, dividends are the only way for the investors to earn profit. While choosing the right stock, you have to choose a company with quality dividends.

Ratios 🔢

The various ratios that help you to choose the stocks wisely are given below

-

Price-to-earnings (P/E) ratio

The ratio which determines the stock value by which you should spend to gain a $ 1 profit

-

Price-to-book (P/B) ratio

Its the ratio compares the company’s book value against the market price

-

Price-earnings to growth (PEG) ratio

The ratio which measures percentage growth in comparison with the annual EPS

- Return on equity (ROE)

The ratio which measures the profitability of the company against the percentage of equity

- Current ratio

Its the ratio which measures the capacity and caliber of the company to pay off the debts

- Earnings yield

The ratio which divides earnings per share by the share price

- Relative dividend yield

The ratio which measures the dividend share of the company with the index

- Debt-equity ratio (D/E)

The company’s debt shall be measured against the assets and measuring how the company you’re planning to invest in is performing while comparing to the competitors in the field.

Final Thoughts:

While choosing a stock, you need to keep the following key points in your mind:

- Understand the pulse of the market

- Prepare a proper and strategic trading plan

- Make use of a screener to analyze the market

- Learn to manage risks properly

Poor management is another major issue that you might face while you’re constantly invested in the stock market. Many factors may affect the trade. You need to find the best strategies to avoid the risks. Poor decision-making may directly or indirectly affect you as a beginner while trying to invest in the stock market. Your strategy should be intact. Create a wide portfolio and learn to be prudent enough to invest in stocks wisely as a beginner.

Start small, stay informed, and avoid rookie pitfalls. With tools like the Entri Stock Market Course, you’ll turn curiosity into confidence. The Indian stock market awaits make your first move a smart one 🚀!

| Achieve Financial Freedom with these courses? | |

| Stock Market Trading Course | |

| Forex Trading Course | |

| Mutual Funds Course |

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

How to choose the best stock to invest as a beginner?

As a beginner, you should be aware about the pulse of the market before investing as a beginner. Develop a strong sense of knowledge about how your prospects in business are paralleling with your business ethics and goals. You have to apply the stock analysis skills that you learned to find the best stocks to invest in. As a new investor, you might be confused about the value of stocks.. Learn to use qualitative and quantitative analysis.

What are the key points that the beginners should keep in mind while choosing the stocks?

There are many key points to keep in mind as a beginner in investment. The first and foremost criteria is the complete knowledge about the market. Prepare a proper and strategic trading plan and make use of a screener to analyze the market. Along with it you have to learn to manage risks properly.

What are dividends in quantitative analysis?

The quantitative analysis is the proper way to understand the stock market which includes dividends. Dividends should be considered as part of company profit that is intended to be returned to the shareholders of a company. Without selling the shares, dividends are the only way for the investors to earn profit.

What are the measures that you ought to be careful while investing in stocks?

You should do the following steps to avoid mistakes to become a successful investor. It includes the research ,analysis, analysis of the risk factors and avoid having an emotional approach while investing.

Why is choosing the right first stock important for new investors?

Picking the right stock builds confidence and sets a positive tone. In 2025, with the Indian market’s volatility (e.g., Nifty’s 13% drop), a smart choice helps beginners avoid early discouragement and fosters long-term success.

How do I define my investment goals as a beginner in 2025?

Start by deciding your purpose and timeline. Saving for a car in 2 years? Opt for stable stocks like HDFC Bank. Planning for retirement? Growth stocks like Zomato fit. Clear goals guide your stock picks.

Should I only invest in industries I know?

Yes, starting with familiar sectors like tech (Infosys) or retail (Titan) leverages your knowledge. In 2025, this approach helps you spot trends, like e-commerce growth, without getting lost in complexity.

How do I research a company’s fundamentals in India?

Check revenue, profits, and debt on NSE/BSE sites or tools like Moneycontrol. In 2025, look for consistent growth (e.g., Reliance’s ₹43,000 crore profit) and low debt-to-equity ratios for stability.

Are dividend stocks good for new investors in 2025?

Absolutely! Stocks like ITC (₹15/share dividend) offer steady income, ideal for beginners seeking reliability amid market dips. Look for a 3-5% yield to balance growth and returns.

How can the Entri Stock Market Course help me choose stocks?

The Entri Stock Market Course offers beginner-friendly lessons on fundamentals, trends, and strategies. In 2025, it’s a perfect companion to master stock picking and boost your Indian market success.