Table of Contents

It’s that time of the year when you are scrambling to file your Income Tax Returns before the due date. If you are doing this for the first time, it is quite common to be confused by the process, especially with the various forms and documents. This blog provides you with a step-by-step guide on how to file income tax returns (ITR) for the financial year 24-25.

Check out this video by Entri in Malayalam!

Key Takeaways:

- ITR filing does not mean that you would have to pay to the government. It means that you could file for a return on the taxes you have paid for a financial year.

- Anyone with an annual income of ₹3 lakhs and above is required to file an ITR.

- There are 4 types of individual ITR forms to be selected based on your income.

- The benefits of filing an ITR include TDS/TCS refund and faster visa processing.

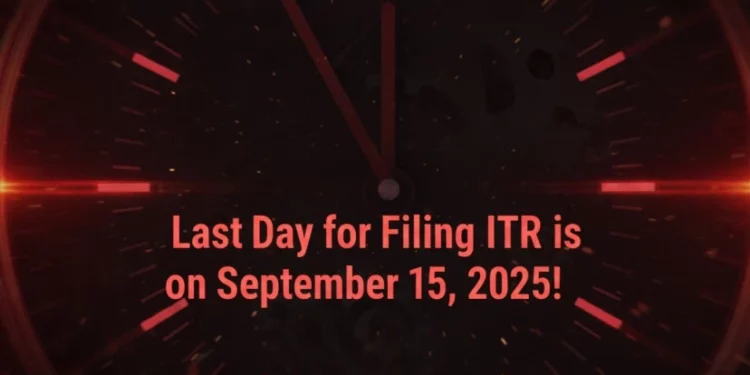

- The due date for filing individual ITR is September 15, with a penalty fee ranging from ₹1000 – ₹5000 depending on the income, if exceeded.

Important: The Central Board of Direct Taxes (CBDT) has extended the last date to file income tax return from July 31, 2025, to September 15, 2025, for the financial year 2024-25. This is for the taxpayers whose accounts are not required to be audited, such as salaried taxpayers, NRIs, and pensioners. The same goes for self-assessment tax for FY 2024-2025 (AY 2025-26). However, the norm remains the same, without any change for advance tax payments for FY 2024-25 (AY 2025-26)

Introduction: What is ITR?

Have you ever felt frustrated about the amount of taxes you pay every year to the government? For any sort of investments, the government takes a cut, sometimes more than the required amount. But, what if we told you that you could get it in return? Yes! And you could do that by filing for an ITR or Income Tax Returns. Whatever money you have spent as tax can be returned to you by filing an ITR every year.

Now, what exactly is this ITR? ITR is a form used to report our income, expenses, tax deductions, and the taxes that we’ve paid in a financial year. It is also a report or a document stating that you have paid due taxes for the financial year. In the same manner, if you had to pay a tax amount that is more than the tax liability you have according to your income, with the help of the ITR.

Sounds too good to be true, right?

Who Should File ITR?

1: Accounting provides information on

Now that we have an idea of the what and why of an ITR, the obvious following question would be, who should file an ITR? Is there some sort of criteria to file for an ITR? Is it applicable if I’m employed, a driver, or even a YouTube streamer? The Income Tax Department of India has stated the following categories that require people to file for an ITR at the end of every financial year.

- Salaried employees

- Freelancers/Professionals

- Business Owners

- Individuals with capital gains

Additionally, anyone with an annual salary of 2.5 lakhs and above should file for an ITR. However, according to the new tax slabs, having a yearly income of 3 lakhs and above requires you to file an ITR. Does this mean that those who earn below the specified amount should not file for an ITR? Not exactly. An ITR can be your income proof, which you can submit for any required services; therefore, it would never be in vain to file an ITR.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Types of ITR Forms

Most people are either unaware or confused about which ITR form they should choose to file. If you choose the wrong form, it may lead to the rejection of the ITR file. Here is a detailed list of the types of ITR forms for individuals to choose from according to their eligibility:

ITR 1

Specifies to salaried individuals, including pensioners and those who have one house property.

ITR 2

Specifies to individuals with capital gains, such as salary, pension, foreign income, interest, dividends, etc. Additionally, the aggregate must be above 50 lakhs in a financial year.

ITR 3

Specifies individuals who have income from businesses, a profession, or even from being a freelancer. If you are a trader, the income you obtain from trading, such as intraday trading, makes you eligible for this ITR form.

ITR 4

Specifies individuals with presumptive income, not exceeding more than 50 lakhs per financial year.

Step-by-Step Guide to File ITR

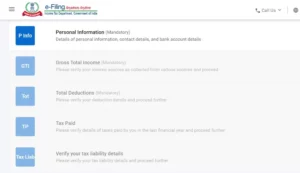

Here is the step-by-step breakdown of how to file ITR by yourself:

-

Step 1

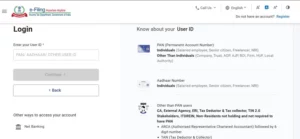

Go to https://www.incometax.gov.in. Click on the login/register button to begin.

-

Step 2

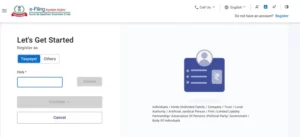

If you have already registered, click on the “login” option and enter your PAN/Aadhar number and password to log in. If you are new to the site, click on the “register” option and fill in the required details to register.

-

Step 3

Once you have registered and logged in, you’ll be redirected to the page where you have to select the assessment year and the mode of filing. Selecting “online” mode is recommended.

-

Step 3

Choose the ITR form according to your eligibility.

Latest Update: Income Tax Return Forms of ITR-1 and ITR-4 are enabled to file through the Online mode with prefilled data at the e-filing portal. Excel Utilities of ITR-1 and ITR-4 for AY 2025-26 are also available for filing.

-

Step 4

Proceed to fill in the income details such as salary, business income, capital gains, deductions, etc.

-

Step 5

Add the bank account you prefer to receive returns if eligible. Cross-verify all the questions you answered as well as the details you have filled in.

-

Step 6

E-verify using Aadhaar OTP. If you incur any charges, you can use net banking to pay them securely.

Benefits of Filing Income Tax Returns (ITR)

A lot many people are hesitant to file the ITR, thinking that they would have to pay a lot more tax. The truth is that such notions are baseless and invalid. According to the recent update, individuals with an income of up to 12 lakhs do not need to pay any taxes under the new regime for the financial year 25-26.

Naturally, one would think, since my income is less than 12 lakhs, I do not need to file for ITR as there are no tax deductions for me. On the contrary, filing an ITR provides you with many benefits regardless of whether you are liable for any tax or not. Here are the common benefits that you receive while filing for ITR.

-

Claim TDS/TCS Refunds

Imagine you are a freelancer with an income of ₹10,000 per month. Let’s say that the government takes 10% of your income, leaving you with ₹9000 for the month. Does this mean that you have lost your precious hard-earned ₹1000? Yes and no. This deduction is known as TDS (Tax Deducted at Source) and can be claimed by filing ITR. Therefore, the money deducted is returned to you and not gone for good.

TCS (Tax Collected at Source) is another tax deducted when you buy a product and can be reclaimed through filing for ITR. Now, that’s a benefit you don’t want to miss out on!

-

Proof of Income

Those who have applied for loans and credit cards must have been required to submit proof of income for the repayment of the loan. When in need of loans of huge amounts, the proof of income needs to be authentic and certified. Filing ITR grants you the benefit of providing it as proof of income for loans and credit cards, as it shows the capability of the borrower for repayment.

-

Visa Processing

ITR filing document helps to speed up the visa processing, resulting in a smooth and easy procedure. This is a major benefit for people who may need to apply for visas soon.

-

Avoid Penalties

Not paying taxes on time leads to penalties, which unfortunately cannot be reclaimed. Through filing ITR, you can ensure that you are paying your taxes on time and thus avoid penalties and end up not paying extra.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Documents Required

The documents required digitally while filing for ITR are as follows:

- PAN card, Aadhar card – used to register in the portal

- Form 16 – provided by the company where you work at the end of the financial year

- Bank account details – including all transactions

- TDS certificates

- Investment proofs – including land, car, house, etc.

Common Mistakes to Avoid while Filing ITR

There are two approaches when filing ITR: one is to hire a chartered accountant to handle the procedure, while the other is to file individually. When doing it by yourself, it doesn’t hurt much to be a bit cautious and look out for these common mistakes to avoid while filing ITR:

-

Choosing the wrong ITR form

As stated above, make sure to select the right ITR form to avoid rejections while filing.

-

Not reporting all sources of income

Includes:

-

- Interest gained from FD

- Income gained from Mutual Fund investment

- Capital gains

-

Missing Tax-saving declarations

You need to read and understand each declaration that appears in the filing process so that you do not miss any of them, and thus result in false declarations.

-

Not E-verifying ITR

The filing process requires you to e-verify, and if not done, will lead to a definite rejection of the application.

Due Dates & Penalties

The ITR filing usually starts by April and ends by July. Therefore, for individuals, the last date for filing ITR is July 31st. Remember to file for ITR before the said date to avoid penalties for late filing. The usual amount for penalties ranges from ₹1000 – ₹5000, which solely depends on the income of the individuals. Mark your calendars to avoid penalties and to have a smooth filing process, especially if you are expecting returns from deductions like TCS and TDS.

Conclusion: To File ITR Or Not To…

By now, you must have an understanding of whether filing ITR is a boon or a bane. The benefits and relevance of the ITR outdo the misconceptions prevalent about filing ITR. The bottom line is that this is the ultimate proof of being a tax-paying citizen of India, with the added benefit of getting back extra taxes that you had to pay. By following the mentioned steps and common mistakes to avoid, you can make your ITR filing a seamless process. So, start the process now, and forget about penalties!

|

Courses Offered |

|

|

AI Powered Business Accounting and Finance Certification Programme |

SAP FICO Course |

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Frequently Asked Questions

Who is required to file an Income Tax Return (ITR) for FY2024-25?

Anyone whose gross total income exceeds the basic exemption limit (₹2.5 lakh for individuals below 60 years) must file an ITR. Additionally, filing is mandatory for certain high-value transactions, foreign income/assets, and if tax has been deducted at source (TDS), among other cases.

What is the last date to file ITR for FY2024-25?

The due date for individuals (not subject to audit) to file their ITR for FY2024-25 is July 31, 2025. This date may be extended by the government if needed.

Which ITR form should I use?

-

ITR-1 : For salaried individuals with income up to ₹50 lakh.

-

ITR-2: For individuals with capital gains, more than one house property, or foreign assets/income.

-

ITR-3: For individuals running a business or profession.

-

ITR-4 : For presumptive income from business or profession (if total income is up to ₹50 lakh).

Refer to the blog’s section on choosing the correct form for more details.

Can I file my ITR without Form 16?

Yes. While Form 16 simplifies the process, you can still file your ITR using payslips, bank statements, Form 26AS, and the Annual Information Statement (AIS).

What documents are needed to file ITR?

-

PAN, Aadhaar

-

Form 16 (if salaried)

-

Form 26AS and AIS

-

Bank account details

-

Investment proofs (for deductions)

-

Capital gains statements (if applicable)

-

Rent receipts, loan certificates, etc.

Is Aadhaar mandatory for ITR filing?

Yes. Quoting and linking Aadhaar with PAN is mandatory for ITR filing, unless you’re specifically exempt (e.g., NRIs).

What happens if I miss the ITR filing deadline?

You may file a belated return with a penalty under Section 234F. However, you may also lose the right to carry forward certain losses.

How can I check if my ITR is successfully filed?

After submission, you’ll receive an acknowledgment (ITR-V). Once it is verified (online or by post), the Income Tax Department will process it and send an intimation under Section 143(1).

How do I e-verify my ITR?

You can e-verify using:

-

Aadhaar OTP

-

Net banking

-

Bank account/Demat account EVC

-

Digital Signature Certificate (DSC)

What if I made a mistake in my ITR?

You can file a revised return before December 31, 2025, or before completion of assessment—whichever is earlier.